Reports about stock markets don't usually begin with a personal story of a hospital visit, but these are exceptional times.

Thanks to friends working inside London hospitals, I got an early tip-off about a loophole for any UK resident to get vaccinated right away - no matter their age, risk group or essential worker status.

How so, and why does it matter for this story?

Let me explain.

Coronavirus vaccines have a short shelf life, and any leftover doses need to be used up on the same day. Since many elderly patients don't turn up for their vaccination appointment, there are usually unused jabs at the end of each day. It would be an incredible waste to discard them, all the more at a time when other countries are struggling to get hold of vaccines.

If you knew which hospital had vaccines delivered on what day, you could go there during the last 30-60 minutes of the day and – with a bit of luck – get vaccinated on the spot even if you were a 21-year old spring chicken.

Following a friend's tip-off, I went to my local hospital, St Charles in Notting Hill, at the right time. Indeed, I could have received a vaccination that evening, had I been registered with the UK's National Health Service (which I am not, since I am registered with the Channel Islands health service). However, several friends to whom I had passed on the message, did get their vaccination.

One such friend replied: "I am so pumped."

She was excited about potentially being able to travel again in the foreseeable future, continue her international work and see her family. Indeed, just as this Weekly Dispatch went to press, The Times reported "British officials have started work on a 'vaccine passport' as Greece prepares to waive quarantine rules for tourists who can prove that they have been inoculated against coronavirus."

Will the Brits have the Mediterranean's beaches to themselves in 2021? Is the world going to get a reprieve from the infamous Anglo-German towel wars?

How it all plays out remains to be seen, and I am watching it with bated breath. In any case, I loved the experience of visiting a hospital where it was all happening and at a time of day when those who weren't yet entitled to the free vaccine turned up in droves to get it. There was a palpable sense of excitement in the air – bordering on a party mood! Even the hospital staff seemed elated. The energy of the place was incredible. It will stay with me as one of the more memorable moments of the pandemic.

The prevalent fear of a rapidly developed, politically charged vaccine seems to gradually get replaced by something else. Even some friends who were quite sceptical about the vaccinations are now making an effort to get it – and as soon as possible.

Are we seeing a change in perception and attitude that will eventually also influence stock markets?

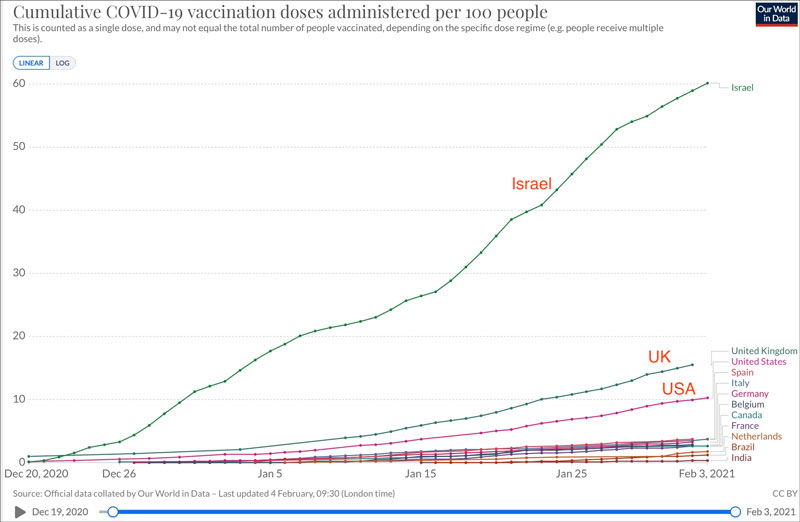

The UK just passed the 10m vaccination milestone, in what has become the world's most successful vaccination drive outside of Israel. Covid, lockdowns and vaccinations remain the most controversial subject on the planet. I share many of the often-raised concerns and have not yet made a final decision as to whether I'll get vaccinated myself. However, you'd have to be blind not to notice a distinct change in the national mood shaping up in the UK right now.

Interactive chart available here: https://ourworldindata.org/covid-vaccinations

As the Daily Telegraph put it in an opinion piece called "Vaccine success is on the brink of transforming the lockdown debate" on 14 January 2021:

"After almost a year of watching the seemingly unstoppable onslaught of Covid-19, the speed of progress now is hard to take in. Just a few months ago, Chris Whitty, the Chief Medical Officer, was telling colleagues he didn’t believe a vaccine would come in time. Now we have several of them, highly effective, already delivered to millions worldwide. The logistics, the safety: it’s all going as well as can be expected – in Britain, especially."

During the ensuing three weeks since the article appeared, matters have very much progressed into that direction.

The big question is, what happens next?

I've looked at two trends that were already taking place on the UK stock market, and which would continue even without the successful vaccination drive.

A third trend could soon emerge and add to the scope of opportunities currently available on the UK stock market.

Here is what you need to know.

This IPO boom will reshape the FTSE-100

Usually, IPOs are only relevant to those investors who subscribe to them or trade in these stocks following their listing.

However, the London Stock Exchange is about to experience an IPO boom with much wider reverberations.

Over the past five years, the UK stock market has been one of the world's worst underperformers. The laggard performance is usually credited to Brexit, but the truth is a bit more nuanced. The FTSE-100 and FTSE-250 indices had long been heavily weighted towards banks, resource companies, and energy stocks, aka the worst-performing business sectors anywhere in the world. It sure didn't require Brexit for seeing the indices underperform.

Thanks to the coming wave of IPOs, the composition of the indices is likely going to change significantly over the next 6-24 months. The country's booming tech, media and healthcare sector is going to take care of that.

The UK has more unicorns and potential unicorns than Germany, France, and the Netherlands combined. London's unique strength in attracting talent and providing venture capital is paying off once again.

Among the current contenders for IPOs are:

- Darktrace, a cyber security company worth GBP 4bn.

- Checkout.com, an online payment company worth GBP 12bn.

- TransferWise, a payment solution provider valued at about GBP 8bn.

These companies are large enough to become members of leading indices, and they have already signed up professional advisors to prepare an IPO.

As Bloomberg reported in a 1 February 2021 article:

"Medical marijuana firm MGC Pharmaceuticals, online auction-marketplace operator Auction Technology Group and investment firms Digital 9 Infrastructure Plc and NextEnergy Renewables Ltd. all said they are planning to tap U.K. investors.

London has been the main engine of a European IPO market renaissance, accounting for nine out of the 22 listings announced this year in the region and providing three of its top five largest offerings so far."

These dynamic growth firms are going public and are likely to replace old economy firms in indices. The London Stock Exchange and its leading indices probably have a few good years ahead of them.

Never mind the possibility of an early opening up of the economy on the back of the UK's vaccination success.

That's why one of Goldman Sachs' leading strategists recently wrote:

"I have a strong preference for UK over Europe – a trend which began to establish itself through Q4."

Indeed, others have already come to the same conclusion and pumped record amounts of money into buying up entire UK companies.

The M&A boom continues

I must sound like a broken record on this one. British companies are among the world's most interesting takeover targets. I've already alerted my Members accordingly back in mid-2019, and my view has now been vindicated by the seemingly never-ending wave of takeover bids over the past few months.

On 1 January 2021, I published a Weekly Dispatch titled "Brexit special: A list of potential British takeover targets".

The London market has since seen a GBP 5.3bn bid for GW Pharmaceuticals (ISIN GB0030544687), a cannabis therapy pioneer, as well as a private equity funded bid approach for Marston (ISIN GB00B1JQDM80), a GBP 600m pub chain.

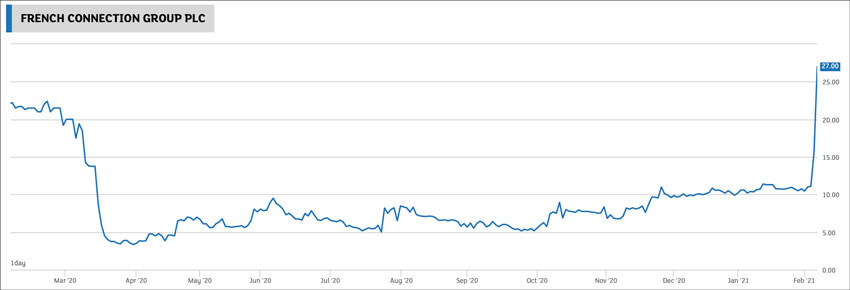

Just hours before I published this Weekly Dispatch, two potential bidders emerged for French Connection (ISIN GB0033764746), the clothing retailer. The stock shot up 78% (!) this Friday morning. The stock is up 160% compared to just one week ago – testament to how bombed-out many valuations are.

The UK market still has plenty of undervalued companies, and it's the most open capital market in Europe – unlike, for example, the French, which just blocked a Canadian takeover approach for its supermarket chain, Carrefour (ISIN FR0000120172). Seriously?! Needless to say, international investors do notice such differences.

Thanks to its unique political and economic position in Europe, the UK is now set to attract the biggest slice of Chinese capital destined for investment in European real estate. Investors from Hong Kong and China are expected to pour GBP 13bn into London – on top of GBP 33bn of investment flowing in from elsewhere. No other European capital is attracting that much real estate investment.

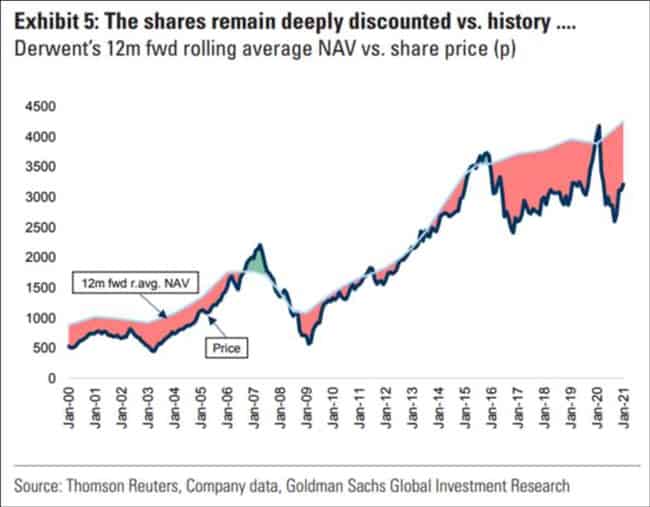

Goldman Sachs has just tipped Derwent (ISIN GB0002652740) as a favoured bid target. Derwent is the largest real estate investment trust that focusses on Central London, particularly office properties. Its stock is trading at a record-level discount to its underlying asset value, given the prevalent concerns about remote working killing office space. Increasingly, these concerns are questioned as exaggerated.

As the Daily Telegraph article noted: "Barclays chief executive Jes Staley told the online Davos summit last week that long-term home working was not 'sustainable' as it would 'be a challenge to maintain the culture and collaboration' of organisations."

Will Derwent be the next company to become a target? The stock could surge if it did, given how far below its net asset value it is trading right now.

Plenty more money will be made on the back of foreign and domestic investors issuing lucrative bids for British companies.

You can do worse than check back to my 1 January 2021 Weekly Dispatch for names of other British companies that could end up in the crosshairs of bidders.

"Reopening plays"

Last but far from least, there is the possibility of investing in companies that would benefit from a successful reopening of the economy.

Whether you believe the vaccination drive will be a success or not, is not something I will argue over. The views on corona, vaccinations and related subjects are deeply embedded in most peoples' belief systems, and I am not the right person to convince anyone of a different viewpoint. My job is to provide you with ideas and insights that you can use to integrate into your opinion (or choose to ignore altogether!).

There is incontrovertible evidence that some successful investors are getting ready for such a reopening. They may be wrong, or they may be right. In any case, this is already happening.

Take Liu Zaiwang as an example. The Chinese tycoon, who's made a fortune in the construction industry, has been quietly amassing a 13.3% stake in Cineworld (ISIN GB00B15FWH70), a leading chain of cinemas.

Cineworld has recently seen more than its fair share of drama. Besides closures due to the pandemic and subsequent funding issues, there have been boardroom antics about executive pay. The GBP 1bn company is still trading 80% below its pre-pandemic level. One successful investor, at least, believes the stock is now worth picking up at this level. As CityAM reported on 29 January 2021, Cineworld could also end up seeing a bid – making it a combined bid target and reopening play.

The UK economy is heavily driven by tourism, leisure, and services, all of which have taken a particularly hard hit during the pandemic. Many stocks are still down 50%, 70% or even more, and some will never fully recover. But there are exceptions and outliers, some of which could stage incredible turnarounds. Suppose the UK did succeed to (at least partially) lift itself out of this malaise through mass vaccination and do so earlier than other countries, there'd be considerable potential for selected stocks.

One such stock is Capital & Counties (ISIN GB00B62G9D36), the company which owns the Covent Garden estate in Central London. Just like Derwent, and as repeatedly highlighted to Undervalued-Shares.com Members, the stock is currently extremely cheap.

Britain seems "good to go"

I might be biased, given that I've called the British Isles my home in some shape or form since 1998.

However, it definitely looks like the stars are aligning for the UK to outperform other European markets over the next 12-24 months.

Having another three weeks left of my current stay in London, I am certainly keeping an eye out for exciting opportunities.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Video interview with Philipp Haas, investresearch (in German)

I am delighted to kick off a series of chats with Philipp Haas, founder of investresearch (and one of my paying Members, actually!).

In our first video, Philipp and I give some insights into our investment background. Future videos about specific investment ideas and themes will follow!