Image by Arild Lilleboe / Shutterstock.com

Politics has seen some stunning reversals of late.

Americans gave Trump a landslide victory and strong mandate.

Germany's candidate for Chancellor, Friedrich Merz, wants to close the border to illegal immigration as soon as he gets elected.

The UK's Chancellor of the Exchequer, Rachel Reeves, has just thrown her weight behind a third runway at Heathrow airport.

These are extraordinary U-turns, which would have been unthinkable until recently.

Will something similar happen to North Sea oil?

A sector under siege

There are few other sectors that have had as unfavourable an outlook as North Sea oil producers.

Europe's goal for "net zero" led to a negative attitude of the continent's policymakers towards domestically produced oil. The sector was under pressure even before the pandemic. Oil majors were selling off North Sea oil projects at low single-digit valuation multiples because they considered it a run-off sector.

Along came the war in Ukraine and spiralling energy prices. The UK's "conservative" government introduced windfall taxes on the profits of energy producers, further diminishing the sector's attractiveness. An entire string of operators, including US energy giants Chevron and Apache, decided to quit the UK.

The government's tough love approach put pressure on the share prices of domestic oil and gas companies. One such case is London-listed company Kistos Holdings (ISIN GB00BP7NQJ77, UK:KIST), which had been set up in 2020 to exploit unloved and undervalued oil projects in and around the North Sea.

Following a share placement at a price of 100 pence in December 2020, the share price initially went up more than 6x within less than two years. By August 2022, the stock was trading at 655 pence.

It's now back down at 133 pence, and investor sentiment could hardly be worse. In a private chat group, one participant described Kistos Holdings' chairman and major shareholder as "hated and so toxic".

Kistos Holdings.

Well, despite his alleged toxicity, Andrew Austin is still producing a lot of the stuff that keeps the world going around. It's one thing to virtue-signal about net zero and related subjects, and another thing altogether to run the operation that keeps homes warm and cars running.

Britain now has the highest energy prices of the Western world. Based on figures from September 2024, the cost of power for industrial businesses has jumped 124% since 2020, catapulting the country to the top of international league tables. Industry energy in Britain is now about 50% more expensive than in Germany and France, and 4x than in the US.

Earlier in January, Britain's petrochemicals billionaire, Sir Jim Ratcliffe, warned that the country's chemicals industry was having "the life squeezed out of it" by high energy costs.

Industry can sustain brief periods of high prices, but permanently high prices make companies take drastic actions. Since 2021, Britain's chemicals sector has shrunk by 37%. In an industry that currently employs 600,000 people, such cuts mean hundreds of thousands of jobs gone.

What's more, such cuts only mean that the production of these chemicals and products is moving to countries less hostile towards fossil fuel-based energy. Policy wonks call this phenomenon "carbon leakage". Countries like China are having a right old laugh about it all, given that these policies make business come their way.

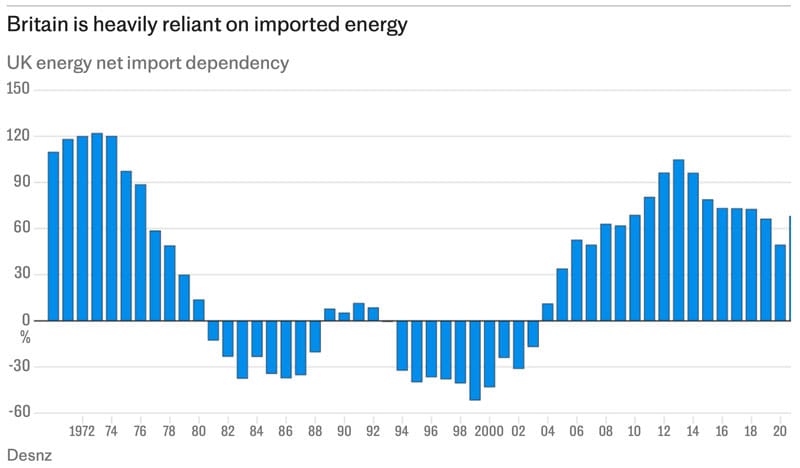

Source: The Times, 13 January 2025.

How long is this going to continue? Not much longer, I speculate.

New trends more often than not start in the US and then move westward from there. It's now once again "drill, baby, drill" in the US, and energy autarky as well as low energy prices are high on the agenda of the new American administration. Trump knows that historically, a direct and strong link exists between low energy prices and a country's affluence.

I suspect the winds of policy change will arrive in Europe before too long. If that were the case, I'd want to have bombed-out stocks of North Sea oil producers in my portfolio.

Kistos Holdings is a good example of what's on offer.

Source: The Telegraph, 3 January 2025.

"Cash, baby, cash!"

A caveat first, I only had a cursory look at this company. In fact, I tested this thesis just last night at a dinner in Edinburgh. I figured my audience would be at least somewhat familiar with the subject, given Scotland's long-standing involvement in North Sea oil. Interestingly, my thesis mostly drew sceptical faces, which only encouraged me further.

Yours truly speaking with readers in Edinburgh.

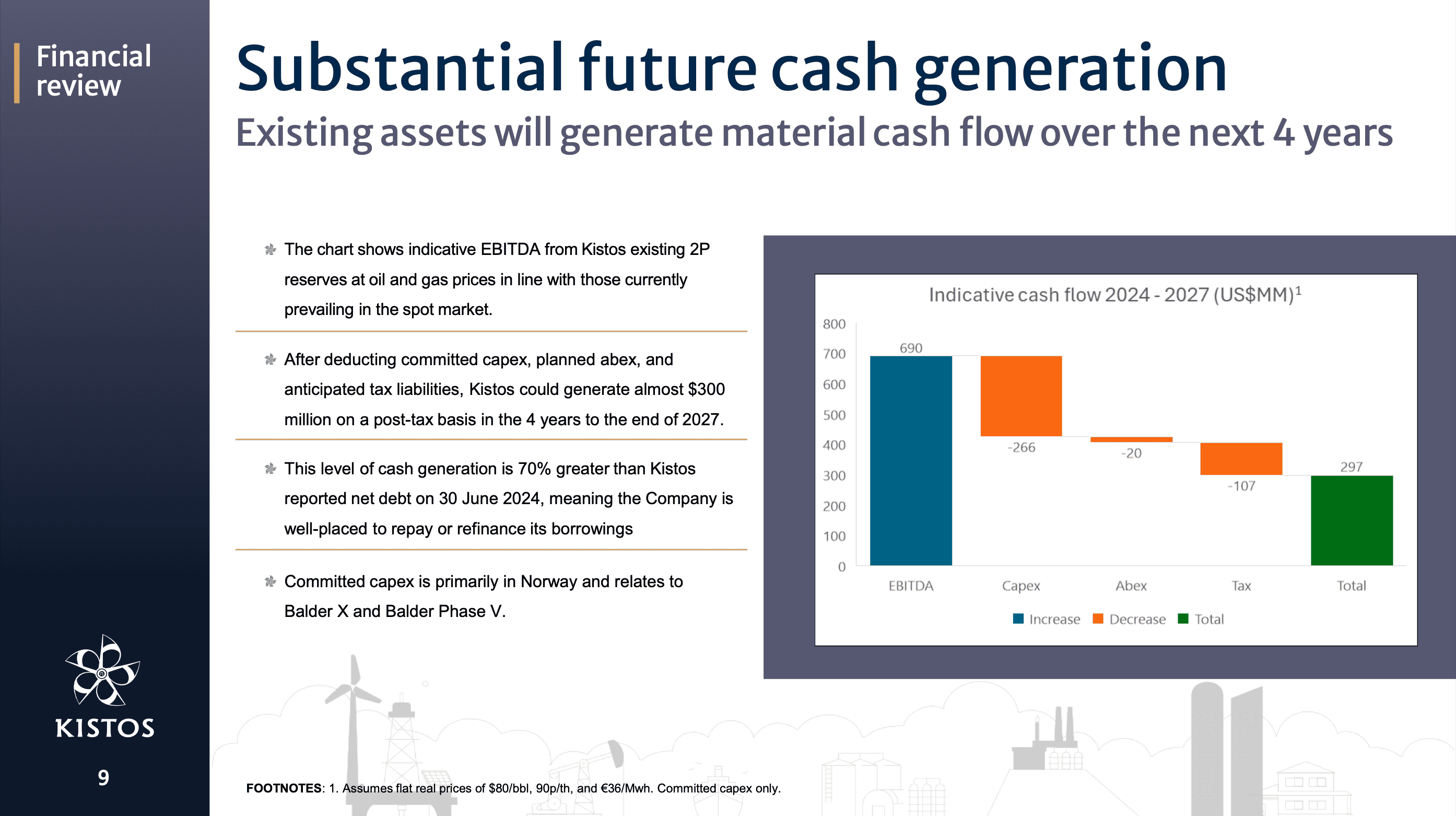

Kistos Holdings has some extraordinary valuation metrics, once you look at its ability to generate cash. As the November 2024 analyst presentation shows, the firm could generate USD 690m of cash between now and 2027. Even if you consider the company's commitment towards capital expenditure, decommissioning expenditure, and tax liabilities, it will have USD 300m left over – 70% greater than the reported net debt on 30 June 2024.

Source: Kistos Holdings, 11 November 2024 analyst presentation (click on image to enlarge).

Or, as one well-informed reader and analyst summarised it, Kistos Holdings currently has a market cap of GBP 100m but it could have net cash of GBP 400m by 2030. The share price is currently trading at 0.25x the expected 2030 net cash, which is almost unbelievably low.

These projections start to make sense when you look at the valuation multiples paid for transactions in the space over the past few years. E.g., with its purchase of TotalEnergies' gas storage business, Kistos Holdings paid GBP 25m for an asset that generates GBP 7m of free cash per year. These are businesses that generate massive cash and probably have a longer lease of life than the market currently gives them credit for. The UK has insufficient gas storage facilities, Kistos Holdings could repurpose some of these facilities to store hydrogen.

Andrew Austin may be seen as hated and toxic by some, but he once led another oil company to IPO on the London market and produced stellar returns for his investors. RockRose Energy went public in January 2016 at a price of 50 pence and was sold for 1,850 pence per share in July 2020. Austin's investors made 42x their money.

Austin could have retired altogether given that he cashed out GBP 66m, but he is said to be deeply passionate about building oil and gas companies. With Kistos Holdings, he has created a new vehicle that is invested in North Sea oil and gas in the UK, Norway, and the Netherlands. That's besides its interest in gas storage in the UK.

The company has various challenges, including the following:

- The production start of the Balder Future project in Norway got delayed.

- At least for now, the UK's aptly named "Secretary of State for Energy and Climate Change", Ed Miliband, remains on his ideological warpath against fossil fuels.

- With 8,400 barrels of oil equivalent (boepd) per day, Kistos Holdings is a tiny operation by international standards, and it could struggle to get much attention from investors.

Still, it looks like the kind of stock that could benefit from a recoiled spring effect if or when the UK government changes its attitude towards domestically produced, cheaper, and reliable fossil fuels.

When will politics go the other way?

Trump has already come out publicly, calling Labour's decision to abandon North Sea oil "a very big mistake". He urged Sir Keir Starmer to "open up" the North Sea.

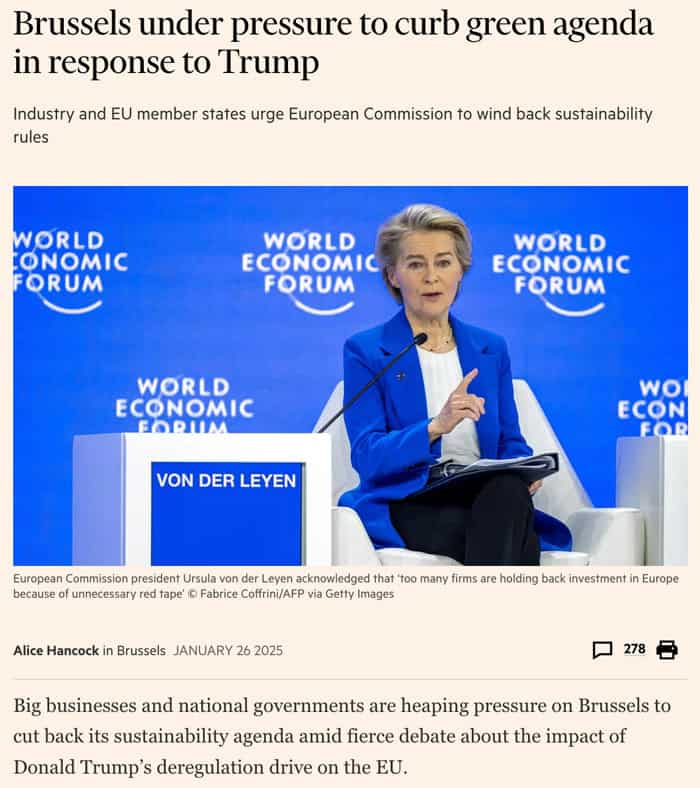

Source: Financial Times, 26 January 2025.

For now, Trump's call has not led to any result:

- On the day before this Weekly Dispatch came out, Scottish courts decided that the UK's previous government's decision to allow the Rosebank oilfield project to go ahead was unlawful because it contravened the country's climate goals.

- Harbour Energy, the biggest producer of North Sea oil, has recently had to pay a tax rate on its profits of 102% – effectively expropriating shareholders.

- The exodus of large companies from the North Sea continues. Exxon withdrew in July 2024, and in October 2024 Deltic Energy announced that it would sell its North Sea assets after concluding that Britain was no longer attractive enough to invest.

With that in mind, Kistos Holdings is not a slam dunk, despite its projected free cash flow.

That said, it might only take ONE statement from a senior member of Starmer's cabinet to spark speculation about the sector's revival. Divisions in the government's approach are already becoming visible, if you believe the analysis published by The Telegraph on 26 January 2025.

Source: The Telegraph, 26 January 2025.

There are already signs that Europe will abandon its self-harming energy policies and instead return to energy realism. As the Financial Times just reported, the "EU debates return to Russian gas as part of Ukraine peace deal". Speak of policy U-turns!

Will UK politics swing that way? You be the judge.

If (or when) it does, Kistos Holdings should no longer be trading on the current level. Markets tend to anticipate developments before they actually happen.

Weird Shit Investing returns!

The 2024 inaugural Weird Shit Investing conference exceeded all expectations – and this year's edition will be even better!

Weird Shit Investing will be back in not just two cities across different continents, but three:

Hong Kong, 19 June

London, 24 June

New York, 26 June

If you are looking for a place to pick up genuinely new, outside-the-box investment ideas and challenge yourself to impress a truly switched-on audience, we'd like to hear from you.

Weird Shit Investing returns!

The 2024 inaugural Weird Shit Investing conference exceeded all expectations – and this year's edition will be even better!

Weird Shit Investing will be back in not just two cities across different continents, but three:

Hong Kong, 19 June

London, 24 June

New York, 26 June

If you are looking for a place to pick up genuinely new, outside-the-box investment ideas and challenge yourself to impress a truly switched-on audience, we'd like to hear from you.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: