Given geopolitical developments, Uncle Sam has become coy about handing sensitive government work to foreign-controlled entities – which extends even to British companies, such as London-listed Learning Technologies Group.

The global leader in e-learning, talent management, and talent acquisition has over 5,000 employees in 35 countries and generates revenue of GBP 560m (USD 730m). It also provides services to the US government that involve the handling of classified information.

Will Learning Technologies Group have to flee into the arms of American ownership?

Could this yield a lucrative bid for outside shareholders?

Undervalued-Shares.com takes a closer look at what might be a unique situation among British takeover targets.

Learning Technologies Group.

From highflyer to laggard

What is today Learning Technologies Group (ISIN GB00B4T7HX10, UK:LTG) started in 2013 as Epic Group, then a leading e-learning group. The company took over a listed cash shell by way of a reverse takeover. The stated aim of the transaction was to create a vehicle with access to capital markets. The company's management planned to pursue a buy-and-build strategy and create one of the world's leading businesses for learning technologies.

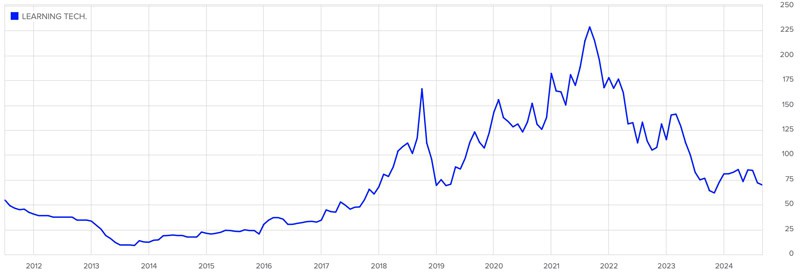

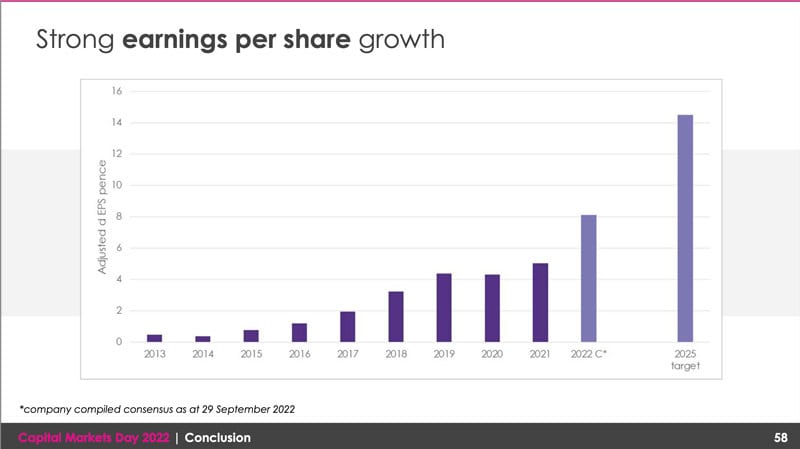

And it did! A total of 17 acquisitions followed, and shareholders benefited significantly. Earnings per share multiplied, and so did the share price – by 2,300% between 2013 and 2021, from 9.5 pence to 228 pence.

Source: Learning Technologies Group.

The acquisition spree was funded through a combination of equity and debt. Back then, equity markets were buoyant, and debt was cheap.

How times have changed.

Interest rates rose, equity market valuations for mid-sized British companies contracted, and the recently rather iffy macroenvironment made large corporations reconsider their budgets for learning and training.

Since its peak three years ago, the stock of Learning Techologies Group has lost 70% of its value.

Forced by markets to reconsider its strategy, the company recently pursued a different approach.

Under the mantra of "active portfolio management", Learning Technologies Group has been selling off some of its portfolio companies. In fact, it's remarkable just how often management has referred to "active portfolio management" in recent communication with shareholders.

Streamlining and deleveraging the group

After the rapid-fire acquisitions of the 2010s, Learning Technologies Group decided to sell its subsidiaries Lorien, a specialist for engineering solutions, and TTi Global, an external staffing business. These two businesses had only found their way into the company's portfolio because they were part of the package in a large acquisition in 2021. Lorien and TTi didn't really fit into the strategic focus on learning and talent management, so they were first to go when management started to clean up the group's portfolio. The resulting sales proceeds of USD 22.2m went towards deleveraging the group's balance sheet.

Another streamlining took place by merging smaller entities into the group's larger businesses. Watershed was merged into Rustici, LEO into GP Strategies, and Reflektive into Bridge.

June 2024 brought a watershed moment in Learning Technologies Group's current efforts to streamline its portfolio. The company sold VectorVMS, a vendor management platform for contingent labour, to PIXID Group, one of the largest vendor management platforms in Europe. Learning Technologies Group pocketed USD 50m as a result.

VectorVMS had also found its way into Learning Technologies Group's portfolio because it was part of a larger group that was acquired in 2018. At the time, Learning Technologies Group spent USD 150m to acquire PeopleFluent, a company offering talent management solutions for regulated industries. Within that group sat two divisions that were so different from the rest of the business that they were immediately separated from the rest of the group. VectorVMS and a firm called Affirmity have since been run as an independent business and brand.

In its 2022 Capital Markets Day, Learning Technologies Group had stated the combined value of these two firms as USD 35m. Now that ONE of them has been sold for USD 50m, it makes you wonder what the other one – Affirmity – may be worth, not the least because Affirmity is reportedly larger than VectorVMS. It's no surprise then that in recent times Learning Technologies Group repeatedly stated that the stock market was currently not putting enough focus on just how much value was sitting within its portfolio of companies.

That's also the judgment of one particular investor who is worth listening to.

A quiet billionaire who never sold a share

You'd be forgiven if you have never heard of Andrew Brode, the 84-year-old British tech entrepreneur.

Even though Brode temporarily built a GBP 1bn fortune, he "has shunned the limelight", as Forbes once wrote in an extensive feature.

However, Brode's fortune has shrunk considerably since 2021, mainly due to his biggest holdings, two companies listed on the London Stock Exchange.

With a 14.85% stake, Brode is the single-biggest shareholder of Learning Technologies Group. At its peak, that stake will have been worth GBP 273m. Today, it's worth a more modest GBP 82m. Brode's 24.5% stake in RWS Holdings (ISIN GB00BVFCZV34, UK:RWS), a service provider for translations and localisation of content, is still worth GBP 170m, but it's down 73% since April 2021 when it was worth GBP 630m.

Like many others, Brode is known to be frustrated with valuations granted to mid-sized tech companies listed in London.

For several years now, an increasing number of British companies have considered to delist in London in favour of a listing in the US. Much as that isn't a panacea, it is notable just how much more dynamic the US market is.

The Conversation reported in a 23 April 2024 feature: "Why is the London Stock Exchange losing out to the US – and can it stem the flow?

Two decades ago, UK-listed equities accounted for 11% of the MSCI World Index, which tracks the global equity market. Now they represent a meagre 4%.

Since 2020, several LSE-listed companies, including Cambridge-based biotech firm Abcam, plumbing supplier Ferguson and packaging firm Smurfit Kappa Group, have moved to the US.

Most recently, oil and gas giant Shell has threatened to do the same. In 2023, the Nasdaq raised US$13 billion (£10.4 billion) while the LSE managed US$972 million from the companies floating on it.

The aggregate market capitalisation of LSE-listed equities went down to US$3 trillion in February 2024, from US$4.3 trillion in 2007, whereas the US market has grown three-fold to US$53 trillion.

More than 30 companies with market capitalisation over £100 million are leaving London's public equity markets. Thirteen companies have undertaken and completed takeover bids and 17 companies delisted."

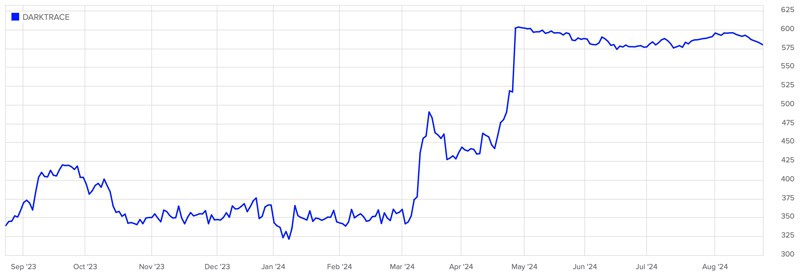

Undervalued-Shares.com had reported early and repeatedly about the wave of takeover bids for British companies. American investors, in particular, are comfortable with buying British companies. Just recently, American private equity firm Thoma Bravo struck a GBP 4.3bn deal to buy British cyber security company Darktrace (ISIN GB00BNYK8G86, UK:DARK) in an all-cash transaction. Darktrace shareholders bagged a 44% premium compared to the average price in the three months preceding the transaction.

Darktrace.

Another recent high-profile case is that of Hargreaves Lansdown (ISIN GB00B1VZ0M25, UK:HL), the UK's leading investment platform for retail investors. Shareholders received a 54% premium, even though that price was still too low by the look of it. Hargreaves Lansdown's founder, Peter Hargreaves, decided to roll over half of his stake into the new private equity structure. He wanted to remain invested, because he believed in the long-term growth prospects of the business that he built.

Could something similar happen at Learning Technologies Group?

There is a logic behind asking just that question, and to ask at this particular moment in time.

American ownership as a must?

In 2021, Learning Technologies Group launched a takeover bid for US-based GP Strategies Corporation, then one of its biggest competitors for digital learning and talent management. The USD 394m transaction was Learning Technologies Group's biggest-ever deal.

While GP Strategies remains the company's biggest pillar, it recently developed a nasty problem.

The American subsidiary also handles sensitive work for the US government, and this has become an issue in today's geopolitical circumstances. As a UK-controlled company, GP Strategies has recently become ineligible to work on new classified contracts for Uncle Sam.

As if the increase in interest rates and the tougher macroenvironment weren't enough of a challenge already for Learning Technologies Group, it now also has a US regulatory issue. The amount of business affected by this is comparatively small, but investors don't take kindly to public companies that run into actual regulatory issues with Washington, DC.

What's an undervalued British tech company to do in such a situation?

Flee into the arms of American private equity would be one possible solution.

Learning Technologies Group has no dominant shareholder. Brode and his sidekick Jonathan Satchell control a combined 24.14%, and one would assume they aren't sellers per se given the compelling long-term growth potential of the industry. However, they will be frustrated with the persistently low valuation of their company on the London market.

The remainder of Learning Technologies Group is mostly in the hands of large fund managers: the six largest fund managers with stakes in the company own a combined 36%. These owners wouldn't ever have any loyalty to a company and sell out if someone made a reasonable bid. Never mind all the other frustrated holders and how they would react to the possibility of bailing out on the back of a decent cash offer.

Could Brode and Satchell even have an interest in facilitating such a bid?

Learning Technologies Group is certainly vulnerable to a bid, even a hostile one. American control of the company would automatically make the issue with Uncle Sam go away.

Combine these logical possibilities with the current tendency of British companies to look to the American market for higher valuations, and you have what is probably a bid situation waiting to happen. Though based on what is known about Brode and Satchell, they'd then probably want to negotiate a roll-over and remain invested – like Stephen Hargreaves did.

Some in London are currently speculating about such a chain of events – and these rumours are probably only going to get louder.

A catalyst for a bid soon

Takeover situations can drag on forever. There is always the risk of being stuck in a value trap.

In the case of Learning Technologies Group, one little-known factor could lead to a bid coming in sooner rather than later.

When the company acquired PeopleFluent in 2018, two subsidiaries were kept independent from the rest of the newly formed group – VectorVMS, and Affirmity.

VectorVMS has already been sold, and Affirmity could be next. Learning Technologies Group's management has been speaking a lot recently about its aim of active portfolio management. Affirmity is not part of the core portfolio, so it's only logical to conclude that it's next to be sold. That firm's market position in so-called "Diversity, Equity and Inclusion" could make it a desirable target for some bidders. In fact, some industry circles speculate that its sale could yield up to USD 100m. It would mean that the two non-core divisions that were part of the 2018 PeopleFluent acquisition yielded as much in a sale as Learning Technologies Group paid for the entire acquisition.

If that scenario were to play out, Learning Technologies Group's undervaluation would become even more visible than it is already.

Following the sale of VectorVMS, Learning Technologies Group had reduced its remaining debt to just GBP 6m. Management has achieved a complete deleveraging of the company, which is a remarkable milestone. Given its current market cap of GBP 554m, Learning Technologies Group now has an enterprise value of GBP 560m. Management is currently guiding for 2024 revenue of GBP 480-500m (following disposals) and EBIT of GBP 88-93m. Taking the mid-point of the EBIT guidance leaves the company valued at just over 6x EBIT.

An estimated 30-40% of the group's revenue is from its software business, which tends to be valued at closer to 12x EBIT in M&A transactions. Its consulting divisions would probably fetch around 9x EBIT. Learning Technologies Group stock should attract a premium of 40-50% if (or when) someone decides to bid.

A potential acquirer would be incentivised to make a bid soon, if you give credence to industry rumours about a potential upcoming sale of Affirmity. If Affirmity got sold at anywhere near the rumoured valuation, Learning Technologies Group would have revealed yet more about the higher underlying value of its portfolio. The company would then have an even stronger balance sheet and a more streamlined portfolio – all factors that could lead to an increasing share price and large shareholders being less willing to sell out, making a potential bid more expensive.

Of course, all such scenarios always have many potential twists and turns. E.g., if rumours about a potential sale of Affirmity spread to such an extent that they moved the stock price of Learning Technologies Group by more than 5%, the company's management would be obliged under UK takeover rules to explain itself publicly. The Takeover Code has long been criticised by some as rather lax in some aspects but the recent high-profile sanctioning of ten deal-makers has upped pressure on stricter enforcement. The executive teams of publicly listed companies will likely become a lot more cautious going forward when it comes to the risk of violating the code by favouring one group of shareholders over another. To be clear, there are no indications that any of this would apply to Learning Technologies Group – this is merely a comment to analyse the possible scenarios for this company.

Source: Financial Times, 30 July 2024.

In the next weeks and months, much will depend on whether these rumours turn out to have legs. Will speculation about a pending lucrative sale of Affirmity persist and end up influencing the share price as well as forcing major holders to ask questions? It remains to be seen. At this stage, it's nothing more than hearsay, and potentially entirely unsubstantiated.

What does have legs, in any case, is the logic of turning Learning Technologies Group into an American company:

- The regulatory issues of its US business would vanish overnight.

- American investors pay a higher multiple for such a business. A private equity company could restructure Learning Technologies Group in private and relist it in New York at a later stage.

- American private equity firms tend to be in a stronger position when it comes to helping their portfolio companies pursue global growth opportunities.

Will they, or won't they?

Brode isn't one to sell equity, but as the case of Hargreaves Lansdown shows, a major holder not willing to sell out no longer represents a hurdle for a deal to go ahead. An American investor could own >75% and only keep Brode as well as Satchell onboard – which would be fine in terms of American ownership requirements.

Learning Technologies Group is just one of many undervalued British stocks, and undervalued stocks can remain undervalued for a long time.

What's potentially unique about this situation is the compelling rationale for a change in majority ownership. In addition, a potential pending sale of Affirmity might help speed up decisions. After all, Affirmity is already a separate operation, and management's incessant indications to streamline the portfolio does make a sale of this subsidiary look like a logical next step.

What does it all boil down to?

The hearsay and rumours are impossible to confirm, but they do fit into a logical analysis of the company.

Among the plethora of London-listed takeover targets, Learning Technologies Group is one currently worth paying attention to.

Internet leader at a bargain price

The world's leading Internet companies tend to be hugely profitable, and their stocks valued at a premium.

Once in a while, though, you can buy into them at a bargain price – such as Meta and Spotify in 2022.

Who could follow in their footsteps?

The latest report from Undervalued Shares has identified another global Internet leader that is currently available at a bargain valuation.

If you missed buying Meta or Spotify in 2022, this one is for you.

Internet leader at a bargain price

The world's leading Internet companies tend to be hugely profitable, and their stocks valued at a premium.

Once in a while, though, you can buy into them at a bargain price – such as Meta and Spotify in 2022.

Who could follow in their footsteps?

The latest report from Undervalued Shares has identified another global Internet leader that is currently available at a bargain valuation.

If you missed buying Meta or Spotify in 2022, this one is for you.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: