Warren Buffett's Berkshire Hathaway isn't the world's only company with a six-digit share price.

Switzerland's famous chocolate manufacturer, Lindt & Sprüngli, has a stock trading around the CHF 100,000 mark (roughly six digits in euros and dollars). It's a company with a CHF 23bn market cap, so anything but a small cap. The stock has been at this level for years. Scarcity or market manipulation could not explain this price tag.

Why did investors bid up the share price to such a level, and is it still worth buying?

A decades-long success story

Lindt & Sprüngli (ISIN CH0010570759, SIX:LISN) isn't so much a company as an institution.

The 177-year-old company has long been known not just for its high-quality chocolate and its "Luxemburgerli" macaroons, but also for innovation and creativity. In what otherwise seems like a relatively boring segment of the consumer product market, Lindt & Sprüngli regularly pushes the envelope with its branding, product strategy, and marketing approach. Its products are sold worldwide through 500 of its own stores, as well as over 100 independent distributors. Its 14,000 employees generate sales of CHF 4.59bn per year.

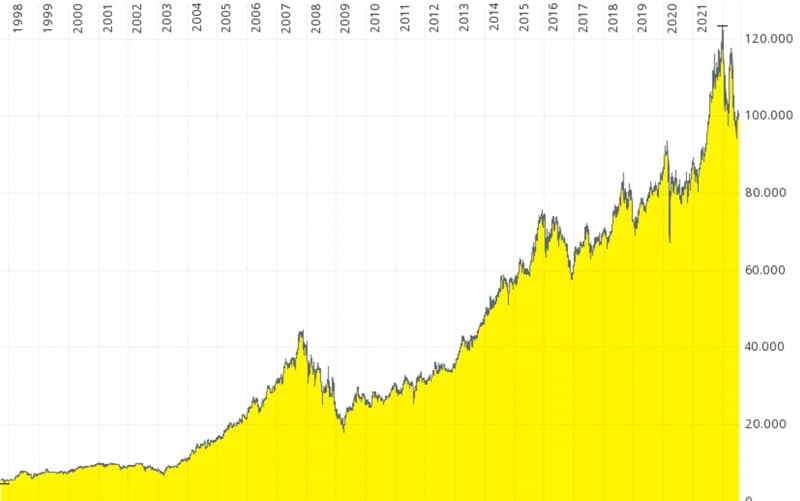

Lindt & Sprüngli stock has experienced an almost unstoppable rise. While in the late 1990s, you could have bought an ordinary share of the company for CHF 6,000, the same share would have set you back over CHF 120,000 in late 2021. Despite the recent sell-off, the stock is still trading around the CHF 100,000 mark.

Lindt & Sprüngli.

Indeed, this particular company knows how to keep its shareholders loyal. Being a shareholder of Lindt & Sprüngli is almost akin to being a member of a club rather than a company co-owner.

Steady, steady wins the race

The annual general meeting of Lindt & Sprüngli bears certain similarities to that of Berkshire Hathaway (ISIN US0846701086, NYSE:BRK.A). I haven't been to either one, but it's easy to see that the meeting in Switzerland has connotations of a Woodstock for Swiss capitalists with a liking for chocolate.

Shareholders get a gift box – which, unsurprisingly, contains chocolate!

The investor relations website displays photos of the annual gathering, and it looks popular indeed. This is a company than many will be proud to be a shareholder of in a mixture of Swiss patriotism and financial acumen. After all, it's not just a fun investment with an annual injection of sugar and cocoa, but also quite simply a good investment purely in monetary terms.

Not many would have expected this stock to turn into such a star performer just two decades ago. I remember how back in the 1990s, Lindt & Sprüngli stock was seen as a solid, albeit somewhat boring investment. A 2001 article from Switzerland's Finanz & Wirtschaft, for instance, called the stock expensive because of its price/earnings ratio of (at the time) 22.

Indeed, one has to ask what valuation multiples are justified for a chocolate company. It's not like the growth of the global chocolate market – around 2-5% p.a. – could keep up with that of companies in tech, e-commerce, or healthcare. For most growth investors, that's too boring a growth rate to even give it a second look.

However, Lindt & Sprüngli is a model case of how steady growth and excellent management pay off, and eventually may even result in so-called "multiple expansion" (seeing a stock's valuation multiples increase).

This company has made it an art to grow faster than its underlying market. How so? It latched onto the premiumisation of chocolate. In Western Europe and North America, in particular, high-quality chocolate products have become "affordable luxury". Lindt & Sprüngli managed to position itself as the go-to chocolate producer that consumers are willing to pay a premium for.

The company expects to grow sales by 6-8% p.a., i.e. faster than the underlying chocolate market. Crucially, it also expects to keep increasing its margin. Between 2014 and 2019, the EBITDA margin climbed steadily, from 17.4% to 20.3%. It increased its margin every single year, which indicates that it's the result of good management rather than one-off external factors. Following the turbulence caused by the coronavirus pandemic, it dipped to 17.4% in 2020 but recovered to a near-record 20.1% in 2021. The long-term trends that have made Lindt & Sprüngli so successful in the past are all still in place, and the company plans to improve the margin by 0.2-0.4% (20-40 bps) per year.

It's not so much that Lindt & Sprüngli does anything unusual, it just does everything slightly better than its competitors, and it is very consistent in what it does. That, too, strikes me as very Swiss.

Like quite a few of Switzerland's most famous companies, Lindt & Sprüngli generates a minuscule fraction of its business at home. Domestic sales contribute just 4% to the group. Over 46% of sales are generated in the rest of Europe, and 37% come from North America. Interestingly, the rest of the world so far only contributes 12% to the company's sales. One would expect that high-quality Swiss chocolate will grow in popularity with consumers in Asia and other high-growth regions as their middle class becomes wealthier. If this assumption held true, Lindt & Sprüngli's growth story could have a lot further to run.

Even a company as spoilt by success as Lindt & Sprüngli occasionally has to deal with a downer. In 2017, the chocolate manufacturer was accused of purchasing cocoa that was sourced from protected areas in Africa. However, Lindt & Sprüngli quickly committed to fixing these issues, and it is doubtful that such bumps in the road would ever cause more than a temporary problem to the tightly managed company.

Not an undervalued share

Just like the chocolate, the stock of Lindt & Sprüngli is a premium product.

In 2021, earnings per share came out at CHF 2,049. At its current stock price, the stock is trading at nearly 50 times earnings. Over the past 20 years, not only has the company grown consistently, but the stock also experienced significant multiple expansion. A p/e of 50 is very expensive, but it has been like that for a long time and the rarity of the stock plays a role. Not many ordinary shares come to market for sale, and there is one persistent buyer in the market – Lindt & Sprüngli itself. The company is funnelling hundreds of millions of its free cash flow into buying back stock. Throw in a loyal shareholder base that likes getting gift boxes, and you start to understand why this producer of premium chocolate also has a premium stock.

For those who are eager to participate but cannot quite afford an ordinary share, help is at hand. In line with Berkshire Hathaway's affordable "B" shares, Lindt & Sprüngli has issued a "participation certificate" that allows you to buy into the company for about 1/10th the amount (ISIN CH0010570767, SIX:LISP).

Just like real estate on Paradeplatz, buying into such a high-quality Swiss business comes at a premium price. You still get a gift box, though. The infamous "natural dividend" that is part of many consumer product companies in the German-language area acts as an additional sweetener for this investment.

Missed Lindt & Sprüngli in the 1990s?

Come to think of it, Switzerland does offer investment bargains – if you know where to look.

Just like Lindt & Sprüngli back in the 1990s, there is another well-known Swiss brand name that you can currently invest in on the cheap. It currently offers the best buying opportunity since the Great Financial Crisis.

Another Swiss investment bargain

My latest pick from the Alpine country is one of the best-known brands in private banking "Made in Switzerland".

At no point since 2008 has this stock been so attractive: record-low valuation in absolute terms, the prospect of a new multi-year boom for its business, as well as a >6% p.a. dividend yield and massive share buy-backs while you wait.

Accumulate while markets are still under pressure!

Another Swiss investment bargain

My latest pick from the Alpine country is one of the best-known brands in private banking "Made in Switzerland".

At no point since 2008 has this stock been so attractive: record-low valuation in absolute terms, the prospect of a new multi-year boom for its business, as well as a >6% p.a. dividend yield and massive share buy-backs while you wait.

Accumulate while markets are still under pressure!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: