Image by Willy Barton / Shutterstock.com

Visits to London always make for an interesting time, but all the more at the height of a pandemic.

When my airport taxi took me down the M4 into London on 14 December 2020, everyone else who could was driving in the opposite direction. London was about to head into a third lockdown, and bleak times were ahead. People had already depleted their mental reserves, many companies had used up their financial buffer, and the darkness of the winter months promised to add to the overall pain.

Yours truly couldn't help himself.

I wanted to witness firsthand how London coped, and I wanted to use the resulting intel to work out what sort of city (and country) was going to emerge on the other side of the tunnel.

Things looked dire if you followed the news headlines, but I also sensed this would be a period of extraordinary opportunities and exciting insights.

Ignoring my mum's worry about seemingly travelling right into the eye of a storm, I intended to meet with lots of people to hear their insights and observations.

What did I learn during the ensuing nine weeks?

One of the subjects I was keen to get a handle on was the future role of cities.

Apocalypse or Renaissance?

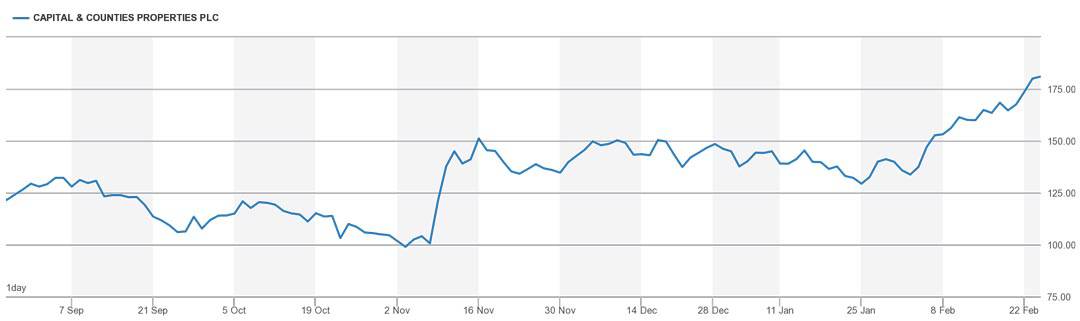

Long-standing Undervalued-Shares.com readers already know that I like companies that own AAA real estate in major cities. In a previous report for Undervalued-Shares.com Members, I had featured Capital & Counties (ISIN GB00B62G9D36), the company that owns Covent Garden in Central London.

How will property investments in major cities perform during the post-pandemic world?

It's a question that affects hundreds of publicly-listed real estate companies around the world.

Is it true that "Superstar Cities Are in Trouble", as The Atlantic mused on 1 February 2021?

Indeed, things are not immediately looking too good when you read "City centre rents suffer biggest collapse since financial crisis" (Daily Telegraph, 9 February 2021).

However, as readers of this website know, a crisis can also make for a one-off opportunity.

When the outlook is desolate, and prices are depressed, it is often the perfect time to deploy money.

I have spent a ton of time reading up on the future of cities as a whole, as well as sub-categories such as office real estate or retail properties.

There is no shortage of opinions on the subject, and world-leading experts are battling it out over views that are often diverging by 180 degrees. Whatever conclusion you'd like to believe in, there is someone out there who will provide you with your preferred confirmation bias.

The Financial Times reported on 7 February 2021 that London's entertainment industry "warned of 'cultural ruin' from Covid impact". A dead West End wouldn't bode well for property across the entire capital. After all, who wants to live in a cultural wasteland London?

On the other end of the spectrum are those who view the current crisis as just another blip. London does have a stellar history and managed to recover even from the Great Fire of 1666 and the Blitz. One opinion piece from the Sunday Times argued that "Our cities will be reborn — young, gritty and fearless".

Which one, then?

Among all the opinions that I collected during my stay, this one seemed the most intelligent:

"There will be new ways of arranging things. London won't die, nor will it be all rosy right away. It'll be nuanced, ongoing changes. Whether your real estate investments benefit from these changed will depend on being in the right location with the right concept."

Indeed, the future of London probably can't be summarised by one-sentence absolutes.

Cities such as London aren't going to die. Nor will everything go back to how it used to be.

It'll be somewhere in between, with a few new opportunities thrown in to make it all more interesting.

One of my personal experiences in pandemic London illustrated that perfectly.

A Zoom hater goes wine tasting on Zoom

When it comes to choosing between an online and an offline experience, I would long have chosen offline in 100% of all cases.

Tasting events are a case in point. In the past, I've regularly spent oodles of money on food and drinks-related events in London. Sipping vintage champagne under the guidance of a world-leading wine expert at the headquarter of Christie's? Hell, yeah! This sort of event meant going to an exciting venue, mingling with other participants and the hosts, and stopping over at one of the private members' clubs of St James's before toddling home.

Who in their mind would want to replace such experiences with staring at a Zoom screen?

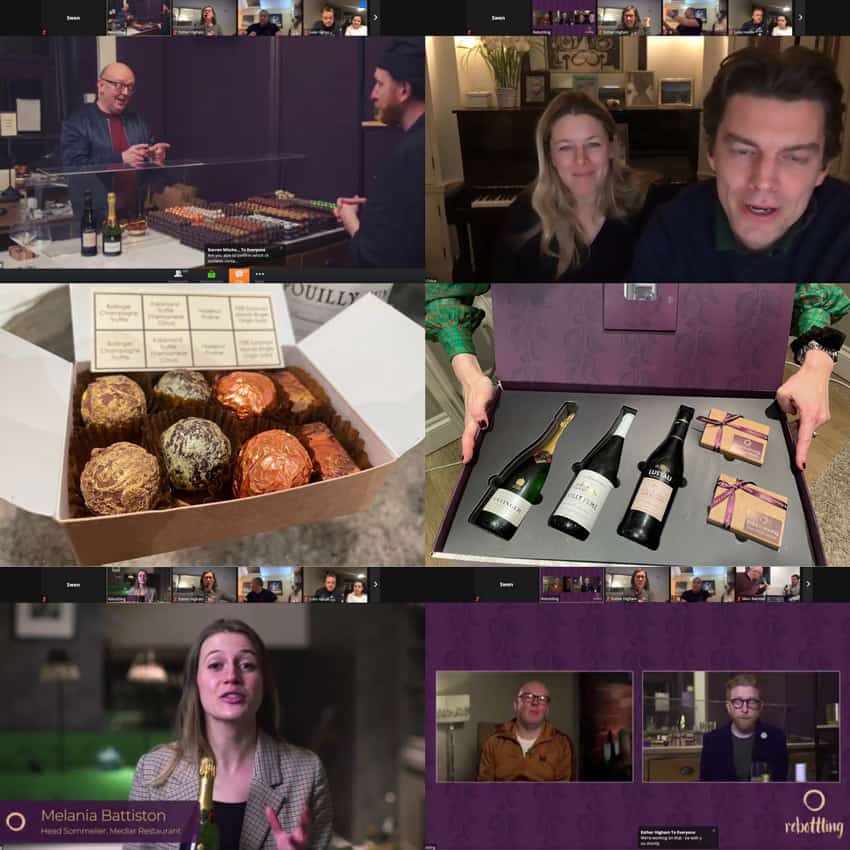

I rolled my eyes when a friend invited me to a combined wine-and-chocolate tasting via Zoom.

It was hard to refuse, though.

My friend had bought a stake in a start-up company that aimed to popularise the concept. Having me participate was his way of testing if the company could appeal to my demographic.

When friends ask for help with their ventures and projects, I am not one to decline.

As it turned out, the experience blew me away.

The company created an exciting unboxing experience, used world-class narrators for leading the online gathering, and made participants feel they were part of a community.

170 people joined the Rebottling.com Zoom event.

It reminded me of being a guest on a live TV show.

For sure, this was a next-level online experience.

The experience taught me something that summarises my view of the future of cities.

The future of cities is nuanced, exciting, and just a bit different

I'll continue to go to offline events whenever I'm in London. Nothing beats walking into Christie's headquarter and enjoying the vibe and heritage that only a 255-year old institution can offer. Real-world experiences will never diminish for human beings, and cities are where you find them in unrivalled range and quality.

Equally, I am open to attending online events when I have nothing else in my diary or when I am not in the right location. The tech acceleration sparked by the pandemic means there is now a new calibre of online events, and they are surprisingly good.

Online and offline are not mutually exclusive. As a result, we may simply see the overall market getting bigger. You can now attend world-class events even if you don't live in a city. If Christie's ever gets around to hosting high-quality online wine events, it might only lead to more tourists wanting to visit London to experience them in the real world, too.

In between these factors, how real estate in cities will fare over the next few years depends on its location and purpose.

London did see an oversupply of some types of housing even before the pandemic hit, especially in the upper end of the market. Some brownfield redevelopment, such as the gargantuan Nine Elms project south of the Thames, have turned out to be slow sellers (besides having all sorts of other problems). Times of crisis expose bad projects that could only ever take off in boom times. It could be five or ten years before Nine Elms turns into what its developer promised it would be.

Equally, I doubt Christie's headquarter will be turned into social housing anytime soon. Every Londoner I know is gagging to enjoy the facilities of the city as soon as circumstances permit. All that's missing is for the reopening to happen, which is now tentatively scheduled to be done in phases starting 13 April and ending 21 June 2021.

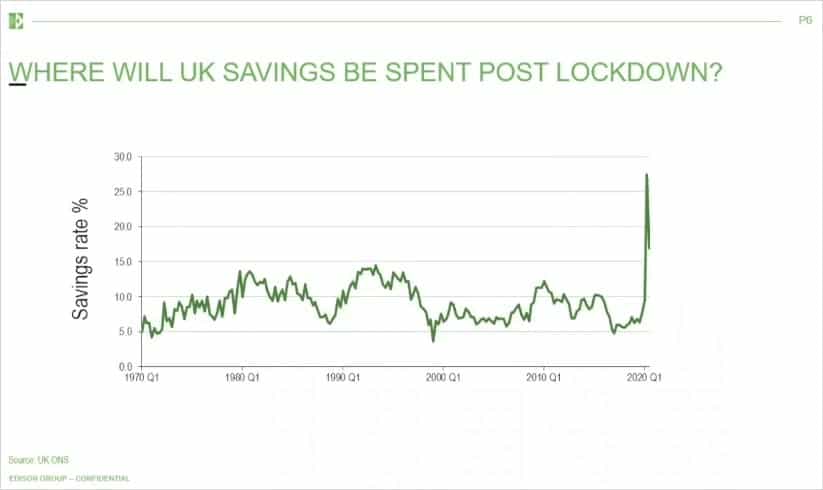

Once the lockdown lifts, some of these locations in London could benefit from what may yet turn out an unprecedented spending boom. The savings rate of British consumers has spiked during the pandemic, temporarily reaching 26%. The Bank of England estimates that Brits put away an additional GBP 125bn. That figure equates to over GBP 2,000 for each person in the country. British consumers are not known to hang on to their money, and the extra savings could spark a consumer boom that may yet go down in history as the Crazy Consumer Boom of summer 2021.

Other parts of London will adjust to new circumstances. That's what cities always do – they adjust when the situation changes. Things usually change in ways that are somewhere in the middle between the old status quo and the hysterical predictions of those who fear that the end is nigh.

The truth simply usually lies somewhere near the middle.

Companies will now be even more open to allowing working from home. Corporate employees are less likely to have their own desk and instead will "hot-desk" (it's a verb!). There is no doubt, going forward companies will need less space and work harder to use space more efficiently. Case in point, HSBC just announced aggressive cuts to its use of office space – 40% of its office space will go!

Are we going to see empty office towers as a result?

I doubt it.

What is often underestimated is just how much wealth, creativity, and human ambition is pushing into cities like London at any given time.

Oceans of ink have been spent on reporting that 700,000 people left London during the pandemic. Much of the Western media gleefully saw this as confirmation that Brexit Britain was finally getting what it deserved.

Less has been made of the 2.9m (!) Hong Kong Chinese who since recently have the right to move to the UK. They were given the so-called "British National Overseas" status in 1997 to protect them against potential repression by the Communist Chinese. 24 years after Britain handed the former Crown colony back to Beijing, a new visa scheme was introduced in early 2021 to allow those 2.9m people to come to the UK. Right now, estimates are that 300,000 will come. I wouldn't be surprised if the actual number turned out much higher.

Krauts and frog-eaters leaving Britain to protest Brexit?

Bye. 👋

In come the Hongkies!

An empty space in London usually doesn't remain empty for long.

Too many opportunities beckon in world-class cities, too many possibilities for generating wealth and satisfying personal ambition.

Indeed, it's extraordinary to witness just how many new companies and fortunes are currently rising out of London (and the UK), despite the pandemic.

These new companies are mostly heavily web-based, but they mostly still need a physical space.

I realised that when visiting a friend to mingle in London's start-up world.

The British start-up wealth generation engine

WeWork offices are generally in great locations, but the one next to the Tower of London is a particularly attractive one.

On one side, it looks out towards the skyline of the "City" (banking district), the Tower of London, the Shard (tallest building in Europe), and the iconic Tower Bridge.

On the other side, it enjoys views of St Katherine Docks, THE inner-city yacht harbour and a pretty pedestrian area where it's enjoyable to stroll even when everything is closed (I did so with a reader who suggested to meet up).

The WeWork co-working space was less busy than it would typically be but far from empty.

I asked my friend how the companies located in the office were doing.

"So many start-ups get bought out, so we have a lot of fluctuation in here. These guys over there were bought by Google. The ones over there were purchased by Microsoft."

I asked about his firm.

"We just got our funding round done. It's all systems go for executing our growth plans."

The firm had started a bit over a year ago. With less than a dozen employees, it's now worth in the double-digit millions and flush with cash. The next funding round is almost guaranteed already, following a globally renowned company offering to underwrite it in its entirety when it's required.

Staff get salaries that are on the lower end, but they also got equity at founder conditions. I quickly did the maths. Two founders, no more than two handfuls of staff members, and start-up funders routinely bidding up valuations – everyone there will have done well, at least on paper.

My friend is about to book a post-pandemic holiday in an extremely exotic location (and not as a backpacker!).

As he puts it, "Now I have the money to do it."

He is 24.

Building successful firms so quickly is difficult if you don't have the network effect of a large city at your disposal:

- A deep pool of talent to hire and (if necessary) replace staff.

- Any and all service providers you ever need within a few stops on the underground.

- Multiple funders and acquirers all within a mile or two.

Sure, you can start a company anywhere. But in a city like London, a start-up simply tends to have extra wind under its wings.

I have heard the thesis that Silicon Valley isn't needed anymore. Silicon Valley is now supposed to be anywhere and everywhere. The famous Californian ZIP code allegedly got replaced by Zoom calls.

That will work for some companies. However, it usually requires a founder and a team who have already built their personal networks.

Try to get a business off the ground if you cannot personally meet potential first-time clients. Try raising funds from investors with whom you don't have a personal relationship. Try judging and hiring employees that you have only met via Zoom.

Good luck with that!

Many of the journalists who write about these subjects have never attempted anything like it themselves. They like to write in absolutes because it gets their articles more clicks.

Another friend from London's venture capital scene put it like that: "Our new investments have ground to a halt. We just administer the existing investments and give additional money to people that we already knew personally before the pandemic. How could we commit millions if we have never met the founders? If we did and it went wrong, our investors would ask us if we had been insane."

Travelling to meet people in person has mostly been put on hold, but building new companies has continued throughout the pandemic, all the more if you could keep meeting people in your own city rather than to travel further afield. During the past 11 months, places like London's various WeWork locations have continued cranking out the next generation of start-ups, would-be unicorns, and real unicorns.

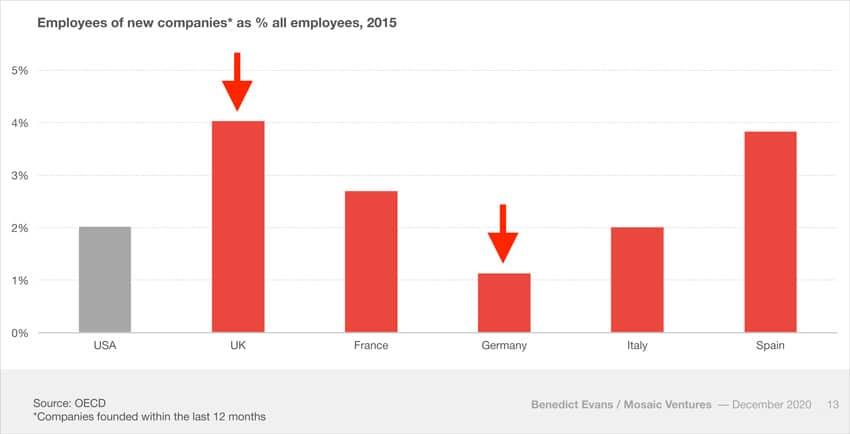

As I wrote in my 5 February 2021 Weekly Dispatch: "The UK has more unicorns and potential unicorns than Germany, France, and the Netherlands combined."

Indeed, Britons are four times more likely to work in a start-up than Germans.

Having met many start-up entrepreneurs recently, I can confirm that London's wealth-generating engines are still humming away just fine.

The amount of money that will be unlocked by the upcoming IPOs of British tech firms is staggering.

As I put it in my Weekly Dispatch:

"London has been the main engine of a European IPO market renaissance, accounting for nine out of the 22 listings announced this year.

Among the current contenders for IPOs are:

Darktrace, a cyber security company worth GBP 4bn.

Checkout.com, an online payment company worth GBP 12bn.

TransferWise, a payment solution provider valued at about GBP 8bn."

There could be up to 200 tech-related IPOs in the pipeline in London.

Suppose you add up the entire pipeline of potential IPOs, trade sales and other liquidity events for founders. In that case, there is probably a triple-digit billion amount of financial wealth coming Britain's way.

Notably, it's a younger generation that stands to benefit disproportionally.

We now have a new generation of 20-something and 30-something wealth owners appearing on the horizon. Members of this age bracket are more likely to agree to a low salary and long work hours if, in exchange, they get significant equity in the business. Many of them won't know much about traditional personal finance, but they sure know the ropes when it comes to start-up equity. Speaking to people in WeWork, I was impressed by the widespread awareness that you need to be there when a company is founded, because that is when the chunkiest equity stakes are handed out. Millennials have financial challenges, but they also have unprecedented opportunities for creating wealth for themselves in ways that their parents could have only ever dreamed about. It's challenging for young people to get on the property ladder these days, but building wealth through start-ups is faster, easier and more achievable for them than ever before.

That young generation's new-found wealth eventually makes it into the real estate market, consumption, and, increasingly, the stock market, too.

Markets around the world are currently experiencing a renaissance of retail investor interest, and much of that involves the younger generation. It is driven by firms such as Robinhood but also by globally-accessible online brokerage firms like Interactive Brokers (who I keep recommending to readers).

Websites such as Undervalued-Shares.com also play a modest role. I do have a fair share of younger readers and will work to attract more of them.

So many new market participants are pumping cash into the stock market right now.

That is just one of the reasons why you should take a closer look at the UK's stock market.

Takeover mania continues to throw up opportunities

I must sound like a broken record when I point towards UK companies as cheap, attractive takeover targets. Just check back to my Weekly Dispatch from 1 January 2021, "Brexit special: A list of potential British takeover targets".

It is worth pointing out yet again, though. The wave of lucrative takeovers in Britain continues unabated, and other publications are finally picking it up, too.

On 14 February 2021, the Financial Times headlined: "Private equity firms eye UK stock market for cheaper deals":

"Private equity groups are stepping up their pursuit of British companies, capitalising on a UK stock market that has fallen even though resurgent US equities have set record highs."

The latest target was Equiniti (ISIN GB00BYWWHR75), a company that provides back-office services. An American private equity company had wanted to buy the company since the days before the pandemic. The lockdowns then held matters up for a year. On 8 February 2021, the Americans made their move and offered a 40% premium on top of the recent share price. "Not enough", was the reply from the company. On the day of the announcement, the share traded as much as 52% higher. It's since come off again, but the company remains in play.

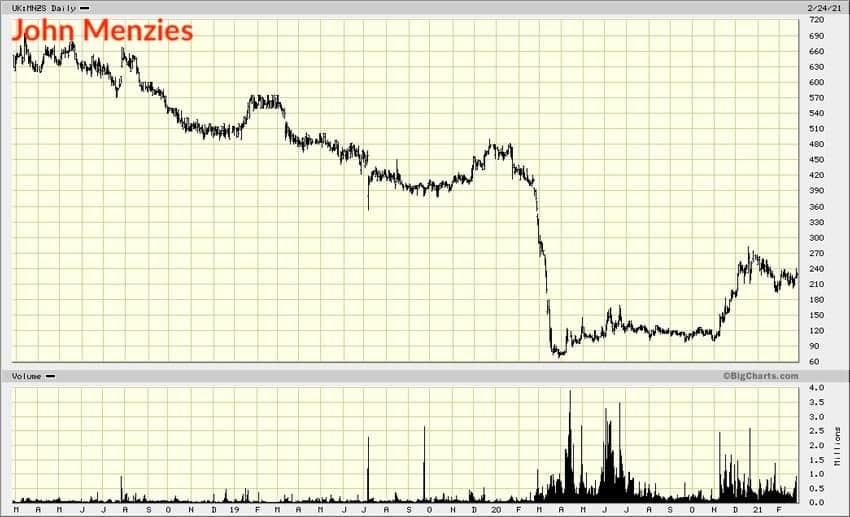

Another candidate for something similar happening is John Menzies (ISIN GB0005790059), the world's #2 (or maybe #3) ground-handling company at airports. I had pointed it out as a takeover candidate before the pandemic. My timing was off, given the subsequent fate of the aviation sector. However, the fundamental case for consolidating the industry remains the same to this day. Will private equity suitors finally get into gear? I think they will. Thanks to the bombed-out share price, I'd expect a bid at 80% to 120% above the current stock price. Anything less, and the key shareholders are unlikely to accept the offer.

Gripping as takeover battles are, there are plenty of other opportunities that don't fall under that category.

In complexity lies opportunity – British insurers

Something that always piques my interest are industries that are too complex for most investors to analyse.

That's where attractive situations could be hiding.

Take the idea offered by Alex Wright, manager of Fidelity's Special Values fund. He has invested no less than 15% of his client money in publicly-listed British insurance companies. These British insurance stocks are currently the biggest overweight position in his fund.

In a 16 February 2021 webinar, "Finding value in the UK" organised by Edison Group, he summarised it like that (starting at 47 min 26 sec):

- Insurers are a complicated sector and get lumped in with banks. In reality, British insurance companies hold globally diversified investment portfolios in bonds and infrastructure. They are a play on the global economy rather than a play on Britain.

- Insurance companies are often seen as sensitive to economic downturns. However, since the Great Financial Crisis, they have put a stronger focus on resilience. Case in point, British life insurers posted the same profits in 2020 as they did in 2019. In comparison, British banks suffered massively in 2020.

- The stocks of British life insurers offer good dividend yields, have learned to play to the ESG agenda, and have plenty of growth potential due to the investment needs of the annuities sector.

- Favourites to look at right now are Legal & General (ISIN GB0005603997), Aviva (ISIN GB0002162385), Phoenix Group (ISIN GB00BGXQNP29) and Just Group (ISIN GB00BCRX1J15).

Over the past ten years, Wright's fund ranks fourth in a nine-strong group of comparable British funds. His 152% total return beat the 127% peer group average and the 74% return provided by the broad market.

Wright's ideas might be worth checking out in more detail.

These are just examples, and I always advise my readers to do their own due diligence. My writing is primarily geared towards pointing you in the right direction so that you can carry out your own research. Also, keep in mind that my Weekly Dispatches do not offer any form of ongoing reporting (check my Frequently Asked Questions for more details). If you want ongoing reporting about specific stocks, you'll have to fork out USD 49.

Free reading material about the British opportunity

These days, there is a lot more reading material about opportunities in Britain, and much of it even for free.

Check out:

- Financial Times, 10 February 2021: "UK stocks creep back into favour after years of ‘benign neglect’" (free if you stay within a monthly limit of articles)

- Investor's Chronicle, 16 February 2021: "Will the 2021 takeover surge continue?" (free)

- Daily Telegraph, 20 February 2021: "The British shares on a 50pc 'Brexit' discount – for a limited time only" (free if you stay within a monthly limit of articles)

Value investors will take delight in knowing that 25% of the British market is trading on a single-digit price/earnings ratio for 2022.

But value is just one theme, and there are plenty of other angles.

Indeed, there is an all-new tune about to be played at the London Stock Exchange:

- More tech companies thanks to a booming IPO market.

- British companies are placing more emphasis on global expansion rather than the EU.

- Growing retail investor participation in the market.

All of this makes for a plethora of opportunities.

Will we see a revised and regrouped FTSE-100 Index reach 10,000 in the coming years?

Some people are now starting to wonder if that may yet be on the cards.

It'd require ending the index's current overweighing of banks and energy companies, and replacing them with tech and life science companies. Britain's got plenty of those, and more of them are due to come on the market.

This could set the British market alight in a way that, right now, few can imagine.

The vibe has started to turn

I had arrived in London two days before the Great Lockdown of Winter 2020.

When this email goes out to my readers, I will be on my way back to Sark in the English Channel. My departure date turned out to be two days after the release of the "roadmap" that will hopefully see Britain's lockdown end on 21 June 2021.

Unbeknownst to me when I planned my travel dates, I perfectly captured the beginning and the end of extraordinary months in the UK's capital. (Though I do occasionally credit my gut feeling with subconsciously steering me towards the right dates.)

Details of Boris Johnson's roadmap and all the other contentious issues aside, it's evident that the situation is starting to get better.

Early February 2021 was an extraordinarily dark period in London. In retrospective, that was the proverbial moment when it was darkest just before dawn.

In mid-February 2021, the veil suddenly began to lift.

The streets got busier again.

Hyde Park, my daily running track, suddenly saw the same density of visitors as it would during normal times.

Friends were starting to make plans again.

During the ten days leading up to me spontaneously writing this missive, London's energy changed notably. It was like someone let pressure out through a valve.

A makeshift gig in Notting Hill – things have started to get back to "normal".

No doubt, the Britain that emerges from this pandemic will, in many ways, be different. Some of the damage done will be impossible to undo.

There has yet to be a reckoning at the ballot box. Voters will eventually ask politicians why they did what they did. My prediction is that some future elections will be similar to the timeless scene "This is what happens when you find a stranger in the Alps" from The Big Lebowski. If you don't know what I am talking about, you can watch the three-minute scene on YouTube. I have no doubt that the (mis)handling of the pandemic will result in significant political pushback once the dust settles. You simply know things are serious when even the BBC's Emily Maitlis hints that she would like to see politicians punished and locked up (before hastily deleting her tweet). The potential political fallout of all this – once the dust settles – could have a significant influence on investment trends. It's an interesting subject, though one for another day.

In the meantime, I bet that humans will not have fundamentally changed just because a virus (and politicians) brought everything to a temporary halt.

Things will have changed, but there'll probably be a point where we realise that many of the dramatic predictions didn't come to pass.

Businesses that got hit hard will come back and start to rebuild.

Incredibly, London's banking district just saw the approval of a new high-rise building. 55 Gracechurch Street will "embody many of the emerging trends for post-pandemic office space – delivering a ‘workplace destination’ alongside extensive retail, cultural, public art and open space", said the company press release. If they are building even more of the stuff, maybe the office isn't going to die just yet?

Even that old favourite of mine, Capital & Counties (ISIN GB00B62G9D36), is finally showing signs of life again. If the chart is anything to go by, Covent Garden should yet again become an important hub within London when the capital reopens.

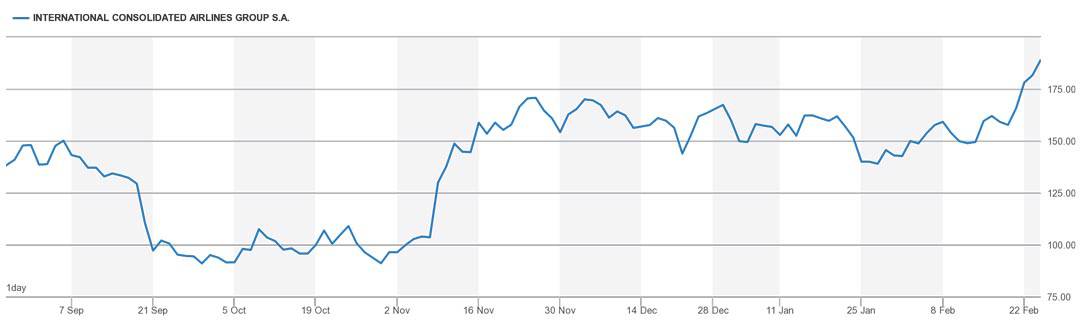

Ditto for International Consolidated Airlines Group (ISIN ES0177542018), the owner of British Airways and Iberia. Members of my website are just about to receive an update about the company, summarising the airline's prospects over the coming months and years.

As soon as our pandemic overlords permit, I'll be back to eat in Covent Garden and fly off on British Airways.

Just about everyone else I know is eager to do the same.

Watch out for that summer boom of unexpected proportions. London's resilience may yet again surprise on the upside.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: