There are some countries where looking for value investments is akin to the proverbial shooting fish in a barrel.

Enter Argentina, and enter Loma Negra (ISIN US54150E1047), the country's cement giant.

Here is the story of a market-leading, solidly financed Argentinean company that is trading at incredibly cheap multiples. It's a stock which anyone can easily buy and sell on the New York Stock Exchange because its ADRs were listed in the US in 2017.

Surprising figures about Argentina's cement cycle

When I look for value in beaten-down countries, I prefer to look at companies that have been around for decades and which operate in timeless industries.

Loma Negra fits the bill. Founded in 1926, the company has been dominating Argentina's cement production for decades. At last count, it controlled between 45% and 50% of the country's cement production.

Handily, Loma Negra has effectively carved up the market. Argentina's infrastructure is lacking in many ways, but for cement producers faced with sky-high transport costs owed to the material's weight, it keeps competition relatively low. Broadly speaking, Loma Negra's biggest competitor, Swiss-based Holcim (ISIN CH0012214059), controls those geographical parts of the Argentinean market that Loma Negra isn't overly active in.

Without a doubt, Argentina continues to make headlines for its troubled debt situation, volatile politics, and financial suffering of its population. Yet, cement remains in demand. During the first eight months of 2021, sales of cement in Argentina were just 1% below the record year 2017.

Like so many other countries, Argentina is lacking housing and infrastructure. With what little financial resources the country and its people currently got available, they build as much as they can. Between January and August 2021, cement usage surged 36.7% compared to the previous year. Who knew?

Based on the most recent figures, it looks like Argentina is well on the way to starting its next cement market cycle. In most other countries, the cement market runs in cycles that last eight to ten years. In Argentina, the past two decades have brought three cycles of six to seven years each. The most recent bottom of the market was in 2019. If the country sticks to its pattern, the next three to four years will continue to bring growing cement sales and a peak around 2026.

The biggest beneficiary of this cycle?

Loma Negra, the undisputed market leader and a company that will soon benefit from an ace up its sleeve.

A major development at year-end 2021

Loma Negra went public in 2017, near the peak of the last cement market cycle. The stock traded as high as USD 27 but fell as low as USD 3 when Argentina spiralled into its most recent debt crisis. It's now trading at just under USD 7.

Unlike many other Argentinean companies, Loma Negra didn't participate in that era's fashion of taking on massive amounts of debt. The company never had a particularly high gearing, and it even reduced its debt load further when it sold Yguazú Cementos S.A., its Paraguayan subsidiary in August 2020.

The proceeds - USD 109m in cash for a 51% stake - went towards repaying most of what little debt Loma Negra had. As a result, the company is likely to finish the year 2021 with a miniscule debt load of 0.2 times EBITDA.

Before year-end, Loma Negra is likely to announce the successful completion of a game-changing investment project that started in 2017: a USD 350m endeavour to build a state-of-the-art cement plant called "L'Amalí II". The facility in Olavarría, in the Buenos Aires Province, has mind-boggling proportions: L'Amalí II will single-handedly expand Argentina's cement capacity by ≈20%, and that of Loma Negra by ≈40%.

Besides the overall increase in capacity, Loma Negra will benefit from:

- Lower production costs, because L'Amalí II is more modern than any other cement plant in Argentina.

- An improved ability to focus on producing clinker during winter. Clinker is an intermediary product of the cement industry, and it can be produced with lower energy usage. Energy is more expensive in Argentina during winter, which is why the temporary switch in production will make a lot of financial sense for Loma Negra.

Assuming the cement cycle in Argentina continues to move in the way it has recently been moving, Loma Negra should be able to sell more cement than during the cycle's last peak, and do so with higher margins. Following that logic, the stock should eventually surpass the last cycle's record high of USD 25.

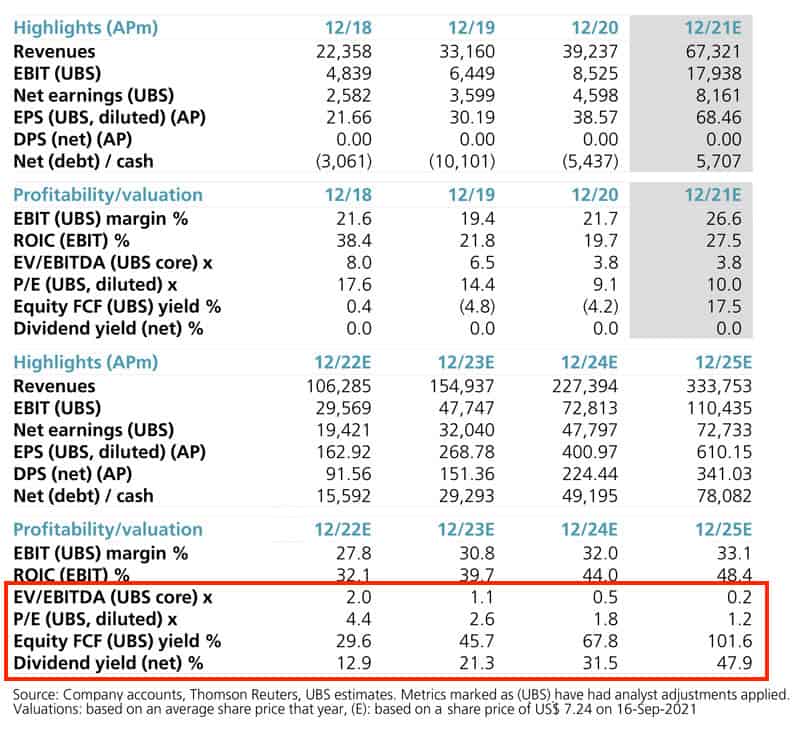

UBS ran the numbers, and the result is worth looking at in detail.

Source: UBS, 16 September 2021.

With L'Amalí II spreading its wings as of next year, UBS expects revenues and earnings to increase dramatically from 2023 onwards. For 2023, the estimates make for an EV/EBITDA multiple of 1.1 and a price/earnings ratio of 2.6. For 2025, the estimates come out at 0.2 (EV/EBITA) and 1.2 (p/e) – an insanely low multiple. During the same period, the dividend yield is projected to rise from 21.9% (2023) to 47.9% (2025).

Incredible?

These multiples are quite in line with the kind of bargain you can find in Argentina, provided you know where to look and have access to up-to-date, professional estimates.

Where's the catch?

For the avoidance of doubt, Argentina remains a country with above-average risk. Politics, macro-economics and the state of the construction industry are all exposed to the particular kind of chaos that the country has become infamous for.

That said, housing and infrastructure remain among any country's basic needs, and Loma Negra is the dominant provider of the key material needed for any construction.

With L'Amalí II destined for completion, Loma Negra's capital expenditure will decrease significantly from next year. Given its low level of debt, the company could easily sit out another downturn if required. Its extremely low valuation should make it worthwhile to wait for the next recovery, even if that were a bit further down the road than currently expected.

Bargains like Loma Negra are the reason why I continue to look at countries, industries and companies that are genuinely out-of-favour. Loma Negra is just another example of the sort of bargain you can find in Argentina (alongside CRESUD S.A. and Pampa Energía - well worth checking out if you haven't already!), and the country probably harbours many more.

No matter how crazy markets go in other parts of the world, there is always a place where bargains abound – and Undervalued-Shares.com will continue to dig out the gems for you.

Gazprom: Profiting from Nordstream 2 and rising gas prices (German-language video)

Gazprom: Profiting from Nordstream 2 and rising gas prices (German-language video)

What's the latest on Gazprom? The stock has seen an impressive development since I first featured it in December 2018.

In my 25-minute chat with Philipp Haas, founder of investresearch, we take a closer look at Gazprom's success story, and what the future holds for the energy giant. Is the upward trajectory going to last?

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get my best investment ideas each year

Join my global audience (Members from over 80 countries!) for hard-hitting investment research that you won’t find anywhere else.

Unlimited access to in-depth investment reports and regular updates - for just USD 49/year, or USD 999/lifetime.

FIRST TIME HERE?

LET'S WORK TOGETHER

Copyright 2021 - Undervalued Shares. All rights reserved. | Privacy Policy | Cookies | Terms & Conditions

Get my best investment ideas each year

Join my global audience (Members from over 80 countries!) for hard-hitting investment research that you won’t find anywhere else.

Unlimited access to in-depth investment reports and regular updates - for just USD 49/year, or USD 999/lifetime.

FIRST TIME HERE?

LET'S WORK TOGETHER

Copyright 2021 - Undervalued Shares. All rights reserved. | Privacy Policy | Cookies | Terms & Conditions