Earlier this week, news broke that private equity firm Partners Group would spend about a billion dollars to increase its stake in Breitling, the luxury watchmaker.

The deal is said to go ahead at 4.8 times the watchmaker's annual revenue, a seemingly eye-watering valuation!

However, Partners Group didn't grow to USD 125bn in client assets by overpaying for investments. The firm's plan is to grow Breitling to double its current size, and to exit in 2027. Well-managed luxury brands promise industry-beating growth rates and profit margins, which make them lucrative despite significant acquisition premiums.

In the past, such takeovers happened mostly among different players in the industry. Today, there is an increasing number of financial buyers.

Which publicly listed luxury goods makers are next on the list to benefit from the industry's ongoing M&A carousel?

A long-rumoured elephant merger?

The first potential target to keep an eye on seems almost too big for a credible takeover target.

Switzerland-based Richemont (ISIN CH0210483332, CH:CFR) is one of the "Big 3" of the luxury goods industry, with a market cap of EUR 64bn. It is best known for watches and jewellery, with brands such as Cartier, IWC Schaffhausen, Jaeger-LeCoultre, Montblanc, and Van Cleef & Arpels.

The luxury goods industry has long speculated that Richemont will eventually tie the knot with Kering (ISIN FR0000121485, PA:KER). The French group is strong in fashion, especially with its lead brand, Gucci. Marrying Kering's position in soft luxury with Richemont's position in hard luxury would make a lof of sense. Kering currently also has a market cap of EUR 64bn.

A merger would help the two companies compete against the ever-stronger world market leader, LVMH (ISIN FR0000121014, PA:MC). With a market cap of EUR 364bn, LVMH is now five times bigger than each of the other two.

In May 2021, it emerged that Kering had actually made an informal approach to Richemont. According to Miss Tweed, the luxury industry blog run by a former Reuters journalist, Kering made a cash-and-shares offer to Johann Rupert, the 72-year-old patriarch of Richemont. The Rupert clan rejected the offer at the time, but this is not to say that the deal wouldn't be on at a later time. These talks seem to have been an on-and-off affair for years, and Richemont even hired Goldman Sachs as advisor at one point.

At the time the last such offer was discussed, LVMH was three times the market cap of Kering. Today, it's five times. The growing gap between the value of LVMH on the one hand, and that of Kering and Richemont as the industry's #2 and #3 on the other hand is indicative of what's happening in the luxury goods industry. Producing desirable items for the world's wealthy is increasingly a winner-take-all proposition. Ever more market share is concentrated in the hands of a few brands, and the biggest players also tend to have the highest profit margins.

For the multi-billionaire owners of Kering and Richemont, lagging behind the multi-billion owner of LVMH has long been merely a nuisance and an ego issue. Increasingly, though, it's also become a real problem for their business, as size is an important success factor.

For a tie-up of Kering and Richemont to happen, several very big egos need to get into the same room and come to an agreement. Both Kering and Richemont are run by a father-and-son team, even though the father-and-son dynamic at Richemont is subject to contradictory information floating around the public domain. In the past, such a deal would have been seen as almost unthinkable. Nowadays, it's not that far-fetched a proposition anymore.

Rupert owns just 9% of Richemont stock, but he controls 51% of the company's vote. Since 2013, the stock has moved up just 30%. During the same period, Kering stock has been up threefold. Kering is perceived to be higher risk, because the fashion business tends to be more fickle. Richemont's brands are seen as more resilient, but there is a perception of mismanagement in at least some of the group's brands.

Given the industry's dynamics, the likelihood of such a deal getting back on the table in the foreseeable future has increased. The ownership structure of these firms makes a deal difficult, but it will probably happen eventually and with Richemont the acquired. As Miss Tweed reported in her 21 March 2021 article:

"Some hedge funds have built up significant stakes in Richemont, betting that a deal with Kering will happen. … Rupert has said he has not asked any of his children to take over from him and become executives of the group -- they remain only shareholders. But time is ticking and Rupert knows he must sort out his succession and the long-term future of his group."

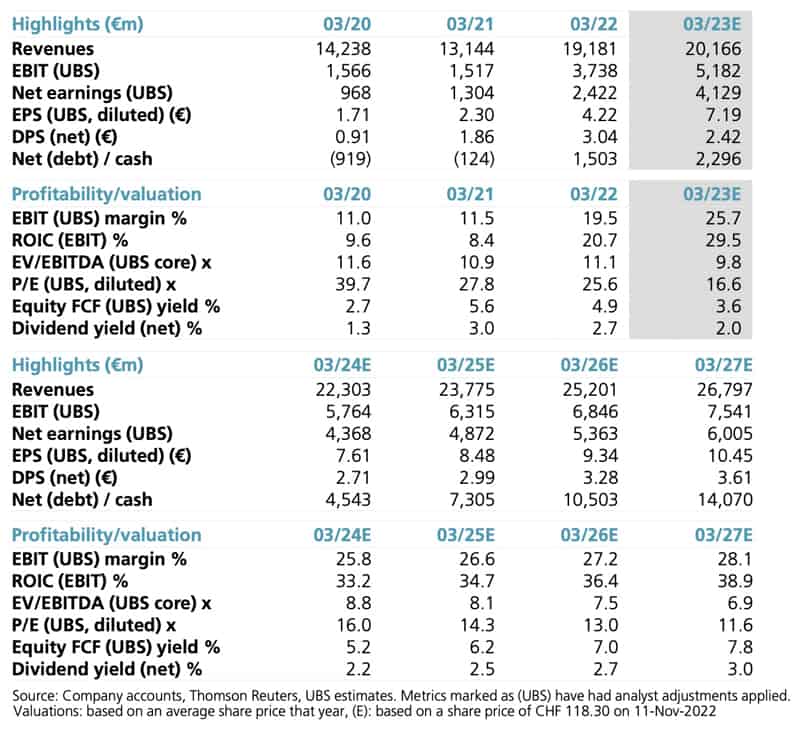

As the following table shows, Richemont stock is currently relatively cheap compared to valuations paid for acquisitions in the sector, especially because of the very high value of Cartier, one of the industry's gems (no pun intended). For an acquisition to have a chance to succeed, Kering would probably have to offer the Rupert family a prominent role in the newly merged company, which has been one of the main issues so far. Richemont has long been known to be all about making money, and a very large amount of cash for the Rupert family may clear the hurdle. The Rupert clan will only have one opportunity to cash out the empire they have built since the 1980s, and they'll negotiate a tough deal.

Source: UBS, 14 November 2022.

Once this largest-ever deal in the luxury goods industry takes place, there'll be an inevitable flurry of activity elsewhere in the sector. It'll make investors the world over wonder where to expect the next bid.

Another perennial target is located in Britain, and its stock is probably good for an upside of 35% if or when a bid finally comes.

Luxury made in Britain – now on sale

Some companies have been a takeover target for so long that no one takes any rumours serious anymore – until a takeover finally does happen after all.

Burberry (ISIN GB0031743007, UK:BUR) has been an on-and-off takeover target for the better part of ten years (see also the 24 September 2021 Weekly Dispatch "Burberry – the next takeover target?").

In the past, these rumours were more than just rumours on several occasions. Burberry has already turned down several bid approaches, including a potential cash-and-shares bid in 2016 by the American luxury goods group, Coach.

The company has seen several rounds of leadership changes in recent years. In November 2022, the new CEO, Jonathan Akeroyd, presented a new strategic plan, which outlined Burberry's ambitions to grow its revenue to GBP 4bn over the next 3-5 years, compared to GBP 2.3bn in 2021. Longer term, the company aims to achieve GBP 5bn. The market seems to give the new leadership the thumbs up. Over the past three months, Burberry stock has been up 30%. A would-be acquirer is now facing the risk that the longer they wait, the more expensive it gets.

However, the stock price is still far below where a bid would have a realistic chance to succeed, according to some observers. Nick Train is a star fund manager at Lindsell Train, whose fund is one of the largest shareholders of Burberry with a 5% stake. He recently stated that "he would be 'adamantly opposed' to any offer which was 'remotely' near Burberry's current valuation." According to a 23 October 2022 article in the Daily Telegraph ("How bargain Britain has left Burberry at risk of a takeover"), company sources couldn't imagine a bid succeeding for less than GBP 2,850 per share, which is 35% above the current share price. Lo and behold, among the companies that could be interested is Kering.

Source: Miss Tweed, 18 July 2021.

If you'd like an even higher upside, you need to look further afield. The luxury goods industry has a much broader representation on the world's stock markets than most people are aware of. This includes some long-forgotten names – companies that have not been the focus of investors for years, and whose circumstances make them benefit from the industry's changes in ways other than an outright bid.

One of them is Swatch Group (ISIN CH0012255151, CH:UHR), a watchmaker that is much more a part of the luxury goods market than its name suggests. Its stock could have an upside of 2-3 times, provided its family shareholders finally implement a range of long overdue changes.

Swatch Group is a special situation

Switzerland-based Swatch Group carries the name of cheap plastic watches, but it's really a luxury watch company. About 70% of its annual revenue of CHF 7.3bn comes from three high-end watch brands – Omega, Longines, and Tissot. The colourful plastic watches sold under the Swatch brand contribute a paltry 4% to group sales.

Swatch Group used to be a darling of investors and journalists alike when it was run by Nicolas G. Hayek, the legendary "founder", CEO and major shareholder of the company. Hayek wasn't really the founder as such, but he single-handedly saved the Swiss watchmaking industry from collapse in the 1980s. The company was the result of the merger of several loss-making Swiss watch brands, which merged under the roof of a company initially called SMH and later rebranded as Swatch Group.

Hayek died in 2010. Since then, his two children Nayla and Nick have been running the company.

The next generation's performance is a mixed bag. Swatch Group isn't in crisis per se. In 2021, it earned net profit of CHF 765m from CHF 7.31bn of sales. The company's balance sheet shows an 85% equity ratio, and there is a CHF 2.6bn cash hoard.

However, the seemingly strong financials hide a number of structural issues. E.g., during the past years, the four watch brands that jointly make up about three quarters of the company's revenue have all been losing market share. At a time when the industry is all about concentration and winner-take-all, seeing the famous Omega brand slip from its long-held #2 market position to #3 was a painful development. It's also hugely value-destructive for shareholders.

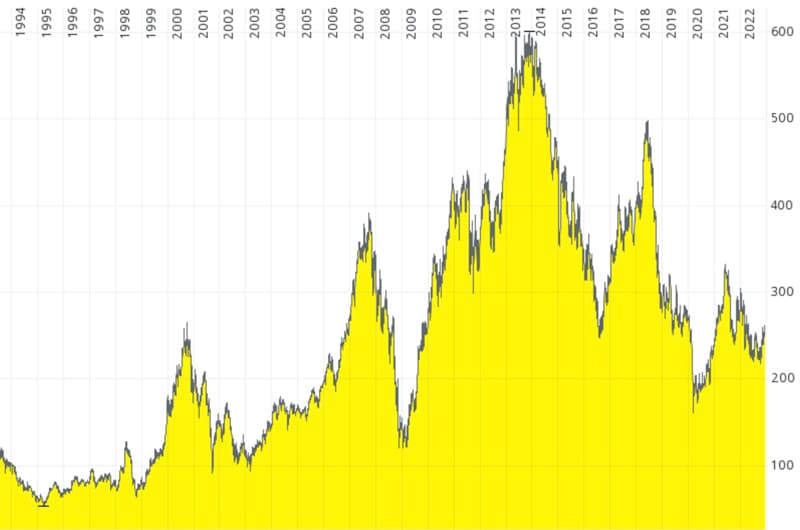

Since 2013, shares in Swatch Group have fallen 58%. The company used to be "the world's largest watch company", but it lost that crown in 2021. Unsurprisingly, Swatch Group is currently trading at depressed valuation metrics.

Swatch Group.

In fact, if Omega was rejuvenated and traded at the kind of valuation multiples that Breitling commands now that it's been rejuvenated, the value of the Omega brand alone would cover nearly the entire enterprise value of Swatch Group. That's despite Omega contributing just 35% to the group's revenue, i.e. there are 16 other brands and a number of other operations and assets. Based on the sum of its parts, Swatch Group could be worth 2-3 times its current share price if only it got a proper shake-up.

Will the stock of Swatch Group ever break out of its lull?

Right now, the market values this possibility at zero.

However, shareholders could be in for a surprise. Pressure on the Hayek family is mounting, and Swatch Group has a whole plethora of strategic options, including the increasingly good prospect of simply using the red-hot M&A market to consolidate its brand portfolio. Selling some of the 17 watch brands could set free significant additional value, as could a change in leadership. Even more importantly, such changes would ensure that the Hayek family doesn't suffer an embarrassing continued loss of relevance.

Swatch Group is a dull company with a surprising amount of upside, and the dynamics stirred up by M&A, IPOs and other corporate action in the sector should get it back on the agenda during 2023 and 2024. This is a defensive investment with a lot of upside.

The full details of Swatch Group's fascinating investment case can be accessed in this 34-page research report (out today, released just hours before this Weekly Dispatch).

Latest stock pick: Swatch Group

Swatch Group is highly profitable, has a gold-gilded balance sheet, and sits on a mountain of cash. Yet, the market treats it as a company in decline.

Just the expectation of possible change should see Swatch Group's share price jump, though.

The stock's record-low valuation could turn out a temporary bargain.

How long till break-up?

Latest stock pick: Swatch Group

Swatch Group is highly profitable, has a gold-gilded balance sheet, and sits on a mountain of cash. Yet, the market treats it as a company in decline.

Just the expectation of possible change should see Swatch Group's share price jump, though.

The stock's record-low valuation could turn out a temporary bargain.

How long till break-up?

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: