A Bloomberg terminal costs USD 30,000 per year, and it requires a steep learning curve from its users. Even those who can afford it often shy away from it.

What if you could get Bloomberg quality data and insights, but without the price and the learning curve?

That's the goal of Jens Nordvig, founder of MarketReader.

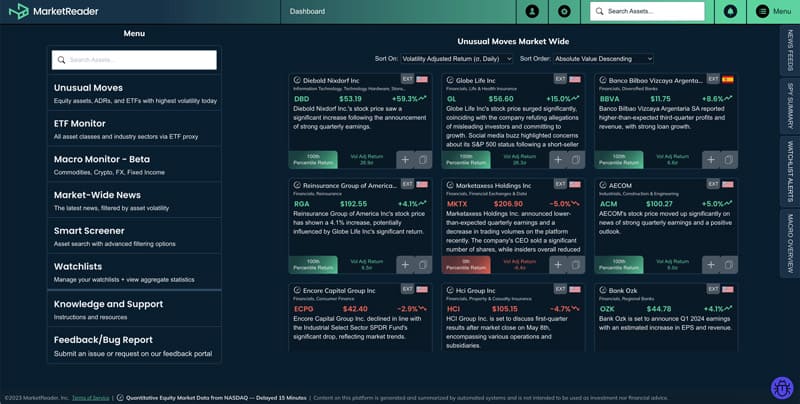

Over the past three years, his team have built a tool that explains – in real time and in an automated way – what is happening in markets.

At any given time, you can check:

- Why is Apple stock up today?

- Why are oil prices slumping?

- What's behind the dollar's latest move?

You can also look at different time horizons and literally ask: "What happened with my portfolio last month?"

Once the entire product suite has been rolled out, it will work across asset classes, too: "How have the interest rate changes affected the gold price?"

MarketReader promises to weed out the noise and help you quickly and easily zoom into what is actually happening with your stocks, ETFs, currencies, and other asset classes. It can also help you generate new ideas by pointing out unusual price movements.

Markets are extremely complex, and such a system must sound like a combination of magic and snake oil.

However, the man who has made it happen is someone who many of the world's best investors not only take very seriously but pay large amounts of money. Nordvig is a Danish-born PhD economist who was Head of Research at Nomura and Bridgewater, before working as Managing Director and Strategist at Goldman Sachs – with multiple industry awards won along the way. He subsequently set up his own research firm, Exante Data, to provide analysis based on crunching massive amounts of data. Within just a few years, Nordvig managed to win half (!) of the world's top 100 institutional investors as clients. Hedge funds, pension funds and other large institutional investors pay an annual five- or even six-figure sum to get access to the full scope of Exante Data's work, and to occasionally speak to the man himself. Exante Data became famous for a few research coups, including recognising the novel coronavirus as a market driver two months before it became a major subject. Major financial players trusted Exante Data's analysis of the pandemic as the real thing, because it was purely data-driven.

Yours truly paying Jens Nordvig a visit.

MarketReader started as a spin-off of Exante Data in 2021. Undervalued-Shares.com was one of the first websites to have featured it while still in its infancy.

Fast-forward 21 months, and Nordvig has:

- Signed a partnership with Nasdaq.

- Won multi-million backing for building the new firm.

- Landed the first six-figure enterprise deals for using MarketReader.

Just two weeks ago, he sent a message to his professional network:

"We have started talks with the BIG BOYS about strategic cooperation. … We have received interest from PE about potential acquisition. While this is too early for us, it is interesting, nevertheless, and once again illustrates we are leading in our specific space (real-time insights, beyond news) and industry experts are taking note. …. On The Pre-Series A Round & Future Rounds, we will be finalizing this pre-series A round with participation from … new angels (including one of the most well-known personalities in equity strategy)."

Undervalued-Shares.com doesn't usually feature services from early-stage ventures, but MarketReader is an exception. Not only could it be uniquely useful to Undervalued-Shares.com readers but now is the ideal time to trial and get familiar with the system.

If MarketReader does what it promises, then it's a tool that could indeed "pay for itself 5-10 times over each year, even if you are a private investor", as Larry McDonald, founder of The Bear Traps Report, once said in a call with users.

As a blog that is primarily followed by private investors, Undervalued-Shares.com likes the idea of a tool that promises to democratise access to high-quality information and empower individual investors to understand why the markets are moving – without having to spend 30 grand a year or attend an extensive course on how to use such a system.

Undervalued-Shares.com had a chat with Jens Nordvig, to discuss how MarketReader can help investors small and large, and where the investment world is going in terms of utilising AI.

Below is an edited transcript of this conversation, which you can also watch (or listen to) as a video.

Swen Lorenz: Jens, it's great to see you again. I've known you for over 20 years. We don't get to meet often enough. I'm in New York with you, which is your chosen home since… when?

Jens Nordvig: Since 2004. So when we were in London, it was more than 20 years ago.

SL: We obviously haven't changed. None of us got older. And we've come together to speak about a very exciting new project, which I've known about almost since inception. When I visited you last time, slightly outside of New York where you live, you were just in the process of setting up MarketReader as a new venture. That was 2.5 years ago, I think. And I wrote about it on my blog, Undervalued-Shares.com, at the time. I think I was one of the first people to write about it. And it's come a long way since then, and I've followed it at every step of the way, really. I thought now is a great time to report about it again, and I will cover in my questions to you at a later stage why I think now is the perfect timing to speak about it. But first, as an introduction, MarketReader. So, what is it? Why is it relevant to investors, small and large? What can it do for people? Give us the download and the pitch.

JN: The concept behind MarketReader is very simple. We just want to explain in an objective, precise way what's going on in the market. The concept is simple, but doing it is not so simple, because the market is complicated. There's no simple technology that can do it. Lots of people have tried to do it before. But the approach we've taken is that we've built a lot of quant models that really help guide the process, get to the right conclusion. And then with the latest AI technology, we can put the conclusion in a simple piece of text.

You don't need to know about all the models that are involved to generate the result, but you can get the gist of it. And in that process, you weed out an incredible amount of information; all that background noise that can take hours, days, weeks to sift through, we have done. And once you've done it in a piece of software, you can do it at scale. You can do it for thousands of assets at the same time. And it really generates the type of insight that you can't generate as a human. We want to make it easy to understand for a human. But it can do it at a scale where one person certainly can't do it alone.

SL: I just have to say, I'm still somewhat sceptical, being a bit of a Luddite. Markets and the entire world are just so complex. How could a computer ever possibly get to a point where it can, as you just put it, create an objective automated explanation of what's happening? Obviously, AI is helping, and I think that probably changed the equation in the last 12, 18 months, especially. Just how do you do it? How does this work?

JN: I'll be honest with you, it's not a simple system. We've been cranking for two years, as you said, and putting all the models together. And then the final sort of icing on the cake is that we have the AI layer that summarises all that quantum material, puts all the different dimension of analysis together. There are four types of analysis that we do in order to get good results. It is anything to do with news, social media will be captured in the system. But that's just one dimension.

Then there's all the stuff that is on the calendar, anything that gets repeated, earnings releases, CPI releases, and so forth, we analyse that as well.

Then there's anything to do with flows, volume, like the more technical things in the market, we analyse that as well.

And finally, we analyse all assets together. We know how different assets interact with each other. It's very hard to do that for thousands of assets if you're human, but we can do that.

Those dimensions together is the sort of secret sauce where we can really embrace the complexity and then put the final conclusion in a simple way in front of you.

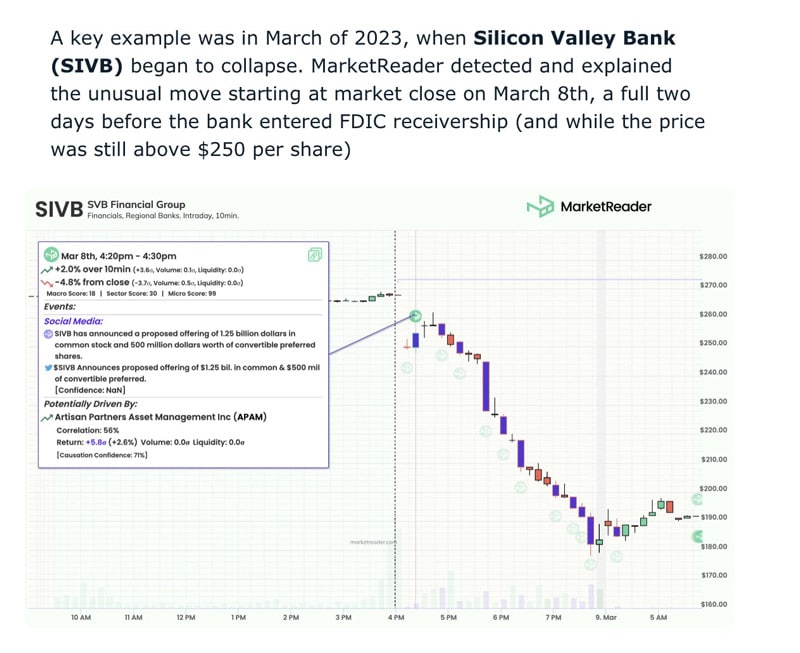

SL: There was one particular moment in the genesis of MarketReader that captured my imagination and convinced me that there was really something to it, and that was in spring '23 when Silicon Valley Bank went bust. MarketReader indicated with two days lead time that something was happening. You had it on your radar two days before it entered receivership.

JN: Maybe I had the same experience as you, because that was literally when I started to use the platform myself for the first time, literally that spring, a year ago.

And what MarketReader does is, because it scans so many assets at the same time, it always kind of finds the epicentre of the earthquake. In March 2023, it was certainly Silicon Valley Bank, and it popped up on the screen, this is the most volatile thing in the market.

And you can see immediately it was spreading to First Republic, and it took the market two days before it totally caught onto it.

JN: So social media can certainly be important, and we ingest an incredible amount of social media content, and try to get rid of all the noise, all the stuff with emojis and rocket ships and all that kind of stuff, we get rid of that.

But I think the key thing is: can we explain everything with social media? No!

It's really like having that multidimensional approach where you squeeze as much juice out of social media as you can, but then say that we have all the other dimensions as well, because if you try to put too much weight on one dimension, you're going to end up with not that great results, right?

It's really that multidimensionality that's key to the results quality.

SL: This is something that I get. As I said, I'm quite old-fashioned, I manually check all sorts of sources on the web for relevant information, also because I use quite arcane resources occasionally, and it makes intuitive sense to me that if I have a system that has the computational power and, for lack of a better word, a software backbone that knows how to amalgamate all this information in a way that is in tune with what I'm looking for as an investor, that is incredibly valuable. And that's what you're now offering with MarketReader as a product which you can subscribe, right?

JN: Yes.

And so there's two ways that we can sell MarketReader.

We can sell the MarketReader platform, where an individual user can go in and understand what's going on in the market quicker than before. They can have their own watch list where they have certain things that they care about and get really good information about that in a very timely way.

We can also deliver our feed. All the content could also be delivered to a trading platform. There are trading platforms that want to have an upgrade from "dumb news" and traditional news that is not very insightful. They can also ingest parts of this feed.

So there's two ways that we can sell this and we want to do both.

SL: I would imagine that quite a few people who see our interview or read it will recognise you from other work that you've done before because you've been running Exante Data, your research firm. At your existing firm, one of the other really memorable instances where everyone suddenly read your work was when you pointed towards the novel coronavirus as a potential market driver. I remember vividly back in those days in early 2020 reading your Twitter feed, which is quite widely followed, and you were visibly crunching enormous amounts of data, which is what Exante was always doing, bringing data together and then doing your magic sauce thing with it. Would it be fair to say that in a way this work at Exante Data has uniquely prepared you for what you're doing with MarketReader now? But instead of advising multi-billion hedge fund managers, you're now also making this available to an everyday investor because it's a readily available product on the Internet.

JN: Yes, so I definitely like to analyse data.

Lots of people have opinions about things, right? I like to have a data-driven approach.

And the first company I founded, Exante Data, really grew incredibly in 2020 because we had a process where we could forecast COVID pretty precisely.

Early on in the pandemic, people thought that the epidemiologists were forecasters. They didn't know that they were just always forecasting the worst-case scenario. They thought it was actually a forecast, right? There was like a window where you can say, if you could actually do a precise neutral forecast, you could really beat market dynamics. It was very interesting, and it took quite some time before the market caught onto it.

Obviously, when we had the first case in the United States, and New York totally shut down, nobody had really thought about it, and the market totally tanked. That was very interesting.

In terms of the background for MarketReader, the reason why I felt that I had to do a second company was that I spent a couple of decades helping institutional investors around the world, and I thought it would be really fun to do something that was for a much bigger audience.

So rather than 100 hedge funds or 200 institutional investors, I thought it would be fun to do something for 100 million people, right? Something for a big audience.

You can look at it in different ways, but there's about 400-500 million people in the world that are trading in some form, whether it's stocks, cryptocurrencies, like on their own, right?

Not all portfolios are the same size, but there's a lot of people interested in the market, and they all fundamentally have the same kind of desire to understand what's going on.

If you're making money, losing money, you need to know why. And that's what we're trying to do on scale.

SL: I would definitely question your figure of 400-500 million investors around the world. I'd say it's at least a billion by now. There's so much interest, especially thanks to crypto, whatever you think of it, a lot of people have started to invest in some shape or another.

JN: I'm glad we're questioning in that direction!

SL: It's also really worthwhile me pointing it out because you're probably way too modest for it. The marketing for Exante Data has always been very much based around the fact that you just know people, so you haven't been out there marketing yourself. It's fair to say that some hedge fund managers or institutional investors pay you a six-figure amount per year to pick your brain. So for you to now make your expertise available to what is essentially the retail market as well with a subscription that costs something like USD 100 a month, that's quite a change in direction, but it's also helping to democratise investing. So you're doing a great service to the investing world, and you're doing that building on the extraordinary experience you made in a very different part of the investment world.

JN: The way I like to think about that is that the structure that we've put together for this piece of software is in a way similar to the human structure that has been in place at a trading desk at a top hedge fund.

When the market is moving and the big portfolio manager comes down on the trading desk and asks what's going on, they would have gone through a process trying to crunch the flow data, speak to people at the broker-dealers, what's going on, looking at the news, looking at the calendar, thinking about how different things are.

They would have gone as humans through that process, and what we're doing is really to put all of that into an algorithm and a system that does it automatically on a massive scale. And then because of the new technology that's available in the AI space, not only can we actually achieve it, but we can also put the content in front of you in a way that's very digestible.

SL: If even I can use it, then I think everyone can do it. But it's just incredible, the amount of complex analysis you can do in the background and then put a simple piece of text in front of people.

JN: That's where the revolution is. We started building this army of models before the AI technology was really fully available, and then we put that layer on top. I think this is also why we have an advantage now because if you're just putting too much pressure on the AI alone with not that fantastic models, not that great data, it's not going to give you good results.

But if you have the combination of very solid models in the background and then good ability of the AI to put it into a digestible piece of text, that's a really fantastic combination.

SL: That's now leading to something else that's worth pointing out, and that was ultimately the reason why I hit you up for the interview now. When we spoke in the car two years ago somewhere outside of New York, I told you that one day I want to do an interview with you about MarketReader and how investors of any size and any background can use it. You've now started to sign up – or you're in discussions, I don't know what you can disclose – with large corporate clients who want an enterprise solution, who basically want to purchase your system for the entire company or for their clients as well. Your company has raised some venture capital, you've been fundraising recently. Can you tell us a bit more about where all of that is standing? Because enterprise deals would be a huge proof of concept, obviously.

JN: When you're building a new product, it's always a bit nerve-racking to figure out who wants to buy it. What we can see very clearly is that trading platforms and wealth management platforms that are trying to deliver a good service can absolutely see that having MarketReader content on their platform – which we can deliver as a data feed – is something that's going to be a huge upgrade for them.

They have kind of noisy, stale news feeds now. Now they can get really to-the-point insights that will be a totally different quality.

The feedback we're getting definitely is that those trading platforms, those wealth management platforms that have active clients, they can see the value and we can do deals with them pretty quickly. That's very exciting. We're at a very interesting point in time right where revenue is being generated.

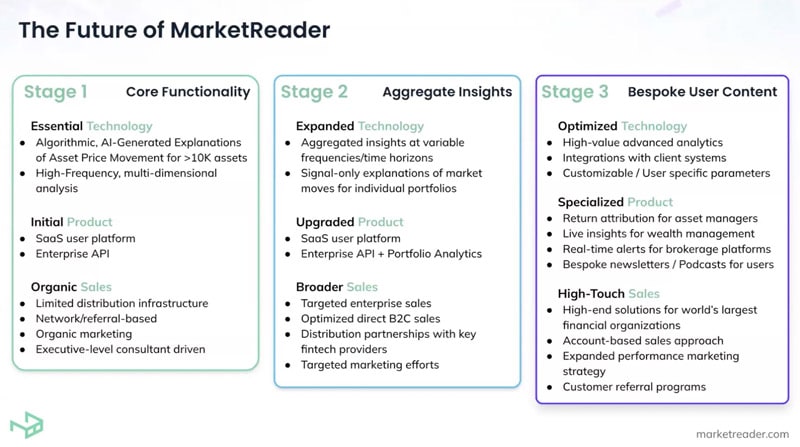

In terms of looking a little bit further into the future, and the reason why we would like to raise capital and continue to grow aggressively, is that we can build on this technology, right.

The most obvious next phase of MarketReader would be that we essentially have a solution where not only do we have the ability to generate insights about individual assets, but we can also essentially tell a story about your portfolio.

If you have a portfolio with 50 instruments in it, we can use the technology to essentially give you a story about what's going on. We can go into the kind of science fiction world, and we can say we're not that far from a situation where we can do a custom podcast for you.

"Swen, good morning. How are you doing? This is what's going on in your portfolio."

Can you imagine, compared to having generic content you listen to on CNBC or Bloomberg or whatever, how it is to actually have a podcast about your portfolio? We're not that far away from it. We have actually done the hard part.

Now we just need to aggregate it into a space where we use the information about your portfolio, we can put it in audio format if that's what clients want.

We can do incredible things with this technology.

SL: There are obviously a lot of people who claim that AI and software can do all of these things, but there are also the critics and the sceptics who say that, for example, with AI, one of the common problems is when the AI software hallucinates. Is that something you've ensured is not going to happen in your system?

JN: Yes. So there's a technical concept that's called "retrieval augmented generation", and that means very simply that the AI system only relies on very specific information that we give to it.

It's not that we have an AI engine that roams the world and tries to figure out what's going on.

We are essentially hand-holding. We tell the AI to go and focus on this and that, and then it needs to do a simple task of generating text, certainly in terms of putting it into a form that people can digest.

We give it certain tasks where it's going to make determinations, but it's on an extremely curated stream of content, and this is so crucial, right. If you put too much pressure on the AI to do too much, that's when the hallucinations come into play and can be a major problem.

SL: Fascinating. I'm speechless, and I worry about my own future now having heard about AI or MarketReader-generated podcasts. You mentioned that "with MarketReader you can bring data to life and tell a story". Hand on your heart, do you think that I'm going to be out of work with Undervalued-Shares.com in the future?

JN: No, I don't think so. But if people like you use a tool like MarketReader, you'll be more efficient in terms of generating content yourself, and then you use your own human judgment to add the spice to it.

We're going to have a situation where when you're communicating with your clients, your network, you can't do a bespoke story for each of your clients, each of the people in the network.

We can generate that bespoke, but if you want to offer some unique human perspective, some thoughts that have never been thought before, that's when the human and brain and creativity comes into play and is still extremely valuable.

SL: It's this monitoring that I was so interested in on a personal level, because I have readers who are entirely content with me sending out a summary once a month of what happened with some of the stocks that I've reported about in the past, and others would love to hear about everything in real time, which is a service that I obviously can't provide. However, with the right software put on top of that entire issue, there's probably a bespoke service that I may be able to create in the future, who knows? I'm obviously focused on equities, but MarketReader will eventually do this across asset classes once you've rolled out all the functionalities, right?

JN: Yes. So like I said, okay, we effectively think like we could serve everybody who are interested in understanding what's going on in the market.

We can discuss whether it's half a billion people or a billion. It's certainly many.

It's the same thing in terms of how many assets do we have in the system. At the moment we have about 15,000 stocks that are trading in the US. It could be US names or ADRs.

And then we have a bunch of macro assets.

In a year or so, I would like to say, we have now 100,000 equities in the system and we have all macro assets. That's certainly the goal we have.

SL: If people want to learn about this and get an introduction to MarketReader, you now have a daily newsletter – the MarketReader Minute.

JN: Yeah, that's actually really funny. "Newsletter", that sounds like something very, very old-fashioned, right? Why would we do a newsletter?

But it's actually been a massive success. For this MarketReader Minute concept, we use all the insights that are generated within the system, and we just put it in an email that is an AI-generated email that tells you these are the stocks that are moving the most today. These are some of the macro instruments that are moving the most today, whether it's gold or the euro, whatever it is.

And we also have at the top the most important kind of narratives that are driving all markets together, beyond the asset level.

Because an email is such a simple thing, it has allowed a lot of people to very quickly actually understand that they have never seen an email like that, one that actually was not humanly written.

SL: I get it every day now and I read it. And having been testing MarketReader lately, I love how it also engages with me in such a way that I think about how can I contribute to the system to make it better. In the backend of MarketReader, there is a section where you can provide feedback or ask for particular features. Do you get a lot of engagement from users, and does that lead to a lot of changes?

JN: Yes, we definitely want to learn from our users. Like, I think one thing we have learned has a lot to do with the frequency at which we provide the information.

When we created the MarketReader system originally, it was a super high-frequency system because in terms of getting the conclusions right, we need to do the analysis in very high frequency because otherwise, you're kind of co-mingling too many different things.

So we need to do the analysis in high frequency, but it doesn't mean that we have to present the results in high frequency.

What we are finding is that the very high-frequency information is information overload for most people. So instead, we now have a couple of different frequencies.

We have a frequency that is "the day so far". When you wake up, you want to know, what did I miss when I was sleeping? That's "the day so far" frequency, and that updates during the day.

But we also have a monthly concept where you say, if there's a stock that you want to catch up on that you haven't followed day and night for the last couple of weeks, you say, tell me what's going on, what's been happening, the most important stuff for the last month.

So one thing we're definitely learning from our users is that different people have different time horizons.

We want to be able to provide the content on any time horizon they want.

SL: I expect to hear a lot more about MarketReader in the months to come. And there have obviously been a lot of systems over the years that have claimed to do this, that or the other in terms of providing automated information in a very digestible form. I've got a huge respect for anyone who's ever tried it, and I've tried out some of these systems. I'm already signed up to MarketReader, so you don't need to convince me. But let us know from your perspective, why go for MarketReader and not any of the other systems that's out there that does something similar or claims it can?

JN: I think it's we have embraced the complexity in the market. We understand that the market is complex. We've not tried to build a simple system. And that's the reason why we can have good overall results. That's the key.

SL: To add to that, I think the key is also that you work incredibly hard. Whenever I send you a message, the reply comes straight back at any given time of the day or night. I can see the entrepreneur in you. Is there anything else you think we should cover that we haven't mentioned yet?

JN: Feedback is great. If people want to get in touch with me, they can do that. We can go on marketreader.com and check out what we're doing there. If you want to follow me on Twitter, my Twitter handle is @jnordvig. That's another way to be in touch with me.

Or you can go through Swen, and we can definitely get introduced.

SL: Your Twitter account is highly recommended, because you're really worthwhile following. Thank you very much for that amazing conversation! It's been extremely insightful, and I fully expect to read about MarketReader in other publications very soon because I think you're about to take off. Best of luck for that.

JN: Thank you. And thanks for stopping by in New York City. I know you have a very busy schedule.

SL: Always a pleasure.

About Jens Nordvig, PhD, Co-Founder and CEO of MarketReader: Jens Nordvig has an unbroken track record as leading markets strategist that spans well over two decades. For five years running, including the worst of the European financial crisis, Jens was the #1 ranked currency strategist by Institutional Investor. He was also awarded the Wolfson Economics Finalist Prize. Previously, Jens was a Managing Director at Goldman Sachs, a Senior Investment Associate at Bridgewater Associates and Head of Fixed Income Research and Global Currency Strategy at Nomura Securities, before founding Exante Data in 2016. Jens is also at the forefront of using Al in connection with financial market analysis with MarketReader, a company he co-founded in 2021.

Jens holds a PhD in Economics from the University of Southern Denmark as well as a MA and BA degrees in economics from the University of Aarhus. He is a frequent guest on CNBC and Bloomberg TV and has published op-eds in The Financial Times. Jens is regularly interviewed by Barrons and Forbes. He is the author of "The Fall of the Euro" (2013).

About MarketReader: Financial markets are more difficult to understand than ever before. MarketReader has set out to change that. MarketReader is a market analytics company that leverages financial odelling and generative AI to explain why the market is moving in real time. It provides simple, concise summaries of asset moves to users on a web-based platform in addition to a dedicated API feed for enterprise clients. Founded in 2021 by experts in economics, trading, and financial technology, MarketReader provides clear, objective explanations of asset price movement in a way that is accessible to all types of investors, from retail to institutional. Learn more at https://marketreader.com.

Mid-cap bid target

Western Europe has many industry-leading mid-cap companies that are hardly known among investors.

The company featured in my latest research report has a 50% market share in its industry in Europe, is trading at just 5x EBITDA, and has started to grow by 30-40% p.a. in a major overseas market.

Few analysts or fund managers follow the stock – but they should!

The company's CEO and COO have been given a strong financial incentive to at least double the share price by mid-2026.

It looks likely that they will succeed.

Mid-cap bid target

Western Europe has many industry-leading mid-cap companies that are hardly known among investors.

The company featured in my latest research report has a 50% market share in its industry in Europe, is trading at just 5x EBITDA, and has started to grow by 30-40% p.a. in a major overseas market.

Few analysts or fund managers follow the stock – but they should!

The company's CEO and COO have been given a strong financial incentive to at least double the share price by mid-2026.

It looks likely that they will succeed.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: