The peculiar case of Holding Bursátil RegioIf a company goes public through a non-conventional process, its stock often ends up falling through the cracks – at least initially!

The peculiar case of Holding Bursátil Regional, also known as NUAM, could become an interesting case study.

The company is newly listed following a merger of three regional stock exchanges, and it has not yet received formal analyst coverage. However, with 60 brokerage firms as members, 5-10 of them should come out with initiation reports in the foreseeable future.

The stock is also dirt cheap, which these initiation reports are likely to highlight.

"NUAM" is a story that you are going to hear a lot more about in the future. You've read it here first.

Regional stock market merger

Holding Bursátil Regional – literally, Regional Exchange Holding – is the result of the first ever multi-country emerging market exchange merger in history.

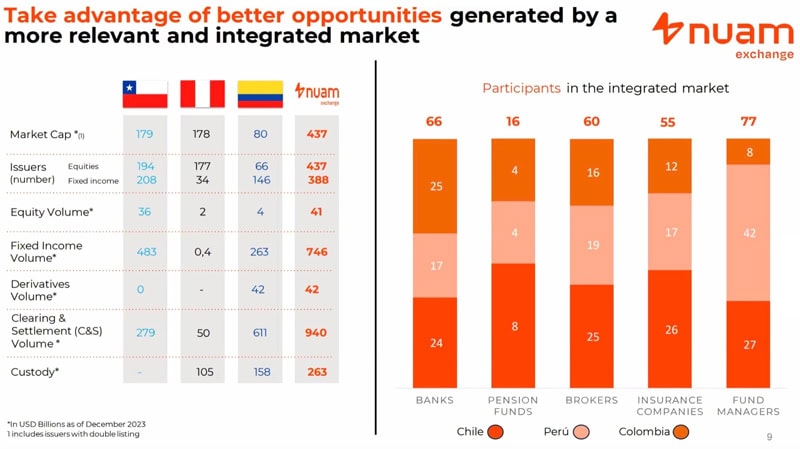

Following a process that lasted several years and which proved highly complex both legally and technically, the company now unites the respective stock exchanges of Chile (Bolsa de Comercio de Santiago), Colombia (Bolsa de Valores de Colombia) and Peru (Grupo BVL) under one roof. In fact, it's much more than that. The new holding company has brought together 18 different entities, including companies that organise markets for fixed income and derivatives, deal with custody, and provide technology services as well as data services. As with most exchanges, it's not necessarily with the trading itself that all the money is earned, but also with a range of ancillary services.

The merged company is generally referred to as "NUAM", a word play on "Bolsa Nueva Americas" or "Exchange of the New Americas". Technically speaking, the stock exchange platform is called NUAM, and the company is called Holding Bursátil Regional (ISIN CL0002892397, Chile:NUAM).

NUAM.

The merged stock exchanges have a combined market cap of about USD 300-400bn and about USD 1tr of fixed income. Foreign exchange comprises more than USD 800bn, and there is over USD 500bn worth of custody to take care of. These are regional markets, but the combined size is starting to matter.

Source: NUAM / Auerbach Grayson client call, 7 May 2024.

Interestingly, prior to their merger, the individual three stock exchanges were actually already listed. Its taken several years to arrange and execute the transaction, and the shareholders of these exchanges had the option to receive shares in the new entity in a ratio of 40/40/20.

To make matters even more complicated, the old listings of the individual exchanges still exist, because they haven't yet carried out a squeeze-out of the hold-out shareholders. The remaining free float of these exchanges is small, but the continued existence of their own listings confuses investors. However, this matter will be dealt with the foreseeable future; a modern exchange cannot present itself to investors if its own capital structure and listing are not up to standard.

Before too long, though, NUAM is going to attract attention because of its profitability and growth prospects.

Margin growth, M&A, and more

The combined exchange now represents markets with a total population of 105m people and GDP of USD 850bn – about 50% of Brazil's population and size. It has 85% of Brazil's market capitalisation, but only 15% of its trading liquidity. These figures are less stark when taking the respective free float ratios into account, but the fact remains – trading volumes on NUAM have a lot of catching up to do in order to level with Brazil. This should start to materialise now, though, due to the launch of a single unified trading platform for NUAM's markets.

And the potential to catch up doesn't stop there.

During Q3/2023, NUAM achieved an EBITDA margin of 39%. That's not just far below the 50% margin that the company wants to achieve by 2030, it's also way below the 60-70% margins that are common for exchanges in emerging markets. Their 2030 target margin is probably really conservative.

As the newly formed, larger company invests into better tech and creates additional services, its margins will probably only have one way to go.

There is also a card to play in the continued regional consolidation of Latin American exchanges. Other exchanges in the region similarly lack critical mass and sufficient connectivity. NUAM already owns 28% of the Bolivian stock exchange through its ownership of a company in Peru, and it has a 6% stake in the Dominican Republic exchange through its ownership of the Chilean stock exchange.

NUAM's management team has a great track record when it comes to unifying markets and launching new products to create additional revenue streams. E.g., the group also built a crowdfunding platform for Colombia, which could also incubate future candidates for a full listing.

The other successful regional player is B3 SA (ISIN BRB3SAACNOR6, BR:B3SA3), Brazil's stock exchange. It has a market cap of USD 12bn, and could launch a bid for NUAM if it wanted to increase its regional footprint. Short term, a move would be unlikely because of ownership restrictions for strategic assets and politics. Longer term, however, there is no reason why Latin America shouldn't also see its sector of exchanges consolidate towards just one or two large players. Exchanges are a scale-game!

Short-term undervaluation

For now, it's striking how cheap a valuation the stock of NUAM is trading at.

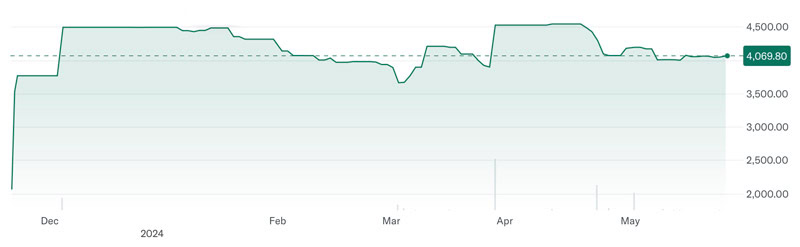

With 91m shares outstanding and a share price of CLP 4,100 (Chilean peso, circa USD 4.50), the company currently has a market cap of around USD 410m. Leaving aside one-off merger expenses, NUAM earned nearly USD 35m last year. The stock is trading at a price/earnings ratio of 11, which is low compared to other emerging market exchanges (15-25). Once merger synergies have been captured, the p/e should head towards 7 if the share price doesn't rise in the meantime. The stock of NUAM is currently cheap both in absolute and relative terms.

Throw in the fact that the company is debt-free.

What's the catch?

The stock is currently difficult to trade for most investors. You need market access to the exchanges of Chile, Colombia or Peru.

If you have access to these markets, you may even be able to do interesting things with the listed stubs of the national exchanges. There will be another chance to swap these shares into stock of NUAM. Eventually, these stocks will be squeezed out and de-listed.

In the meantime, there is one firm that larger private investors, family offices and institutions can turn to if they are looking to trade NUAM stock: Auerbach Grayson, the New York-based broker specialised in emerging and pioneer markets. The firm has repeatedly organised for block trades of USD 3-5m, and it's generally involved with over half of all trading in the stock. (You can reach Auerbach Grayson by emailing Simon Mandel ([email protected])).

Over time, NUAM will likely release information about new products, successful integration of its various platforms, rising margins, and potential additional M&A. The underlying markets have 60 brokerage firms as members, and it's safe to assume that 5-10 of them will start covering the stock with initiation reports and ongoing research. Longer term, the company could itself become the target of a bid if a company like B3 or someone from further afield spots an opportunity to increase their footprint.

That's plenty of potential catalysts combined with a stock that is cheap and an underlying business that is debt-free, growing, and in a sector with limited new entrants.

Chances are, the stock of NUAM will do as well as those of other newly listed stock exchanges in emerging markets.

Did you enjoy this off-the-beaten-path investment case?

There's more to come!

On 11 and 13 June, I am going to host the Weird Shit Investing conference in London and New York, with over 30 speakers presenting unusual, complex or overlooked investment cases.

Each speaker has to provide a one-page summary of their presentation, which will be collated and distributed as the "Weird Shit Investing manual" – for free, to all subscribers of the Weekly Dispatches.

There are many undiscovered investments out there, and Undervalued-Shares.com remains on a mission to educate and inform you about what's available in the far-end corners of the world's capital markets.

Laggard turning growth stock

The company featured in my latest research report is currently a lame duck.

It has tremendous growth opportunities, though, both organically through innovation and through M&A – if management gets its growth engines revved up again.

Will it?

The upcoming AGM will be crunch time for this company – but by then the stock could already be trading significantly higher.

Laggard turning growth stock

The company featured in my latest research report is currently a lame duck.

It has tremendous growth opportunities, though, both organically through innovation and through M&A – if management gets its growth engines revved up again.

Will it?

The upcoming AGM will be crunch time for this company – but by then the stock could already be trading significantly higher.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: