Until recently, Ørsted, a Danish developer of offshore wind farm, was celebrated as the gold standard of Danish companies.

Its fall from grace was painful.

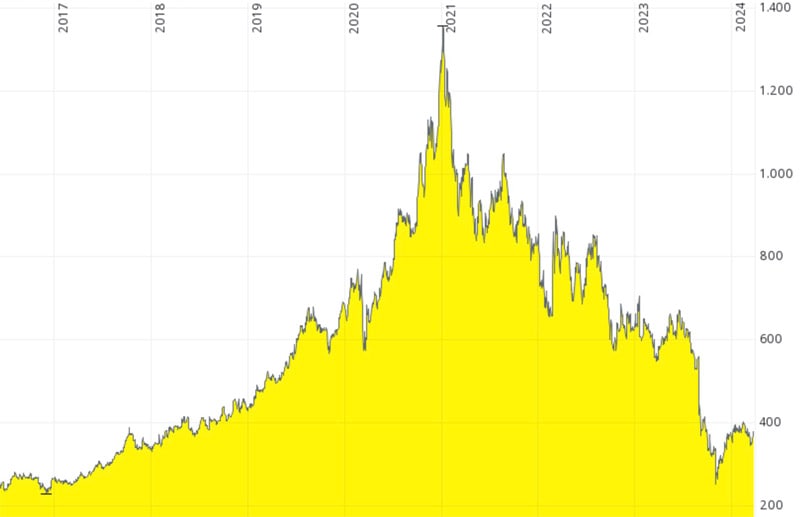

Since early 2021, the stock is down from 1,355 NOK to 365 NOK – minus 74%.

Ørsted was hotly debated at Value Spain, the value investor conference organised annually by Christian Freischütz.

Will the stock manage a turnaround?

Ørsted.

World leader with many world records

Ørsted is Denmark's largest energy company. It specialises in wind farms, even though its early history was all about fossil fuels.

The company had its origin in the Danish state-owned company Dansk Naturgas A/S, which was founded in the early 1970s to manage the newly-discovered gas and oil resources in the Danish sector of the North Sea. In the 1980s, it was renamed Dansk Olie og Naturgas A/S (DONG), meaning Danish Oil and Natural Gas.

Since the early 2000s, what was then still DONG gradually expanded into other parts of the energy markets. In 2009, it adopted an "85/15 vision", which aimed to change the company from 85% of activities based around fossil fuels to 85% based around "green" energy.

DONG eventually sold its oil and gas business to British billionaire Jim Ratcliffe, and committed to phasing out the use of coal for electricity generation. This was the moment when the company decided to yet again change its name. "Ørsted" paid homage to the Danish scientist Hans Christian Ørsted, famous for discovering that electric currents create magnetic fields.

In recent times, Ørsted has been the largest power producer in Denmark with market shares of 49% for electricity production and 35% for heat production. It also owned major power production facilities and projects in Germany, Sweden, the Netherlands, Norway, and the United Kingdom.

Even though it has a general focus on wind energy, Ørsted is primarily known for offshore wind farms. As the world's first offshore wind farm, it is now also the world's largest offshore wind farm company, with a market share of 16% (nearer to 30% if you excluded China).

When so-called renewable energy was all the rage and the investment industry celebrated so-called ESG as the must-do investment framework, Ørsted went from strength to strength. The company was held up as a model for the world to learn how a former oil and gas specialist could transform itself.

Between 2016 and 2021, the stock rose by a factor of five.

At its peak, the company had a market cap of EUR 80bn.

Such a sky-high valuation is something that Ørsted shareholders can nowadays only dream of.

What caused the downfall?

Over the past three years, the offshore wind farm industry was hit by a perfect storm:

- Supply chain disruptions.

- Rising commodity prices.

- Rising interest rates.

The sector's long-established model – a combination of cheap financing, government subsidies, and tax credits – no longer worked out.

The increase in interest rates, in particular, was a real blow for the industry as "renewable" energy projects are fuelled by capital. As Ørsted's CEO Mads Nipper once told the Financial Times: "For a company like ours — if interest rates go up by 3 per cent, that more than eliminates all the profit of a huge investment."

Ørsted was hit particularly hard in the US, where the contracts for developing such wind farms typically had less protection against inflation, and the industry's supply chain was less mature.

The Danes had no choice but two cancel two major offshore wind farm projects that it had planned for the coast of New York and New Jersey. The resulting financial write-downs on the Ocean Wind I and II schemes were quite a blow. Ørsted lost the equivalent of half the investment it had made in the US's offshore wind market up to that point. In absolute numbers, USD 4bn were blown away by the wind – pun intended. Worse, still, the company first announced lower write-downs, only to admit a much worse figure three months later. Investors really dislike such a phased delivery of bad news.

The decision to fold these two large projects in the US also called into question whether to go ahead with the Hornsea 3 off Britain's Yorkshire coast. This project was aimed to deliver power to no less than 3.3m homes, and it was going to be Ørsted's single-biggest investment decision.

Ørsted turned from investors' darling to being widely shunned. Whereas previously, anything the company touched turned into gold, it was now seen as turning everything it touched into rock.

Is there a chance this will change again, and could we see a turnaround in stock price?

A growth company trading (temporarily) at value prices?

Andrés Allende of DIP Value Catalyst believes that Ørsted's turn from ESG darling to uninvestible will reverse, and before too long. He presented his case at Value Spain 2024, concluding that the stock had 50% upside.

Allende pointed out Ørsted's outstanding track record in building and operating such offshore wind farms:

"Ørsted always built on time and on budget, including during Covid. They ring-fenced and bullet-proved their projects. They were very cautious not just with balance sheet and debt, but also with execution."

While the company recently had to reduce its 2030 target for installed renewable electricity capacity from 50 gigawatts to 35-38 gigawatts, the remaining pipeline of new business is secure: "80% of their EBITDA from now to 2030 is contracted."

Countries around the world continue to push for "renewable" energy, and offshore wind farms are very much part of it. Outside of China, operating licenses for offshore wind projects with a total of 40 GW of capacity will be auctioned during 2024. Despite the industry's recent problems, offshore wind is projected to grow from 32 GW of installed capacity to 205 GW until 2030 (split into 141 GW in Europe, 30 GW in the Americas, and 33 in Asia-Pacific).

Governments have also become more realistic in their demands when auctioning off the rights to build these offshore wind farms. In autumn 2023, a UK auction for further capacity got zero bids from wind farm operators. Around that time, both Spain and the US also had problematic auction results.

However, this also served as a wake-up call to governments: if they want to continue to increase the share of wind energy, they will have to offer these licenses on better conditions.

Inflation in the supply chain has also been coming down, at least to some extent. Getting costs under control was further aided by Ørsted cutting 10% of its jobs last year, and withdrawing from some offshore wind markets where it felt the conditions for further expansion weren't quite right.

Ørsted did what companies have to do under such circumstances: put everything up for review and discussion, revise the plan, and push forward. E.g., the Hornsea 3 project in Britain is definitely going ahead.

Source: Financial Times, 20 December 2023.

In his presentation at Value Spain, Allende saw multiple extra catalysts going forward, such as further "farm downs" (partial sales) of existing projects at good valuations, and potentially even write-backs at one or two projects where write-downs may have been too high.

"Ørsted's valuation, based on relatively conservative assumptions, still offers solid upside", his analysis concluded.

The jury is still out

The Q&A session following the presentation was lively.

"If you had asked me to identify the worst Danish large-cap company, I would spend less than a second to decide that it's Ørsted", said Ole Søeberg, organiser of the upcoming Nordic Value investor conference and a widely-known expert for Danish companies.

Another participant asked: "Having a state as main shareholder is usually not the best for investor. What is your take on having the state of Denmark hold 50.1% of the shares in Ørsted?"

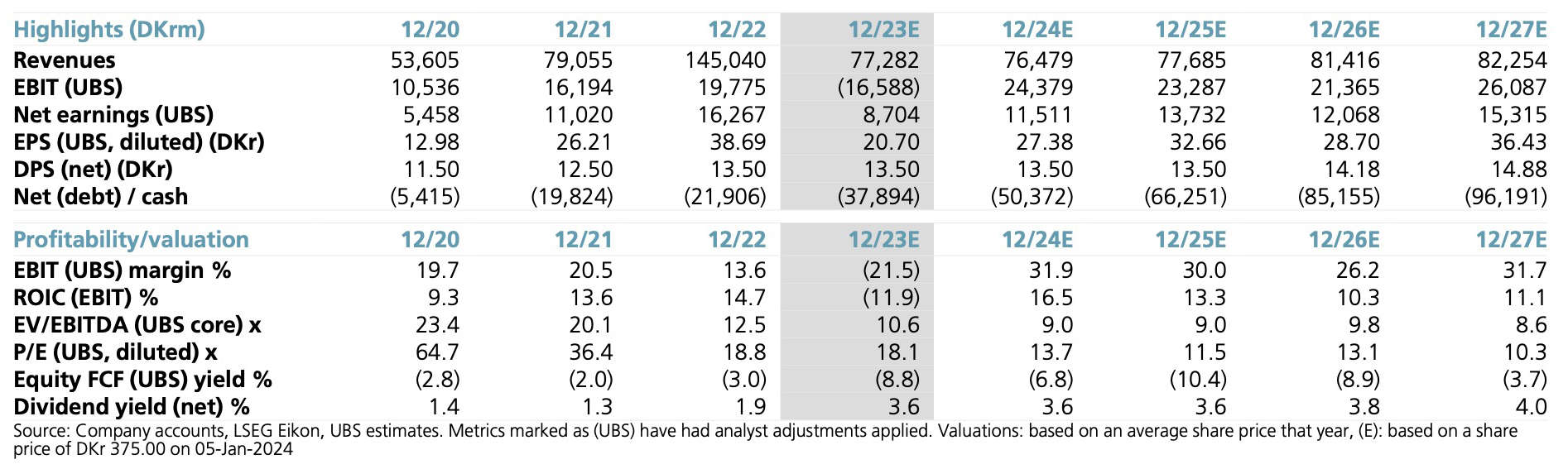

One attendee was concerned: "The dispersion among sell-side analysts for the estimated 2025 numbers is absolutely massive. There are not many companies where you find such a huge spread."

Clearly, the investment case behind Ørsted currently comes with a lot of baggage.

There are many pros and cons that warrant further analysis.

E.g., yours truly had always been sceptical of claims made around "renewable" energy, and warned not to invest into companies that depend on government subsidies, tax credits, and other non-market mechanisms. Such artificial constructs usually break down before too long, because of politics and the zeitgeist change.

However, I am the first to recognise that in this new age of re-investing into areas such as defence and security, offshore wind farms could remain a focus. After all, having such wind farms in your territorial waters (as opposed to importing energy from foreign lands) can increase a nation's energy security. Maybe ESG makes a comeback as "Energy Security is Good".

Seriously, though, I can see many signs of a real turnaround:

- After the painful bust, the industry will have made a 180-degree turn in both capital and cost discipline. Ørsted's reset plan was designed to make it a leaner and more efficient company.

- Given the recent issues with rising interest rates, any project that Ørsted signs in the next 2-3 years will probably start with a very high interest rate reference base.

- Ørsted continues to be the global market leader in the engineering, procurement, construction, and operation of offshore wind farms. If any one company can pull it off, it's probably them.

Recent troubles aside, Ørsted has many ingredients to appeal to quality investors.

As even one of the critical attendees recognised: "Despite all the difficulties, the investment case of Ørsted probably by now has the odds in its favour."

One attendee even wondered if, based on current market conditions, Ørsted can now "lock in the best investment returns of its life."

Source: UBS, 9 January 2024 (click on image to enlarge).

Was I able to definitely choose one side of the argument?

No. But I'd like to find out more! Can Ørsted's management make a convincing case that the next 1-2 years of operation will be consistent and trouble-free? I am eager to speak to them and see how they present their current outlook.

If such a meeting was to happen, you might even be able to join me.

Denmark investor trip – May 2024

As part of my trip to Denmark this May to attend the Nordic Value 2024 conference, I'm planning to visit a range of Danish companies. After all, the small Nordic country is home to a disproportionately large number of successful enterprises, such as Ozempic-producer Novo-Nordisk (ISIN DK0062498333, DK:NOVO), Europe's largest company by market cap, or ALK-Abelló (ISIN DK0061802139, DK:ALKB), a market leader in allergy treatments with a 35% global market share. Since my Weekly Dispatch in late 2023, the little-known stock is up 50%.

What else is of interest on the Copenhagen Stock Exchange?

Earlier this week, I started to reach out to a selection of Danish companies to see if they would meet with me on 23-24 May 2024. A handful of companies have already confirmed, and I am currently working on adding more to the list. In fact, I have also enquired with Ørsted.

There is space for a dozen people – fund managers, family offices, high net worth investors, analysts, or journalists/podcasters/bloggers – to join the trip. It is not yet guaranteed to happen, but if it were, do let me know if you'd like to come along (please include a sentence or two about your background). I'll then see if I can pull it all together (if it works out, there'll also be a fun bonus for the day after the company meetings).

Hot off the press: new in-depth research report

It's raining takeover bids in the UK.

Small- and mid-caps are particularly attractive for bidders. Often with little or no analyst coverage and limited trading liquidity, these stocks have literally fallen through the cracks.

My latest research report – out this week exclusively for Lifetime Members – features one such small-cap.

It has 50-100% upside in case of a bid, and at least just as much upside if no bid materialised and the company remained listed over the coming years.

How is that possible?

Hot off the press: new in-depth research report

It's raining takeover bids in the UK.

Small- and mid-caps are particularly attractive for bidders. Often with little or no analyst coverage and limited trading liquidity, these stocks have literally fallen through the cracks.

My latest research report – out this week exclusively for Lifetime Members – features one such small-cap.

It has 50-100% upside in case of a bid, and at least just as much upside if no bid materialised and the company remained listed over the coming years.

How is that possible?

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: