Seaport Entertainment Group is a NYSE-listed play on the revival of New York’s southern tip. I visited the neighbourhood to evaluate the opportunity.

OTC Markets Group – more than just an interesting stock

Is this a company you should take an interest in?

What about the broad universe of securities listed on the OTC market?

And why does this separate marketplace even exist in the first place?

Literally "over the counter"

In the early 20th century, plenty of US companies had outside shareholders even though they weren't formally listed on a stock exchange.

In 1904, one Arthur Elliot saw an opportunity to organise a market for these "forgotten" stocks, and produced a daily book with bid/ask prices. The book was physically delivered to brokerage firms, and the underlying stocks were also mostly bought and sold as physical certificates. These were the days when companies still issued bearer shares that had to be physically handed over from the vendor to the buyer. That's how the term "over the counter" entered the lingo of financial markets – the share certificates were literally handed over the counter to the new owner. Today, the term broadly refers to any stock that is not traded on an organised securities exchange.

Since those early days of hand-written books being passed around the brokerage firms of Lower Manhattan, the OTC market has grown to be the third largest stock exchange in the US, with an annual trading volume of around USD 500bn. This is a far cry from the trillions worth of stocks traded annually on the New York Stock Exchange or Nasdaq, but it's up tenfold compared to the USD 50bn worth of shares that changed hands on the OTC market in 2003.

This is a remarkable turnaround and rebirth. Following the launch of the electronic Nasdaq market in the 1960s, the OTC market had struggled to even remain in business. By the 1990s, it had a terrible reputation as a place where investors regularly got ripped off by brokers that used the lack of transparency to publish atrociously disadvantageous bid/ask spreads. As a result, the market had lost most of its relevance, and it generated just USD 2.5m in fee income a year.

A 30-year-old brokerage employee called Cromwell Coulson spotted an opportunity to take this market into the modern-day era. He pitched the idea to Michael Bloomberg, with a view to integrating the entire market into his Bloomberg terminals. When Bloomberg laughed him out of his office, Coulson decided to purchase the market himself. Since 1997, Coulson is the marketplace's major shareholder and CEO.

Today, OTC Markets Group Inc. operates several different markets that stocks and other securities can be traded on.

OTCQX: a market for companies that have to adhere to certain standards to achieve and keep their listing (such as providing financial reporting of a specific quality).

OTCQB: a market for smaller companies that can't (or don't want to) fulfil all the reporting standards of the OTCQX market.

Pink Sheets: a market for companies that only make limited information available to investors, and which generally do not collaborate with OTC Markets Group to have their stock traded.

Technically speaking, OTC Markets Group isn't a recognised stock exchange but a so-called inter-dealer marketplace, i.e. a decentralised alternative trading system that sits outside of conventional stock markets. Companies become publicly quoted and traded by virtue of a regulated broker or brokers making prices in their stocks. It is regulated by the SEC, but its regulation has a light touch.

It's also quite a diverse market. The OTCQX segment as the "Best Market" has 615 listed companies, which are complemented by the OTCQB market with 1,239 companies. The Pink Sheets provide quotations for over 1,500 companies.

Besides stocks, the OTC market also provides quotations for some exchange traded funds, bonds, commodities, and derivatives. In total, over 12,000 securities are traded on this market. Their exact composition is somewhat opaque, and many of them will barely ever trade. Some of the most active, however, see daily trading volume in the tens of millions. On its corporate website, OTC Markets Group provides a lot of information about the market and its listed securities.

In addition to listings for US companies, OTC Markets Group publishes prices for a large number of foreign companies, such as Nestlé, Adidas, and Heineken. Why would a multi-national firms want to have its stock traded on such a seemingly niche market? Foreign firms often don't want to provide the US regulator with financial reporting based on US listing requirements. On the OTC market, foreign companies can list their stock using domestic financial reporting, provided they are already listed on a so-called recognised stock exchange. It makes for an easy backdoor route into the US equity market.

Also, many US investors are still with brokerage firms that don't offer access to international markets. They can use the OTC market to invest in foreign stocks without placing an order abroad. All it takes is for them to accept that market makers will earn a small margin on their order (or a big one if they don't place their order with a suitable limit).

For companies that want to see their stock traded on any of these market segments, OTC Markets Group provides a range of support services at a fee. These include help in fulfilling listing requirements in the first place, as well as disseminating information to investors. Selling such services comes on top of the listing fees of the market. On the whole, the fees charged by OTC Markets Group are significantly lower than the equivalent prices for the Nasdaq market.

As a light-touch, cheaper alternative to conventional stock exchanges, OTC Markets Group has carved out a lucrative niche – and it's been good for its own shareholders, too.

OTC Markets Group.

Don't play the market – own the market!

When Coulson purchased control of OTC Markets Group in 1997, the company subsisted on USD 2.5m in annual revenue.

In 2022, it generated USD 105.1m in revenue and net income of USD 30.1m. By anyone's standard, this is an insanely profitable company.

Its revenue is split between listing fees (USD 20.9m), providing corporate services to listed companies (USD 47.8m), and selling data (USD 36.4m).

It's been a highly lucrative venture for Coulson to get involved with. When he bought control of the operation, it would have been worth no more than a few million dollars (if at all). Today, Coulson owns 42% of a company that has a market cap of USD 650m. Since 2010 alone, the stock of OTC Markets Group is up 16-fold, having risen from USD 3.50 to now USD 56.

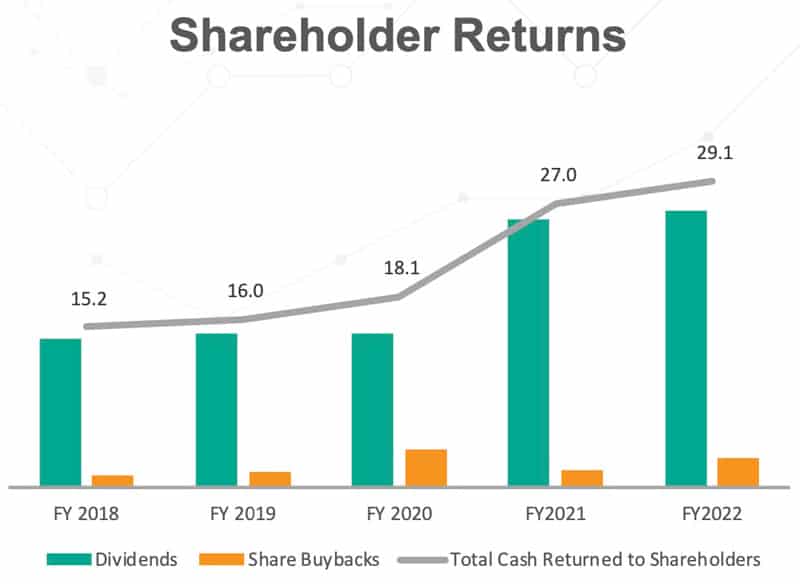

What looked like an operation about to go out of business in the 1990s has become an incredibly attractive business to own a part of. OTC Markets Group requires no inventory, little in terms of equipment, and just a small team to run it. The company tends to convert 80-90% of its EBIT into free cash flow. Since 2012, OTC Markets Group has grown its cash flow by 22.3% p.a., and it has a history of raising dividends and carrying out share buybacks. Management has proven very adept at allocating capital in an efficient way and aligning its interest with those of outside shareholders.

The entire operation is also a great example of the "Flywheel Effect" that Jim Collins made famous in his book "Good to Great: Why Some Companies Make the Leap and Others Don't". The competitive advantages of its business segments work together to create positive feedback loops that build momentum, which in turn increases the payoff of any incremental push. OTC Markets Group's flywheel strategy is simple: transparency drives liquidity, which drives data and ultimately more liquidity.

In many ways, OTC Markets Group has been more successful than the comparable London AIM market and Toronto's TSX Venture Exchange. It's difficult to procure precise numbers that would make these markets directly comparable, but it's pretty clear that on the whole, OTC Markets Group has been gaining market share on its competitors.

The question is, will it continue like that?

Foreign companies as a growth opportunity

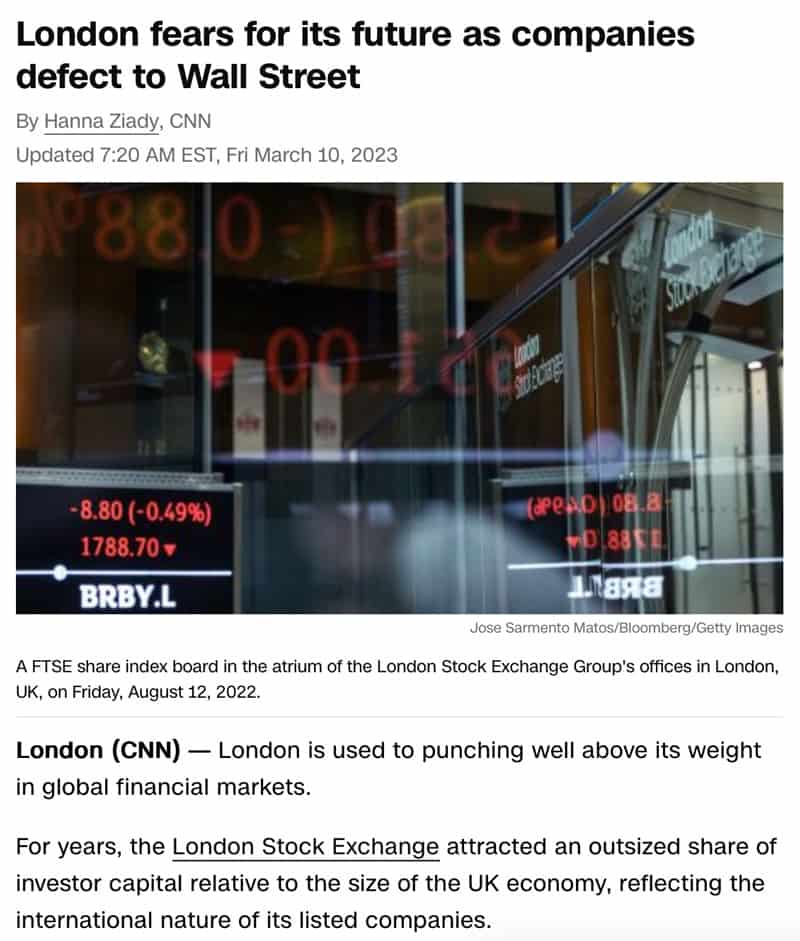

During the past few weeks, quite a few UK companies have made headlines by saying they wanted to shift their primary listing to the US. While most of these firms comprised blue-chip firms that would list on the NYSE, such news are indicative of a broader trend that also benefits OTC Markets Group.

Source: CNN, 10 March 2023.

No one has a definitive number of companies that are listed on a stock market outside of the US, with estimates ranging from 25,000-75,000. There are probably a lot of foreign companies that could benefit from a listing on the US OTC market. This market can be an attractive proposition to list on a market that US investors can easily access, without having to jump through all the hoops that highly regulated markets like the NYSE and Nasdaq require.

The same attraction holds true for US companies that would like to access investors and offer liquidity to their shareholders but without relying on the more expensive and more complex listing services provided by NYSE and Nasdaq (the latter being the main competitor of OTC Markets Group).

Source: Euromoney, 2 December 2021.

Also, the US economy has traditionally been very good at churning out additional companies that require investor access of some kind. The organic growth of the US economy should provide ongoing tailwind for OTC Markets Group.

There are some question marks about the future of equity markets. E.g., new digital technology and tokenisation could fundamentally change how we use such trading platforms, and even redefine what it means to be a publicly traded company. This poses risks to OTC Markets Group, but it could also provide further growth opportunities if the company managed to integrate these new possibilities into its platform in a timely and competitive manner.

For now, OTC Markets Group is also growing through acquisitions. In 2022, it purchased Blue Sky, a law compliance database covering over 100,000 equity and debt securities. Blue Sky fits neatly into the company's existing data services, and the acquisition adds another high-quality, recurring revenue stream to the mix. OTC Markets Group also recently took over EDGAR Online, the supplier of real-time SEC regulatory data and financial analytics.

Historically, stock exchanges and marketplaces have been exceptionally strong and resilient businesses. OTC Markets Group doesn't have a monopoly status per se, but it would be very difficult (and probably, impossible) for any new operator to break into this market. Even though it is not technically speaking a stock exchange, OTC Markets Group benefits from the same barriers to entry, wide margins and pricing power that have made listed companies such as Intercontinental Exchange (NYSE operator) (ISIN US45866F1049, NYSE:ICE), CME Group (Chicago Mercantile Exchange operator) (ISIN: US12572Q1058, Nasdaq:CME) and the London Stock Exchange (ISIN GB00B0SWJX34, UK:LSEG) such extraordinarily successful investments (learn more about this type of business in my Weekly Dispatch "Investing in stock exchanges – why are some investors so keen on it?").

London Stock Exchange Group.

It's very rare that you can get a stake in such quality companies at a low valuation. Over the past five years, the stock of OTC Markets Group has been trading at an average price/earnings ratio of 24. Even during the market turmoil of 2022 and the recent sell-off of financial stocks, the company's stock price has held up remarkably well, currently trading at 22 times consensus estimates. Many investors nowadays are looking to keep money invested for the long term in companies that are unleveraged, with recurring revenue, and a real chance towards further scaling their business in a meaningful way.

Quite likely, the market is sensing that OTC Markets Group is looking forward to another few good years – on the back of growing its market share, offering new services, and increasing prices and margins for existing services. After navigating many technological and regulatory changes for 26 years running, the management team around the company's main shareholder is more likely to succeed in this ever-changing environment than not. And as a much smaller company with a tiny market share, OTC Markets Group has a higher probability of yet again growing its size by a multiple than the existing industry behemoths like the NYSE and Nasdaq (for further details on the company's operation and financials, check out this 3 October 2020 long-read by Neto's Notes ).

OTC Markets Group comprises many more fascinating aspects. In fact, if its stock were cheaper, I'd be tempted to publish a much more in-depth research report about the company – also since I believe that one day, it will itself be acquired. OTC Markets Group's major shareholder is not getting younger, and the Intercontinental Exchange, in particular, is very acquisitive. It wouldn't surprise me if private equity had a go at acquiring the company at some stage (if it hasn't done so already). This is a business with untapped pricing power, and potentially many more areas to monetise its access to these listed companies. Its balance sheet is just waiting to be leveraged to a higher degree.

For myself, though, the most interesting part of this operation are some of the companies listed on the OTC market rather than the marketplace provider itself. It's here that you can still find outstanding investment value, and overlooked gems that are waiting to be discovered.

Look where no one else is looking

Undervalued-Shares.com has repeatedly featured examples of stocks that are either unlisted or trade over the counter, and which are still tremendously undervalued compared to their underlying assets:

- "Secret Californian company with billions in water rights?"

- "Pinelawn Cemetery – making a fortune from 'land share certificates'"

- "'The International Stock Exchange' is about to take off – catch it while you can"

Generally speaking, the less transparent, the higher your chance of finding an outstanding bargain.

One of the key challenges in researching such companies is to strike a balance between the lack of transparency and the ability to trade. The most untransparent market is the Pink Sheets, and while it can be very rewarding to research companies traded on the Pink Sheets, bear in mind that they do generally lack meaningful trading liquidity. As the example of Pinelawn Cemetery has shown, a fascinating investment case with lots of exclusive background information can be wasted if it's virtually impossible to actually buy the stock.

Exceptional opportunities do exist, though, and I have just worked through a particularly compelling case – my latest in-depth research report for Undervalued-Shares.com Lifetime Members.

Hot off the press: publicly listed Venezuela recovery play

Is there a more crisis-ridden country than Venezuela?

Would you seriously consider investing in it?

You should, and maybe even urgently so.

Secretive fund managers have started to chase assets in the country, and it is now becoming apparent, why.

Investing in a Venezuelan turnaround could gain a LOT of momentum in 2023 – and even possibly as early as the next few weeks.

Undervalued-Shares.com reveals the single best option to profit from a recovery.

Hot off the press: publicly listed Venezuela recovery play

Is there a more crisis-ridden country than Venezuela?

Would you seriously consider investing in it?

You should, and maybe even urgently so.

Secretive fund managers have started to chase assets in the country, and it is now becoming apparent, why.

Investing in a Venezuelan turnaround could gain a LOT of momentum in 2023 – and even possibly as early as the next few weeks.

Undervalued-Shares.com reveals the single best option to profit from a recovery.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: