New York-based portfolio manager Isaac Schwartz is passionate about global, unconstrained, and value-focused investing. What can we learn from him?

Weekly dispatches

Every week, I send out an email with observations about markets, investments, and random other subjects. These emails will help you shape your world view, they will teach you new investment strategies, and they will also give you new ideas that you can research further.

MOST POPULAR WEEKLY DISPATCHES

How I work (part 2): The 10 worst mistakes of my investing career

The value of going against groupthink

Riches among ruins (part 2): my 5,000% investment adventure in war-torn Iraq

Ferrari – the company, the stock, and my car

11 highlights from our dinner with Kuppy

Sark – bidding for the Barclay estate and going public

USA – the unstoppable juggernaut?

Hungary investor trip – what we learned

"The art of execution": how to manage your own portfolio

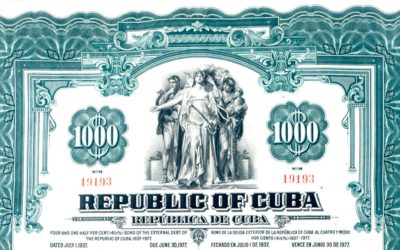

How to make a fortune off defaulted debt

An amazing history of defaulted German bonds from 1930, czarist Russian bonds from 1917, and the upcoming opportunity with Cuban bonds from the 1930s and 1950s.

The (not so) secret Channel Islands stock exchange

The Channel Islands have become a thriving economy that few people have on their radar, and there are several ways investors can benefit from it – including the local stock exchange.

Finding opportunities (and adventure) among unlisted companies

Unlisted companies often offer the best-ever investment opportunities – provided you know how and where to find them!

Is British Airways a 15% p.a. compounder for the 2020s?

You’ll be surprised to read about British Airways (BA) on my blog. All the more, since this company is not itself listed on the stock market. You need to buy into Madrid-listed International Airlines Group (IAG, ISIN ES0177542018), a holding company that owns 100% of British Airways.

Blogs to watch (part 4): PensionCraft

PensionCraft by Ramin Nakisa is the perfect starting place to learn the very basics of investing.

Israel’s gas is finally flowing, and you can make money off it

Of the ten investments that I featured last year, nine were up and just one down. The black sheep has now finally started to turn and soared skywards. There is an opportunity waiting for you.

Non-consensus viewpoints – the guiding strategy for my 2020 research!

To succeed in investing, it’s not enough to be right. You have to be right AND outside the consensus. This is a little-understood quirk of the stock market.

Blogs to watch (part 3): The MacroTourist

“The MacroTourist” by Kevin Muir finds macro trends and investment ideas that no one else believes in. It’s original, contrarian and accessible!

The world’s no. 1 stock market in 2019 – and what about 2020?

A year in review: What lessons can we learn from 2019’s stock market performance?

Special report to flip Black Friday on its head

Are you sick of all the Black Friday special offers? Everyone wants to sell you stuff that you don’t need. I just published a Black Friday story that potentially EARNS you money instead of making you SPEND money.

A visit to the Boeing factory and the mystery of its resilient stock price

While the Boeing 737 MAX is still grounded, the company’s share price hasn’t suffered any lasting damage. How come Boeing stock is so resilient?

Blogs to watch (part 2): LT3000

LT3000 is one of the smartest investment blogs I’ve come across. Its author, Lyall Taylor, has a real talent for analysing a subject in great depth and from different perspectives.