Image by Sobrevolando Patagonia / Shutterstock.com

In May 2021, I alerted Undervalued-Shares.com Lifetime Members to Pampa Energía as one of "the top 1% of the cheapest stocks in the world."

The thesis worked well.

In October 2023, I was able to tell them to take money off the table. The stock had risen from USD 15 to USD 37.

Little did I know just how strong a performer this stock was going to be.

It's now at USD 60, and an analyst has just issued a target price of USD 75.

What's been driving the Argentinean energy stock, and how much further could it run?

Pampa Energía.

The ever-rising EBITDA of Pampa Energía

Pampa Energía is Argentina's largest electricity producer, providing 12% of the country's energy needs.

When I featured the stock in an extensive research report to Undervalued-Shares.com Lifetime Members in 2021, it was very much a fallen angel. Between 2013 and 2018, it had risen 20-fold. Then came Argentina's next crisis as well as the pandemic, and the stock lost 85% of its value.

However, it was always a crisis-resistant business, due to a little-known quirk of Argentina's energy market. About 40% of Pampa Energía's energy production was delivered under long- term supply contracts that were linked to the US dollar. Much as this left another 60% of the production exposed to the vagaries of the Argentinean peso, the dollar-linked contracts gave the company a solid foundation to stand on.

As I pointed out back then, the underlying reality of the group was much better than the bombed-out stock price made it appear. For 2021 and 2022, Pampa Energía was projected to achieve an almost pre-pandemic EBITDA. The company was solidly financed with a net debt/EBITDA ratio of 1.5, and it was even repaying some debt prematurely to save on interest. All the while, it was using its cash flow to buy back – on the cheap – its outstanding bonds and equity.

When I first featured the stock, it was trading at 2.6 times EV/EBITDA based on 2021 estimates, and 2.2 times EV/EBITDA based on projections for 2022. This was low in both relative and absolute terms, and it put the stock in the top 1% of the cheapest stocks in the world. You'd think that following its massive rise, it would now be trading at higher multiples.

However, a few days ago, Auerbach Grayson contacted me to point out the latest earnings projections. The emerging and frontier market brokerage firm that is well-known for its access to local equity research in the markets that it trades in, had re-published a report from Latin Securities.

The 16-page note concluded:

"Focusing on short-term multiples could be misleading, as most earnings growth will occur in 2026 and 2027. Standalone EBITDA should almost double between 2024 and 2027, suggesting a 2.6x EV/EBITDA for 2027. Including contributions from subsidiaries, the ratio drops to 2.4x. Our 12-month target price of US$75 per ADS is conservative, as we haven't fully accounted for potential upside in the power generation segment."

The stock is now up 400% since I published my research report, yet it's projected to still trade at the same earnings multiple and remains a bargain by many standards.

How is that even possible?

Painful as it is (considering that I parted from the stock too early!), I decided to investigate.

Reforms are taking hold in Argentina

No article about Argentina would be complete without mentioning Javier Milei, the country's chainsaw-wielding libertarian president.

Milei has now been in office for under a year, and he divides opinions like few others. There are some early indications of success, though. The Wall Street Journal just dedicated an article to Milei's work in reforming the Argentinean housing market:

"Argentina Scrapped Its Rent Controls. Now the Market Is Thriving.

For years, Argentina imposed one of the world's strictest rent-control laws. It was meant to keep homes such as the stately belle epoque apartments of Buenos Aires affordable, but instead, officials here say, rents soared. Now, the country's new president, Javier Milei, has scrapped the rental law, along with most government price controls, in a fiscal experiment that he is conducting to revive South America’s second-biggest economy.

The result: The Argentine capital is undergoing a rental-market boom. Landlords are rushing to put their properties back on the market, with Buenos Aires rental supplies increasing by over 170%. While rents are still up in nominal terms, many renters are getting better deals than ever, with a 40% decline in the real price of rental properties when adjusted for inflation since last October, said Federico González Rouco, an economist at Buenos Aires-based Empiria Consultores."

Quite a few private investors that I know are currently looking at relatively cheap Argentinean real estate as an investment, or as a Plan B type diversification.

The same could increasingly be true for the country's energy sector. At a time when Western European countries are shutting down proven, cost-effective energy sources, Argentina is opening up its massive energy sector to investment.

As I had already analysed in a report on CRESUD, another Argentinean stock, in March 2021, Argentina is sitting on potentially game-changing energy reserves. Its Vaca Muerta shale oil region holds the world's fourth-largest energy reserve of this kind, equivalent to about 25% of the shale energy reserves found in the US. Three quarters of that energy stored comes in the form of gas, the other quarter in the form of oil.

It was always clear that Argentina's government was going to prioritise the developing of these energy reserves. The distant harbour of Buenos Aires was always going to be out of range of Greta Thunberg's sailboat, and with well over 40% of Argentineans living in poverty, it was clear that any sane government would eventually open up this dormant resource to investment.

As Latin Lawyer concluded in January 2024:

"Argentina's energy sector on the cusp of transformation following President Milei's inauguration

On 18 December 2023, the executive branch published the Decree of Necessity and Urgency 55/2023 (DNU 55) in the Official Gazette, declaring that the national energy sector would be in a state of emergency – with regard to the generation, transportation and distribution of electric power under federal jurisdiction and the transportation and distribution of natural gas – until 31 December 2024.

Among other matters, DNU 55 launched a tariff review process for electric power and natural gas services that are subject to federal jurisdiction. This is the first step towards introducing financial sustainability for the energy sector and is a 180-degree policy shift from the previous administration, where energy subsidies were the norm."

Indeed, in early July 2024, Milei won final approval of his flagship free-market reforms, including legislation that will help incentivise major investment in the oil and gas sector.

"Milei's final goal is to boost the country's most valuable fossil fuel asset, the Vaca Muerta reserve, Argentina's main oilfield.

Vaca Muerta primarily exploits shale oil and gas, covering more than 30,000 sq km (11,500 sq miles) in Neuquén province, north-west of Patagonia. The region is considered one of the world's most substantial fossil gas deposits, and has one of South America's most promising capacities for expanding gas and oil production.

With more than 1,000 active wells, it has attracted leading multinational companies such as Vista, Chevron, Shell, Petronas, Equinor, PAE, Tecpetrol, Exxon, and Phoenix, as well as YPF (Yacimientos Petrolíferos Fiscales, SA), the majority state-owned energy company.

Argentina's oil production jumped 27% from 2022 to 2023 and some even believe the country has the potential to quintuple its oil output."

Interestingly, one company NOT mentioned in The Guardian's line-up of fossil fuel culprits is Pampa Energía.

A little-noticed deal in the Vaca Muerta region

Among investors, Pampa Energía is primarily associated with production of gas and electricity, besides owning some hydropower resources.

The company always had a valuable toehold in the Vaca Muerta region, though. As my report set out in more detail: "Who are the biggest beneficiaries of a Renaissance of Argentina's energy sector? Pampa Energía is one of them, because the company owns 8% of the Vaca Muerta shale gas acreage."

Pampa Energía has since been active in optimising its potential.

The company announced plans to get into the oil market aggressively, primarily because oil is free from production constraints. If Argentina produced too much gas, it wouldn't have the means to export it easily. Oil, on the other hand, is different.

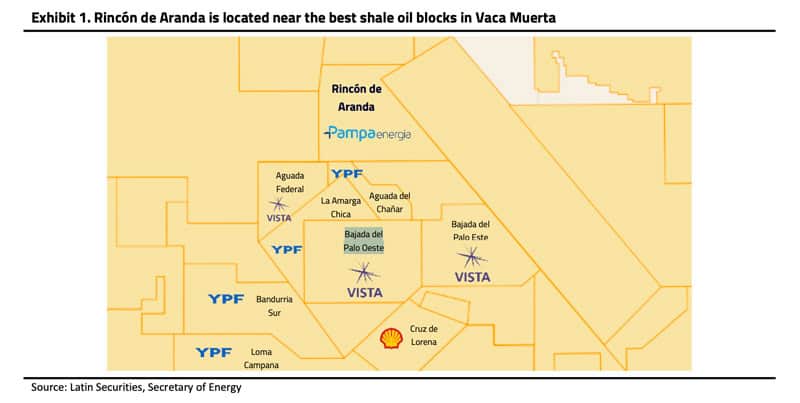

As a result, Pampa Energía swapped some gas assets in the Vaca Muerta basin for a property with substantial oil prospects, Rincón de Aranda. The new property is just above two oil production properties that have become famous within the investor community. One of them, Bajada del Palo Oeste, is held by the much better-known Vista Energy (ISIN MX01VI0C0006, NYSE:VIST), a Mexican high-flyer stock that is up 20x since early 2021. Also nearby is La Amarga Chica, a field held by YPF (ISIN 51000, NYSE:YPF). Both properties account for 30% of Argentina's total shale oil output.

Source: Auerbach Grayson, Latin Securities.

Despite its prominent neighbourhood, the full scope of the opportunity has not yet become widely known among the investor community. As Auerbach Grayson and Latin Securities point out:

"Pampa Energía's (PAM) new shale oil project, Rincón de Aranda (RdA) in the Vaca Muerta formation, is flying under the market's radar. Yet, if successful, it could almost double PAM's EBITDA by adding US$500m to US$700m, multiplying its crude oil output eightfold, and reducing its dependence on regulated operations. PAM plans to rely on its natural gas and power generation cash flows to fund its new venture. This strategy is analogous to Vista's approach a few years ago when its conventional assets backed shale growth. Developing the RdA block should add PAM 40k bpd of crude oil by 2027, driving growth beyond its electricity generation and natural gas operations. Additionally, it will enhance its export potential and reduce reliance on regulated tariffs. Over the next three years, PAM is set to become the most diversified player in the energy sector."

To be clear, this prospect isn't guaranteed yet. Pampa Energía has drilled pilot wells, and these have shown promising results. As of today, though, the company is producing only a modest 5,000 barrels per day (bpd) of oil. The scaling-up of production has yet to take place, and it comes with execution risk as well as a need for significant investment. Still, it's easier to imagine these scenarios now that others have already shown that it's possible. Vista invested USD 1bn in developing Bajada del Palo, and as a result its shale oil production went from 5,000 bpd in early 2020 to 44,000 bpd by 2023.

If it all unfolds as planned, the stock of Pampa Energía should have further to run. Latin Securities is currently setting a USD 75 target price but notes the target is conservative. Nota bene, that's despite the current weakness of the oil price. Also, the longer-term potential of Argentina and Vaca Muerta is much bigger than this, given the sheer size of the resource and many Western countries' reluctance to get their hands dirty with producing their own fossil fuels.

It's up to Milei to unlock this potential, and current indications are that he is on the right path.

Where to find another such opportunity?

The stock of Pampa Energía is up 400% since May 2021.

When I first featured it, the prospects came with risks and uncertainties:

- Argentina was a mess.

- Vaca Muerta had not yet raised the awareness of investors.

- Bombed-out stocks always take a bit of courage to invest in.

However, this was also the time when you could invest on outrageously advantageous terms. This website is called Undervalued-Shares.com for a reason.

As I put it back then:

"You can turn it as you like, the stock of Pampa Energía is dirt-cheap at its current level. … Based on the current valuation, you are effectively paying a modest price for the electricity generation division and the other assets are thrown in for free – including the ownership of 8% of the shale gas stored in Vaca Muerta. …. And that's before we speak of the upside case, which would happen if Vaca Muerta turns out to be the natural resource for Argentina to get itself out of its current financial predicament."

If you missed buying into Pampa Energía at the time, is there a comparable groundfloor opportunity out there right now?

As it turns out, there is!

It's a fairly similar set-up:

- The country that the company is located in is a mess.

- The oil fields of that region are not yet well-known, even though their underlying economics are extremely attractive.

- The stock is bombed-out.

In terms of valuation, this stock may be trading at a forward EV/EBITDA ratio of 1, or even less than that.

It's a stock that I featured in a report for Undervalued-Shares.com Lifetime Members. If you missed buying into Pampa Energía in 2021, this one is for you.

Unknown dividend pearls with up to 16% returns (German-language video)

Helios Underwriting is an insurance play unlike any other, rolling up a little-understood legacy sector nestled within Lloyd's of London's insurance market.

With an exceptionally high dividend and growth potential, what are the risks and opportunities of this investment?

This talk with Anton Gneupel of D wie Dividende and fellow investor Norbert Schmidt gives an insight into two catalysts, and why now is a good time to take a closer look.

Unknown dividend pearls with up to 16% returns (German-language video)

Helios Underwriting is an insurance play unlike any other, rolling up a little-understood legacy sector nestled within Lloyd's of London's insurance market.

With an exceptionally high dividend and growth potential, what are the risks and opportunities of this investment?

This talk with Anton Gneupel of D wie Dividende and fellow investor Norbert Schmidt gives an insight into two catalysts, and why now is a good time to take a closer look.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: