Bill Ackman and Pershing Square hardly need an introduction.

Ackman is a celebrity hedge fund manager with 1.5m followers on X and nearly USD 10bn to his name. His firm is widely known for its countless high-profile activist cases.

There is also his closed-ended fund, Pershing Square Holdings, listed in Europe.

"Pershing Square Holdings is one of two funds that I bought for my sons, hoping they keep it for decades.", a fund rating virtuoso recently told me.

This endorsement piqued my interest.

Besides, the fund is legally based out of Guernsey – my backyard, so to speak!

Despite its widely known brand name, not everyone knows the ins and outs of this particular investment vehicle.

It's time to take a closer look!

Pershing Square Holdings.

A knack for polarising bets

Bill Ackman isn't afraid of controversy.

In fact, he uses controversy as a guiding light for his investment research. He once said that his most successful investments were controversial at the time, and that one of his rules in investing was to "make a bold call that nobody believes in".

Naturally, this didn't always work out.

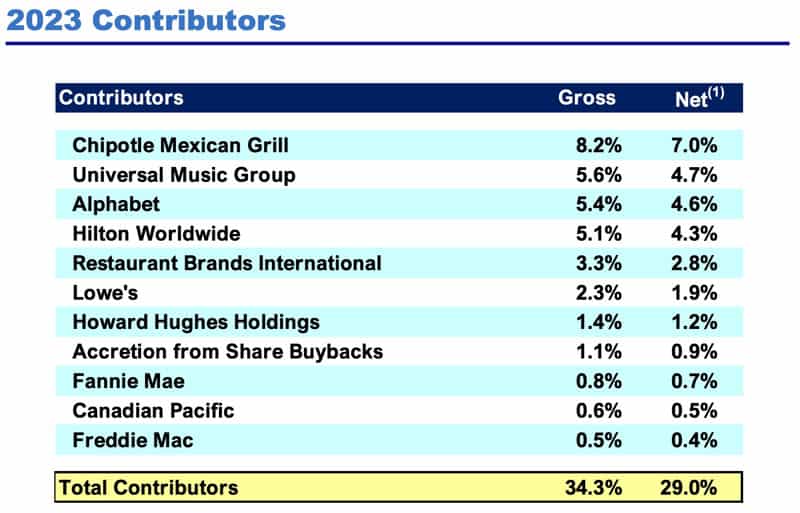

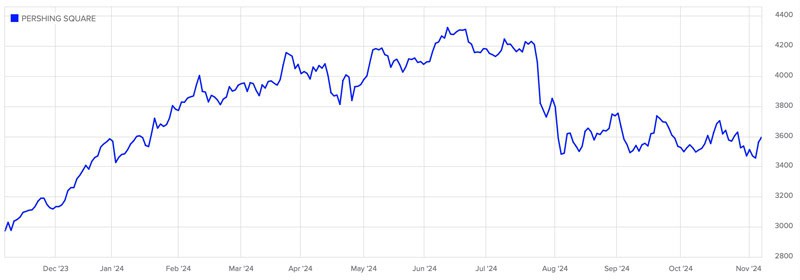

It worked out often enough, though, to make Ackman one of the world's most successful money managers. Over the last ten years, his publicly listed Pershing Square Holdings (ISIN GG00BPFJTF46, UK:PSH) increased its net asset value by 13.6% p.a., which compares to 12.6% p.a. for the S&P 500 and 5.3% p.a. for the FTSE-100. Managing money since 1992 and regularly outperforming markets, Ackman has amassed a net worth now approaching USD 10bn. His personal wealth will mostly stem from performance fees charged to his clients, and the subsequent successful investing of his own money.

Two mantras that Ackman passionately believes in are to invest for the long term and to do so with conviction. The latter is a euphemism for running a highly concentrated portfolio, a topic that I once dedicated an article to ("Concentrated bets – how the world's best value investors got rich").

Must-watch: "Bill Ackman's 10 Rules for Investment Success" (15 minutes).

Managing external money always contains the risk that investors lose patience and withdraw their funds at the worst possible time. This is a problem that every fund manager will have struggled with at some point. Funds always raise the most external money at market peaks, and they then get redemptions when markets are near their low.

If you want to run a concentrated portfolio of typically 8-10 long-term positions, it's much better if you can operate with so-called permanent capital. That's why in 2012, Ackman created Pershing Square Holdings as a closed-ended, publicly listed fund.

Investors in this fund are free to buy and sell shares daily at the market price. However, that doesn't affect the amount of assets invested in the fund. The manager of such an entity can make truly long-term bets and never has to worry about fund outflows. Ackman being more of a "go big, or go home" kind of guy, a closed-ended fund is more suited for his temperament.

In late 2014, Ackman raised USD 3bn for the new entity, which subsequently listed its shares in London and Amsterdam. He chose the European market for the fund because a similar fund accessible to retail investors would have faced regulatory hurdles in the US with regard to charging performance fees.

This was a period when Ackman engaged in two high-profile investments, both of which he came to regret. His bet on what was then Valeant Pharmaceuticals / now: Bausch Health (ISIN CA0717341071, CA:BHC) and his shortselling of Herbalife (ISIN KYG4412G1010, NYSE:HLF) turned into year-long controversies that are haunting his reputation even today. By 2017, it had all gotten so bad that Institutional Investor asked "What's Eating Bill Ackman?".

These two stocks also weighed on Ackman's performance. Between 2015-2018, Pershing Square Holdings racked up four successive down years losing a cumulative -34.4% of its net asset value, while the S&P 500 returned +32%.

Following the IPO in 2014, the share price of Pershing Square Holdings dropped by half. It took until 2020 for it to get back to the IPO level.

However, even Ackman's bad bets mostly turned out well in the end. Looking back at the last ten years, the performance of Pershing Square Holdings looks rather good. Indeed, Ackman remains widely regarded as one of the most experienced practitioners in his field.

Does Ackman still have it – and could his fund even outperform further?

A matured, experienced Ackman

Looking at his career from a 33,000-foot view, it appears that the 2010s were a period of Ackman learning and maturing.

During the Great Financial Crisis of 2008, Ackman made an extremely successful bet on credit default swaps. He quickly rose to amassing significant personal wealth, managing large amounts of money, and enjoying public celebrity.

It'd require superhuman abilities to not temporarily get carried away a bit.

The subsequent high-profile flops did lead to some introspection, and a change in strategy.

After nearly halving his clients' money during 2015-2018, Ackman decided to go back to basics. He cut staff, reduced public appearances, and instead hunkered down in his office to focus on investment research.

The following year, his hedge fund returned 58.1%. Ackman was back to his usual self.

In hindsight, this proved that Ackman had stamina and wasn't just a fair-weather fund manager. From today's perspective, this period of adversity should be counted as a valuable asset. Anyone investing with Ackman today will benefit from his desire never to repeat what he went through back then.

Even though he remains in the public eye and keeps a very active presence on X with more followers than ever before, it appears that Ackman has become more effective at managing his public persona.

He also hasn't done a single activist campaign since 2021 – another notable change for someone previously known as a fervent activist investor.

A man famous for contrarian bets, it turned out he himself was one. Anyone who bought into Pershing Square Holdings when Ackman was "out" will have made 3.5x their money by now. Over the past five years, Pershing Square Holdings' net asset value has grown by 31.2% p.a. compared to 15.7% for the S&P 500.

How did he do it?

Pershing Square Holdings' investment strategy is easy to summarise. It's based around the following core principles, which any value investor will instantly recognise as familiar.

With its equity having grown to now USD 12bn, the European fund holds a portfolio of fairly well-known, liquid names.

In addition, the fund utilises a conservative degree of debt leverage. Given its size and the quality of its management, Pershing Square Holdings has been able to access low-cost, long-term debt. The fund currently has outstanding debt equivalent to less than 20% of its portfolio, and it would not go higher than 30%. The current external financing matures between 2027-2039, and it has a weighted-average cost of capital of 3.08%.

Given all that, what's not to like?

A lot, it seems. The market is currently valuing Pershing Square Holdings with a discount of 33%. Something seems off, or at least that's the first impression if you compare the share price to the underlying net asset value.

Why such a discount?

Closed-ended funds are a peculiar animal.

During boom times, they can trade at a premium to their underlying net asset value. This makes no sense, but such periods do occur.

Most of the time, though, they trade at a discount. In the case of Pershing Square Holdings, this went as high as a 40% (!) discount to net asset value in mid-2022.

London has a long-established market for such closed-ended funds and investment trusts, and many of them reached record-level discounts in mid-2022, with some even getting discounted as much as 50%.

In the case of Pershing Square Holdings, the reason for the persistent discount lies in a combination of:

- Market circumstances and peer valuations.

- Bill Ackman's reputation following the debacles with Herbalife and Valeant.

- Questions over the entity's fee structure and long-term plans.

The fund's fee structure, in particular, is a long-standing contentious subject. Pershing Square Holdings charges an annual 1.5% management fee and a complicated variable performance fee of up to 16%. This is lower than the (in)famous "2 and 20", but it's much higher than the fees of conventional public equity funds.

Hedge fund managers forever get challenged on the fees they charge. Institutional Investor did so back in October 2014 when it questioned Ackman's fees ahead of Pershing Square Holdings's IPO. Despite the phenomenal outperformance of markets during the past five years, it remains a topic of conversation today.

However, there is also the superior performance of the fund during the last half-decade.

Given how Ackman visibly earned the fees that he charged, are these concerns akin to barking up the wrong tree?

Two fund management mavens piqued my interest

The discount of Pershing Square Holdings decreased to nearer to 20% when earlier in 2024, Ackman pursued the IPO of "Pershing Square USA", the US equivalent of Pershing Square Holdings.

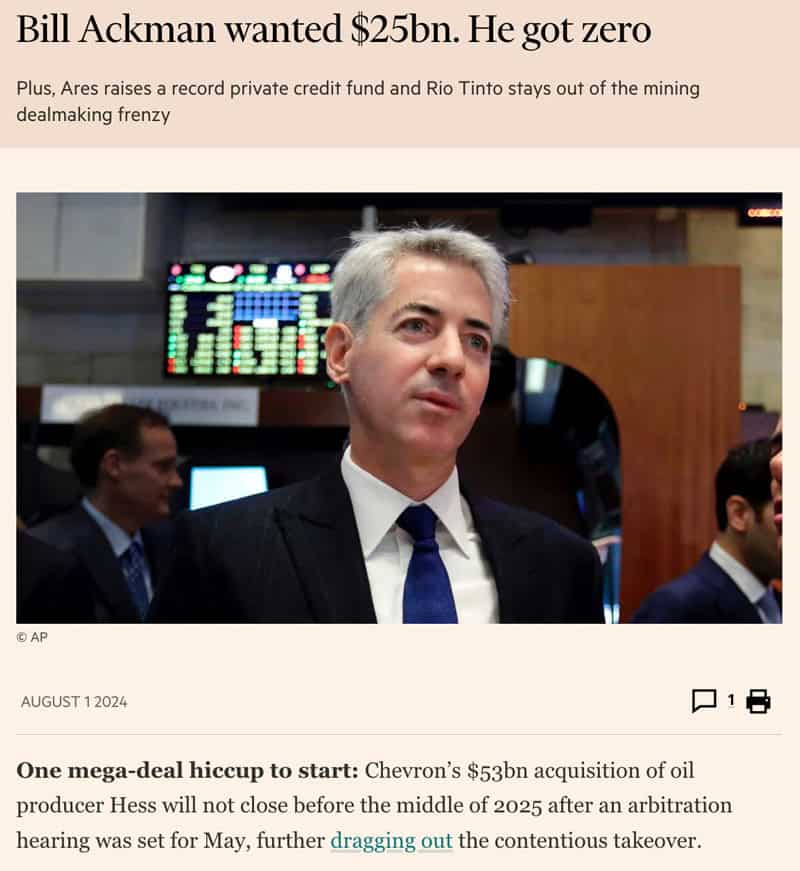

The IPO of such a large sister vehicle in the US would have significantly reduced the fees charged to the European vehicle. However, Ackman's fundraising ambitions of USD 25bn for Pershing Square USA didn't work out. The plans for this vehicle were first cut back by 90%, and then postponed altogether.

As a result, the discount at Pershing Square Holdings widened again. It's now back at 33%.

Pershing Square Holdings.

Following the recent drop, should investors now take a closer look?

I first took notice of Pershing Square Holdings because of a colleague. Harald Berlinicke, Partner for Fund Selection at Sarnia Asset Management, is a widely followed LinkedIn influencer in the fund industry, and also manages his own family office.

As he told me in a WhatsApp message:

"A discount of 30% to NAV is ridiculous when you look at Ackman's three- or five-year performance. Keep in mind this isn't a fund with illiquid private equity-type underlying investments, but a portfolio of S&P 500 stocks."

When asked why his family has been an investor in Pershing Square Holdings, Harald also pointed me towards:

- Significant insider ownership, now 27% of the entire share capital.

- Ongoing share buybacks, which benefit long-term holders.

- Ackman's age of just 58, which means investors get him in his prime.

Ackman's experience of more than three decades, in particular, is currently an undervalued asset. Anyone buying into Pershing Square Holdings will basically buy into Ackman. In recent years, Ackman further added to his track record for successful macro bets:

- In 2020, he spotted the risks caused by the pandemic and placed a USD 27m bet on credit default swaps. The investment yielded an almost 100x return.

- In 2021 and 2022, his performance benefited significantly from his investing in interest rate swaptions.

- In 2023, he made further money from positions geared towards a change in interest rates.

Ackman has both the ability and freedom to pursue unusual opportunities. E.g., his extremely high conviction in Howard Hughes Holdings (ISIN US44267T1025, NYSE:HHH) has led to his vehicles controlling 37% of that company – an outsized, influential position that an ordinary fund could not take.

Could Pershing Square Holdings one day become more of an operating company than just a fund?

Indeed, Ackman has said in the past that he hopes to mimic Warren Buffett and Berkshire Hathaway (ISIN US0846701086, NYSE:BRK). Buffett had originally managed a fund, but then swapped to the idiosyncratic model pursued by his publicly listed investment holding.

Given his current age, Ackman probably has a remaining runway of several decades. Few people know that Warren Buffett made 99% of his current net worth after the reached the age of 50. Could we yet see Ackman emerge as a younger, different version of the Sage of Omaha?

Another of my professional contacts has analysed this question in extraordinary detail. Adrian Courtenay is a London-based portfolio manager of the GA-Courtenay Special Situations Fund. When he is not busy finding undervalued gems for his fund, he writes outstanding but little-known white papers about investment-related aspects.

One of Adrian's best-ever pieces is "Pershing Square Holdings: How far away to Berkshire Hathaway?", a dense 43-page analysis asking if Ackman could grow Pershing Square Holdings into a new, different version of Berkshire Hathaway.

It's not an easy read, but one that is dripping with brilliance and hard-hitting information. If anything, anyone who actually does take the time to read it will learn a lot about investing. Quite possibly, they will also conclude that Pershing Square Holdings may – over the coming years and decades – turn into the kind of evergreen investment that you wish you had never sold.

To get in, now may just be a pretty good moment.

Quite possibly a good time to invest

Given his success and outspokenness, Ackman is a character that many media outlets and journalists love to hate. Envy might play into that, given Ackman's social media following exceeds the audience of many journalists. Besides, Ackman turned from registered Democrat to endorsing the election of Donald Trump.

When his ambitious USD 25bn fundraising campaign had to be shelved, there was a fair amount of Schadenfreude going around.

Source: Financial Times, 1 August 2024.

The discount at Pershing Square Holdings got larger again, and Ackman is currently laying low when it comes to his IPO plans in the US.

However, it's only a matter of time before he will come back. As one of his fund's investors told the Financial Times, Ackman is "a once-in-a-generation talent". Anyone taking an objective outside look will conclude that a 33% discount is really rather a nice bargain and bound to be a temporary phenomenon.

Source: Investment Week, 16 August 2024.

Given the learnings from the first attempt, Ackman is unlikely to give the launch of his US closed-ended fund another go until he is absolutely sure that he will succeed. He is also a marketing genius, with a track record for turning adversity into a selling point, besides having that great entrepreneurial trait of never giving up. Betting against Ackman would seem bold, to put it diplomatically.

The eventual IPO of a permanent capital vehicle in the US will reduce the fees at Pershing Square Holdings, making more investors realise that buying into a liquid, successful portfolio with a >30% discount will very likely make for longer-term tailwind. A fund like Pershing Square Holdings should really trade at a discount of no more than 10-15% (if any at all). Longer term, a combination of share buybacks, superior performance, and fee reductions should get it there. All the while, Ackman's stock picks and macro bets should add further to the net asset value.

This does not even include the additional upside potential provided by the fund's Special Purpose Acquisition Rights, or "SPAR". In September 2023, the fund received SEC clearance to launch a variation of the traditional SPAC design. SPAR is a hidden optionality within the portfolio, and one that could eventually add another 5% to the fund's performance. Right now, it is thrown in for free.

Any investment comes with risks, and there are a number of matters worth keeping an eye on:

- If or when Ackman raises funds for a US vehicle, he will have to manage a much larger position size. The more assets someone manages, the harder it is to outperform markets.

- With multiple vehicles to manage, keeping conflicts of interest at bay can become harder.

- Like everyone else, Ackman depends to some extent on markets remaining buoyant. US large-caps are now anything but cheap – though exceptions apply.

With all that said, it appears that Pershing Square Holdings is an interesting long-term investment indeed.

You do have to bet on the man, but with plenty of other factors contributing tailwind and confidence.

If I had sons to put away money for, I'd consider Pershing Square Holdings, too.

Hot off the press: new in-depth research report

Once the reconstruction of Ukraine begins, it could become the biggest foreign-sponsored reconstruction programme of the last 80 years.

Think Marshall Plan, but on steroids.

The reconstruction will present a triple-digit billion market opportunity – but opportunities for private investors to get in are scarce.

My latest research report – out last week – features one company that will likely become the focus of investor money pushing into the country – and is easy to trade!

Hot off the press: new in-depth research report

Once the reconstruction of Ukraine begins, it could become the biggest foreign-sponsored reconstruction programme of the last 80 years.

Think Marshall Plan, but on steroids.

The reconstruction will present a triple-digit billion market opportunity – but opportunities for private investors to get in are scarce.

My latest research report – out last week – features one company that will likely become the focus of investor money pushing into the country – and is easy to trade!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: