If you thought gold or diamonds were expensive, think again.

It's radium that would set you back US 10,000,000 for a single GRAM. Compare that to gold being worth just USD 85 per gram.

Radium occurs naturally, but there is simply very little of it.

Fancy getting yourself a bit of the valuable radioactive material?

Well, the world of Big Pharma is currently on a quest to find as much as it can get hold of.

Radium is needed to produce "the world's rarest drug", and it could single-handedly transform the treatment of cancer.

Is this material the medical equivalent of the Arch of the Covenant?

It all started in the Congo

In today's day and age of search engines and Google Maps, it's difficult to imagine a time when governments had the power to erase places from a map.

This is what happened to Shinkolobwe, a place in the Congo that American, British and Belgian authorities effectively hid from the rest of the world during the Second World War and throughout much of the Cold War.

As far as they were concerned, Shinkolobwe simply didn't exist. The name was taken off maps, government officials denied the place existed, and journalists were refused access.

These authorities wanted to hide what was then one of the world's most strategic resources – uranium.

Specifically, what they were keen to hide was the fact that Shinkolobwe offered a grade of uranium unlike anywhere else in the world. While Uranium is also found in decent quantities in Canada, Australia, Kazakhstan, and the US, only the Congo's Shinkolobwe had uranium ore with 60% purity grade – far more than the attractive 0.3% purity grade found elsewhere. In Shinkolobwe, even the "waste product" still had 20% purity.

A contemporary photograph of the Shinkolobwe mine.

The Congolese uranium mine's outstanding purity was the result of freak circumstances, and no comparable deposit has ever been discovered on Earth.

It eventually proved a veritable asset for the construction of the first atomic bombs.

Incredibly, uranium was initially considered worthless.

When a British prospector, Robert Rich Sharp, stumbled across this particularly rich uranium ore body in 1915, he had no takers for the material. Sharp was working for Union Minière du Haut-Katanga (UMHK), the largest mining company in the Belgian Congo and owned by Belgium's King Leopold II. What he had actually been looking for was copper, so the find of seemingly worthless uranium was a disappointment to him.

However, what turned out valuable shortly after the mine's discovery was the radium deposit found alongside the uranium.

Source: Bestor.

"Belgium radium", a thing the world over

When the first mining operation started in Shinkolobwe in 1921, it was the radium that the Belgians were after.

Thanks to the work of Marie and Pierre Curie, the married couple of scientists who later won a Nobel Prize for physics, radium was recognised as useful for treating tumours. The use of radioactivity in cancer treatment was primitive by today's standard, but it laid the groundwork for today's forms of radiotherapy and chemotherapy. And to produce radium, you first had to get large quantities of uranium out of the ground.

Where did the radium come from?

Shinkolobwe!

UMHK shipped ore containing uranium and radium to Belgium, where it was processed in a plant that was hastily built by another Belgian company in the town of Olen. The Société Générale Métallurgique de Hoboken (SGMH) ran the operation where radium was isolated, packaged, and sent to buyers.

"Belgium radium" became a thing the world over.

In fact, the Belgians dominated the material's world trade.

By 1923, SGMH was allegedly able to single-handedly satisfy the entire world demand for radium. By 1925, the Belgians' market position had become so strong that the last American producer shut down because they couldn't compete on price.

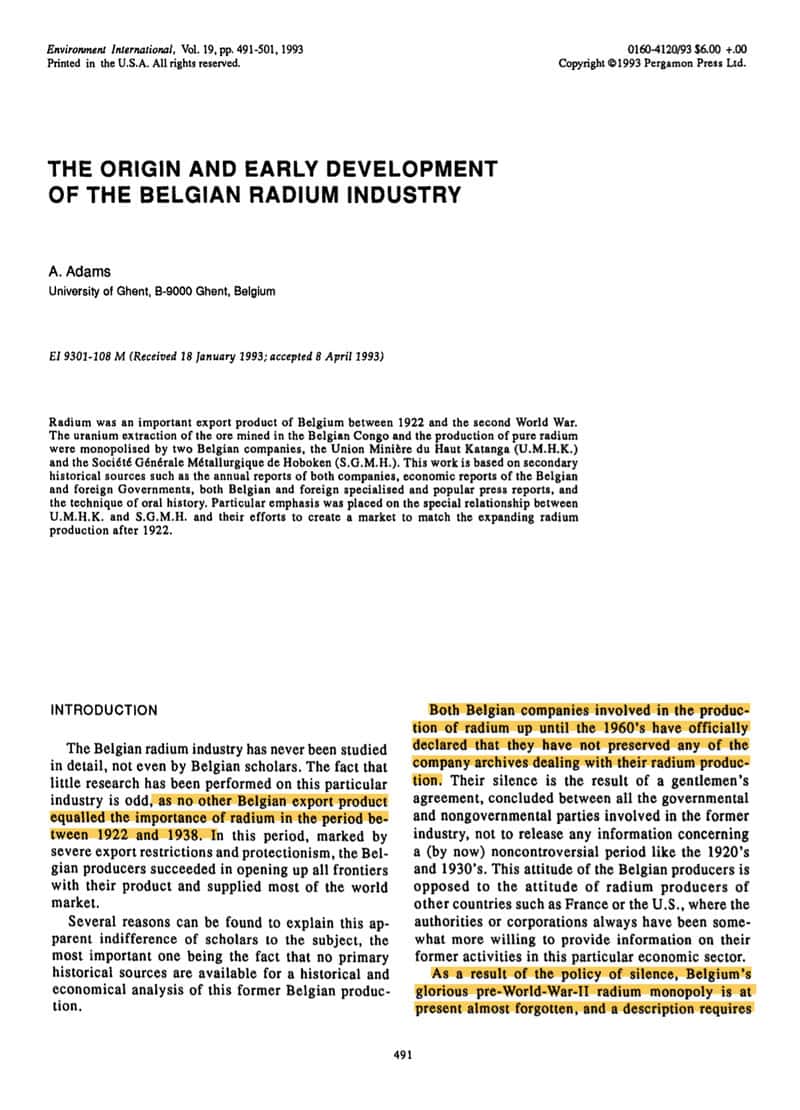

Between 1922 and 1938, radium was Belgium's "biggest" export item.

To put it like that is misleading, though. Anything relating to size and quantity needs to be taken with a pinch of salt.

The actual quantities were extraordinarily small. At peak production, the Belgians produced not even four (!) gram of radium per month.

When the Curies first experimented with the material, they had to process ten TONNES of uranium ore ("pitchblende") to extract 1/1,000th gram of radium – the equivalent of one billionth of the raw material they started with.

It was one of the world's most valuable materials, though.

At a time when gold cost less than USD 1 per gram, radium was trading between USD 90,000-120,000 per gram. The Belgians' costs to produce the material were never released, but estimates of about USD 20,000 per gram are probably the right ballpark. This was a lucrative industry to be in.

Source: ScienceDirect (paywalled).

When the Belgians had built a stockpile of radium, they were sitting on an absolute fortune – at least for a while.

Radium was considered a useful product only for a limited period of time.

Eventually, its manifold ill effects on humans and the environment received increasing attention. The fact that radioactive substances were increasingly used in nuclear weapons changed public attitudes towards the material, and its use as well as production collapsed.

In the Czech Republic, where some of the early discoveries of radioactive materials were made, you can still stay at the Hotel Radium Palace. In the olden days, visitors would have taken baths in radium water. Today, you'll struggle to even find references to these times. Only the name remains.

However, you are quite likely to hear more about radium soon.

A new era for radium – thanks to "Ac-225"

On 29 July 2024, the Financial Times reported: "The hunt for a rare nuclear isotope that could redefine cancer care

Shortages of rare nuclear isotopes that rapidly shrink tumours threaten to undermine the development of breakthrough treatments in which health companies have invested billions of dollars, experts in the nascent radiopharmaceuticals field have warned.

By combining a nuclear isotope with an antibody, the microscopic drugs — also known as radioligands — deliver a toxic payload directly to cancer cells.

But actinium-225, the most common isotope used in the experimental treatment, whose decaying protons and neutrons emit powerful 'alpha' radiation, is in increasingly low supply.

Reliant largely on dwindling supplies from Soviet and American cold war-era stockpiles of precursor radioactive materials, companies have struggled to obtain enough actinium to treat the thousands of patients being enrolled in clinical trials.

But they are betting that this highly targeted form of radiotherapy could become the next big innovation in cancer care if they overcome these supply chain challenges. With half of all cancer patients receiving traditional radiation therapy, radioligands have the potential to offer a more powerful treatment with fewer side effects to millions of patients.

Jeff Legos, global head of oncology at Novartis, said radiopharmaceuticals could become 'a mainstream therapy' tackling the 'big traditional cancers', which make the disease the leading cause of death worldwide. Morgan Stanley analysts predict the radiopharma market will be worth $39bn in sales by 2032."

Source: Financial Times, 28 July 2024.

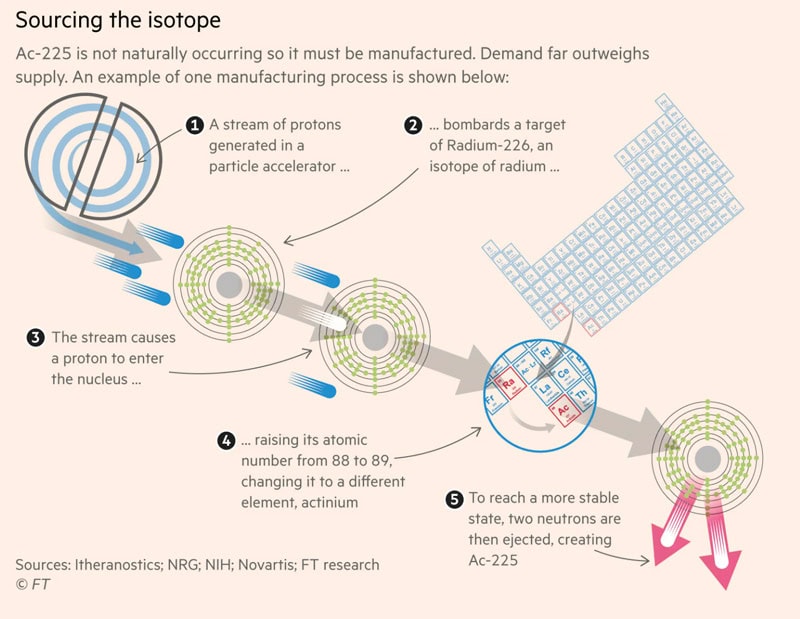

This form of cancer treatment has proven to be highly effective, but the availability of Actinium-225 (Ac-225) poses a real problem as the material does not occur naturally.

It can, however, be produced from radium.

One source claims that a gram of radium could be used to extract enough Ac-225 to treat about 1,000 patients. As such, a gram of radium would be worth USD 10m.

Another source claims there was a way for producing Ac-225 from radium that allows to recycle the radium over and over again – making it a nearly inexhaustible resource. In such a scenario, the long-term value of radium could exceed anything else you have come across in your lifetime.

It's not surprising that the Financial Times claims that "companies would pay anything to get hold of actinium starting materials".

They won't have to send out Indiana Jones, though.

As luck would have it, Belgium had kept a stockpile of radium.

Belgium – the old and new king of radium?

Many countries have a bit of radium stored somewhere, usually tied up in radioactive waste. Even if that waste could be recovered, processing it is complicated and expensive. Given the extremely low concentration of radium in most radioactive waste, for most countries it would not be viable to get involved. The quantities recovered would be too small.

It's different for Belgium, though.

While the government of Belgium eventually left behind its involvement in Africa, it still has 100-200 grams worth of radium sourced from its Congolese mines. This is documented in a little-known, recent video that was produced with the involvement of Belgium's government and which you can find if you know where to look.

The leftover radium is probably stored in a facility called "HADES" in Mol – though it's difficult to tell for sure, because the sector that is involved with radioactive materials comprises an absolute maze of organisations and acronyms. Other parts of it could also be stored at UMTRAP, a facility run by Umicore, the successor company to the old colonial mining operation:

"At the UMICORE site in Olen there is a legacy of historical radium-bearing waste, substances and contaminations resulting from the production of radium in the period 1922 – 1977. … The 'Umtrap', a bunker which contains under a sheet of copper, sand and earth, 55,000m³ of radium and uranium waste. These are either raw materials or contaminated soil, sediments and demolition materials."

In one of these landfills, authorities measured 400 times the concentration of radium than would normally be allowed. This dump had long been treated as expensive waste but it is now becoming a potential gold mine – pun intended, all the more so since gold is barely worth a fraction of radium's financial value. Belgium can most likely offer a combination of ready-made radium still in storage and extracting meaningful quantities from its radioactive waste.

Belgium's HADES storage facility for nuclear waste at 225m underground (photo: SCK CEN).

Given new demand for Ac-225 and the possibility of producing "the world's rarest drug" from radium, the old stockpile suddenly has a new value altogether – for doctors, patients, and financially for the companies involved with its complex extraction and subsequent use.

As circumstances would have it, a little-known Belgian company with a long history in using radioactive substances for cancer treatments has recently secured the Belgian radium stockpile for its operation.

In another little-known twist, this company has even figured out how to use complex technical processes that allow for the radium to be used OVER AND OVER AGAIN to produce Ac-225. In fact, this radium can be used for decades to come. Ac-225 is so powerful a substance that it is difficult to get your head around. Though, who would have ever even heard of it?

Obviously, this is a company I immediately took a closer interest in.

A new research report about a deeply undervalued stock

It's at this point that I will have to put disappointing news in front of you – or at least some of you.

The fact that a publicly listed Belgian company got its hands onto the domestic government's stash of invaluable radium reserves is something you could only find out if you read the footnotes of Belgian company reports – and even then, you'd probably struggle to piece together the puzzle.

The information about this particular company is one of the most unusual finds of my entire investment career.

If you want to have access to it, you'll need to get your wallet out (if you haven't already).

The name and details of this company are all included in my latest research report, and thus revealed to Undervalued-Shares.com Members only.

If these additional details aren't worth punting USD 49 of your money, then there isn't anything I can help you with.

At a time when uranium and related materials are experiencing a renaissance, this stock makes for a genuinely unique investment thesis.

Based on 2026 estimates, it is trading at EV/EBITDA of 6x.

The upside provided by the matter of Ac-225 is not yet priced in, and it's a groundfloor opportunity.

Indian Jones would be proud of this one!

Hot off the press: new in-depth research report

The global hunt is on for Actinium-225, the uber-rare nuclear isotope that could redefine cancer care.

The head of oncology at Novartis believes it could become "a mainstream therapy" for tackling the "big traditional cancers" – 50 (!) different forms of cancers.

Big Pharma is pouring billions into new pharmaceuticals using Ac-225.

My latest research report – out just now – digs deep into the company which could become the global market leader for supplying the material that everyone is after.

Hot off the press: new in-depth research report

The global hunt is on for Actinium-225, the uber-rare nuclear isotope that could redefine cancer care.

The head of oncology at Novartis believes it could become "a mainstream therapy" for tackling the "big traditional cancers" – 50 (!) different forms of cancers.

Big Pharma is pouring billions into new pharmaceuticals using Ac-225.

My latest research report – out just now – digs deep into the company which could become the global market leader for supplying the material that everyone is after.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: