Image by kibri_ho / Shutterstock.com

In July 2024, I wrote about stocks that would benefit from the reconstruction of Ukraine.

At the time, the mere possibility of a peace deal for Ukraine was a non-consensus viewpoint.

Since then, a lot has happened.

The possibility for peace in Ukraine is now in the news almost daily.

Following a deal, hundreds of billions in foreign aid will go towards private companies.

What are the options for getting exposure?

The wisdom of the crowd

Growing Internet traffic for a particular subject is a good indicator that something is afoot.

Traffic to my July 2024 Weekly Dispatch "Ukraine reconstruction – which stocks will benefit?" recently spiked.

The article had already generated a lot of interest when it was first published eight months ago, which in itself is a valuable indicator.

The fact that it's now received renewed interest is a remarkable tell. A few weeks ago, investors started researching how to benefit from a potential modern-day Marshall Plan.

As I wrote last year (abridged):

"All wars come to an end eventually. When the shooting is over, the rebuilding begins.

An intense discussion about Ukraine's reconstruction is guaranteed to happen, for all the obvious reasons:

- The native population that remained in Ukraine will want to rebuild their country.

- For many Western leaders, securing Ukraine's future is a high-priority item, supported by at least a significant part of the electorate.

- A reconstruction would be a financial bonanza unlike few before. It represents an opportunity for a massive wealth redistribution from Western taxpayers to those involved with the reconstruction. Corporate lobbyists in Brussels and elsewhere will go into overdrive mode to make it happen.

The numbers are going to be staggering.

When Zelensky spoke about reconstruction in July 2022, he mentioned that a USD 750bn reconstruction plan was required."

More recent reporting also confirmed that the numbers involved will be absolutely staggering. Companies (and empires) will be built on the back of Ukraine's reconstruction.

Source: The Week, 6 February 2025.

There are other indicators, too.

E.g., a journalist formerly working for Bloomberg and The Associated Press, Adam Brown, recently relaunched Ukraine Rebuild Newswire. He has been beefing up his news operation in anticipation of a need for a central hub of information about this coming multi-decade project.

Obviously, all sorts of hurdles remain.

Trump promised to finish the war within 24h of taking office, but he failed to deliver. So far, he has spoken to Putin, and a summit in Saudi Arabia is being prepared. It remains to be seen how all this progresses – if it progresses at all. If it does progress, it still remains to be seen if the deal is implemented successfully.

Source: Polymarket.

Also, Ukraine will at least for quite a few more years be a place where investors have to deal with significant corruption. The country was ranked among the Western world's worst cases of corruption before the war, and the situation is not likely to have improved of late.

Never mind the difficult logistics of a country that has had a significant percentage of its infrastructure taken out by missiles.

Still, there is a growing sense that a deal to stop the shooting in Ukraine is now a matter of "when" and "how", rather than "if".

99 stock ideas

Most people will probably be surprised about the sheer number of available options, and their broad scope.

Oddly, reporting about this subject is still somewhat of a hot potato. To suggest that a deal will be done with Putin is seen as treasonous by some. There remains some reluctance to talk about it, and as a result, only a limited amount of reporting is available.

At this stage, even just listing out the different options has value.

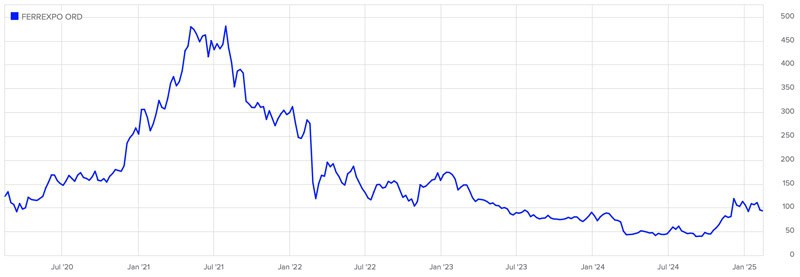

Undervalued-Shares.com Members already received an in-depth research report on such an option: Ferrexpo (ISIN GB00B1XH2C03, UK:FXPO), a Swiss-domiciled and London-listed Ukrainian producer of iron ore pellets. After the report was published in November 2024, the stock nearly doubled in a matter of week.

Ferrexpo.

Indeed, many Ukraine plays have since gained in value rather significantly, showing once again how the stock market anticipates news before it happens. A subset of Ukrainian stocks that are listed on the Warsaw Stock Exchange has just regained its pre-war level. This includes the Ukrainian agriculture stocks that I had featured in an April 2022 Weekly Dispatch, at a time when these stocks had completely fallen out of favour.

So, what else is available and where can you still find upside?

Anyone with an interest in the subject can use the following list as a starting point for their own research.

At the end of the article, I'll name one investment that may be the single-best way for betting on this entire trend – and without having to go to great research lengths!

I am sure there are ideas that I've missed. If you can think of any, please send them over!

The reconstruction bonanza

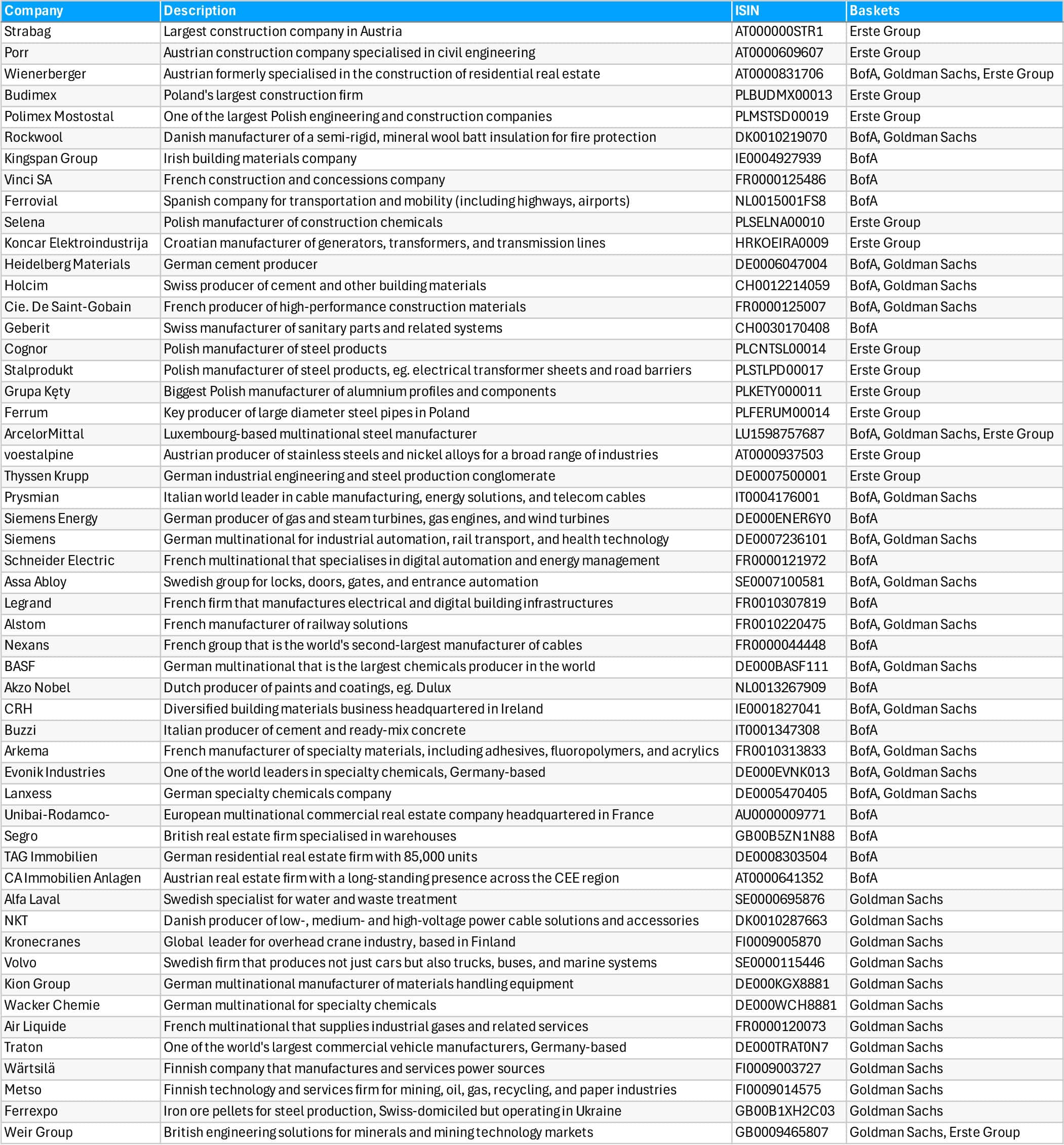

After a hot war, the immediate tasks at hand include rebuilding residential real estate, roads, bridges, and energy infrastructure. This translates into an obvious opportunity for construction and civil engineering companies. As it were, this is also a sector that offers investors plenty of options for engagement.

Ukrainian companies are going to be part of this, but other European countries will likely get the lion's share. Companies from countries such as Austria, Germany, and France don't just have the know-how, but they will also be favoured because of funding for reconstruction from their respective governments. In Europe, in particular, large companies are often intertwined with government interests. There is a reason why Brussels, the headquarter of the EU, has no less than 33,000 corporate lobbyists. Neighbouring Poland is also of particular interest because of its proximity and close involvement with Ukraine.

Rebuilding energy and transportation infrastructure will be a major theme, given the physical damage the war has caused. However, there will also be the aspect of rebuilding things better or replacing them with a new option. Funding from the Eurozone will probably push Ukraine towards building a "net zero"-type infrastructure, provided this theme survives the next few months of ongoing political changes around the world. Rebuilding affordable housing and adding altogether new housing will be another major theme. There is a multitude of potential subthemes, whether it's bathroom fittings, insulation material, or building security.

Several investment banks have already provided an overview of the companies that are set to benefit:

- As far back as April 2023, Austria's Erste Group published "Rebuild Ukraine – Opportunities? More a when than an if!". This seminal report was premature, but its list of investment ideas remains just as relevant today and is thus included in the table below. As Henning Esskuchen, head of CEE equity research at Erste Group, told me: "Currently we are working on an update, most likely focusing on the biggest risk for Ukraine, which is a fragile and imposed agreement, not addressing their needs and not providing a secure framework for rebuilding."

- Over the past weeks, Bank of America Securities (BofA) and Goldman Sachs both recommended their clients to buy a basket of European stocks if they wanted to get broad exposure. On 13 February 2025, BofA clients participated in a call with Ukraine's Deputy Minister of Economy, Oleksii Sobolev, covering "the state of the Ukrainian economy, key sectors for reconstruction, growth reforms and government programs for foreign direct investments and eventual EU accession."

The following table provides a summary of these investment bank baskets. Please note that the reference to Erste Group is based on its 2023 report, whereas the references to BofA and Goldman Sachs are hot-off-the-press.

Construction-related opportunities. Source: Erste Group, BofA, Goldman Sachs (click on image to enlarge).

Download this table as an Excel sheet

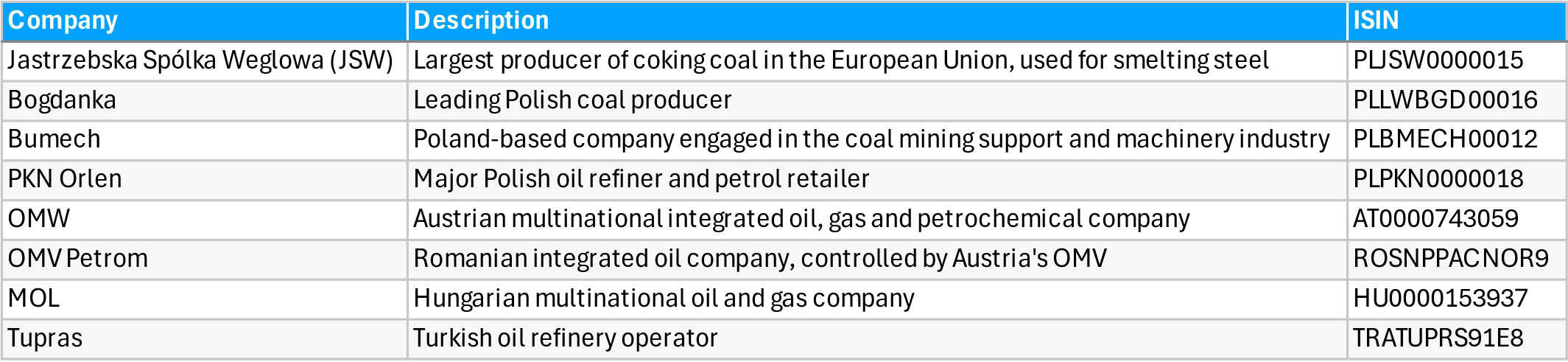

Europe's return to energy realism?

Energy is Europe's super-charged political subject. Whether its renewable energy, the still ongoing imports from Russia to Europe, or the re-import of Russian energy to Europe via markets such as India, it's a complex, messy and polarising subject that most Europeans prefer not to even talk about.

That said, it's objectively true that Europe now has some of the world's highest energy prices. This has had an effect already, e.g. in the form of European companies uprooting themselves and moving to jurisdictions with energy abundance, such as the US. "Germany" and "de-industrialisation" are two terms that nowadays often roll off the tongue together, and Germany's energy policies play a major role.

Pressure has been building to revert to more realistic energy policies.

Of late, there have even been the first whispers of the EU considering to go back to using cheap Russian energy.

Source: Financial Times, 30 January 2025.

How will it all continue?

Given political, fiscal, and economic pressures in Europe, some kind of energy realism is likely to return, and could now be imminent and happen in rapid fashion. It will look country-specific, but it should lead to an overall calming down.

Energy stocks in Central and Eastern Europe (CEE) have been particularly out-of-favour and cheap, and could experience a re-rating. Hungary's MOL is now trading at a price/earnings ratio of 8 and pays a 9% dividend yield.

MOL.

The opportunity also includes companies such as Polish coking coal producers, given how much energy will be needed for producing steel. Diesel demand in Ukraine is also likely going to increase because of the reconstruction effort.

The following table provides an overview of stocks that fit this bill.

Energy-related opportunities. Source: Erste Group, own research (click on image to enlarge).

Download this table as an Excel sheet

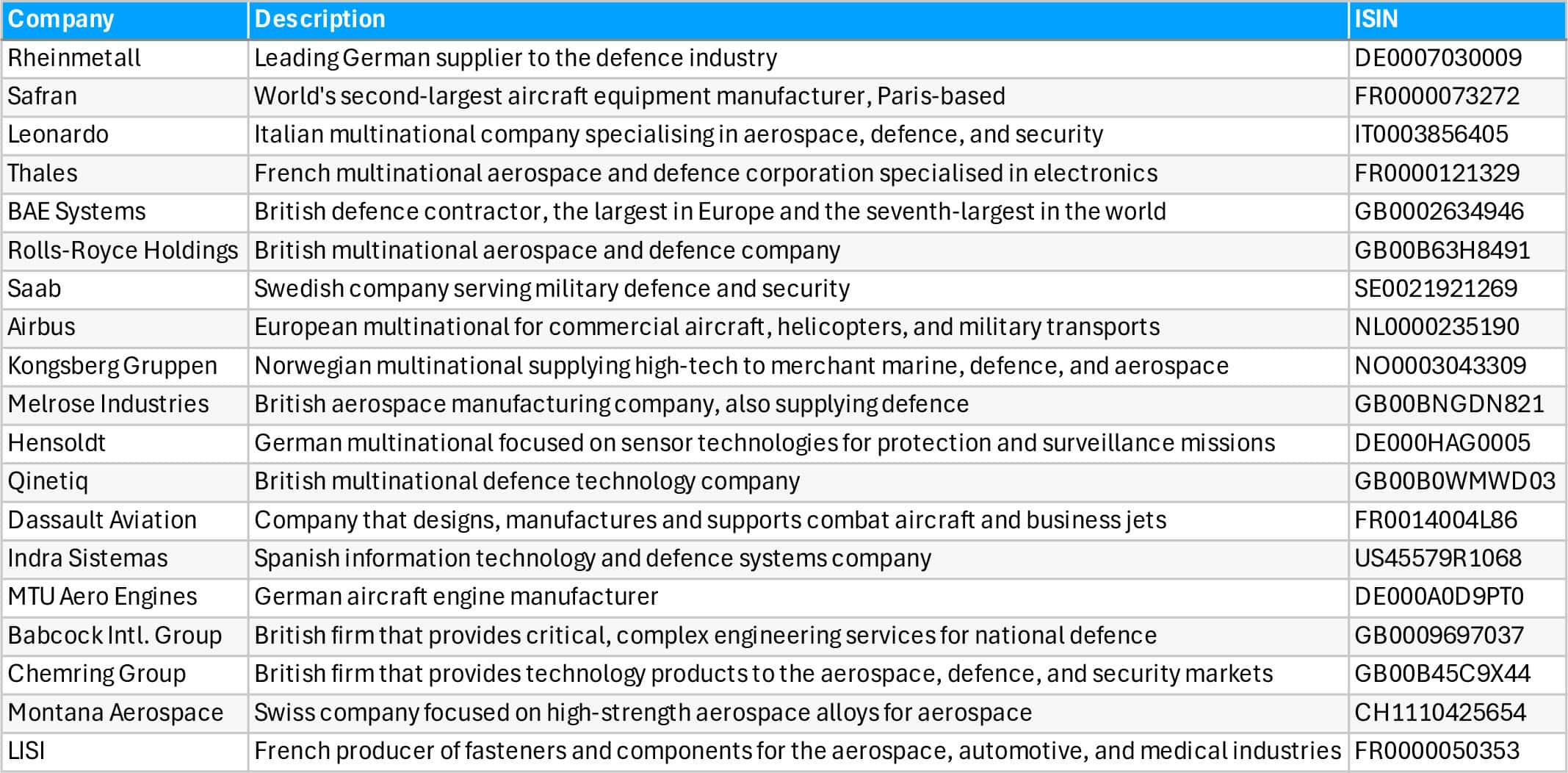

Defence as a secular trend

It may sound counter-intuitive, but defence may be a theme that will develop alongside the reconstruction of Ukraine.

In the first instance, defence stocks have had a strong run since the outbreak of the war. If or when the shooting stops in Ukraine, the sector may experience a pullback, and possibly even a strong one given how much some of its stocks have gained. Rheinmetall (ISIN DE0007030009, DE:RHM), for instance, is up 8x since hostilities began.

However, this could offer an opportunity to buy the dip:

- Ukraine will want to keep re-arming, given its location bordering Russia.

- Trump will keep pressing NATO on spending more. This might not get to the 5% of GDP that Trump demands, but 3-3.5% seems entirely achievable and would already make for a secular change in defence spending.

- The war in Ukraine demonstrated how warfare has evolved. Specific parts of the defence sector will now be seen as a long-term growth trend. Drones, anyone?

The defence basket presented by BofA to its clients is "purposefully broad to allow ample liquidity and some exposure to new warfare, drones and cyber security."

The following table lists related opportunities.

Defence-related opportunities. Source: BofA (click on image to enlarge).

Download this table as an Excel sheet

Other Ukraine-related ideas

There is a swathe of stocks that could become connected to the theme of rebuilding Ukraine, both directly and indirectly:

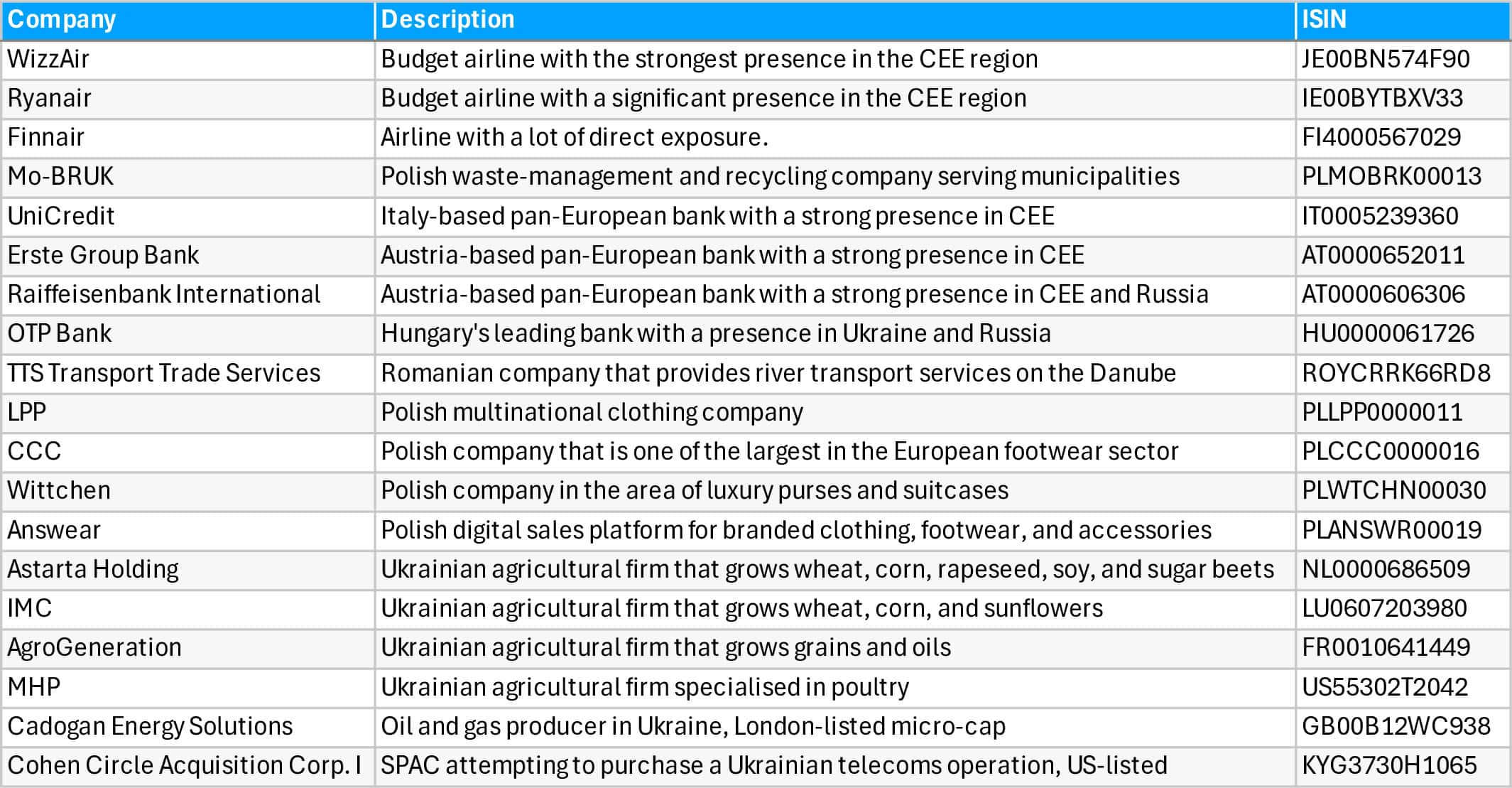

- Ukrainians being free to travel again? Wizz Air, Ryanair, and Finnair will likely profit.

- Ukrainian agriculture operations will probably get their share of foreign support, to strengthen what is one of the backbones of the Ukrainian economy and with plenty growth potential given the abundance of fertile land.

- Ukrainian consumer demand recovering could benefit certain Polish retail companies.

Besides, some idiosyncratic opportunities exist:

- Cadogan Energy Solutions (ISIN GB00B12WC938, UK:CAD), a London-listed company with a GBP 11m market cap. The firm owns an oil and gas project in Western Ukraine and is sitting on GBP 20m of cash – so much that a liquidation would still yield a profit even if the oil operation was vaporised. The stock had suffered from the presence of a Belgian entrepreneur with a questionable reputation, who controlled the voting majority. However, he died aged 95 in late January 2025, which could result in change at the company.

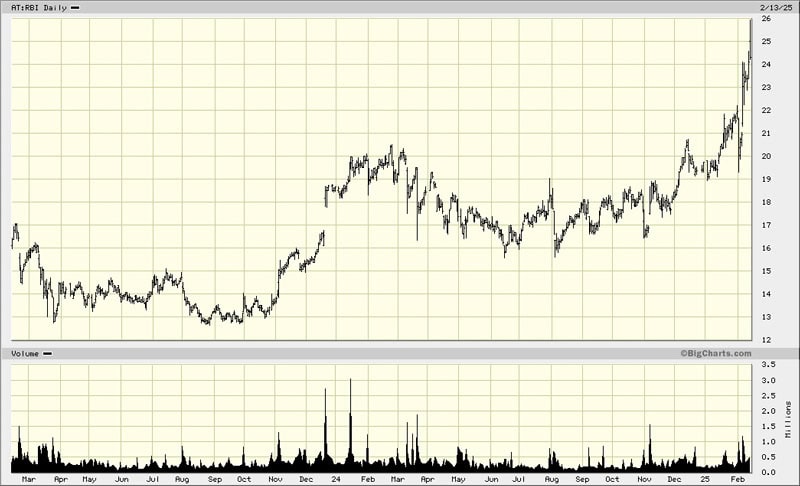

- Raiffeisenbank International (ISIN AT0000606306, VIE:RBI), a stock that Undervalued-Shares.com Lifetime Members will already be familiar with. The Austrian bank doesn't just have a significant presence across the region, but it also still owns a highly profitable Russian subsidiary. This was held against the company for a long time and led to the stock trading at unbelievably low multiples. An end of the Ukraine war could resolve the issues surrounding stranded Russian assets, and Raiffeisenbank International would be a roundabout way to benefit. The stock is already up 80% since the in-depth Undervalued-Shares.com research report in November 2023, but even now it remains one of the cheapest banks listed on European markets. In BofA's Ukraine basket, it is the cheapest stock of the entire list measured by price/earnings ratio.

Raiffeisenbank International.

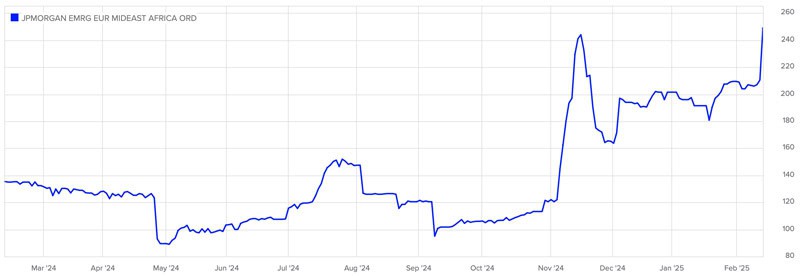

- JPMorgan Emerging Europe, Middle East & Africa Securities (ISIN GB0032164732, UK:JEMA), another case from the Department of the Weird and Wonderful. Formerly the JP Morgan Russia Fund, it was renamed after the invasion and is now commonly referred to as "JEMA". The fund kept holding on to its Russian investments, but valued them at zero. I pointed to the stock in a July 2024 report for Undervalued-Shares.com Lifetime Members. The stock was trading at 130 pence but had a net asset value of over 600 pence if treating the Russian assets at the price they were trading for on the Russian stock exchange. Speak of mispricing and getting something for free! The stock just rallied to 248 pence, but it still has a lot of upside. What's more, it's a perfect example of how private investors can beat the big guys. Most investment funds would not have been allowed to take advantage of this opportunity, but private investors and niche funds could (and did!).

JPMorgan Emerging Europe, Middle East & Africa Securities.

- Cohen Circle Acquisition Corp. I (ISIN KYG3730H1065, Nasdaq:CCIR), a US-listed SPAC and a potentially quirky idea in the making. Telecoms company VEON is seeking to spin out and list its Ukraine operator, Kyivstar, via this SPAC.

As ever, there are obvious opportunities and less obvious ones.

A firm that I cannot recommend highly enough if you are looking for quirkier ideas is Roemer Capital. Its managing director and head of distribution, Luis Saenz, publishes a daily newsletter on stocks in countries such as Kazakhstan, Saudi Arabia, and Russia, which has been the world's single-best source for information on stranded Russian assets. When many conventional brokers and banks left their clients hanging, Luis provided the information necessary to deal with the problem.

On the day before this article was published, Luis sent a note to his readers about "stocks outside of Russia would potentially benefit from an improved geopolitical landscape towards Russia":

"TotalEnergies (TTE FP, N/R): Holds a 19.4% stake in Novatek (NVTK) and also has significant interests in its LNG projects: a 20% stake in the Yamal LNG project and a 10% stake in the Arctic LNG-2 project. Additionally, TotalEnergies is a key customer of Yamal LNG, with the largest long-term LNG contract of 4 million tons per annum (mtpa).

BP (BP US, N/R): Holds a 19.8% stake in Rosneft. Both BP and TotalEnergies have been unable to transfer several billion dollars combined from Russia due to dividend restrictions on their stakes in Novatek and Rosneft.

JEMA LN. The former Russia Equity Fund by JP Morgan Asset Mgmt.

Uniper (UNO GR, N/R): owns an 84% stake in Unipro.

Raiffeisen Bank International (RBI AV, N/R): is the 100% owner of Raiffeisenbank (Russia), which contributed 60% of RBI’s consolidated revenue for the first 9M24.

UniCredit (UCG IM, N/R): Fully owns UniCredit Bank in Russia, which serves corporate and individual clients, SMEs, and financial institutions. Russia accounted for ~8% of UniCredit's consolidated net profit in 9M24, with NI of EUR599M out of a consolidated EUR7.75B.

Kazatomprom (KAP LI, BUY) and KazMunayGas (KMGZ KZ, BUY) would benefit from their integration with Russian counterparts.

Fortum (FORTUM FH, N/R): Holds a 98% stake in Forward Energo (formerly PJSC Fortum) and a 30% stake in TGK-1."

Email Luis if you'd like to be added to his list: [email protected]

The following table contains many of these quirkier names, with no claim to be complete.

Download this table as an Excel sheet

A new convergence theme

Russia's conflict with Ukraine has not just caused physical damage, but it also raised some longer-term political implications. The EU could undertake steps to bring the entire CEE region closer into the fold, both politically and economically. For some countries in this region, this could mean EU accession while for others, it could bring more attention overall – or more handouts from Brussels, which is a plus at least in the short term.

EU accession was a theme in the 1990s and 2000s, and it helped stocks from the region gain in value rather significantly. We could now see a repeat. As Erste Group put it in its April 2023 report: "Rebuilding Ukraine might add back to the region what it has lost as main story and we might see another EU convergence theme emerging, with positive implications for the entire CEE region."

A second wave of accession to EU membership could lead to money flowing from the Eurozone into these markets.

A new EU convergence is possibly the most interesting theme to play. This is also where you may still get the best value for money right now.

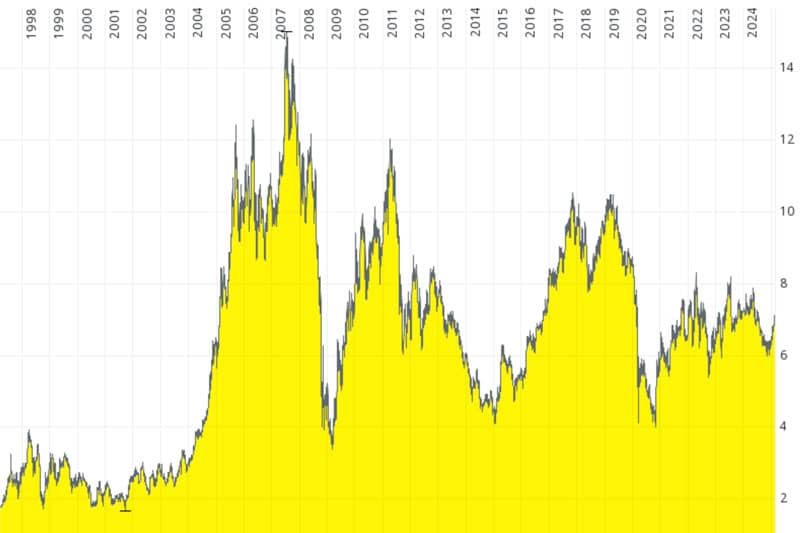

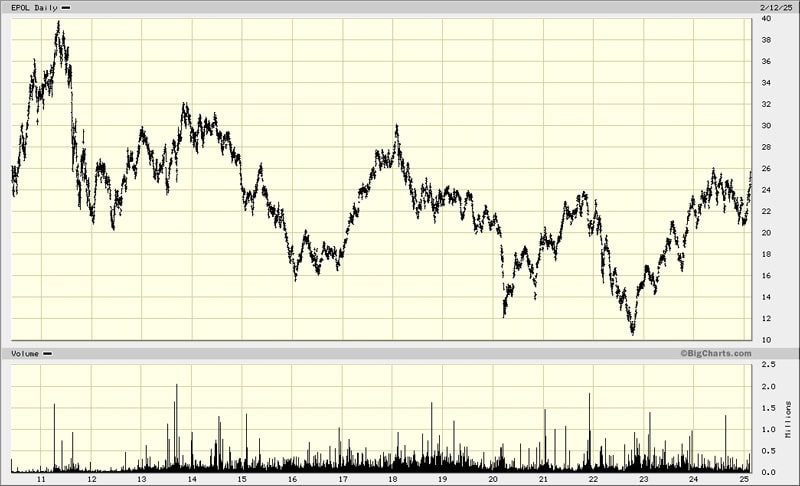

It may just be as simple as buying a Poland ETF, i.e. the iShares MSCI Poland ETF (ISIN IE00B4M7GH52, NYSE:EPOL).

Poland is the most important economy in the region, and the most investible one in terms of its scope of public companies and market depth. Poland also remains one of the world's cheapest stock markets. It has suffered a lost decade, where the economy boomed but the broader stock market went nowhere.

Source: Financial Times, 27 August 2024.

The Polish market is cheap in absolute terms, even though there is a lot of nuance and complexity to this much-cited figure. E.g., the main Polish index contains many old economy companies, which invariably will be trading at low multiples and probably not experience a great deal of multiple expansion.

Then again, Poland could just be THE winner of an end of the war in Ukraine:

- Additional business for Polish companies because of geographical proximity.

- Existing close(-ish) integration of Poland's economy, population and workforce with Ukraine. Poland took in more Ukrainian refugees than anyone else, and it had several million Ukrainian immigrants before the war even began.

- A perception of Poland as a country that continues to come out ahead of adverse circumstances (as also reported in my 2020 three-part series about investing in Poland).

The Polish market has started to move, but it remains cheap.

To get one-stop exposure to Ukraine, buying a Poland ETF is probably a smart way. In fact, it may actually be the one truly valuable takeaway from today's article.

iShares MSCI Poland ETF.

A trend that is here to stay

The news surrounding this theme evolves almost every hour.

For many of the companies listed in today's article, there are already news stories linking them to Ukraine. A few examples plugged from Ukraine Rebuild Newswire:

- "Wizz Air matches Ryanair's plan to resume Ukraine flights within 6 weeks of any ceasefire"

- "Kingspan to start building Ukraine factory 6 months later than first planned after paperwork crunch"

- "Ukraine's agricultural exports reach pre-war levels"

The big question is, how much is already priced in?

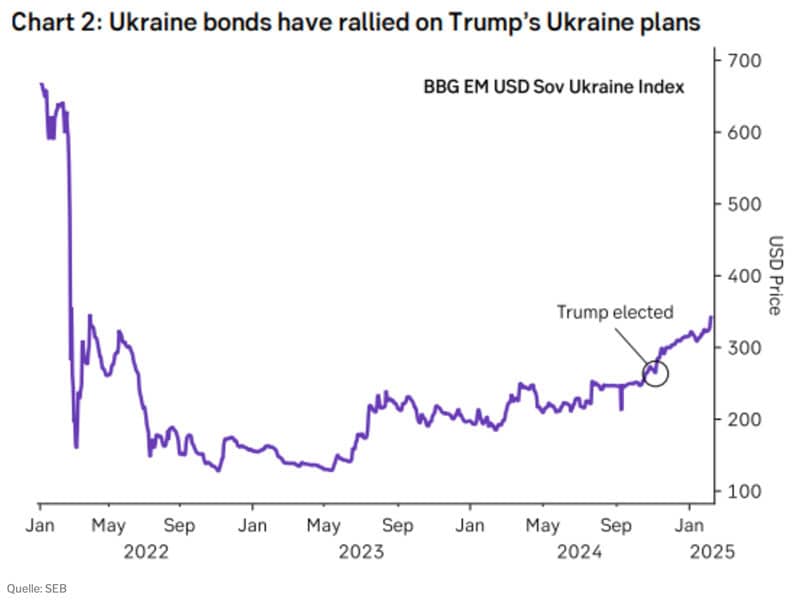

Some Ukrainian bonds have rallied 3x since their spring 2023 lows; you can no longer buy Ukrainian assets for fire-sale prices.

Somewhat oddly, this trend has even reached parts of the globe that you wouldn't immediately associate with benefiting from the reconstruction of Ukraine. E.g., certain South Korean stocks have been rallying on the back of expectations that they'll be involved in rebuilding Ukraine. Whether that's justified or an online craze, we leave for others to judge.

Without a doubt, though, it won't take long before we could see new, speculative ventures popping up. Some will be listed through shell companies in places like the UK or Germany. The Ukraine reconstruction boom will be a veritable boom indeed, and it'll also bring scammers into the fold. It's Ukraine, after all!

Entirely separate from all this, there is also the fast-growing venture capital sector for Ukrainian defence tech companies. Ukraine has a highly educated workforce, and the military threat will remain. Could this be a re-run of Israel's success in defence tech? Some do think so, but venture capital is not an easily accessible asset class. Imagine Ukraine giving birth to one or the other multi-billion defence tech company, and what that could do economically and otherwise for the country. Is a Ukrainian Wirtschaftswunder entirely out of the question? Who knows!

There are many opportunities – but also so many unanswered questions and challenges to overcome.

Even if rebuilding the Ukrainian economy began soon, it will likely be 10% below its pre-war level in 2027. This provides an idea for how long a process is needed before the country can get back to some kind of normal, economically and financially.

Besides, there are many voices who don't quite believe yet that a deal will be struck, or that a deal can be executed successfully.

Still, it all boils down to this: with a potentially new political set-up and plenty of financial support from the West, we could see Ukraine develop in a previously unseen fashion. It might be a 10-20-year investment theme, and it's worth spending a bit of time to dig deeper into the opportunities that sound like a fit for your particular investment needs.

The Sherlock Holmes of stock markets working for 'Poor Millionaires' - Swen Lorenz (podcast)

Graham Rowan of Diary of a High Net Worth Investor and I recount my journey from a young stock market enthusiast to a seasoned investor and author.

We also take a closer look at the depth and breadth that Undervalued-Shares.com has to offer, and uncover what led to the creation of the Weird Shit Investing conference.

The Sherlock Holmes of stock markets working for 'Poor Millionaires' - Swen Lorenz (podcast)

Graham Rowan of Diary of a High Net Worth Investor and I recount my journey from a young stock market enthusiast to a seasoned investor and author.

We also take a closer look at the depth and breadth that Undervalued-Shares.com has to offer, and uncover what led to the creation of the Weird Shit Investing conference.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: