Johann Rupert is South Africa's richest man with a USD 14bn fortune.

He is globally known for his control of luxury goods company Richemont.

Based out of Luxembourg, there is another holding company that he keeps control of: Reinet, a EUR 6.6bn entity. Despite its shared trading in Amsterdam, Luxembourg, and South Africa, hardly anyone has ever heard of it.

A billion-euro exit from one of its investments is making it timely to take a closer look.

Reinet.

Third-generation family empire

South Africa's Rupert clan started its business in the 1940s.

The late Anton Rupert, who died in 2006 at the age of 89, had dropped out of university because he couldn't afford to study medicine. Instead – as legend has it – he used his last remaining GBP 10 to start manufacturing cigarettes in his garage.

Out of that grew Rembrandt Group, a major international tobacco company.

In the 1970s, Rembrandt was consolidated into Rothman. In the 1990s, Rothmans merged with British American Tobacco (BAT). At that time, Anton's son, Johann, had already taken the helm of the family empire.

Johann held on to the stake in BAT but expanded into luxury goods. Using a complex web of companies to optimise for taxes, mobilise outside capital without giving up control, and deal with South Africa's capital controls, he built Compagnie Financière Richemont (ISIN CH0210483332, CH:CFR), which today is known as one of the world's largest luxury goods companies with ownership of brands like Cartier, Alfred Dunhill, Vacheron Constantin, and Montblanc.

The Ruperts are famously private, but their control of Richemont inevitably keeps them in the spotlight.

However, another publicly listed vehicle that the family controls almost goes unnoticed, even though it's also a multi-billion-euro enterprise.

Reinet is an investment holding that was created in 2007 as a result of restructuring the family fortune.

In 2007, changes in tax laws made it necessary for Richemont to spin off its stake in BAT. In a complex manoeuvre, this stake was moved to another entity, Reinet, which then distributed most (but not all!) BAT shares to its shareholders.

Reinet got rid of 90% of its stake in BAT by distributing the shares, but it held on to the rest. Its stock was listed on what is Euronext-Amsterdam today, and it also trades on the Johannesburg Stock Exchange and the Luxembourg Stock Exchange.

The corporate website has the flair of a website created two decades ago. Clearly, investor relations are not high on the agenda.

The Ruperts only own 24.93% of the Reinet capital, but ownership of 1,000 management shares gives them control over the investment entity's strategy. Using multiple share classes to give the family additional voting rights is something the Ruperts are (in)famous for.

Reinet made headlines when it was created in 2007, but has since attracted limited media interest.

Hardly anyone noticed when Reinet recently sold almost all of its remaining BAT shares through an institutional placing. Overnight, nearly a quarter of Reinet's investment portfolio was converted into cash.

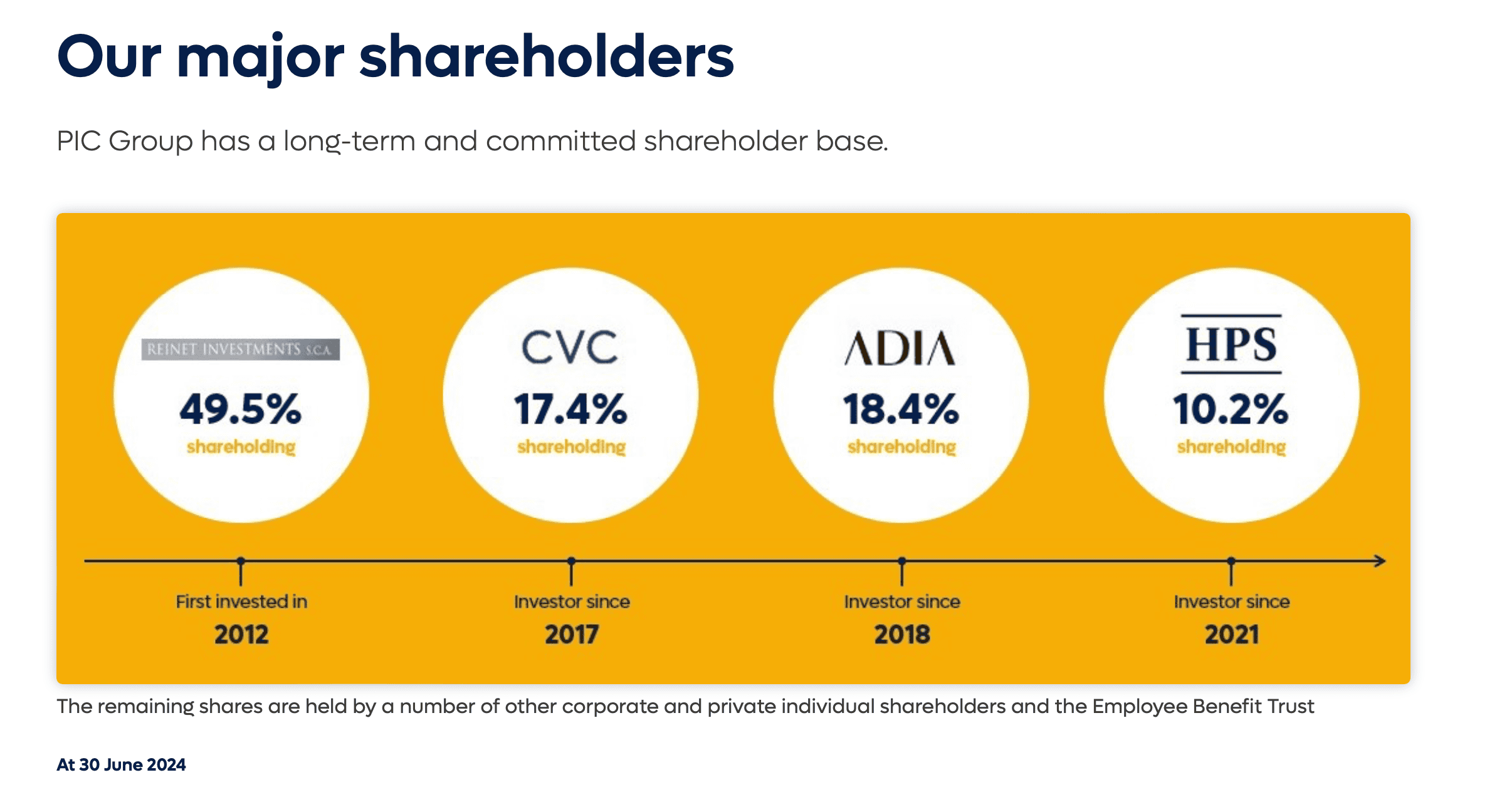

Reinet also owns a 49.5% stake in a specialty finance company that is highly respected in Britain's finance industry and quite well known, but which everyone assumes is privately held and inaccessible for outside investors.

Obviously, this set-up spurned Undervalued-Shares.com to take a closer look.

Concentrated investment portfolio

Reinet Investments S.C.A. (ISIN LU0383812293, Euronext:REINA) is incorporated in Luxembourg. It owns all of its investments through a closed-end, specialised investment fund also established in Luxembourg, Reinet Fund S.C.A. F.I.S. of which it owns 100%.

This is not a structure that investors would be immediately familiar with. Chances are that the Ruperts had tax-related reasons to structure the company that way. Besides, they like to have control of outside investors' money and (for obvious reasons) base their entities in countries other than South Africa.

As Johann Rupert states on the website:

"Our goal is for Reinet to provide shareholders with an investment vehicle which will manage their funds in a conservative manner, protecting capital whilst aiming to achieve growth over the long-term."

Initially, the portfolio consisted mostly of BAT shares. These long paid an attractive dividend yield, which over time gave Reinet the necessary firepower to pursue other investments.

In July 2012, Reinet invested EUR 503m in a major stake in Pension Corporation, a specialist insurance company that buys out the long-term liabilities of paying pensioners from the corporate defined benefit pension plans operated by British companies. The investment was a big, bold bet, with a game-changing effect on Reinet.

Pension Corporation was created by Britain's private equity veteran, Edmund "Edi" Truell. Formerly known for his work at Duke Street Capital, Truell set up Pension Corporation in 2006 as a vehicle to consolidate pension schemes in the UK. By creating larger pools of pension obligations and putting better investment management in place, he wanted to exploit inefficiencies in the British pension market.

Truell raised GBP 872m off the bat, turning Pension Corporation into Britain's largest-ever start-up.

Source: Financial Times, 4 October 2006.

During the first few years, Pension Corporation failed to grow as promised, and some British media outlets enjoyed pointing out that Truell was struggling to get closer to his goal of managing GBP 20bn in pension schemes. Truell was an outspoken backer of the Conservative Party, Boris Johnson, and Brexit, and he regularly made headlines for proposing hyper-ambitious undertakings, such as setting up a British Sovereign Wealth Fund or building a subsea cable to import geothermal power from Iceland. In 2020, The Times published a rather critical piece on Truell that asked "are his latest ventures a stretch too far?" (see below).

Source: The Times, 19 January 2020.

Today, Truell and his backers are having the last laugh.

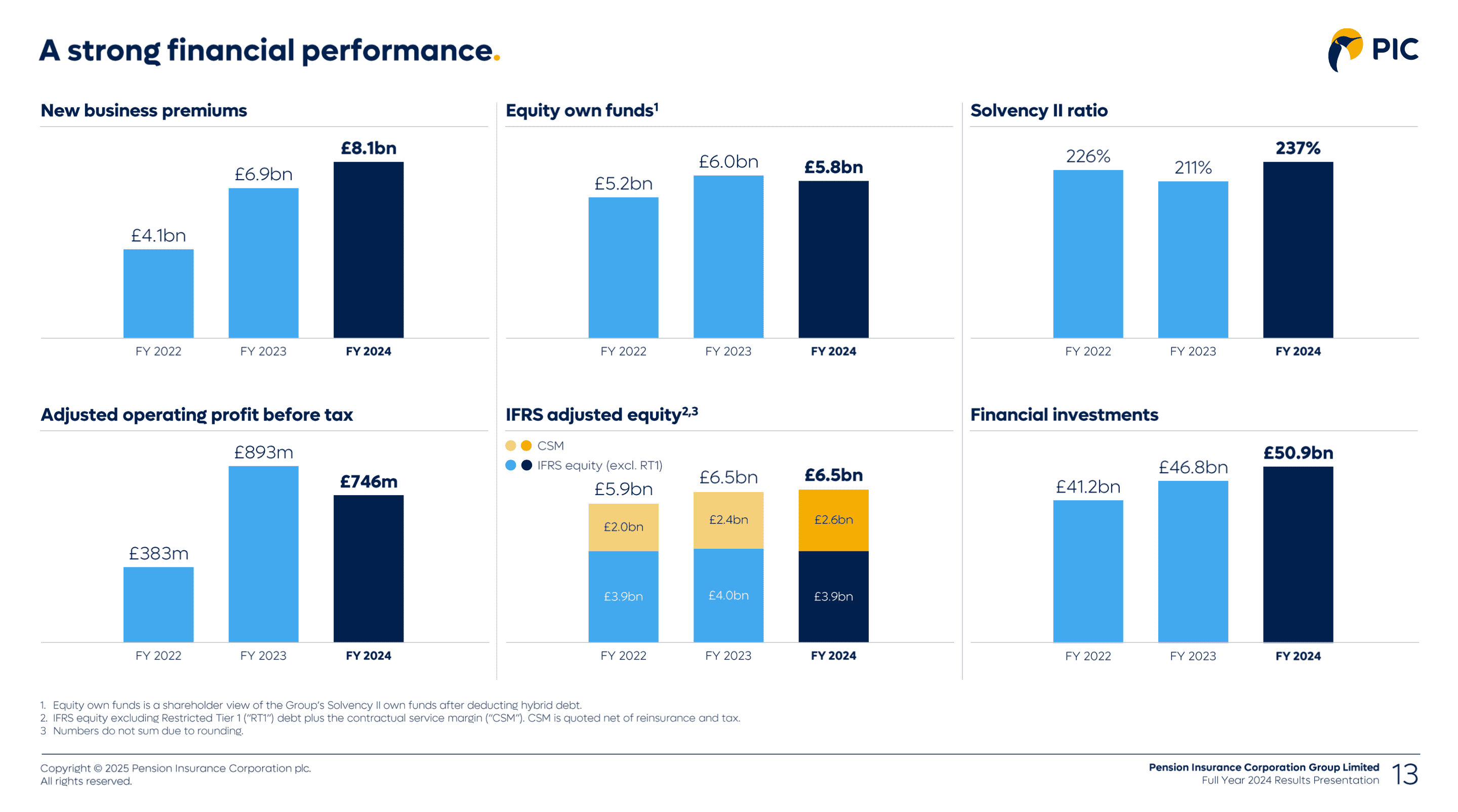

Pension Corporation now manages around GBP 50bn of pension schemes. In less than two decades, the firm has become one of the most successful financial service companies in the UK.

Truell always had sterling backers, but his winning the backing of the Rupert family for the 2012 funding round of Pension Corporation must count among his biggest-ever achievements. Usually, a funding round of this size would have required taking multiple new investors onboard. Instead, Reinet took the entire available round at the time. It was a veritable coup for Truell.

(For disclosure: Truell backed my work in the Galapagos Islands, and the Richemont-owned IWC Watches was the largest corporate donor of the Galapagos charity that I headed as CEO. For the purpose of this article I did not speak to any of the parties mentioned.)

In its 2024 annual report, Reinet shows its stake in Pension Corporation as being valued at EUR 3.47bn. This includes a 10% valuation discount that the company applied to the stake because it's an illiquid investment.

Pension Corporation is a privately held company, but it does publish an investor presentation on its website. Is this a mere PR exercise to deal with the company being in the public eye due to its involvement with pensions, or is this a first step towards eventually making it a publicly listed company? At this stage, God only knows – and maybe, the handful of large Pension Corporation owners.

What's certain, though, is that Reinet will now be looking for its next big investment(s).

It received nearly EUR 1.5bn from selling its stake in BAT.

When Reinet last reported in September 2024, its stake in Pension Corporation made up 52.6% of its portfolio and BAT another 24%. The investment holding also owns stakes in several private equity vehicles, which added another 18.4% to its portfolio. Stakes in a range of smaller entities, some of which are listed, make up the rest. The portfolio was last valued at EUR 6.6bn.

With EUR 1.5bn in cash coming in, Reinet now seems destined to place another large bet before too long.

Johann Rupert is notorious for not distributing money to shareholders and plotting large acquisitions instead. Reinet has not made a statement as to what it intends to do with the cash, but it wouldn't surprise anyone if it was used for a single large investment.

This could involve Johann, or his son Anton, who is destined to take over the reins of the family empire one day.

In the meantime, is Reinet worth an investment?

One for the watch list

On 30 September 2024, Reinet's net asset value amounted to EUR 36.25 per share based. The stock is currently trading at EUR 23.20, a 36% discount to its net asset value.

Presumably, the actual net asset value will be higher. Applying a discount to Pension Corporation's valuation seems unjustified given the company's quality. However, it also remains to be seen which effect the sale of the BAT shares in January 2025 will have.

Could Reinet be a clever back door route to getting exposure to Pension Corporation? Besides Reinet, the investors holding major chunks of Pension Corporation include CVC Capital Partners and HPS Investment Partners, both of which presumably want to see a liquidity event eventually.

Over the past two years, Pension Corporation earned a pre-tax profit of GBP 893m (2023) and GBP 746m (2024), respectively. Reinet has valued its stake in Pension Corporation based on the company's equity of GBP 5.8bn. Given how seemingly profitable it is, would Pension Corporation achieve a higher valuation in public markets? Valuing insurance companies and specialty finance operators like Pension Corporation is a science in itself, and without being given further insights it's impossible to say.

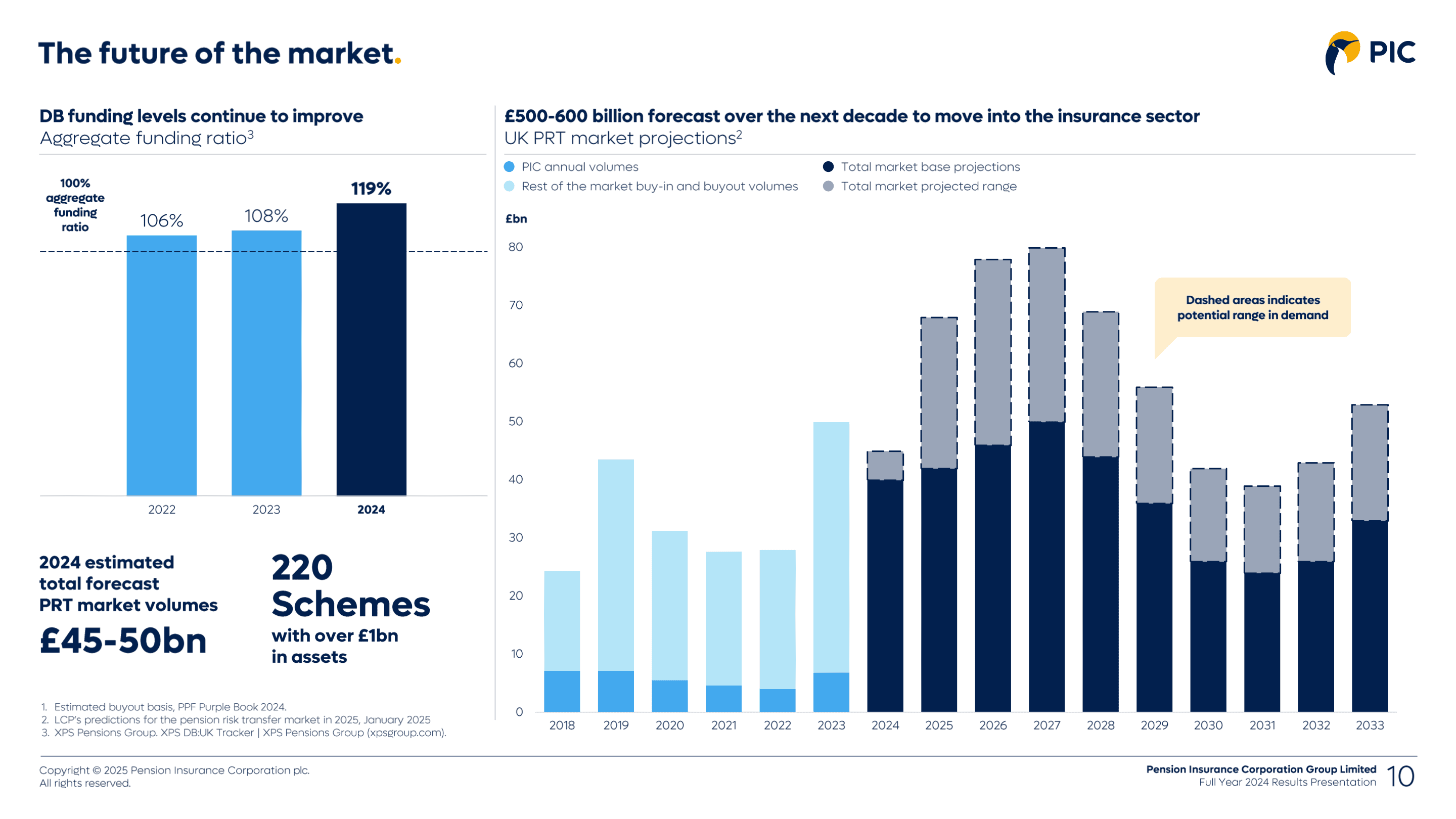

What's certain right now is that Pension Corporation is positioned to benefit from a huge growth market that comes with extraordinarily high barriers to entry. Over the next ten years, another GBP 500-600bn of British pensions are expected to move into the kind of insurance scheme that Pension Corporation offers. Most of that growth will go to just a small number of existing operators. Given how delicate the issue of pensions is, the boards and trustees of companies and pension entities will not hand their mandates to anyone but the few best, proven operators in the space.

Setting up a new firm like Pension Corporation will be almost impossible nowadays. As far back as 2011, the Financial Times had reported that there was "just a handful of specialist companies in this area". One is Goldman Sachs-backed Rothesay Life, which today is Britain's #1 in the space with GBP 68bn of pensions under management. Pension Corporation comes in second with GBP 50bn of pensions under management. Besides, there are traditional insurers such as Aviva, Legal & General, MetLife, and Prudential. Competition in this space will remain limited because a start-up would require billions in funding just to get going. As Britain's second-largest company in the space, one would expect Pension Corporation to be seen as a premium-quality investment if (or when) taken to market through an IPO.

Its timely backing of Truell has already provided Reinet with an incredible homerun, effectively achieving a 7x return on its investment in 13 years without even counting the dividends paid out by Pension Corporation in the meantime. This return is all the more remarkable given the ticket size the Ruperts deployed.

Anyone investing into Reinet currently buys into a pot of cash and a discounted stake in Pension Corporation. The other assets are effectively thrown in for free, so the fact that they are more difficult to value is not something to worry about. Reinet last paid a dividend of EUR 0.35 per share, and since 2018 has bought back shares for over EUR 200m. More details can be found in the company's most recent interim report from September 2024 and its March 2024 annual report. As it stated in the most recent interim report: "Reinet's net asset value of EUR 6.6bn reflects a compound growth rate of 9.0 per cent per annum in euro terms, since March 2009, including dividends paid."

What is something to worry about is the company's governance structure.

As a partnership limited by shares, Reinet is managed by a general partner rather than a board of directors. The general partner is Reinet Investments Manager S.A., a Luxembourg entity owned by the Rupert family. Reinet has no directors or employees, and pays its general partner a management and performance fee. Details about this can be found in the company's listing prospectus.

With the Ruperts being so firmly in control and the company having the unusual structure and investment portfolio as described above, it seems unlikely that the discount to net asset value will decrease dramatically. Most similar holding companies trade at about the same level of discount.

That said, a liquidity event at Pension Corporation (or the prospect thereof!) could get the share price moving. It would lead to over 50% of the portfolio being converted into cash and/or getting revalued at a significantly higher price – or a combination of both!

Just as much, there may be changes in the family, including the inevitable changeover from Johann Rupert to Anton Rupert, the designated successor among Johann's three children. Johann will turn 75 in June 2025.

The Rupert family own just 24.93% of Reinet, and the remaining share capital has some notable owners: South Africa's Public Investment Corporation owns 15%, Singapore's sovereign wealth fund, GIC, was last reported in 2020 to be onboard with 2.97%, an entity related to the late South African billionaire Allan Gray had last reported a 4.97% stake, and British fund manager M&G has reportedly upped its stake above 5% (from 3.8%).

Given that M&G will likely have a good understanding of Pension Corporation's long-term intentions, its stake increase may be a valuable clue.

That said, Reinet is not a company I'd be dying to invest into right now. It's one worth checking on every year, in case something changes dramatically. If volatile markets ever led to its share price dropping to nearer to 50% discount to net asset value, I'd probably jump at it.

Out now: Iconic New York at a discount

Once every decade (or two), the world's iconic cities offer you an outstanding investment opportunity in real estate.

You can currently buy into one such opportunity in New York. It comes at a discount, ahead of prices probably catching up with much more expensive neighbourhoods of the Big Apple.

The latest report for Undervalued Shares Lifetime Members investigates one US-listed company that is exploiting this opportunity.

Its stock is a bargain with 2-5x upside over the coming 4-7 years.

Out now: Iconic New York at a discount

Once every decade (or two), the world's iconic cities offer you an outstanding investment opportunity in real estate.

You can currently buy into one such opportunity in New York. It comes at a discount, ahead of prices probably catching up with much more expensive neighbourhoods of the Big Apple.

The latest report for Undervalued Shares Lifetime Members investigates one US-listed company that is exploiting this opportunity.

Its stock is a bargain with 2-5x upside over the coming 4-7 years.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: