A colleague in the fund management industry did what many others wish they had done. He sold ALL his Russian (and Ukrainian) stocks on the day before the shooting started.

Roman Fuzaylov is a partner at Prince Street Capital Management, an emerging markets and pioneer markets specialist based in the US and Asia. His Tamerlane Fund, which has racked up a cumulative performance of 37.9% (net of fees and expenses) over its three-year life even after the recent market bout, invests across Europe, the Middle East, and Africa (EMEA). Russian equities previously made up one of the biggest parts of Roman's portfolio. As a result of his timely selling, he now has a significant chunk of cash that he can redeploy elsewhere, and he can do so at a time of great dislocations in equity markets.

Where does Roman see opportunities to put investors' money to lucrative use?

I picked Roman's brain about some of the wider issues resulting from the current crisis, as well as specific companies that are worth taking a closer look at.

This interview is an Undervalued-Shares.com exclusive (legal disclaimer: it does not represent investment advice).

Roman Fuzaylov, Prince Street Capital Management.

Swen Lorenz: I just have to ask this one first, what was the ultimate trigger for you to sell all your Russian and Ukrainian holdings in time? I am asking as someone who told his readers to hold onto Gazprom, and this position is currently stuck and valued at zero in brokerage accounts. What did you see that I've missed?

Roman Fuzaylov: It was a very specific thing that got me to sell. What changed my view were the events of 21 February, when Russia announced the recognition of independence for the two new republics. That was a step that I always thought the Russians would take eventually. What I hadn't expected was that the borders within which their independence would be recognised would be borders that lie well within Ukrainian territory. It was a subtle point but one that I was very focussed on. It seemed clear to me that if they recognised borders of those administrative regions as they were constituted previously as part of Ukraine, meaning borders that lie within Ukrainian control today, it would effectively be a declaration of war.

On 22 February, there was a statement from Putin himself on the subject. He said these two new republics set out their borders in their constitutions, and that Russia recognises their constitutions. He took a maximalist approach to this question, and it seemed like they were courting conflict openly at this point.

Given everything that had transpired up to this point plus this new provocation, we started to sell. We sold just about everything that day and the next day. The following day, the war was announced. Markets collapsed the day after, and the rest is now history.

Our fund is currently down 17% year to date, which is largely down to the situation in Russia. However, we didn't have one fifth of our portfolio get stuck and we didn't have to mark positions down to zero. Cumulatively, since inception, our fund's performance is still +37.9% (net of fees and expenses). Over the life of the fund, our Russian investments did make us money.

Our next task is to figure out how investment looks post this event, and to redeploy the capital we freed up when selling our Russian and Ukrainian stocks.

Swen Lorenz: Your fund describes itself as an EMEA long/short equity fund. You do have focus on emerging markets and less developed countries in this region, though. Describe your investment universe to us.

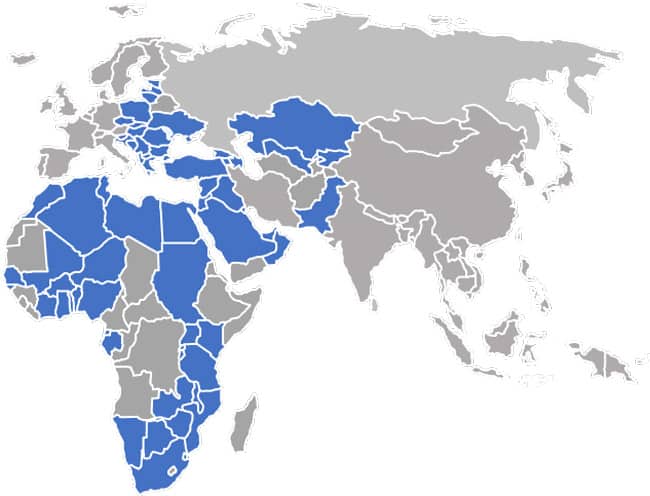

Roman Fuzaylov: The EMEA region is sort of everything between the Americas and Asia, but our focus within that is Central and Eastern Europe, Middle East, and Africa. This is very broad and very diverse geographically, but not as evenly developed in terms of capital markets. Some countries in this region don't even have a stock market yet, but you also have Poland in there, which is now ranked as a developed country.

Prince Street Tamerlane Investment Universe.

The largest markets within that historically have been Russia, South Africa, Turkey, and Saudi Arabia. Now we have crossed Russia off the list, which leaves the other three as largest markets in the region. Then there are category 2 markets that are mid-sized, i.e. places like Egypt, Poland, Pakistan, and the Gulf outside of Saudi Arabia (United Arab Emirates, Kuwait, Qatar). Last but not least, you have some third-tier places which is largely sub-Saharan Africa and places like Kazakhstan or Romania. These markets may have just a few stocks each, but they can be interesting because these few stocks might be quite good. You do have to extra care, though, to not wind up with a good stock in a bad country.

Swen Lorenz: Which country are you currently particularly interested in?

Roman Fuzaylov: Currently, Greece is the largest position in the fund. It had been a large position for a couple of years, and it's now about 20% of the fund. It has taken a bit of a hit during recent weeks. Europe as whole is highly impacted by the entire situation, and the indirect exposure of Europe on Greece is meaningful. However, I believe the country's direct exposure to the current situation is surprisingly small. The important factor in Greece is that the government there is a really good one. It's a government that is business friendly and investor friendly, and which tries to move the country in a positive direction. This is something that Greece hasn't had in a long time. The country is coming off this very deep cyclical trough that it had found itself in, and this is something we had been seeing over the last couple of years already. Until the middle of February 2022, the stocks of Greek banks were off to a great start. Once we ride out this geopolitical uncertainty, I expect Greece will get back to its recovery.

Swen Lorenz: Commodities are currently on everyone's mind. What's your take of the sector?

Roman Fuzaylov: Indeed, another implication from what has transpired recently is that this is going to be quite good for commodity prices. The outlook for commodity prices was quite good even before all this happened, and it's now even better given the likely disruption to the supply chain that the crisis will result in both temporary and structurally. Temporarily, there are fewer ships docking in Russian ports to offtake these commodities, because the shipping companies don't even know if they can even transact with these businesses right now. Structurally, what I expect to happen is that there will be more Russia-China trade and more Russia-Asia trade, but less Russia-Europe trade. What this is going to result in are tighter commodities markets. They were already pretty tight previously, as evidenced by the fact that oil as well as metals were already at multi-year highs before the conflict started. These changes are going to be one more driving factor for that strength going forward, and the question is, who in my investment universe is going to benefit?

Swen Lorenz: And the winners are?

Roman Fuzaylov: South Africa has had a huge boost from the strength of commodity prices so far. This comes on top of the fact that the country's rebound from the pandemic was much slower than what we saw elsewhere. They were slow to remove the restrictions last year, the vaccination effort didn't take off until later in the year, and then the Omicron variant arose. Now, with Omicron having receded and the restrictions coming off, we were going to see a cyclical uplift in domestic activity anyway, but this is now boosted by developments in commodities markets. The South African share prices on the domestic side are low by historical factors. This is a nice confluence of factors that augurs well for South African share prices.

The Gulf region is much more straightforward. Oil prices are up, and they were going up anyway. The Gulf is in the advantageous position of being a beneficiary of higher oil prices and otherwise having limited exposure to Russia. Their markets have responded accordingly. Saudi Arabia has been one of the best performing markets to date, and the other markets have followed as well.

We have started to build some long exposure in Saudi Arabia. We bought two positions and are looking at two others. It still seems like a market that is quite expensive, but you also have some serious tailwinds. The first one is that commodities look as strong as they do, and the other one is the fact that foreign investors had been relatively lightly positioned in Saudi Arabia so far. Fund managers who previously had no exposure to Saudi Arabia are seeing the country's weight in the MSCI Emerging Markets Index expanding. They are being forced by this development to take it more seriously and get more exposure. I expect this to continue. Keep in mind, they have just excluded Russia from the MSCI Emerging Markets Index. If you now count up what's remaining, the Gulf makes up 50% of the index! There are two Saudi Arabian companies that we have been following for a long time, and both are discretionary retailers.

Jarir Bookstore (ISIN SA000A0BLA62) is a retailer that started out as a book store, which may seem completely anachronistic in today's world, but it is still working there, not the least because they are very successful at selling stationery and school supplies. Alongside their bookstores, they have a much bigger selection in electronics, which is now the bulk of the business. They earn a high margin on their sales of stationery and school supplies, but the thing that gets people through the doors are the iPhones and the video games. Keep in mind how young and tech-savvy the population of Saudi Arabia is.

The other company is eXtra (ISIN SA12U0RHUHH8), which is also an electronics chain but it looks more like a Best Buy(ISN US0865161014). They have been quite successful in migrating online. Of course, their shift to online was accelerated by the pandemic, but it was only possible because they had an existing online operation and excellent execution. They have also established a financial business. This started with lending to consumers in stores, but over time they saw a bigger opportunity to build a lending business that is independent from what they are lending in the stores. Today they have a non-bank financial business where they are lending to consumers for general purpose consumer loans, and they are doing that very profitably. They have executed this really well, and it has become a really meaningful part of their business over the course of just four to five years.

Swen Lorenz: In March 2021, I published an interview with David Halpert, the founder of Prince Street Capital Management. David is the inventor of the term Digital Decolonisation, which refers to emerging markets building their own digital champions. Most outside observers would have a prejudice that your investment universe will mostly consist of Old Economy companies, and you have just spoken about commodities, retailers, and banks. Are you pursuing investments in the New Economy at all, and how would you decide on the portfolio composition?

Roman Fuzaylov: Our approach to this question in the Tamerlane Fund has been to have a balanced portfolio between value and growth. We focus on finding good businesses that trade at attractive valuations, and what makes for an attractive valuation can vary hugely depending on what kind of company it is. We think if we have the right mix of those good companies at attractive valuations, then we should make decent returns over time. This might sound like a cop-out, but it communicates something deeper, which is that this value vs. growth trade-off is not what is driving returns over time. Finding the right value stocks and the right growth stocks proves much more important over time than whether growth or value is in fashion at the moment.

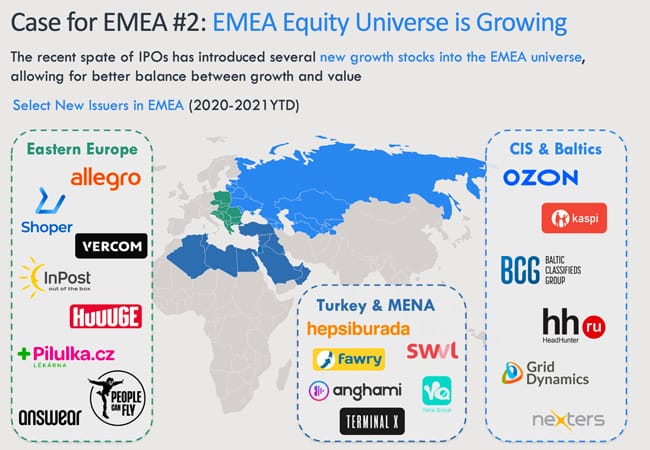

We have had a value bias all along because it's reflective of the geography that we operate in, which historically has been dominated by materials, energy, financials, and telcos – which are all "value sectors". But the nice thing about this part of the world is that over the last years – and over the last two years in particular – there have been more and more growth businesses that have gone public. As you discussed in your interview with David, there is an expanding opportunity set in this part of the world. Unfortunately, a significant part of that was happening in Russia where they had quite a developed tech sector, and those companies are now non-investible. However, there is quite a lot happening outside of Russia. E.g., we are shareholders in Shoper (ISIN PLSHPR000021) in Poland, which is the country's equivalent to Shopify. The company has many of the same really attractive metrics as its Canadian counterpart. Even with Russia out of the picture, we expect Eastern Europe to continue to see more and more listings of this kind, as it has emerged as a real centre for engineering excellence.

Source: Reuters, 9 July 2021.

Elsewhere, there's been an increasing amount of venture capital activity in both the Middle East and North Africa (MENA), and sub-Saharan Africa. There are some very exciting companies out there, real disrupters and businesses that should allow these markets to leapfrog ahead in terms of technology and financial inclusion, and we expect these companies to eventually come public as well. We expect to have an increasing number of exciting growth businesses to choose from in our geography in the coming years.

Source: Prince Street Capital Management, Tamerlane Fund investor presentation.

Swen Lorenz: Playing devil's advocate, it seems that everyone and their brother is now getting excited about commodities. Some say that recent developments are now already priced into commodities-related stocks. Where do you see this going and how heavily are you geared towards the sector?

Roman Fuzaylov: Whether commodities dominate the next two years or just the next six months I am not entirely sure. There is a real risk that if the commodity price momentum goes far enough, it will do enough damage to the global economy and then it short-circuits itself. There is an old saying in the world of commodities that there is no better cure for higher prices than higher prices. I think this is very true and we are going to see how this works later in the year. We have to stay flexible on the subject of commodities and not get too carried away how it's different this time. These are cyclical assets by their very nature. Certainly, for the time being given where global commodity markets are and how commodity stocks are being priced, there are still some more opportunities. About 20% of our exposure is commodities, but we also have 20% invested in growth, and the rest of it is spread across all sorts of other businesses.

Swen Lorenz: A country that hardly anyone has on their radar is Pakistan. I noticed that quite recently, two professional contacts of mine purchased a stake in a Pakistani app, KTrade, which is the local equivalent of Robinhood. You know my interest in trying to be ahead of the curve, and I wonder if Pakistan is a country to look at?

Roman Fuzaylov: Pakistan is a country I have been covering since 2006. I had always been quite attracted to it by virtue of the fact that it's quite a large country. It has the potential to be one of these places that has the critical mass to develop on its own accord, but no one looked at it. It was just off the radar forever. We started looking at it and found interesting companies. Investors from the Gulf region invest in Pakistan pretty actively, there are increasingly strong trade links between the Gulf and Pakistan, and the Gulf also acts as a remittance provider to Pakistan. It's right on the border of the Gulf where we invest a lot and we had in-house expertise about Pakistan, so when it came to decide on the investible universe for the fund, we decided to include it.

Pakistan provides another option in terms of countries that are not so reliant on commodities, along with countries like Turkey and the region of Eastern Europe, which are more manufacturing-driven. However, it has had its ups and downs from a macro standpoint. Like in a lot of the frontier markets, the main thing in Pakistan over time has been the currency. The currency has continued to depreciate over time, and it did do so not in a consistent way but in an abrupt kind of way. What this meant is that if you were invested while there was another bout of depreciating, you tended to generate pretty poor returns in dollars. However, if you managed to invest after the currency found some balance, the chances were that you did better. In 2019, it looked like it was one of those moments to invest. The currency had been depreciating for a while and it seemed like it had finally reached an attractive point in terms of valuation, i.e. from a real effective exchange rate standpoint. We were getting more excited and took a couple of positions, and we have been invested for 2.5 years now. Obviously, during this period the world turned upside down. The pandemic came but Pakistan did reasonably well – and certainly better than India! What's been a negative surprise was that the new government under Prime Minister Imran Khan made promises that didn't materialise. The reform programme that was promised to fix the subsidy regime hasn't materialised, and they failed to fix the state-owned enterprise sector and attract new investment. The government didn't take the hard decisions early, and there is now an election coming up. Commodity prices are moving up and against them, and inflation is moving higher which puts the currency at risk. Cyclically and politically, the environment has shifted in a way that has really changed the risk/reward proposition of the country as a whole. With doubts about the political future of Imran Khan and the currency situation also in question, we have decided to sell and see what happens. For now, we are better off on the outside looking in.

Swen Lorenz: Every day, I get several emails from readers asking if I know a way for buying Russian equities. There is a lot of interest in the idea of buying Russian assets while they are as distressed as they are right now. Do you have a view how the entire issue of Russian stocks will develop from here onwards?

Roman Fuzaylov: Now that the Russian stock market has become excluded from the MSCI Emerging Markets Index, it has become a potentially brilliant off-index trade if it ever returns. Whether it returns is quite hard to tell. What I think is going to happen is that eventually the fighting will stop. Whether it will be primarily on Putin's terms or less so on Putin's terms, at some point they will reach a resolution to this issue. The question then becomes whether Russia can have a constructive relationship with the rest of the world and, in particular, with the West and Western capital markets. That seems much harder to imagine right now. It's hard for me to see how investment into Russian equities is going to return quickly. The sanctions regime is going to remain in some shape or form, and I think it will remain in a harsher form than it existed prior to the war. Whatever incentives are given to the Russians to stop the fighting, some rather punitive forms of sanctions will remain. I imagine that will make it challenging for people to invest, not just technically but also emotionally and philosophically. It's all very hard to tell. The stocks trade for pennies on the dollar in theory. When will we be able to place an order for Russian shares that a counterparty will accept? Currently, no one knows the answer.

Swen Lorenz: Are there themes or companies that are directly related to Russia and where you see opportunities?

Roman Fuzaylov: Where I do see interesting opportunities over time are companies that are on the periphery of Russia, and which have meaningful business in Russia or Ukraine. These have been hit very hard, disproportionally hard in many cases. I think there is going to be an opportunity and a rebound over time. The uncertainty that this represents will eventually fade, and even if their Russian businesses are written off altogether, what remains will still be worth more than what the shares trade for.

E.g., there is a UK-listed airline, Wizz Air Holdings (ISIN JE00BN574F90), which has sold off very sharply on this. Russia and Ukraine represent 5-7% of their business but the shares are off 40%.

Also, there is a retailer in Poland, LPP SA (ISIN PLLPP0000011). The Commonwealth of Independent States (CIS) region was a quarter of their sales and profits, but the shares are down 50%. Coca-Cola Hellenic Bottling Company (ISIN CH0198251305) is another one. Russia is 20% of their sales, but the stock is down 40% since the year began. They may lose the Russia franchise altogether, but there are all these other countries that make up 80% of the business.

There are these sorts of situations where I think the cessation of conflict will eventually allow for these stocks to heal from a capital markets standpoint. Even if their Russian businesses turn out to be worth nothing, at least we will know where we are and what we are working with. For these companies I see an interesting rebound over time. These places that have been hit and which are on the periphery will be the more immediate and interesting opportunities.

Swen Lorenz: Roman, many thanks for allowing me to pick your brain on behalf of my readers. Where can investors learn more about your fund?

Roman Fuzaylov: Our firm primarily deals with institutional investors and family offices but we may accept larger ticket sizes from accredited private investors. If one of your readers wants to contact our office, the email address is [email protected].

War in Ukraine and the economic ramifications

The Russia-Ukraine war poses significant challenges for investors across the world. What are the key issues that you need to be aware of? How can you protect your portfolio (or what's left of it)?

In my hour-long chat with Mikkel Thorup (Expat Money Show), we consider the top investment strategies for the coming year, and spill the beans on our favourite stock picks.

There's a podcast for those who prefer to just listen in, and a video if you'd like to see us in person!

War in Ukraine and the economic ramifications

The Russia-Ukraine war poses significant challenges for investors across the world. What are the key issues that you need to be aware of? How can you protect your portfolio (or what's left of it)?

In my hour-long chat with Mikkel Thorup (Expat Money Show), we consider the top investment strategies for the coming year, and spill the beans on our favourite stock picks.

There's a podcast for those who prefer to just listen in, and a video if you'd like to see us in person!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: