Earlier this year, investors from around the world backed me with GBP 20m of equity to pursue ambitious plans.

A local specialist lender offered to add up to GBP 10m.

We wanted to buy a portfolio of real estate that makes up 20% of the island of Sark, a self-governing jurisdiction in the English Channel.

If the bid had succeeded, we would have gone on to gradually purchase another 10-20% of the island and raise GBP 100m of additional funding to develop the real estate. The large funding round was planned to involve an IPO in London, which would have interested many of my readers.

Sadly, it was not to be – at least, not yet.

We couldn't agree on a price with the current owner, and we have now walked away from the endeavour.

I had previously reported about this project – check here, here, and here.

Many readers wanted to be kept updated, and we wanted to be transparent about the outcome. Today's Weekly Dispatch closes the loop with an exclusive background report.

Sark – self-governing since 1565.

A cathartic but constructive review

Obviously, I would have preferred writing this article featuring a different headline.

Then again, from the very outset, it was always clear that this was an endeavour with a binary outcome.

Either the offer for the real estate portfolio would succeed, or not.

Planning for both scenarios and being mentally prepared for a disappointing outcome was always part of the equation.

Matters may yet come to fruition, but at a later stage.

How did we get here, and what are some of the lessons learned?

This includes lessons and observations for investors, many of whom are interested in the emerging investment theme of the "0.1% refugees". This is a term coined by Harris "Kuppy" Kupperman of Praetorian Capital, the Sark Property Company's anchor investor.

Sergio Leone's 1966 spaghetti Western "The Good, the Bad, and the Ugly" provided the right inspiration for splitting this review into three parts.

The Good

It's difficult to find words to accurately describe what a great bunch of investors, supporters, and service providers came together.

This project had started in the summer of 2021 with a blank sheet of paper, when Sark's 23rd Seigneur, Christopher Beaumont, and I started to put down some ideas. Over the subsequent three years, this had grown into an extraordinary alliance of people who all felt a passion for (and interest in) the island of Sark. They all wanted to see it break from its peculiar stuck situation and realise at least some of its incredible potential.

Source: The Guardian, 16 June 2023.

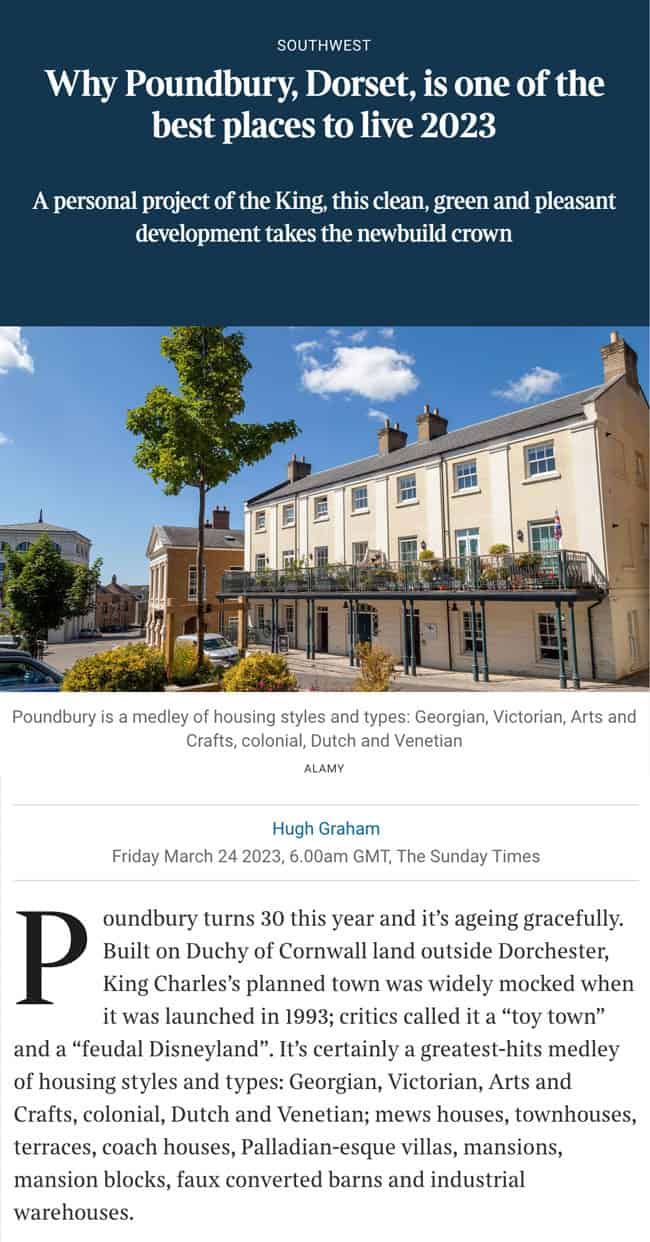

Our team engaged The King's Foundation, created by King Charles III when he was still the Prince of Wales. Over the past 40 years, the organisation has helped dozens of towns in the UK and elsewhere to build community, improve sustainability, and enhance real estate values. Poundbury in Devon, a town that King Charles III is famously associated with, was widely criticised when it was built, but now attracts a significant premium for its real estate because it has become such a desirable place. The King was ahead of the times, and we wanted to secure this know-how to keep what makes Sark special, but also make it an even better place.

Source: The Times, 24 March 2023.

In April 2023, we brought The King's Foundation to Sark to host a first public workshop – funded by us, but entirely for the benefit of the public. A record number of island residents attended. The subsequent working groups created a real sense of optimism and a desire for the foundation to come back. The workshop provided a first glimpse of what Sark could be and what its residents could have, if somehow they managed to combine planning, funding, and broad stakeholder engagement.

Source: Guernsey Press, 26 April 2023 (not available online).

The 120+ investors we assembled – including residents of Sark, Guernsey, Jersey and the UK, as well as people from across the world – were uniquely suited towards helping Sark move on from its difficult past. Many offered to bring more than just money into the fold, such as support with the island's challenges in education, energy, housing, and connectivity. All of our investors happily agreed to the 19.99% voting right limitation that we had put in place, to avoid any one investor dominating the island in quite the way that the family of the late Sir David Barclay had attempted to. We turned down a number of investors who wanted to provide 100% of the funding.

Many other organisations were ready to help either our firm or the government (and people) of Sark:

- The Eden Project offered to share its expertise for turning a tourist destination with an extremely short summer season into more of a year-round destination, as successfully implemented with its visitor site in Cornwall. Besides, the trust operating the Eden Project also has expertise in maximising and protecting biodiversity in the British Isles.

- The Duchy of Cornwall shared with us the valuable insights from creating Nansledan, a Cornish town development aimed at revitalising the area surrounding Newquay, a tourism destination that was once described as "tired, dirty and neglected". Nansledan has a strong emphasis on local architecture and affordable housing, which we would have loved Sark to develop a clear stance on.

- Butterfield Group, Guernsey's leading private bank, was at the ready to create the first-ever mortgage programme for Sark. The Sark Property Company had agreed to provide the capital base for a first-loss guarantee, and to help overcome the other issues that have so far kept other banks from introducing mortgages for Sark since mortgages were legalised in 2020 (following their ban in 1607). We wanted younger residents to be able to get onto the housing ladder, an important step towards solving the island's demographic crisis (the average Sark resident is close to 60 years of age).

- Tipolis, a company that has created a unique, global brain trust of people passionate about innovation in urban living and governance, wanted to help us create services for residents to have greater freedom and choice. We had Titus Gebel – one of the world's leading public intellectuals when it comes to innovation in public governance – on speed dial to advise us, and Titus' team even spent their annual corporate retreat in Sark to familiarise themselves with the reality on the ground and meet residents.

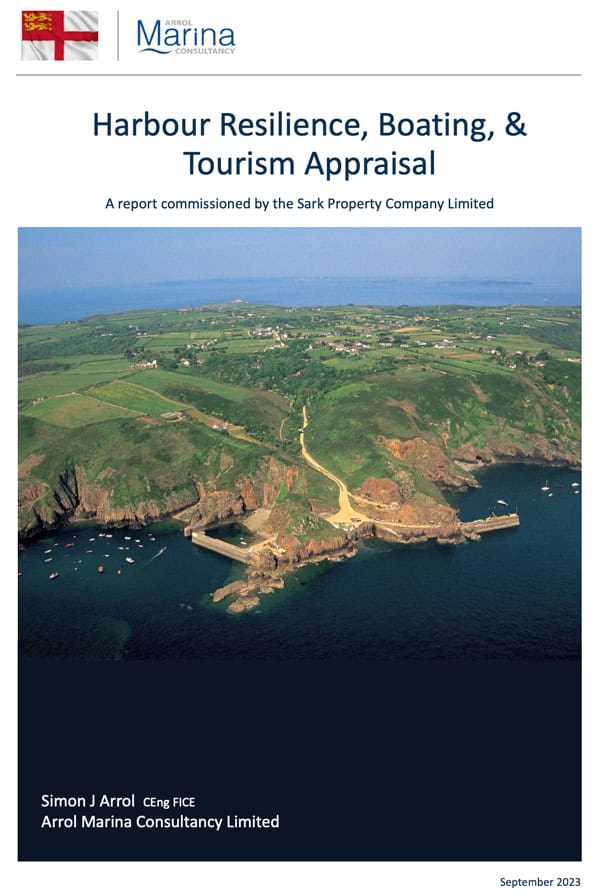

- Arrol Marina Consultancy, one of the world's leading experts for harbours and marinas, helped us to get a clearer idea how it might be possible to improve Sark's harbour with an affordable investment. The harbour is government-owned, but its state affects anyone who lives in Sark or plans to invest in the island.

Source: Sark Property Company, Sark Harbour Resilience Report.

- International Group, a UK-based fourth-generation family business with extensive expertise in private members clubs, offered to help kickstart a private members club in Sark, which could have generated new lines of income and made the island more attractive for a professional, younger clientele. Our company had secured the use of Sark's Seigneurie building as initial headquarter of such a club – think Soho Farmhouse meets Downton Abbey!

Source: Guernsey Press, 6 August 2024.

- Savills Guernsey, Guernsey's #1 real estate agency, advised us on all real estate matters.

- TENN Capital, a local specialist lender for short-term, real estate-backed lending that involves unusual or time-sensitive situations, was our go-to contact for unusual financing needs.

- Several companies providing background checks to private companies and governments offered their services. So far, new Sark residents undergo almost no such checks, making it open to any form of illegal or otherwise undesirable immigration. Our company could have set an example as the first Sark landlord that voluntarily and at its own expense runs professional Know-Your-Customer processes on its tenants, until such a time that the government introduces the overdue measures.

- Many members of the public expressed their appreciation that someone is at least trying to do something about the situation of Sark – the place having been stuck in its current situation for so long.

- Multiple service providers supported my Guernsey-based fund management firm, Sarnia Asset Management, whose fund management license was used to carry out the fundraising. To be as transparent about this entire plan, we opted to structure the funding round in such a way that we had to register and publish a prospectus. The prospectus, which we worked out together with Guernsey's leading law firm, Carey Olsen, got high marks from several of our investors, one of which commented: "I had never before seen a prospectus being so honest and clear about a project than that of the Sark Property Company." We had help from Guernsey's Aspida Group and Beauvoir Group to handle the entire fundraise in a way that befits such a high-profile investment case and future IPO candidate, and to ensure that due diligence was done on every single investor. These efforts were going to be underpinned further by other service providers, such as auditing firm Grant Thornton in Guernsey who we had signed up to audit our future accounts.

Source: Sark Property Company (email for a copy).

Our team of directors was also ace, if I may say so. Sark's Seigneur joined me as second director, followed by the international real estate expert Richard A. Johnson, before we onboarded Harris Kupperman as fourth director.

Never mind the outcome not being the desired one, I can say that I did enjoy every moment of it. This was simply a great bunch of people to work with.

There were a few bad moments, though.

The Bad

Dealing with human beings and proposing something that involves change doesn't only make you friends.

Outright opposition is par for the course when you manage a project of this kind. I had seen much worse when I worked in the Galapagos Islands from 2010-2014. Compared to the challenges I resolved as CEO of the islands' largest private employer, the problems and challenges of Sark seemed a mere triviality.

What does get to you, though, is the sheer tediousness of dealing with professional victim types.

One of my favourite moments was when one island resident came up to me after the public workshop to voice her consternation that (allegedly) she had not been given notice that a public event of such gravity was going to take place. Ahead of the workshop, we had sent out a press release, reached out to all local media, sent emails to all residents that we had an email address of, and used the Sark postal service to deliver a hardcopy flyer to every single household. Never mind postings in Sark-related groups on Facebook and to the relevant people in government. You'd think on an island of 5.45 square kilometres with barely 500 residents, word would spread to everyone.

Instead, you get accused of working in secret.

As the saying goes, no good deed ever goes unpunished.

It's also been upsetting – but also, funny! – to see how some members of government in Sark abuse their power.

Sark's government is commonly referred to under the umbrella term "Chief Pleas", which is the name of its 18-member parliament. Chief Pleas has a speaker, which is a highly visible role and requires a degree of neutrality and professionalism.

When the Financial Times was looking for juicy quotes, the current holder of the office, Paul Armorgie, happily complied:

"'I haven't done my due diligence on Swen other than — well, having worked in hospitality for 40, 50 years there's just, as my mother would have said, there's a nasty smell about him.'"

A high-ranking government official who has NOT done due diligence on a resident but trashes him in global media using the power and credibility of his office – this is the stuff you'd expect in a Banana Republic or an autocracy, not a Western democracy that has stuck to the rule of law for centuries.

Armorgie's gaffe brought a useful lesson, though. It taught me that even in a micro-jurisdiction such as Sark, it's not just raw politics that play a daily role, but possibly even "kompromat" (the famous Russian term for damaging information about a politician that may be used to influence that person).

Sark's current speaker of Chief Pleas seems to have other issues altogether. One of the island's most outspoken users of social media, he followed and liked posts on the sex worker site "OnlyFans" – visible to everyone else.

One Sark resident felt compelled to inform the government office, letting them know that it'd be "best for the image of Sark" if someone advised Armorgie to keep "a separate & anonymous account". The resident worried that "it would be embarrassing if it found its way into the local Telegram channels."

Armorgie's interest in a "40 year old horny married MILF" is probably all the more problematic since he is married and has children on the island.

Did Armorgie really have the reservations against me that he said he had? After all, when he spoke to me in mid-2023 at a public event in Sark where I presented our plans, he told me repeatedly: "All the power to your elbow."

Or is there more (and worse) stuff out there about him, and he is no longer able to be himself? Is he really, as he claims on his Twitter profile, "More muppet than puppet" – or might he be the puppet of interests who hold even more damaging kompromat on him? I can but wonder.

Altogether, I do have to say that along this entire process, the government of Sark as a whole did not rise in my estimation.

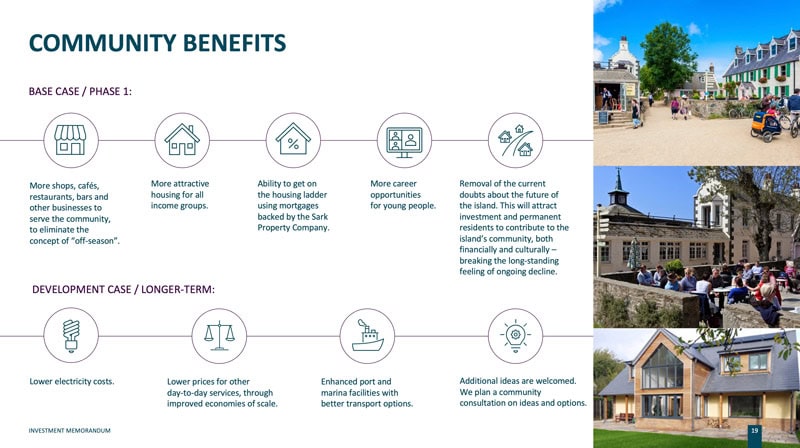

We have tried our best to deliver as many benefits to Sark's existing residents as financially possible and without becoming a burden on the island's treasury. Our widely circulated deck also summarised as much.

Source: Sark Property Company.

The Ugly

I couldn't have pulled all of it together if I had not been deeply passionate about the island *and* convinced of its investment potential.

That said, I just got sparred from a lot of unpleasant work. There were moments when even I was questioning why we were even attempting this.

Much of the portfolio in question is in quite a state. The 40-odd investors who visited me on Sark all saw as much, as I took all of them on a 2.5h walking tour. Our investors knew what they were buying into – warts and all. Even if we had wanted to, on Sark it's impossible to hide anything.

Until the growing interest from the mainstream media, many of the abandoned buildings that form part of this particular property portfolio were left open. Locals and visitors alike often wandered inside, and I often received unsolicited photos.

Not all of the following photos are entirely up to date, and a measure of work has recently been done on some of these buildings. Still, this portfolio is something that requires more than a lick of paint, or a burying of burned plastic waste and metal scrap in the garden. The following photos admittedly are a pick of the worst but were chosen to get a point across.

We based our budget and subsequent offer based around the idea of paying the break-up value of the portfolio and bringing much of the portfolio back into full production within three years. Our budget included GBP 15m of investments into eleven selected properties, with a priority for re-opening hotels and alleviating the housing shortage on the island. We had also planned to use local firms and local employees to the degree possible, and with a particular focus on providing professional career opportunities for younger residents.

Prospective investors and the media often asked me about political risks. From my perspective, the bigger risk all along was the execution risk involved with bringing this portfolio back into full production. All of this initial work could have been done under existing construction legislation. However, anyone managing this would have had to get their hands dirty for years and solve some prickly management problems.

Given the outcome of the first bid, it's not going to be me who has to sort out this mess.

Buying the opposite of sovereign rights – social obligations!

Any owner of this portfolio will have to find a way to deal with a discombobulated set of demands:

- As owner of 20% of Sark, you get zero additional legal rights. The running joke of "buying a country" aside, there really are no special rights coming with a real estate portfolio.

- At the same time, everyone will see the island's largest real estate owner as quasi-responsible for the island's infrastructural needs. That company will be seen as a pinata filled to the brim with goodies, and everyone will hit on it.

Becoming a large land owner in Sark inevitably brings along various social obligations – not necessarily legally, but through social pressure. All the more so on an island that has a decades-long backlog in infrastructural investments, some of which are now ticking time bombs on the government's balance sheet (or, to be more precise, *off* the government's balance sheet).

I have reason to believe that Sark's government is already well aware of the sheer scope of Sark's upcoming financial obligations, which the island will struggle to deal with.

As Chief Pleas' recent 2025 budget document said: "As a low-tax jurisdiction, we have limited means to fund any major or emergency infrastructure projects, for example, La Coupee, energy, sewage or waste disposal."

Sark is allegedly facing at least ≈GBP 20m worth of infrastructure investments, which compares to Sark's annual government budget of GBP 2.2m, and cash reserves of GBP 850,000. Has this been disclosed to the population yet in a way that makes the challenge clear to the voting population and the taxpayer? I don't think it has. Our in-house guess is that Sark has financial needs amounting to GBP 30-50m, and the due date for this backlog of stuff that needs paying for is coming up fast.

Our company had built its investment case around all that. If we hadn't, we wouldn't have received such strong interest from sophisticated investors. It's taken us three years to get such a plan pulled together, and much of it only worked because of the unique global network of the four directors.

This is an issue that other investors will find challenging to get their head around, all the more so given Sark's lack of critical mass. Quirky and interesting as the island is, it doesn’t have the necessary size to easily attract investment. One large building in London, New York or Monaco is worth more than the entirety of Sark, and buildings there don't come with the peculiar set of challenges that Sark has.

These are our views, and not everyone will agree with them.

We are relaxed about watching all this become more apparent over time. As a private company, it's not necessarily a bad thing to take a step back for a while and watch things unfold. It'll be interesting to see if this portfolio attracts any other bidders willing to offer more than we have. We have now heard for years that other interested parties were sniffing around, but none of this alleged interest seems to have led to anything. I doubt any other interest will materialise. This entire process has sadly revealed the true extent of Sark's mess, and how it'll get worse unless something transformative happens. Getting parties to be "interested" is easy in the case of a quirky asset like Sark – but getting a party to put a double-digit million amount of cold, hard cash onto the table is a different matter altogether.

We will also watch with interest if the government succeeds in mobilising the capital needed to keep the lights on in Sark. It had tried in various ways to raise GBP 11m for the island's power production, lastly via a begging letter to the Crown Estate (which got leaked to the Guernsey Press). It's amusing to think that the Crown Estate – which is obliged to send its annual surplus to the UK government for its own stretched budget – would instead consider sending money to an island where residents hardly pay any taxes and couldn't be bothered to build reserves for entirely foreseeable infrastructural needs. The UK media would have a field day tearing into the Crown Estate if this were to happen, whether that money was a loan, a grant, or some other form of investment.

The market will probably get more realistic

"Why didn't you get to a deal?" is a question that our company will be hearing a lot.

We will keep the reply short. The eager buyer did not offer enough to make the current owner a willing seller.

To not jeopardise potential future negotiations, we are not going to disclose more colour.

Why do we believe there could be future negotiations?

Over the next one or two years, the assessment of real estate values on Sark will become more transparent and – as a result – more realistic.

Many visitors to Sark balk at the real estate prices they see advertised in the sole local estate agency (which is owned by the same owner as the large portfolio). In English-speaking countries, people are used to seeing prices advertised by licensed estate agencies as broadly realistic. They don't know that in Sark, it's not quite like that.

As we described in the risk section of our company's prospectus: "Vendors usually start by asking inflated sales prices (often by a multiple), whilst actual transacted prices remain unpublished. There may be collusion with 'fake bidders'. An outsider will find it nearly impossible to get a real understanding of this market."

We believe there'll soon be a new trend in Sark, that of properties being sold via auctions – sometimes voluntary, and at other times forced.

The first such case (ever) is currently getting ready. The property known as "Rosebud" was originally advertised by Sark Estate Agents for GBP 1.2m. The asking price has already been reduced to GBP 850,000 "or nearest offer". Its sale is now being forced by creditors of the owner, using legislation that only came into effect in Sark in 2020. My personal estimate for this derelict property is that it'll sell for around GBP 400,000. Seeing the auction price disclosed will make for an interesting data point. If I am right, the difference between the initial asking price and the eventual sale taking place is 3x.

Sark does not have any publicly available real estate price statistics; the estate agency has never published a price guide. Our company may be the only stakeholder to have done a systematic attempt at valuing property prices in Sark, supported by a major estate agency from neighbouring Guernsey.

When we tried to find an estate agency or surveyor in the Channel Islands willing to provide a professional valuation of Sark real estate, seven of the eight firms we enquired with turned us down. Only Savills Guernsey was willing to work with us, but only on the basis of using their extensive market knowledge to give our valuation work a sense check. Their subsequent assessment of our valuation model broadly confirmed our work, with the sole exception of our valuation for Sark hotels, which they deemed too high based on the relatively large number of comparative transactions in Guernsey and Alderney.

The real estate market in Sark is currently in a peculiar phase. Despite the global publicity that the island has experienced of late and the massive influx of the rich into tax-friendly jurisdictions, prices haven't really moved in any significant way, and there is a notable dearth of transactions.

As Chief Pleas put it in its 2025 budget document:

"The property market has stagnated and 2024 has seen minimal transactions. … 2024 PTT (Property Transfer Tax) income is on course to be the lowest for more than 10 years."

Property boom, much?

Not quite.

While comparable jurisdictions are reporting roaring demand for purchases and rising prices, Sark really only sees increasing demand for rentals.

As a company, we believe Sark will only leave its current downward trajectory once the island's key stakeholders get serious – and honest – about the scope of the problems and the funding requirements to resolve them.

2025 should bring plenty of news in that regard. I fear that much of it won't be to the liking of resident taxpayers and existing real estate owners. But it might just be what's needed for the island to eventually get on a better course.

Markets can only engage in fantasy for so long. Reality always wins in the long run. In the case of Sark, the underlying numbers tell such a clear story that it's likely only a matter of time before real estate owners stop engaging in magical thinking.

I'll be watching it all from a safe distance.

Foreseeing all these issues, when I moved to Sark in 2017 I decided to only rent. The island didn't strike me as the kind of place where I'd tie a millstone property around my neck. For as long as there isn't SOMEONE who gets the island unstuck from its current situation, I wouldn't invest a single pence into the island. It's a great place to base yourself in between travelling – and I'll continue to do so. But it's not a place to really commit yourself to, over and above a tenancy's notice period.

People used to find my strategy to only rent odd, but a few have recently stepped forward to tell me they recognise why I did that. Maybe the public has now caught on to the fact that in its current set-up, Sark has too high a risk of becoming a stranded asset altogether. There is probably a reason why the real estate market has ground to a halt for sales, even though the macro-environment for Sark is better than it has been for probably a generation.

Where do we go from here?

The Sark Property Company isn't going to go away.

We decided to give it two years, after which we will revisit the situation.

Of course, we could get back into the swing of things earlier than that. E.g., if the entire real estate portfolio came up for auction, we'd look at it with interest. Over the past three years, we have done 99% of the work necessary to prepare our involvement.

Like everyone else, we are avid followers of the press to find insights about the circumstances of the family whose name is so widely associated with the portfolio in question and Sark in general. As The Telegraph reported on 23 May 2024, "The Barclay family have been forced to put their online retailer Very Group up for sale in a bid to tackle its mounting debts. .... A sale of Very would leave the Barclays with little of what was once a sprawling business empire."

As Sky News reported on 7 October 2024, "Very Group owners pick banks to spearhead £2.5bn sale … Retail industry insiders speculated the business was likely to be valued in the region of £2.5bn."

In the case of Very Group, there seems to have been a reality check on a potential sales price, and a type of auction beckons presumably because of pressure from exasperated creditors. The figure now reported would be a far cry from the GBP 4bn that the Barclay family had hoped to achieve in an IPO in 2021. In fact, The Telegraph also reported: "The family has previously tried to sell Very on at least two separate occasions but both times prospective investors failed to meet their price expectations."

Who knows if the media are getting this right? However, there seems to be a bit of a theme, and it all comes in the context of the Sunday Times having dropped the Barclay family from its rich list.

Separate but related to that, Private Eye reported on 12 October 2024 that "last month, another bank (BNP Paribas Suisse), joined" the personal bankruptcy petition against Alistair Barclay. This can be verified by checking the publicly filed case information.

We only read the papers, and it's not up to us to speculate about the veracity of these reports.

However, given these reports, it could just be a matter of time for things to unwind. Who knows, maybe the assets on Sark will all be put up for auction eventually? After all, Knight Frank in London had already been offering them around the globe, although seemingly without result. One potential local bidder went as far as saying they "could not make any sense" of the data provided about the portfolio.

Our firm has also made a few mistakes along the way. There are some aspects that we would do differently:

- Blind pool of capital: we managed to mobilise all this capital as a blind pool. We didn't have a firm agreement for the sale yet, and we weren't sure of the ultimate price demand. Frankly, it's a bit of a miracle we got funding together. If we ever raised funds for this again, we'd only do so against a clear offer for sale or if a clear process was in place for an auction.

- Government support: if we were ever to raise capital for the island again, we would only do so against a signed letter of support from the majority of Chief Pleas members. Without such support and feedback, we'd walk away entirely, but not without letting the people of Sark know – since they often seem only partially informed about what's going on at Chief Pleas.

- Time generosity: a venture of this type was always going to face criticism about "you are doing this just for the money". To avoid the issue and build up some social capital, the key people behind this company were very generous with their time. None of the four directors received any pay for their work leading up to the offer. I had committed to work as CEO for a reduced salary of GBP 25,000 per year for the first two years. In any potential rerun, all of this would see a reset.

That all said, the investment case remains. In the era of the 0.1% refugee crisis, a self-governing island like Sark has unique potential.

We might get creative for a potential round 2:

- Outright listing: it's possible that we'd secure a publicly listed shell ahead of making a second bid, which would mean the resulting company would be publicly listed from day one. This would also put Undervalued-Shares.com readers at an advantage, because they will be well familiar with the story and can judge whether this is for them. Watch this space!

- Special rights for first-time backers: I promised everyone who backed us the first time around to give them – if legals permit – a preferential right of first refusal for subscriptions in a second funding round. Our current set of investors suffered not a single penny of losses from backing us, which we ensured so that we could approach them again for a second attempt. Being able to be first in line may have financial value in its own right if it's all done under different circumstances. We will remember who backed us this time, and if we can, we will repay the favour in the future. Our first-round backers are the heroes of this story, because without their capital backing, none of this would have gone anywhere.

- More ambitious plans and higher returns: if we return to this, we will revisit a couple of key aspects. My goal will be to offer our backers a higher return, and possibly on a more attractive mix of assets. Our ambition will definitely be to offer less (for the real estate), and demand more (in terms of collaboration by the government). In our view, the cost of capital for Sark is going to go up over the coming years. Provided I get properly compensated for the time I put into this work, I might still be convinced to put on my rubber gloves and sort this mess out.

What won't change is: all of this makes for a unique, interesting case to work on.

Other angles to play this theme

In the meantime, though, it's worth keeping an eye on other potential investments pertaining to the theme of the 0.1% refugees:

- Undervalued-Shares.com Lifetime Members had access to a London-listed liquidation play that offers very attractive exposure to the booming real estate market of Cyprus. This report is as interesting to read today, as it was when I first published it.

- Florida is another jurisdiction of choice for the 0.1%. My Weekly Dispatches are a free service, and one recent edition featured a stock that allows you to buy into undervalued real estate in Florida.

- The most famous jurisdiction for the 0.1% is, of course, Monaco. Undervalued-Shares.com has repeatedly reported about the Paris-listed stock that gets you a slice of Monte-Carlo at a bargain valuation, both in the free Weekly Dispatches and in the report published for Annual Members.

If the term 0.1% refugee still doesn't tell you much, check back to my article "The 0.1% refugee crisis – how to go long high-net-worth migration".

In any case, watch this space for more. This entire trend is only just beginning, and Sark may yet end up featuring in it.

Unknown dividend pearls with up to 15% returns (German-language video)

Austrian bank Raiffeisen Bank International is one of the leading banks in Central and Eastern Europe. It also runs a highly profitable operation in Russia, where it has accumulated reserves in the millions.

How might the stock be affected by the situation with Russia going forward, and what's in it for investors?

This talk with Anton Gneupel of D wie Dividende and fellow investor Norbert Schmidt explores the different scenarios.

Unknown dividend pearls with up to 15% returns (German-language video)

Austrian bank Raiffeisen Bank International is one of the leading banks in Central and Eastern Europe. It also runs a highly profitable operation in Russia, where it has accumulated reserves in the millions.

How might the stock be affected by the situation with Russia going forward, and what's in it for investors?

This talk with Anton Gneupel of D wie Dividende and fellow investor Norbert Schmidt explores the different scenarios.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: