Just as I was about to finalise my 76-page research report about the Société des Bains de Mer et du Cercle des Etrangers à Monaco S.A. (SBM), America's CBS came out with a great 13-minute video about the Principality.

I have been there often enough, it's a somewhat superficial TV report, and it repeats so many of the old stereotypes about the world's second smallest independent nation. "A shady place for sunny people" and all that.

Still, the CBS report is a joy to watch for anyone with a vague interest in Monaco, featuring great imagery from a top-floor apartment and some drone shots.

If you, too, are interested in the Principality and how to invest in it, you've now got two choices:

- You can watch the CBS video and whet your appetite for purchasing an apartment in Monaco. Prices start at EUR 1.5m for a shoe box and quality residential property will usually set you back between EUR 75,000 and EUR 100,000 per square metre (300% higher than New York).

Anderson Cooper takes you on an enjoyable video tour of Monaco (no registration or subscription required)

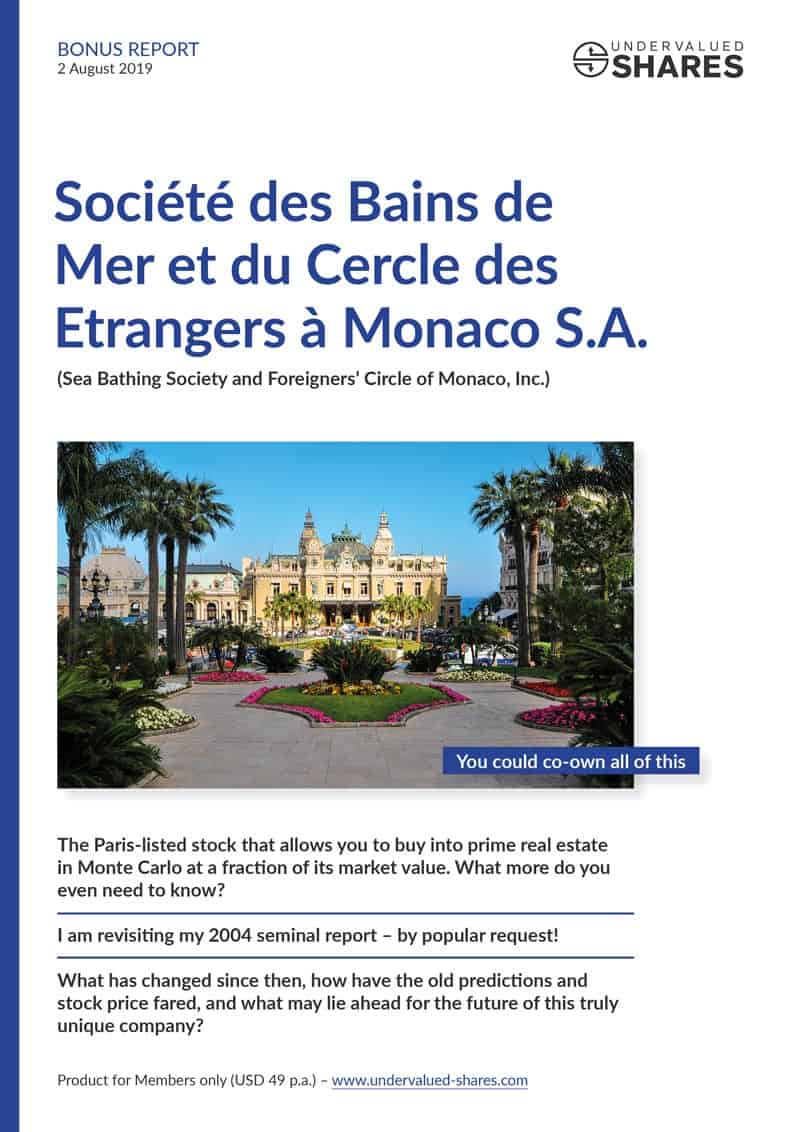

- Alternatively, you can consider investing in SBM shares. The Euronext/Paris-listed company owns a huge portfolio of prime real estate across the Principality (including Hôtel de Paris, the Café de Paris, and the uber-luxurious One Monte Carlo residential development); it's a quasi real estate fund. What's more, its stock is trading at an unusually large discount to the value of its underlying assets.

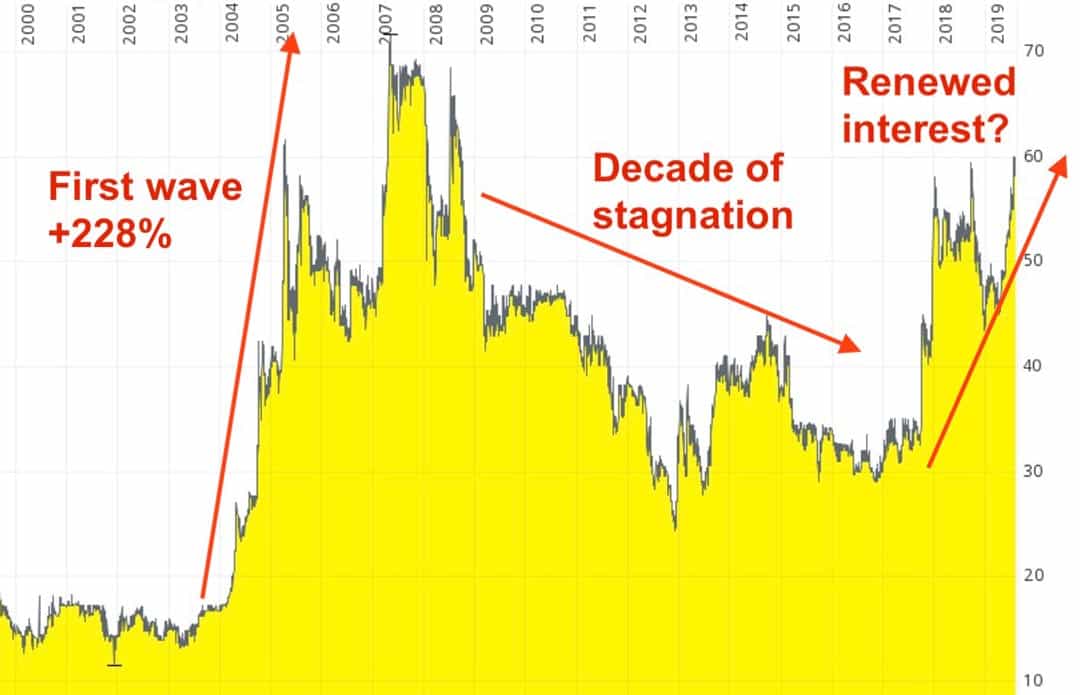

All of which is spelled out in a lot more detail in my latest research report, a sequel to my seminal 2004 analysis of SBM. Back then, SBM was trading at the value of its cash reserves and the entire debt-free real estate was effectively for free. The share first shot up 228%, but then stagnated again for a decade.

Recently, SBM shares once again gathered steam. Is it time to buy again?

SBM shares have recently seen heavy buying.

Is this the world's most glamourous publicly listed company?

Despite owning some of the world's most widely recognised real estate, there is still not a single analyst covering SBM. My report is – to the best of my knowledge – the single most in-depth piece of research about this company (although there is some great commentary in a German investment chat board!).

There is plenty of news to report, for example:

- SBM has just finished building the One Monte Carlo residential neighbourhood. Apartment rents are among the highest anywhere in the world, and SBM has already started to receive rapidly rising rental income. If apartments were sold, they would easily fetch EUR 100,000 per square metre. This is AAA+ real estate if ever there was any. Could SBM even plan another redevelopment along the lines of One Monte Carlo?

- Following five years of record investments totalling EUR 670m, SBM seems likely to achieve record cash flow from 2020 onwards. Though, what are the odds of some of these funds reaching shareholders through dividend payments? Are the revised cash flow projections the reason for the recent heavy buying of SBM shares?

- Bernard Arnault, Europe's richest man, now controls a 5% stake in SBM through his holding, LVMH. Why did the ruling family invite his company to become a shareholder, and what could it mean for the company's future course?

So many questions!

Swen Lorenz takes a closer look at the investment potential of SBM.

One of Europe's most mysterious (and fascinating) companies

I am not revealing which conclusion I drew in my report. This is reserved for Members of my website.

The report a particularly fun piece that'll have you learn a lot about Monaco, too. Come to think of it, it's a bit like buying a country by simply ordering shares through your broker or bank. You'll be able to say that you own a piece of Monaco!

If you'd like to read it, become a Member now and get access to all my past research reports as well as the 10 reports that will be coming up over the next 12 months. It's $49 a year, which is about 10-20 times less than what comparable investment websites would charge you.

P.S.: I've been a busy bee over those last few weeks so there'll be another extensive report following hot on the heels of the SBM report. Due out before mid-August.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get ahead of the crowd with my investment ideas!

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Archive with all past research reports

- Updates on previous research reports

- 2 special publications per year