Wildfires are raging near Los Angeles, which has brought California's perpetual drought back into the news – again.

America's third-largest state has long struggled with its lack of sufficient water resources. California has the largest population of any state, but no reliable rain season. Its current population of 39m is projected to grow to 50m by 2049, and due to the benign climate, there is also a large agricultural sector to be taken care of. All of this does not make for a good combination.

Though it could be good news for some, because anyone with rights to water resources in California is potentially sitting on the proverbial gold mine.

That's why I enjoyed reading up on a family-controlled but publicly traded company that holds private property rights to 1% of the entire water that is produced in California each year. These legally confirmed rights date back to the 1920s when a well-connected wheeler-dealer farming entrepreneur struck a deal with the government. Today's management of the company steadfastly refuses to share detailed information with the public, which has made its stock a regular plaything of speculators.

Welcome to the world of the J.G. Boswell Company (OTC:BWEL), one of the quirkiest American enterprises you could possibly be a shareholder of.

Rumours about this company's precious water rights keep popping up in the media.

Knowledge of history is vital to assess this investment

Lieutenant Colonel James Griffin Boswell I managed to amass what remains one of the largest private properties in the world.

At a time when parts of California were still sparsely populated frontier country, Boswell engaged in all sorts of schemes and manoeuvres aimed at getting control of land. This was an era not too long after California had been taken over from Mexico. The outgoing Mexicans had given land rights for a staggering 9m acres to just 516 people – a nice farewell gift mostly driven by bribes. Once in place, the US-American administration had to work double-hard to check which of these land rights were legitimate. The decades-long process led to a few Land Barons emerging with more land than almost anyone had ever owned in history.

One of the eventual winners of this lengthy process was the Boswell farming empire, which eventually encompassed a staggering 150,000 acres (60,700 hectares or 607 square kilometres). That's ten times the size of Manhattan.

Boswell had imagination and perseverance. Whereas other parts of California were the proverbial land of milk and honey, he chose to focus on the Lake Tulare region in San Joaquin Valley. This part of the state was seen as cursed land consisting of mosquito-infested swamps and salt grass desert. An 1851 travelogue had called the area a "death field".

However, it also sat atop a giant watershed and had no less than 16 rivers that carried the snowmelt from the nearby mountains. The valley's flatness and length, combined with its scorching-hot summers, made it ideal for growing cotton, nuts, peaches, tomatoes and onions. Provided, of course, you had access to water.

An almond tree plantation in San Joaquin Valley.

Nothing will grow here if it's not artificially watered.

Snowmelt from the nearby mountains is crucial for agriculture in this part of California.

The Colonel's efforts to not just secure but then also defend his water rights are legend. His political lobbying included the ousting of one Congressman who stood in his way, and he successfully lobbied the country's Secretary of the Interior to dismantle an 86-year old law that endangered his water rights.

As a result of these various efforts, Boswell and his heirs got to own one of the most extensive farming operations of the United States. To this day, the family company ranks among the country's top 100 overall landowners. The farming operation is one of the country's top 10 in terms of output.

You can participate in the family's ventures by buying stock in the J.G. Boswell Company. The shares of the company are traded on an OTC segment of the US stock exchange. However, only 990,000 shares are outstanding in total, and the family controls most of them. Shares do change hands occasionally, but the average trading volume is just a few dozen shares per day. On some days, no trade takes place at all.

Still, with a market capitalisation above USD 600m, this is anything but a small company.

What's more, the potential value of its assets could amount to several times the current stock price. One of the reasons why Boswell shares have a cult following are the complex but potentially extremely valuable water rights. Some say that in California's new era of ever-worsening water shortage, these are potentially worth billions of dollars.

Water rights are a little-known feature of the Californian property market

As Wikipedia puts it, California has "the world's largest, most productive, and most controversial water system". It's also the most complex, as you can easily see on this page that tries to summarise the entire system.

Who would have known what an "acre-feet" refers to? It's a metric used for measuring water rights. One acre-foot is equivalent to 325,853 US gallons or 1,233 cubic metres.

Of California's existing water production system of 40m acre-feet per year, 400,000 acre-feet (or 1%) belong to the J.G. Boswell Company. The family controls enough water to supply 800,000 households throughout the entire year.

To the degree I could ascertain, the company currently uses virtually its entire annual water allowance to operate its farm. However, in theory, at least, the company could also sell the water. In a state where water is a precious commodity, might this be a more worthwhile commercial use than to try and make money planting tomatoes? If so, what would it mean for shareholders?

Up to now, it's hard to say because the company refuses to make much information public.

Even though it is a publicly listed company for all intents and purposes, J.G. Boswell doesn't even have a website. If you want a copy of its annual report, you'll have to prove that you are a shareholder through a copy of your brokerage account statement. More amazingly still, you cannot get back copies for years when you weren't yet a shareholder. Last but not least, the company makes it clear that it does not want anyone to publicly share the annual report. Doing so will get you blocked from receiving any future copies.

Though all of this is an improvement compared to the time when journalists had to make ten phone calls to get one call back from a company official – who then only ever muttered two words: "No comment."

What's the chronic secret-mongering about, and could this actually be a sign that the share is all the more worthwhile to analyse?

One century of successfully accumulating assets

Since its founding in 1921, the J.G. Boswell Company has accumulated assets worth over two billion dollars even if you leave aside the question of the water rights.

Among its possessions are:

- Not just the 150,000 acres of farmland in San Joaquin Valley, but also 59,000 acres of cattle grazing land in the Sierra Nevada.

- Processing plants and other equipment worth several hundred million dollars (parts of which can be seen on the Boswell Tomatoes website).

- A 46% stake in a cottonseed company called Phytogen, whose other major shareholder is Dow Dupont.

- 96,000 acres of agricultural land in Australia with an accompanying cotton production.

For most of these assets, it's not all that difficult to establish an estimated market value. There is an active market for buying and selling farmland, which allows to value farmland based on the average prices paid per acre in comparable regions of the US.

If you add it all up, the company is sitting on assets that are worth probably north of USD 2bn. The rough split is 60% US-American agricultural operation, 30% Australian agricultural operation, and 10% cottonseed company stake. Its liabilities amount to only about USD 130m, though it would have to pay capital gains taxes if it ever sold some of its assets since they are carried at a lower book value. If the company were liquidated, shareholders would likely receive around USD 1,800 per share purely based on the existing assets, not counting any value for the water rights. That's nearly three times the current share price of USD 650.

By the standards of most value investors, J.G. Boswell shares count as an undervalued stock.

Though the real sex factor could lie in the water rights. Provided, of course, they are worth anywhere near as much as some speculators and pundits make them out to be.

One of the media outlets that once provided fuel for Boswell speculation was Britain's MoneyWeek magazine. A November 2007 article speculated that Boswell's water rights could be worth USD 4bn to USD 20bn – yep, you read that correctly! By the time the article came out, the share had already appreciated from USD 300 to USD 800. Following the MoneyWeek article, it shot up further and reached a new record of USD 1,100. This was the first time the Boswell stock experienced a public hype.

At the end of the following year, it was back down at USD 400. Not only had the estimate probably been wildly inflated, but the market also realised that J.G. Boswell stock was – at least back then – a typical value trap.

Boswell shares experience regular run-ups.

It's beyond doubt that the company owns assets that are worth way more than its current market capitalisation. The problem is, the Boswell family isn't interested in seeing the stock price rise or have anyone else participate in their accumulated fortune.

Though once again, the question of whether this could ever change has recently led to renewed speculation. Boswell shares have seen lively trading in recent months, and the share price has been on the up.

What is it this time?

An Australian land sale has brought the stock back into focus

In July 2019, the company announced that it was inviting bids for parts of its farming operations in Australia. Estimating the likely sales proceeds of a farm in drought-stricken Australia was a tricky affair, but it didn't take much to come up with estimates in the triple-digit millions. Compared to its current market capitalisation, a very significant cash windfall could come the company's way. Had the Boswell family decided to liquidate some of their assets after all?

The small community of Boswell shareholders immediately latched back onto the question of water rights. What would these be worth if ever sold separately, and were shareholders now potentially going to see such a sale?

Water rights in California reportedly have a value of USD 20,000 to USD 30,000 per acre-foot when sold, up from about USD 10,000 at the turn of the century. Based on these figures, the water rights would now indeed be worth USD 8bn to USD 12bn.

However, a closer examination of the circumstances concludes that such estimates are overstating the value of the Boswell water rights. For a start, J.G. Boswell's water rights aren't anywhere near large urban areas which makes them less useful. Also, the company simply needs most of its water for its farming operation. After all, if this wasn't the case, it should have long started to sell some of its annual water allowances. Take away the water, and its land in San Joaquin Valley turns to dust (literally) and several hundred million dollars of equipment need to be mothballed, sold or scrapped. You win the water rights value, but you lose the land's value and much of the equipment. You can't have one without giving up the other, at least so far.

I like an ambitious scenario, but sometimes one simply has to be realistic about what's achievable.

Though there could still be mileage to the Boswell speculation, and here is why.

Will changing family dynamics provide the value catalyst?

A long-standing statistic shows that most family fortunes start to dissipate within three generations.

The equivalent German saying goes something like this (loosely translated by yours truly):

"The first generation builds it up.

The second generation keeps it together.

The third generation knocks it over with its arse."

Nothing is known publicly about the family dynamics of the Boswell heirs. Following the death of James Griffin Boswell II in 2009, the family operation is now owned by that cursed third generation. Even the most unified, coherently-managed families eventually end up with individual members drifting off in different directions.

It's not at all unreasonable to speculate that one day, some of the Boswell family members will want to see the family fortune managed in a different way. In which case, there could be a whole number of different options for the family to pursue:

- Spin-off some or all of the agricultural land into a publicly listed Real Estate Investment Trust (REIT), which then rents out the land. The rental income would make for an interesting income stream and provide reliable dividends.

- Sell those assets that are not vital for the historic farm operation, and distribute the proceeds as a special dividend. E.g., does the J.G. Boswell Company really need to own a minority stake in a cottonseed company?

- Sell the entire company and call it quits. Get a few private bankers to manage the proceeds for the various family members and live happily ever after.

Plus, there are all sorts of other challenges and opportunities.

Who is not to say that California will eventually utilise new forms of energy to produce cheap, abundant desalinated water? Israel has become an interesting case study for such a strategy. The country used to be devoid of water, but is now a net water exporter in the region, thanks to innovations in desalination technology and an abundant local gas supply. Maybe Boswell should sell the water rights before changing technologies make its value plummet?

Could "farmtech" help make the existing farming operation less water-intense, and free up some of the existing water supply to be sold off every year? Even if J.G. Boswell sold just 10% of its water every year, the company could reap significant extra income.

Would the Boswell family ever try to buy up as many shares as it can, before launching a bid to take the company private? After all, they really don't seem to like the idea of being a publicly listed company.

These are pertinent questions, which even the late James Griffin Boswell II asked himself. An 11 April 2000 article by the Wall Street Journal summarised the reasoning of the second-generation heir:

"Mr. Boswell says it's clear that, at times, a farmer could make more money selling a water option than growing a crop. 'I want an alternative to cotton at 50 cents a pound when it costs 80 cents a pound to grow it,' he says."

Much as there are no indications of far-reaching change at the J.G. Boswell Company right now, someday, something could indeed change dramatically. Since the Wall Street Journal article appeared, the balance between the profitability of the agricultural operation and the potential value of the water rights has shifted further to the favour of the latter. At what time does it all get too tempting for the third generation and their fourth-generation offspring to liquidate the empire? I have no answer, but also no doubt that some market participants will continue to wonder about this question. The Boswell speculation isn't going to go away.

A public company that comes with an interesting biography

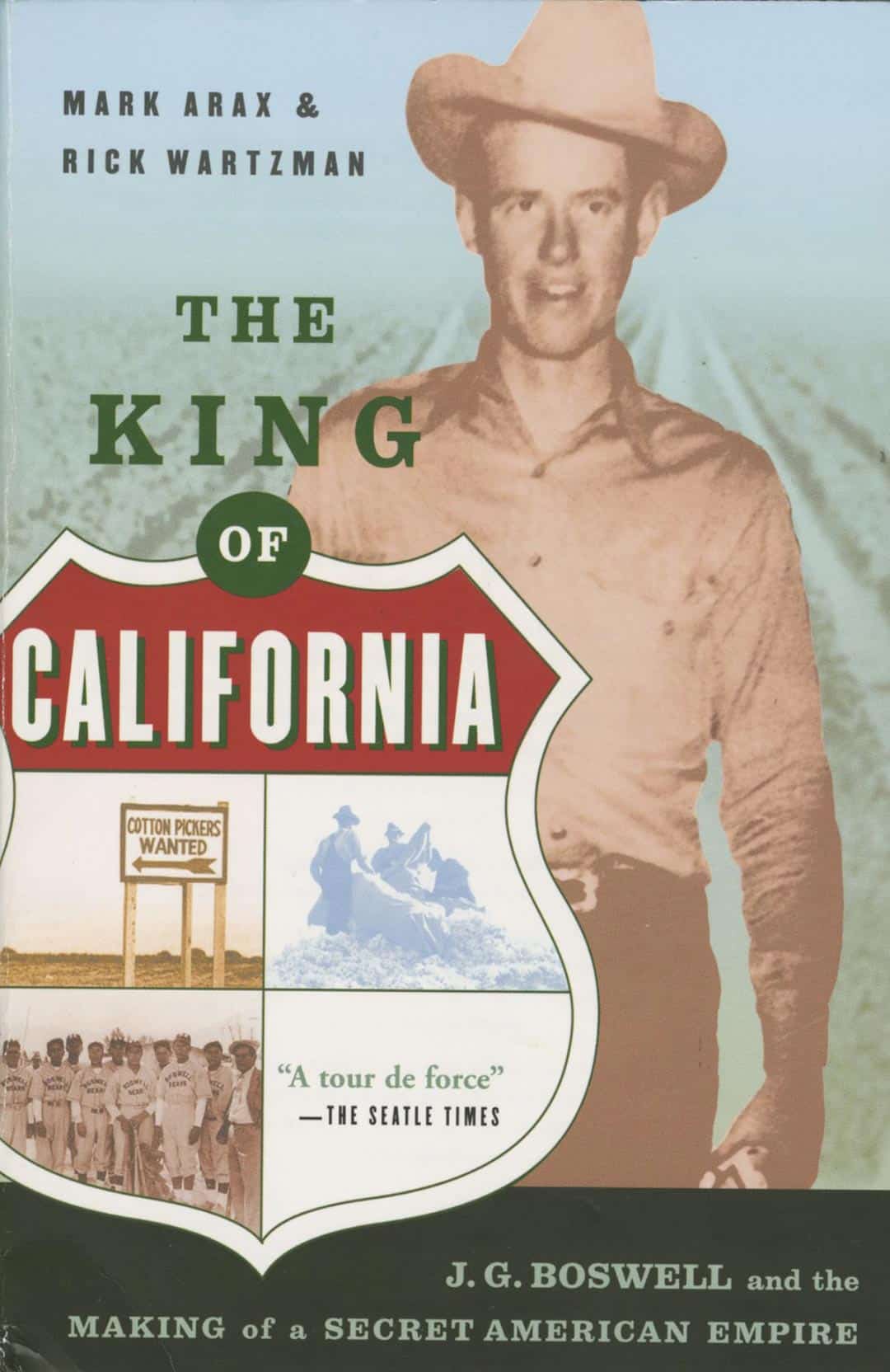

I learned a lot about the J.G. Boswell Company during a 23h train ride from Seattle to San Francisco. After long keeping a copy of "Boswell – The King of California" on my bookshelf, I finally found the right occasion to read through the 550-page tome. Occasionally glancing at the vast expanses of Washington State, Oregon, and California, I made my time aboard the "Coastal Starlight" panorama train even more enjoyable by reading the part authorised, part un-authorised biography of the company's founder.

The late James Griffin Boswell I did eventually open up (somewhat) to a journalist, leading to this 2003 book.

Secrecy was indeed built into the company's DNA right from the start. As J.G. Boswell himself put it: "For as long as the whale doesn't surface, it doesn't get harpooned."

Reading about the family's management of the company and seeing how it has kept it virtually debt-free, I couldn't help but think that these are people you could safely stash money with. If you wanted to own tangible assets in California and have someone else take care of them, you could probably do worse than buying a few J.G. Boswell stock and tucking them away in the far-end of your stock portfolio.

Will you ever get to see the much-higher value of the underlying assets realised? There is no way of knowing.

Is such a scenario possible? It sure is, and its likelihood probably increases with each year that passes simply because of the almost inevitable family dynamics. Once it happens, the share price is probably going to multiply overnight, and you won't even get a chance to buy in at a fraction of the underlying assets' value. The company does have a lot of options available to itself, given that it already has access to capital markets.

What's the worst-case scenario for such an investment? It's for you to buy into Boswell stock just when one of the regular hypes is taking place. In 2007, 2011 and 2014, respectively, rampant speculation drove up the share price. It then lost much of its value during the subsequent cooling-off period. You'd want to buy only at times when absolutely no one is giving the company any attention.

The stock has also seen extended periods of nothing happening at all, such as the 2015 to 2019 sideways movement.

Boswell shares could remain a value trap for decades to come, or they could turn into a stellar performer overnight. I wonder if even the Boswell heirs know for sure what their future intentions are? Though to follow the family's course from the perspective of being a co-owner is probably a lot of fun in itself – and you'll even get that secret annual report!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get ahead of the crowd with my investment ideas!

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Archive with all past research reports

- Updates on previous research reports

- 2 special publications per year