"Time to 'short' coronavirus vaccines?", I asked in January 2022.

I had to choose my words carefully.

This was a time when heretic thoughts could get you cancelled, but my article proved spot-on.

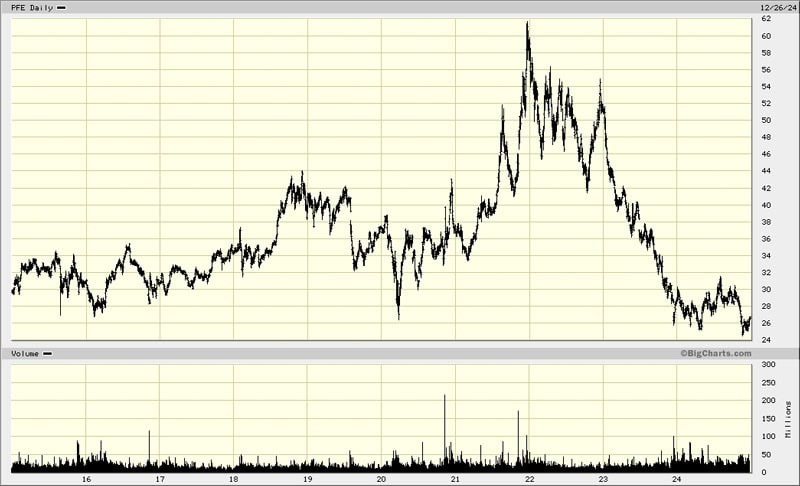

Pfizer is since down 51%, BioNTech has lost 24%, and Moderna has shed 77%.

What's more, we will soon have Robert F. Kennedy jr. involved in US healthcare governance.

Will "RFK" launch legal action that will get Pfizer down to zero?

Or could this be the moment to make a contrarian bet on these stocks?

Pfizer.

A complex but interesting subject

Seriously, who can even be bothered to revisit the pandemic?

And if you do, there are SO many issues when it comes to writing about it – starting with "which data to rely on?" I never believed figures about the share of the vaccinated population. The majority of people I know found a way around, i.e. they didn't get vaccinated but nevertheless had paperwork to travel and even showed up in digital registries. My sample group will have a bias, but seriously – what percentage of the population would nowadays still trust what government and large pharma companies claim? An entire industry had sprung up to help vaccine sceptics live by the feminist slogan "My body, my choice". Official statistics will not have captured just how big this was at the time.

Vaccine sceptics communicated through funny memes.

As I wrote back in January 2022, I fully expected that politics would eventually make this issue get back on the agenda. My timing was too early – as it often is! I expected that the 2022 midterm elections in the US or Boris Johnson's political struggle for survival in the UK were going to deliver a change in vaccine narrative and public debate. Instead, we are now seeing this as an outcome of the 2024 US presidential election.

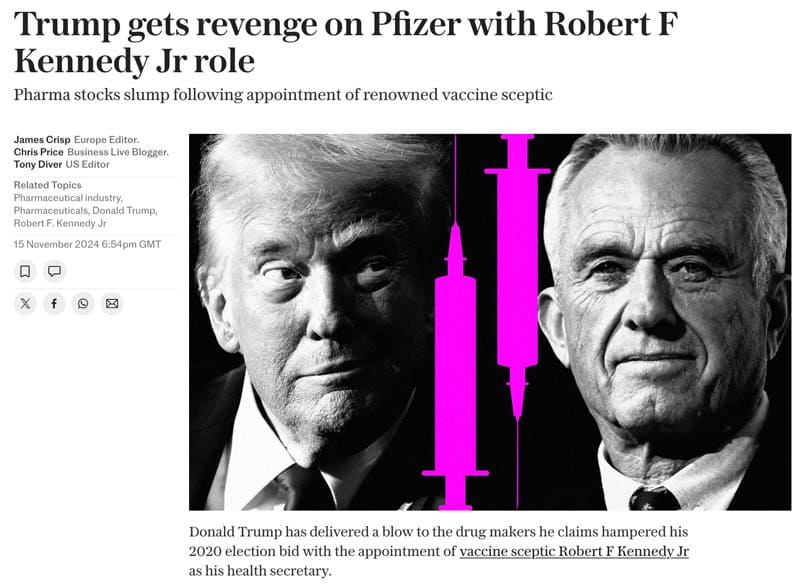

With Robert F. Kennedy jr. ("RFK"), the US now has an outspoken vaccine sceptic as presumptive nominee for United States Secretary of Health and Human Services. He will get to work once president-elect Donald Trump is sworn in on 20 January 2025.

RFK's diverse career included taking on large American corporations for cases of environmental destruction and damages to peoples' health. He authored the 2021 book "The Real Anthony Fauci: Bill Gates, Big Pharma, and the Global War on Democracy and Public Health".

It's no wonder that the stocks of well-known vaccine makers dropped following Trump's election.

Source: The Telegraph, 15 November 2024.

Will RFK use the influence of his office to take these vaccine companies to task, and could that lead to their share prices dropping to zero?

Compared to their pandemic-era highs, the stocks of Pfizer, BioNTech and Moderna have already lost 58%, 69% and 92%, respectively. From that perspective, it wouldn't take much more to wipe them out altogether.

On the other hand, other pandemic-era darlings were written off for good but then unexpectedly roared back to life – such as exercise equipment maker Peloton Interactive (ISIN US70614W1009, Nasdaq:PTON) which had lost 98% of its value. Over the past few months, it has tripled in value after Greenlight Capital's David Einhorn tipped it as a turnaround.

Peloton Interactive.

Pfizer, BioNtech, and Moderna – is now the time to buy?

The vaccine triumvirate

Before considering RFK's potential actions, it's worth noting how different the three COVID-19 vaccine makers are from each other.

Pfizer (ISIN US7170811035, NYSE:PFE) is a USD 150bn market cap pharma giant even after the end of the pandemic boom and the share price fall to its current level. The company's 2024 group revenue of USD 62bn will be well below the USD 81bn and USD 101bn achieved in 2021 and 2022, respectively – but it will still be higher than the pre-pandemic revenue of USD 52bn. Even though today's Pfizer is bigger than the pre-pandemic Pfizer, the stock trades significantly lower than its pre-pandemic level of USD 35-45. The 175-year-old group generates its revenue across a swathe of products in immunology, oncology, cardiology, endocrinology, and neurology. It's currently the 59th largest company in the Fortune 500.

Pfizer.

In comparison, Moderna (ISIN US60770K1079, Nasdaq:MRNA) is a youngster, having been around since 2010. As its name and ticker symbol suggests, the company was specifically geared to work on vaccines involving so-called messenger RNA, or mRNA. mRNA uses a single strand of the genetic material of the virus to teach the body to create a protein that can attack it. This promised to be a much faster route to developing a vaccine than the old-fashioned way of spending years on creating a protein to attack a virus. The company's stated goal was to develop an mRNA vaccine with the capability to suppress a global pandemic within 60 days. With its much narrower focus and smaller existing revenue base, Moderna stock rose by 21x from USD 20 to USD 440. It's now back at USD 40. For Moderna, the pandemic was the first opportunity to prove that its mRNA-based vaccines offer value. Now that COVID-19 vaccines are no longer in great demand, the company will have to show that it can provide solutions for other diseases. Helpfully, Moderna finished the pandemic with a cash hoard of USD 10bn. This has since shrunk to just above USD 5bn, which compares to a current market cap of USD 15.4bn.

Moderna.

Germany's BioNTech (ISIN US09075V1026, Nasdaq:BNTX) is comparable to Moderna. It had started in 2008 with the stated goal of using mRNA technology to develop a vaccine against cancer. When the pandemic started, the company had to pivot towards infectious disease. It developed its vaccine in collaboration with Pfizer, and the resulting product was marketed under the name Comirnaty. The stock rallied by 30x from EUR 12 to EUR 360. It's now back at EUR 108, which is a less steep fall than that of Moderna. BioNTech's market cap is EUR 26bn, and it also has a healthy cash pile left – more on that later.

BioNTech.

Leaving aside the issue of potential lawsuits, where will these stocks go from here?

Pfizer – a value investment with an activist angle

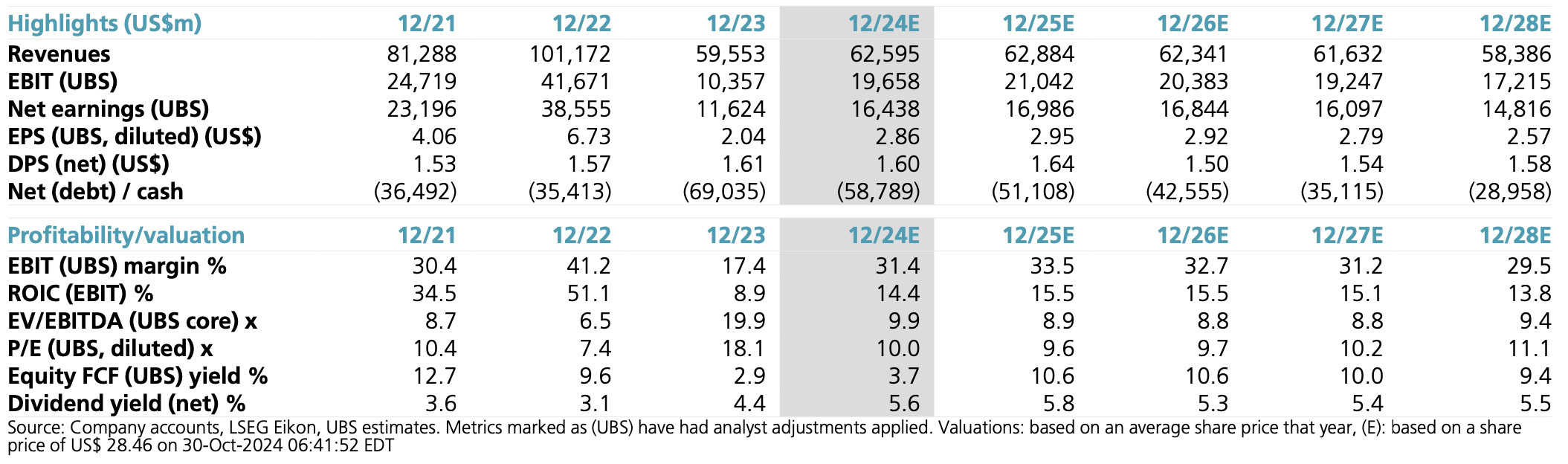

Pfizer stock has become cheap relative to its earnings. Based on estimated 2026 results, the stock is now trading at a P/E ratio of just 9, and the company has a valuation of 8.2 EV/EBITDA. This compares to the rest of the industry trading at a P/E of 14. In absolute and relative terms, the stock appears to be undervalued.

Why the low valuation?

The New York-based company is perceived to be lacking growth prospects. There are doubts about Pfizer's product pipeline and the business rationale underlying its recent acquisitions. According to analyst estimates, Pfizer's revenue will barely grow until the end of this decade.

Activist investor Starboard Value saw the valuation gap as an opportunity, and put USD 1bn into Pfizer shares (the second-largest investment the USD 8bn fund has ever done). Starboard's 74-page investor presentation makes for insightful reading for anyone who wants to dig deeper.

Pfizer's management team claims that its growth prospects until 2030 were better than Wall Street recognises.

In the first instance, Pfizer is an old-fashioned value play. Goldman Sachs recently put the stock onto its list of "laggard" stocks with attractive free cash flow yields. It estimates that Pfizer is trading at a 2025 free cash flow yield of 13%.

Source: UBS, 17 December 2024 (multiples based on a price of USD 26.50) (click on image to enlarge).

Moderna – a (risky) call option

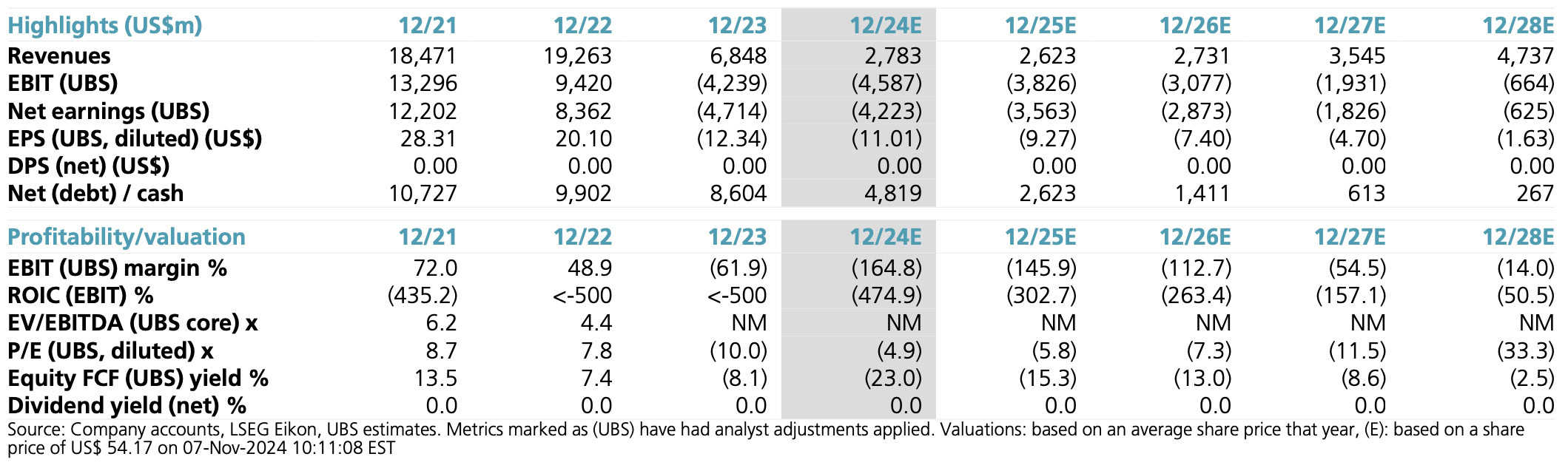

During the pandemic, Massachusetts-based Moderna raked in USD 40bn of revenue. By the time the boom waned, it had built a cash hoard of over USD 10bn.

The stock came back down when investors realised that the COVID-19 vaccine was going to be a one-off boom, but it retained its enthusiastic following regardless. Once it had levelled off, Moderna stock was seen by many as a valuable "call option" (= its R&D projects) married to a comforting cash hoard. It seemed that Moderna had so much cash sitting in the bank that it would be able to spend its way to launching exciting new mRNA products. The cash hoard derisked the investment.

The thesis made sense, but it was not to last. In September 2024, Moderna announced that it was pausing or scrapping several R&D programmes. Management had to reduce revenue estimates for 2025 because of slowing sales of the existing COVID-19 vaccine, and the profitability target was pushed out to 2028 because of the slow speed of its R&D projects. The announced cost cuts totalled USD 4bn between 2025 and 2028, creating worries that the research into new products is not going as well as hoped. If it went well, why not raise more money to fund those products instead of cutting them back altogether?

The stock has since halved (again!). Even though Moderna is going to finish 2024 with a remaining cash reserve of USD 5bn, it is now projected to run out of cash by 2028.

From today's perspective, Moderna is much more your typical biotech venture, with limited visibility of whether products will be brought to market. If it does manage to create personalised vaccines for other diseases, the upside could be enormous for all the obvious reasons. If there are further delays, the company could require more funding, and existing shareholders may get diluted significantly.

Even at current prices, Moderna seems to have a fairly ambitious valuation given that management is still busy right-sizing the ship.

Source: UBS, 7 November 2024 (multiples based on a price of USD 55) (click on image to enlarge).

BioNTech – the better call option?

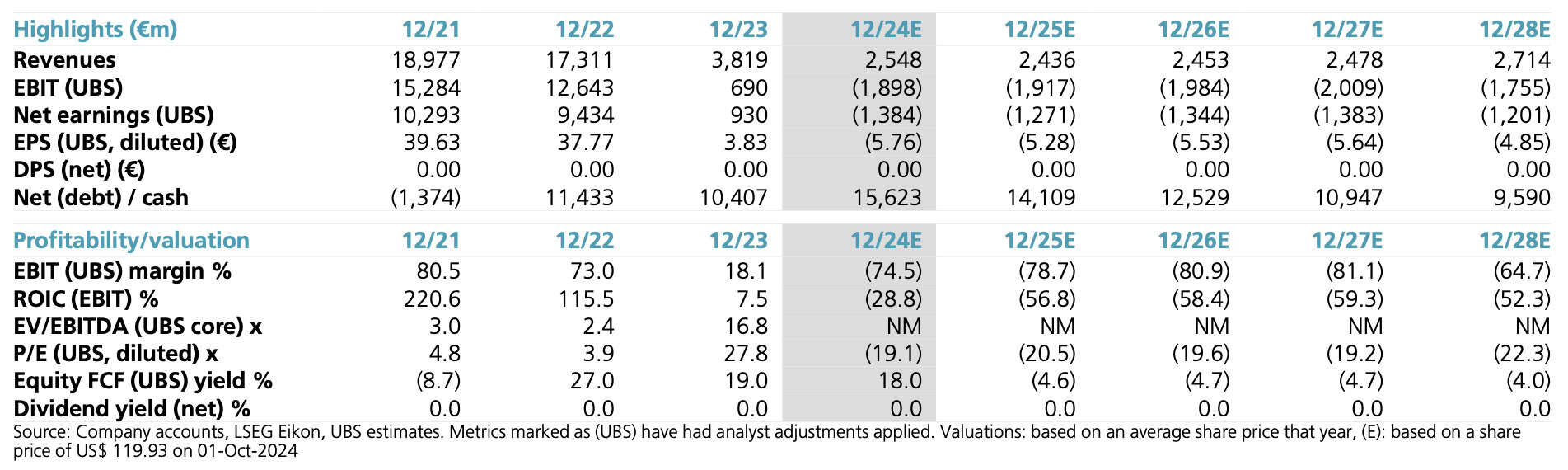

While Moderna has shed 50% of its value over the past half year, its German counterpart BioNTech has gained 50%.

BioNTech has used these past months to project confidence in its work. In September 2024, the stock rallied following the company's presentation at the important annual conference of the European Society for Medical Oncology. BioNTech subsequently published promising results from some ongoing trials, and made a convincing case that advances in AI were going to prop up the company's research. Importantly, it did not have to lower estimates from its remaining COVID-19 vaccine business or announce cuts to costs and research programmes.

Unlike Moderna, BioNTech has no looming end of its cash hoard. The Germans will finish 2024 with estimated net cash of EUR 15.6bn, and even 2028 promises to see EUR 9.7bn remaining in the bank.

Source: UBS, 2 October 2024 (multiples based on a price of EUR 110) (click on image to enlarge).

BioNTech's issue is the same as that of Moderna. Personalised vaccines against cancer and other diseases may promise untold riches once they've been developed, but getting there has proven a rocky road for well over a decade.

For anyone interested in more details, in August 2024 the Financial Times published this excellent long-form article (worth reading in its entirety and including its infographics!):

"The Covid-era tech that could reinvent cancer care

It is early days for personalised vaccine technology and many hurdles remain. Making a personalised vaccine for each patient will be costly and come with supply chain challenges, while pharma groups are constantly advancing other drug types in the ever-competitive cancer field. While 'it's very attractive and very exciting', said Miranda Payne, a melanoma specialist leading a Moderna trial at Oxford's Churchill Hospital, 'it's a little bit hard to see how you'll scale it up for everybody who might need it'.

Several companies have tried to develop cancer vaccine-style products in recent years but the products have struggled to induce an effective response to tumours, especially in late-stage cancer when the immune system is already weak. 'Vaccines have historically been an abysmal investment,' said Marek Poszepczynski, an oncology expert at life sciences investor the International Biotechnology Trust. 'Cancers are very, very good at escaping the immune system.'

…

BioNTech and Moderna are hoping to succeed where others have failed as they seek to develop broad portfolios of cancer treatments.

...

Although it rose to global prominence through Covid, BioNTech's main focus since it was founded in 2008 has been cancer. 'Personalisation of our mRNA vaccines is our most important innovation,' Uğur Şahin, chief executive, told the Financial Times.

Moderna chief executive Stéphane Bancel recalled how he told staff late in the pandemic that '10 years from now, people would have forgotten what we did for the world during the pandemic because we'll be known as one of the most impactful cancer product companies.'"

Just like Moderna, BioNTech is a call option on these research efforts.

However, it seems that it's currently the better call option. Judging the likelihood of success of these research projects is extremely difficult, but the market's perception is currently in favour of BioNTech.

Interestingly, once you strip out cash, the potential opportunity is available at the same price as that of Moderna. Using the estimated 2028 figures provided by UBS, Moderna currently has an enterprise value of USD 15bn, and BioNTech has an enterprise value of USD 16.5bn. Given the different dynamics and the flexibility provided by BioNTech's strong cash position, it would seem that BioNTech is the relative bargain, even after its share price rose 50%.

Source: The Times, 14 January 2024.

What about legal risks?

The issue that lingers in the air but which hardly any analyst addresses in any detail is the risk of lawsuits stemming from COVID-19 vaccines.

Interestingly, Donald Trump didn't just pledge a role to RFK, but also to Dr. Jayanta "Jay" Bhattacharya, another outspoken and early vaccine critique. Bhattacharya was one of the initiators of the Great Barrington Declaration that criticised lockdowns, and was made a pariah during pandemic. He is now nominated as director of the National Institutes of Health – not exactly a household name but the single most important funder of biomedical research in the world, dispensing grants of nearly USD 50bn a year. On 6 December 2024, The Wall Street Journal published an insightful profile of Bhattacharya: "The Man Who Fought Fauci — and Won".

Trump, RFK and Bhattacharya – the triumvirate that will make the triumvirate of vaccine stocks go to zero?

It's not impossible, but it doesn't appear likely.

Lawsuits involving damages caused by COVID-19 vaccines have been filed in a number of jurisdictions already. It's incredibly difficult to make an assessment of the issue, but it does appear that none of the two extreme scenarios expected by the opposing camps of the vaccine discussion came true:

- The world didn't see mass deaths among the vaccinated, as some had predicted.

- Just as much, it's now clear that "safe and effective" was too bold a claim.

As with most things in life, this issue isn't going to come out black or white. Just what hue of grey it is will probably be discussed for another decade or two. Given how skewed much of the data is, there is unlikely ever going to be clarity.

Cynics will say that for large pharma companies, suffering through lawsuits and paying off victims is just another cost of doing business. After all, there has been a long list of such lawsuits throughout the decades, and including actual criminal activity. It was GlaxoSmithKline that had to pay the highest ever settlement, USD 3bn in 2012. However, when it comes to criminal fines, the dubious honour of topping the list goes to none other than Pfizer. In 2009, the American firm had to pay USD 2.3bn to settle a case for falsely promoting some drugs, of which a stunning USD 1.3bn was a criminal fine. Speak of trustworthy corporations!

For developing and promoting the COVID-19 vaccines, the companies making them were given special immunity by the government.

Consider the history of large pharma companies treating expensive lawsuits as part and parcel of their business. What are the chances that these special immunities led to some corners in research and testing being cut, and some product claims coming out a tad better than they deserved?

RFK will be on a mission to address the overall issue, and he will soon have the power of his public office. Will the underlying government apparatus play along with RFK's work, though? The negotiations seem to have started already: in December 2024, Pfizer CEO Albert Bourla had a "constructive conversation" with Trump and RFK over dinner.

There will probably be some sort of reckoning on some of the damage that these particular vaccines caused, but also an agreement to move forward and not sink one of the largest American companies. A four-year term in office wouldn't be enough to achieve that, and large parts of the political establishment would not go along with it anyway.

RFK will likely try very hard to remove immunity for any future vaccines, but he'd struggle (and probably stay clear of) trying to remove the immunity for past vaccines. These companies were given immunity, after all. You can't change laws retroactively.

That's my guess, and it's probably as good as anyone's guess.

Then again, in a way, the stock market already indicates as much.

These stocks are cheap – and possibly worth a closer look

The stocks of Pfizer, BioNTech, and Moderna took a 10-20% hit when news about RFK's involvement hit. However, they seem to have moved on since.

It's also worth bearing in mind that large-cap pharma companies are already trading at a 35% discount to the S&P 500 when measured by their P/E ratios – increasing to a 45-50% discount if you remove Eli Lilly from the list (whose stock benefited from a blockbuster obesity drug).

In that sense, RFK's future actions could already be yesterday's news.

Over the past years, Western nations have not been particularly good at critically dealing with government failures. The more likely course of action in Europe (but also the US) has generally been to deal with an issue superficially and then sweep it under the carpet, while quickly moving on to focus the public's attention on the next issue du jour.

With all that in mind, the time to short the stocks of vaccine makers has now probably come to an end. It'd be ironic if, in a few years, the appointment of RFK to a government position would also just about mark the lowest point of these stocks.

Pfizer could be an interesting turnaround play if Starboard Value's thesis works out. As the Starboard investor presentation shows, Pfizer has fallen *far* behind the valuation of its peers. The company is now under pressure to change, and the low valuation multiples may be as good a starting point as Starboard's outsized investment suggests.

Source: Starboard Value, Pfizer investor presentation (October 2024) (click on image to enlarge).

Moderna and/or BioNTech offer a potentially exciting bet on the future of personalised vaccines. The difficulty lies in deciding which one. Some would argue that the real opportunity lies in buying a basket of the two. As the excellent weekly newsletter from KochBank's Matthias Mirwald mused in March 2024: "Food for thought: If you hold them both, what's your combined chance to eventually be part of a significant mRNA-break-through?"

Food for thought, indeed.

Hot off the press: 100x if Trump buys Greenland?

For Donald Trump, ownership of Greenland is "an absolute necessity".

Could there be an angle that the public hasn't noticed yet, and which makes this ambition more realistic than it appears?

Greenland's potential for resource extraction has already attracted the attention of billionaires.

If Bezos, Gates, and Bloomberg are investing, why shouldn't you – and how can you get in on the act?

My latest research report – out just now – gives the answer.

Hot off the press: 100x if Trump buys Greenland?

For Donald Trump, ownership of Greenland is "an absolute necessity".

Could there be an angle that the public hasn't noticed yet, and which makes this ambition more realistic than it appears?

Greenland's potential for resource extraction has already attracted the attention of billionaires.

If Bezos, Gates, and Bloomberg are investing, why shouldn't you – and how can you get in on the act?

My latest research report – out just now – gives the answer.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: