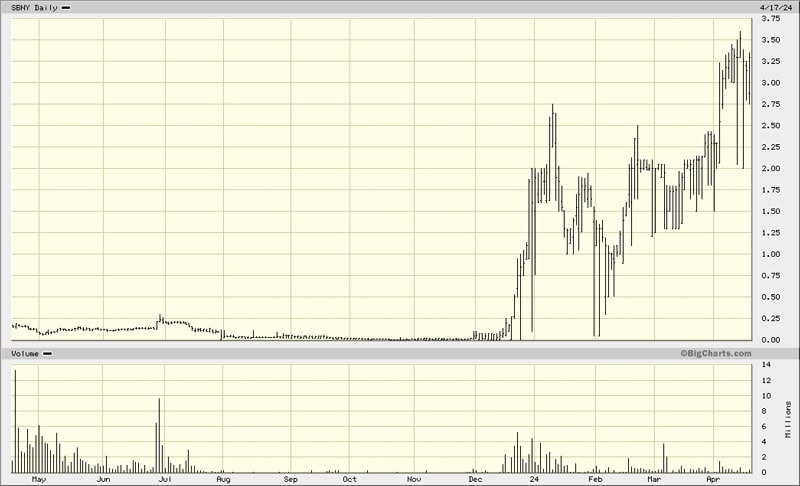

Until October 2023, the share price of Signature Bank was exactly where you would have expected it to be.

The Nasdaq-listed stock traded at just 1 cent.

In case you don't remember, Signature Bank had gotten shipwrecked in March 2023, alongside the other infamous "crypto-deposit banks", Silvergate Bank and First Republic Bank. Its stock had to be considered worthless, at least by conventional wisdom.

However, between October and December 2023, the share price suddenly rose from 1 cent to USD 1.60. Buyers were hovering up shares, sometimes several million in a single day.

The stock then doubled again and reached USD 3.60, and with heavy trading. Following some volatility this past week, it traded at USD 3.30 as this article went online.

It's a fascinating case that may have further to run, and it teaches a few interesting lessons.

Signature Bank.

Third-largest bank failure in US history

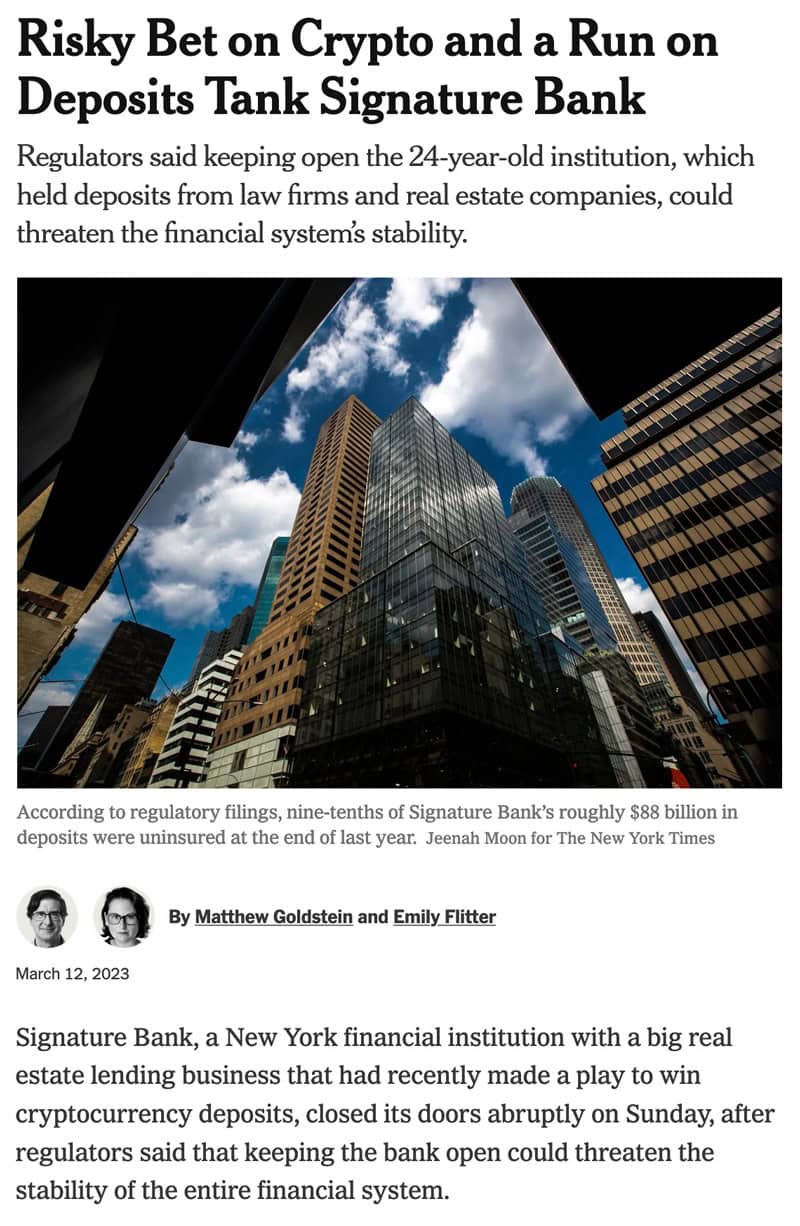

When it was still trading, Signature Bank (ISIN US82669G1040, OTC Expert Market: SBNY) was a New York-headquartered bank with a focus on wealthy private clients and commercial clients.

In 2018, its management decided to aggressively market crypto-related services, allowing clients to deposit their cryptocurrencies with the bank. At the time, this decision gave new legitimacy to the crypto sector, which investors in that space hailed as a major step forward. By spring 2023, 30% of Signature Bank's deposits consisted of cryptocurrencies. In the meantime, crypto enthusiasts had driven the bank's share price from USD 75 in 2020 to as high as USD 375. Its balance sheet had grown to over USD 100bn.

Its focus on wealthy clients and crypto clients also meant that Signature Bank had a record-high percentage of clients whose deposits did not fall under the United States' federal deposit insurance programme. The Federal Deposit Insurance Corporation (FDIC) insures deposits up to USD 250,000 per account. Crypto deposits and deposits that exceed USD 250,000 are excluded.

Almost 90% of Signature Bank's deposits were not protected by the FDIC.

Following the run on (and subsequent collapse of) Silvergate Bank in early March 2023, clients of other banks started to wonder how secure their deposits were. Among the 4,236 FDIC-insured banks in the US, only three had an even higher percentage of uninsured deposits than Signature Bank.

Customers panicked and started to pull out money en masse.

On 12 March 2023, New York authorities closed the bank. Because of its size, the US government considered a collapse a systemic risk, which enabled the FDIC to step in and guarantee all deposits after all. Whereas deposit holders were going to be made whole, those investors who held equity or bonds issued by Signature Bank were going to lose their entire investment. Within one week, the majority of the bank's deposits and loans were taken over by New York Community Bancorp (ISN US6494451031, NYCB), which is the usual way to dispose of a failed banking operation.

Source: The New York Times, 12 March 2023.

Signature Bank became the third-largest bank failure in the history of the United States. Nothing but a carcass was left over, one that New York Community Bancorp had already devoured to the bone. At the time, even 1 cent seemed too much for the stock, given that equity holders were considered to be left with zero. In fact, the stock traded as low as 0.22 cent.

As it turned out, though, there will be assets left to distribute to shareholders and bondholders.

The surprising prospect of getting money back from the bank's liquidation is why its stock has been rallying of late.

Run-off portfolio

Not all of Signature Bank's assets were transferred to New York Community Bancorp. When the bank closed its doors, it had USD 107bn of assets. Of that, only USD 47bn were transferred to New York Community Bancorp – basically, the part of the bank's portfolio that was deemed a worthwhile business. A portfolio with a remaining USD 60bn of loans would remain in receivership, and it was earmarked for a gradual unwinding.

In September 2023, the FDIC sold another USD 28bn of the bank's assets to Flagstar Bank.

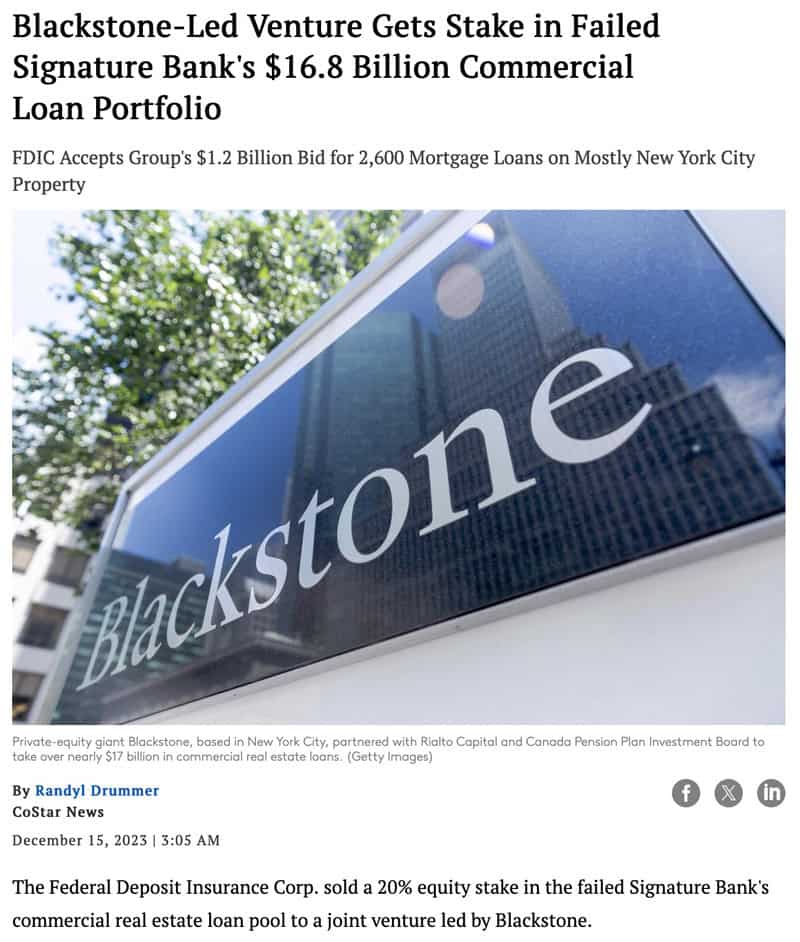

The remaining USD 32bn of loans comprised mortgages made against commercial real estate and rent-regulated apartment buildings in New York – asset classes that are not exactly in favour with investors.

However, the FDIC knew that it was going to release more value from these remaining loans if it allowed them to continue to maturity. The government entity needed help, though, to get the job done, and it had to deliver some evidence that letting this portfolio run off over time was indeed the best way to minimise losses and maximise proceeds.

To this end, the FDIC put these remaining loans into joint venture entities. Minority stakes in these entities were then offered to private equity companies and other financial investors. That way, the FDIC tested what the market would bear for these run-off portfolios, and it'd also rope in the expertise that private equity companies have in managing such legacy loan books.

Spanish bank Santander, and Related Companies, a New York-based real estate company, purchased a 20% and 5% stake, respectively, in the joint venture entity that holds the rent-regulated real estate. Blackstone purchased a 20% stake in the joint venture entity that focuses on the free market real estate.

Source: CoStar News, 15 December 2023.

These financial investors paid the equivalent of 59-72 cents on the dollar. According to press reports, there had been bidders offering more than 80 cents on the dollar (which the FDIC disregarded since it evaluates not just the price offered but also what else the bidder brings to the table).

Blackstone, in turn, immediately resold USD 1.8bn of these loans to other investors.

Why are these transactions relevant for the share price of Signature Bank?

The shareholders still have a claim for any potential excess that is left over after unwinding the remaining loans. That's where things get really complicated, and it's in the complexity of these affairs that one astute credit investor from New York discovered what may be the most lucrative trades of recent years.

An epic investment home-run

Scott Goodwin is the co-founder of Diameter Capital Partners, an alternative asset manager focused on credit markets. Set up in 2017, Diameter was managing over USD 10bn in client assets just four years later.

Goodwin presented his analysis of Signature Bank at this year's SOHN NYC conference. Sensing that Goodwin was going to come up with something special, yours truly took copious notes. Even though Reuters briefly reported about the presentation, no one else has published this story in detail yet.

Judging by the chart shown at the conference, Diameter Capital Partners must have started buying into Signature Bank when the stock was trading at just 1 cent. This will be a small part of their overall investment in the bank, but Diameter Capital Partners will likely have made a 350x return on its first purchases of stock – within just seven months! Diameter Capital Partners' work on this investment case deserves five stars for originality, depth, and results.

For the FDIC to be made whole on the remaining USD 32bn portfolio of loans, it needs to recover 85% of the outstanding amounts. If the recovery rate of these remaining USD 32bn of loans comes out higher than 85%, there will be money left over to go towards holders of the bank's bonds, preference shares, and ordinary shares.

How could any external investor come up with an estimate for the likely recovery rate? Aren't commercial property loans and rent-regulated apartments in New York a money pit where loans and mortgages are unlikely to be repaid?

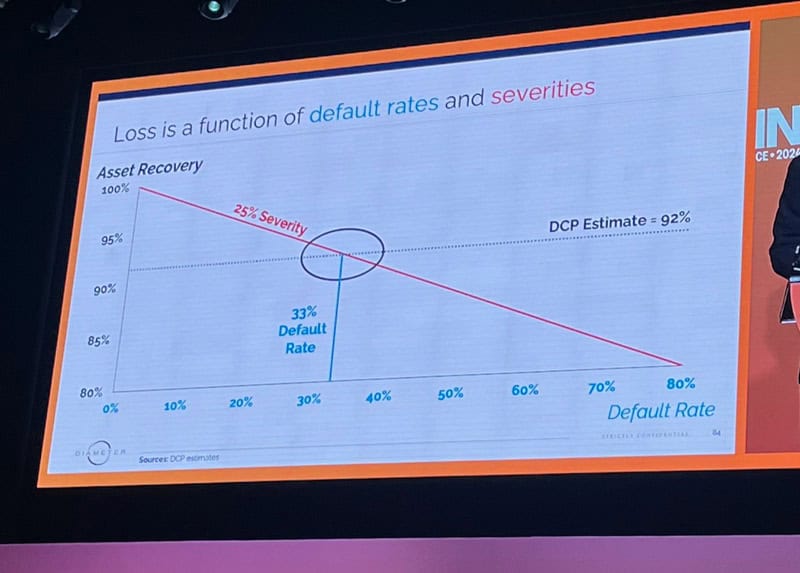

It's all down to the default rate and the so-called severity.

The default rate is the percentage of loans where the debtor won't be able to make a repayment in full.

Severity is the percentage loss suffered when a debtor is not able to make a repayment in full. E.g., a debtor may not be able to pay back the entire mortgage but just 75%. In that case, the severity is 25%.

Source: Diameter Capital Partners @ SOHN NYC 2024.

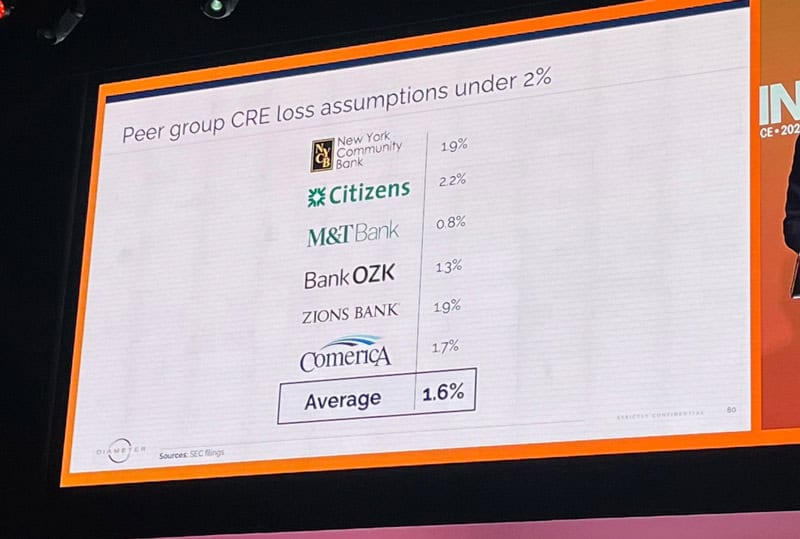

For its analysis of Signature Bank, Goodwin assumed an 8% loss rate (4x of the peer group estimate), and comprising a default rate among debtors of 33% and a severity of 25%.

Source: Diameter Capital Partners @ SOHN NYC 2024.

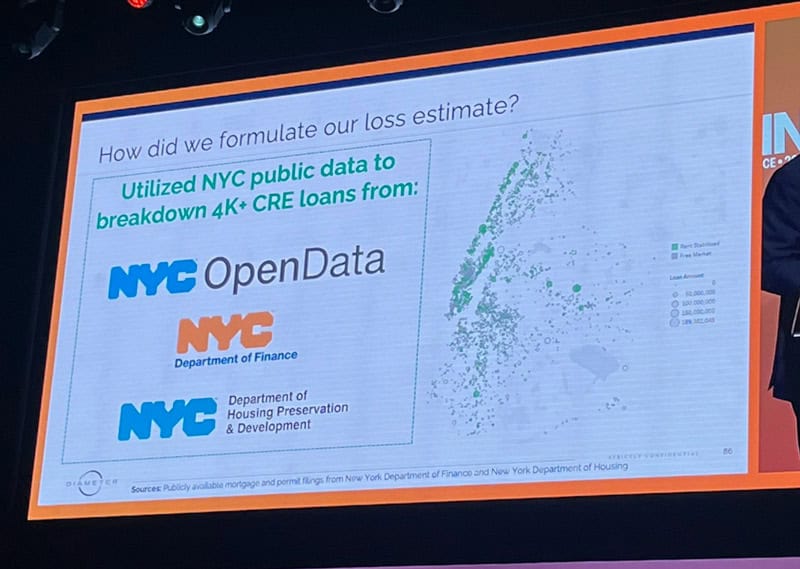

Goodwin's analysis was based on New York's vast public databases on real estate and real estate-related funding. Using AI, Diameter Capital Partners made estimates to:

- Establish the background to these loans and mortgages, i.e. the mix of retail, office, multi-family, and other real estate categories.

- Calculate the debt per unit of real estate, or per square foot. This data was also broken down by borough.

- Compare the resulting data to transactions that took place in 2023. This included further finetuning, such as weighting the loans for the mix of real estate.

The resulting estimate of an 8% loss on the loan portfolio means that 92% of the loan book will be recovered. Given that the FDIC's claims only make up 85% of the loan book, this means there will be money left over to go towards the holders of Signature Bank's bonds, preference shares, and ordinary shares.

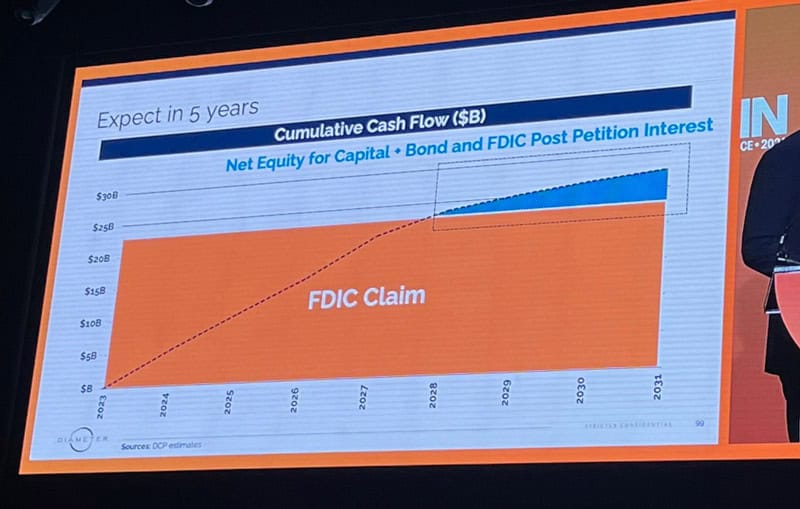

This money is not going to be available immediately since most loans run out in 5-7 years. This gives the managers of these loan portfolios time to work towards maximising how much debtors can repay.

Diameter Capital Partners also estimated the flowback of these funds over time. Several other factors need to be considered, such as asset management fees that will be charged for managing this portfolio. On the other hand, there will also be interest rate payments due on these loans. The situation of Signature Bank didn't change the obligation of the debtors to pay the interest that was agreed when these loans were created. Most of these loans originated before the spike in interest rates, meaning they require payment of 4.0-4.5% p.a., which is relatively affordable.

Source: Diameter Capital Partners @ SOHN NYC 2024.

The FDIC is first in line to receive the money that comes in. According to Goodwin's estimate, the FDIC's claims will be paid off in full at the end of 2027.

Source: Diameter Capital Partners @ SOHN NYC 2024.

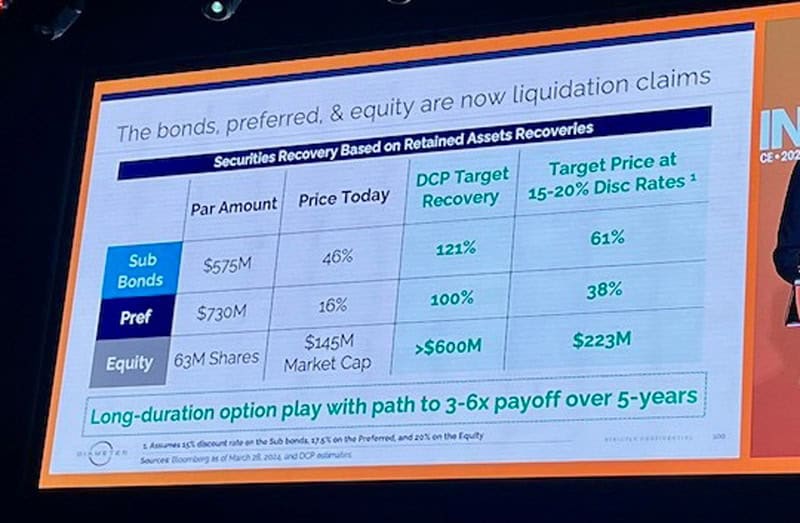

From that point on, the bonds, preference shares, and ordinary shares will have a value again, as they entitle the holder to a share in the remaining leftover proceeds.

For the ordinary shares, Goodwin estimates USD 600m to be left over, which will become available in about five years' time. When discounting this sum by 20% p.a., Signature Bank has a fair market cap of of USD 223m.

Following its increase to USD 3.30 per share, the bank currently has a market cap of USD 224m. Put another way, if Goodwin's investment thesis works out, anyone buying into Signature Bank's ordinary stock today can expect a return of 20% p.a. for the next five years. Given these prospects and Goodwin's informative presentation at SOHN NYC 2024, the stock has seen significant trading volume ever since.

Source: Diameter Capital Partners @ SOHN NYC 2024.

This outcome is of course not guaranteed. Key risks include the following:

- The default rate and severity could turn out higher than estimated, e.g. if the real estate market in New York took a turn for the worse.

- Goodwin's estimates are based on alternative sources of information.

- The joint venture partners have control over some aspects, e.g. they can decide to extend loans. Delays of one kind or another could occur.

Overall, though, Goodwin's estimates struck me as pretty solid, and he wouldn't have gone public with them if he didn't feel fairly confident himself (never mind his firm's amazing track record).

As an opposite scenario, the figures could turn out even better. If the overall loss rate was less than the estimated 8% and closer to the 2% that other banks estimate for their portfolios, the holders of the bonds, preference shares, and ordinary shares could come out even stronger.

(I took a snapshot of every slide of Goodwin's presentation. Get in touch if you'd like a copy of the entire slidedeck.)

Lessons learned from this case

Alongside the investment case as such, there are also some interesting lessons to be learned for investors.

It's what Goodwin summed up in his talk at SOHN NYC: "We dive deeply into businesses with situational and operational complexity."

Just how they succeed in uncovering such names and generating outlier performance, is something that Goodwin and his Diameter Capital Partners co-founder Jonathan Lewinsohn spoke about in an interview with Bloomberg in 2022.

The resulting 40-minute video is worth watching. Alternatively, take a look below for some key quotes from the interview.

On the value of knowing a lot of companies ("names"):

"We believe that there are inefficiencies in markets and that if you are able to be native across these markets, you'll be able to more quickly understand where the dislocations are. … We have a 20-person analyst team here that many of whom have worked with us previously that help us know a lot of names."

On being able to act fast:

"Speed of capital is really what matters. You don't have time anymore in an environment to sit for weeks and think about it. ... Maybe we're a little bit more proactive and aggressive in terms of getting research done ahead of events versus reacting the event and doing the research after the event. … We can react quickly when a mutual fund needs to sell a block of bonds. ... They're calling us or maybe one or two other counterparties that can react in five minutes because we have a proactive process where the research is done up front and we know the names we can respond in seconds. … Part of what we think separates us from many of our competitors even though many of them are great is this combination of knowledge and speed. Speed of capital is really what matters."

On the value of being unconstrained:

"Most of credit is rules based. You have investors who either have a ratings constraint a duration constraint or liquidity constraint mutual funds for example mutual funds others CLOs. ... They have tons of constraints on them and we abide by those constraints. But if you have a universe of names you know and … can be agnostic to where you go on a risk adjusted basis and be fast because you have a trading mentality that is in your portfolio management process ... That's what differentiates it!"

Are you eager to find out more about such outlier investment ideas and how to find them?

Watch out for an event that is taking place in just two months.

"Weird Shit Investing"

Attendees at SOHN NYC 2024 learned about two dozen investment ideas, many of them fairly conventional, though. Goodwin's idea was one of the few that stood out for originality.

Undervalued-Shares.com always wanted to create an event for a truly creative audience to share genuinely original investment ideas. The inaugural Weird Shit Investing conference, taking place on 11 June in London and on 13 June in New York, is such an event.

18 speakers have signed up for London, and 15 speakers for New York. All speakers – a combination of fund managers AND private investors – were vetted, to ensure the quality of the ideas presented.

Due to a cancellation, *one* speaking slot is currently vacant for the 13 June event in New York. Do apply if you want to participate.

At both events, a small number of allocators – family offices, wealth managers, and similar – can also attend. Three such "voyeur" spaces are currently left for both London and New York. Again, do get in touch if you are interested.

For those among you not able to attend either event, don't worry. All ideas presented at the Weird Shit Investing conference will be summarised in a manual that will be made available for free to all subscribers of the Weekly Dispatches.

Each investment case will be summed up in one page, including a short section on what anyone can learn from this particular case. If you want to up your game and become a bit like Scott Goodwin, this will be right up your street!

Mid-cap bid target

Western Europe has many industry-leading mid-cap companies that are hardly known among investors.

The company featured in my latest research report has a 50% market share in its industry in Europe, is trading at just 5x EBITDA, and has started to grow by 30-40% p.a. in a major overseas market.

Few analysts or fund managers follow the stock – but they should!

The company's CEO and COO have been given a strong financial incentive to at least double the share price by mid-2026.

It looks likely that they will succeed.

Mid-cap bid target

Western Europe has many industry-leading mid-cap companies that are hardly known among investors.

The company featured in my latest research report has a 50% market share in its industry in Europe, is trading at just 5x EBITDA, and has started to grow by 30-40% p.a. in a major overseas market.

Few analysts or fund managers follow the stock – but they should!

The company's CEO and COO have been given a strong financial incentive to at least double the share price by mid-2026.

It looks likely that they will succeed.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: