If a stock holds up well during a period of market turmoil, it's often a sign that further gains are to come.

FranklinCovey (ISIN US3534691098) is an American small-cap stock that straddles the areas of "SaaS" (Software as a Service) and "EdTech" (Educational Technology). With a slant towards tech, you would have expected the stock's slaughtering in the recent Nasdaq sell-off. However, it only fell 14% from its all-time high.

I wish it had fallen lower. The stock had been on my list of potential research targets since mid-2021 when it was trading at USD 36. Unfortunately, it soared sooner than I got to write about it and reached USD 52 in early January 2022. It's now back down at USD 46 and I wish it fell further down to its mid-2021 level.

If or when it does, you should seriously consider loading up.

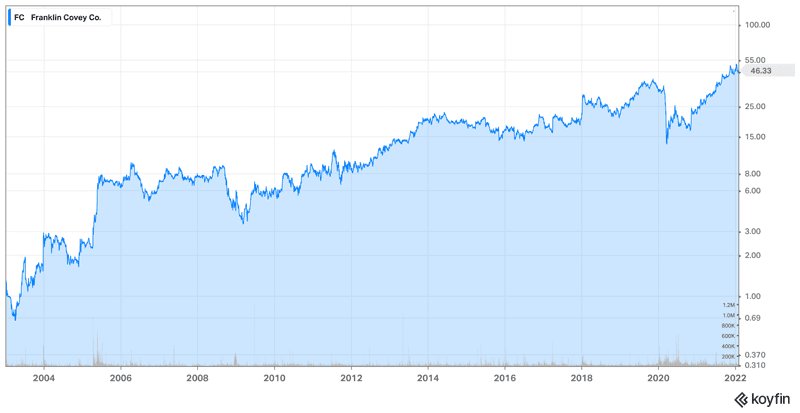

FranklinCovey is a model case for operating a powerful subscription model and throwing off lots of money for shareholders. Its stock is up 4,500% since the company was brought under new leadership and emerged from a crisis two decades ago, rising from less than USD 1 in 2003 to its current level. If I am right, both the business and the stock are facing another great decade (or two) because FranklinCovey operates a proven, scalable model in a market with reliable long-term growth.

You may not have heard of the company or its stock before, but you will probably have come across its most famous product - a bestselling, timeless book which turned FranklinCovey into a USD 600m company.

A highly effective company

"The 7 Habits of Highly Effective People" brought his author, the late American educator and speaker Stephen Covey, global fame. Published in 1989, the book is among the 50 bestselling books of all time, with over 40m copies sold globally. For Stephen Covey, "The 7 Habits of Highly Effective People" laid the foundation for an entire business in leadership training.

Content is king: Stephen Covey's timeless bestseller.

In 1997, Covey merged his leadership training organisation with Franklin Quest, a company that offered similar services to corporate employees. The resulting firm became FranklinCovey, which combines elements of a professional services firm with that of a specialty retailer selling training and productivity tools.

In essence, FranklinCovey helps individuals and organisations improve their performance.

Such training can involve salesforce efficiency, consumer loyalty, organisational culture, and leadership development. Customers can choose between a range of delivery modalities including face-to-face and online training, micro learning, and (of course!) books. Stephen Covey's timeless bestseller is still part of the product mix, even though it primarily serves as a client acquisition tool ahead of upselling customers to more expensive training products. The book gives FranklinCovey instant brand name recognition and credibility.

Seven years ago, FranklinCovey undertook the revolutionary step of switching to what is essentially a subscription-based model. It has paid off massively for the company, even though investors at first didn't recognise what was about to happen.

Disrupting its own business model

Until 2015, FranklinCovey had focussed on selling individual products rather than subscriptions. Legend has it that the company's leader, 67-year-old Robert "Bob" A. Whitman, sat in a ski lift when he had a revolutionary idea. Why not offer all of FranklinCovey's products for a fixed price, with the ultimate aim of making clients take out recurring subscriptions?

That same year, FranklinCovey introduced the All Access Pass. For a one-time fee, clients could access all content that the company had ever published. The pass expired after a year, but it could be renewed and turned into an annual or even multi-year subscription.

The All Access Pass gave clients access to multiple times the content for the same price and as such could have eaten into the existing business. For any company, such a step would have been a scary decision. However, Whitman had taken over as FranklinCovey's CEO at the turn of the millennium and he was one of the biggest shareholders. Given his track record in turning around and growing the company, the board decided to back Whitman's instinct and take the risk.

This was going to prove transformative for FranklinCovey's success. As it turned out, customers would go on to spend a substantial amount more under the new subscription-based model than they would have done under the old one-off purchase model.

How was that possible?

Previously, clients would purchase training for a specific subject, and it would require an altogether new purchase decision to buy training for another area. Having access to ALL training courses for a specific period prompted clients to make the FranklinCovey-based training a permanent part of their corporate planning (instead of just buying the occasional product). Some clients even discarded their other corporate training providers and gave their entire training budget to FranklinCovey instead. Since FranklinCovey gives you all the content you need, why buy anything else?

In terms of sales tactics, this model taps into the so-called status quo bias that is part of our human nature. If you are signed up to a product that you like and use at least occasionally, you are quite likely to simply leave it running based on an ongoing contract. It's a bit like the gym membership which you may keep even during periods when you are not using it; the fact that you can use it again at any time whenever you want makes you feel good. Also, there is the hassle of cancelling and restarting a membership. These are some of the key aspects why subscription-based businesses are such a powerful proposition, provided you can convince clients to buy into subscriptions. Once you have achieved that, you need to keep the churn rate at a minimum.

To ensure that the maximum number of clients are happy long-term subscribers, FranklinCovey employs so-called implementation specialists whose job is to help All Access Pass clients get maximum value from their product. At last count, FranklinCovey reported an annual revenue retention rate of over 90%, which helps the company to maximise the all-important lifetime value of its customers.

The All Access Pass didn't exist until 2015, but such was the success of the new scheme that over half of FranklinCovey's business is now subscription income, with some of these subscriptions being multi-year right from the start.

It did come at a short-term cost, though.

The market's delayed understanding of the new model

Between 2015 and 2018, FranklinCovey's EBITDA declined from USD 35m to USD 20m. On the surface, it looked like the switch to the new subscription-based model was ruinous. As ever when a company decides to disrupt both its industry and own operating model, critics came out of the woodwork. In 2017, a short-seller published a scathing 50-page report about the alleged disastrous decisions by management and their consequences for the company.

Investors had yet to realise that whereas the switch to the new model did cause some short-term pain, it would bring long-term gain.

FranklinCovey had to bear the costs for implementing and managing the switch, some existing customers used the change as a reason to quit, and the sales team had to learn a new approach to selling the product. Disrupting and relaunching a pricing model is never an easy task and will inevitably lead to friction and one-off costs.

It didn't help that the new subscription model also brought changes to FranklinCovey's financial accounting and its reporting to shareholders. The economics of such a model mean that all costs relating to acquiring a new customer – such as marketing, sales commissions and implementation specialists – are put onto the profit and loss statement during the current period, but very little of the customer's lifetime value is booked as revenue during that same period. This means that revenue from new customers appears to be much less profitable initially than is actually the case. Instead, it generates an all the higher margin further down the road. Also, cash flow can be distorted because customers pay upfront, whereas revenue (and EBITDA) is reported over 12 months. It adds a layer of complexity to a subscription company's finances and not all shareholders immediately get the hang of it.

However, the eventual financial results spoke for themselves. Before the introduction of the All Access Pass, clients would typically spend USD 15,000 during a given year. Once the new model was firmly in place, clients typically spent USD 28,000 per year.

FranklinCovey also generates an increasing amount of recurring income. At the end of 2017, just 1% of All Access Pass holders had signed up to multi-year contracts. During 2019, this number had already increased to 32%.

There is much more complexity to all this than I can portray in a short article, but it boils down to the following:

- FranklinCovey has made its overall proposition to new clients more competitive, which in turn helps the company compete in the marketplace.

- It gets more lifetime revenue out of customers, which has grown the overall business.

- On 1 January each year, the company can forecast its expected recurring revenue for that year. This recurring income from the subscription model provides an extremely solid foundation.

The short-sellers who warned against investing in FranklinCovey stock in 2017 were proven spectacularly wrong by the company's performance during 2018 and 2019. Compared to when it made the switch to the new subscription model, its stock is now trading three times higher. What's more, the new model means FranklinCovey will find it a lot easier to unlock the manifold opportunities in its sector.

Scratching the surface of a very big market

Management training is a huge industry globally, generating USD 100bn in revenue for external training providers each year. It is a highly fragmented industry where even the largest operators don't have more than a 1-2% market share, and many providers consist of a single person who offers training in just a single modality or subject area. Within its fragmented industry, FranklinCovey has already reached critical mass.

The company's archive of training-related content cost USD 150m to develop, and even though a percentage of this content becomes outdated every year, it's a powerful legacy asset. There are few competitors that can offer a similar breadth and depth of training content. For slightly larger organisations in particular, it's a compelling value proposition to source a broad scope of training from a single source rather than multiple smaller providers. The corporate training market only grows at the overall speed of GDP growth, but with its superior economies of scale FranklinCovey has outpaced the industry's growth by a multiple for many years already.

Does the Internet with its ever-increasing amount of free or nearly-free content about any imaginable subject matter put FranklinCovey's business at risk? Autodidacts have always been able to find free information about anything they like to learn about, but this has never hindered the company's growth. How come? Larger organisations require a common language and a common goal for their employees. To them, FranklinCovey offers a competitively-priced solution to get everyone on the same page. They wouldn't want their employees to seek free training sources.

Signing up an entire corporation to the All Access Pass costs around USD 200 per employee, or even less if a very large company manages to negotiate a volume discount. Within the machinations of a larger organisation, such an amount will be recouped multiple times over if the training leads to just a small improvement in organisational efficiency.

Even in its home market, the US, FranklinCovey has plenty of room left to grow the reach of its products. While 55,000 corporations in the US fit the All Access Pass client profile, FranklinCovey has signed up just 4,000 so far. The company has already assigned dedicated sales staff to acquire another 7,000 corporations, but it has not even started to make a focussed sales effort for the remaining 44,000 potential corporate clients. The overall number of potential clients is also growing each year due to the ongoing expansion of the US economy.

Further afield, FranklinCovey has already signed licensing agreements with marketing partners in 150 countries. Its training material is available in 16 languages, and local licensing partners have to pay a 15% royalty fee on sales. Given cultural differences, American-type management training may not work for everyone in every location, but it is certainly going to work for a percentage of potential clients in many locations. FranklinCovey's international business so far makes up only 4% of revenue but it grows consistently, and licensing fees come with a high margin.

The company has also started to establish itself in education, where it offers leadership and self-esteem courses for children aged 4-16. Even though this division is tiny compared to the rest of the business, it has grown at a rate of 56% during the first quarter of the current fiscal year 2021/22. It could well turn out to be a seed that grows into a significant part of the group.

It is beyond the scope of this article to cover all the possible angles for FranklinCovey continuing its decades-long growth path. However, there are some other resources that you can use to delve deeper into the company. If I am right, more investors are gradually waking up to this particular growth opportunity, not the least because the stock is cheap relative to its competitors.

Stock at all-time high, yet undervalued

With a market cap of around USD 600m, FranklinCovey is too small to attract the attention of large investment funds and investment banks. In 2018, however, it became the core holding of Askeladden Capital, a small-cap fund that specialises in finding the kind of undervalued gems that readers of Undervalued-Shares.com would also be interested in. Its manager, Samir Patel, started to load up on FranklinCovey stock in mid-2016 when it was trading around USD 15 per share. Eventually, it grew to be his single largest position with a portfolio weighting of up to 38%. Samir presented the stock at MOI Global's "Best Ideas 2019" conference; the 40-minute recording of his presentation still makes for an informative summary by someone who has done a deep, ongoing analysis of the business. You can also find more information about FranklinCovey in the investor letters published by Askeladden Capital.

I reached out to Samir for his assessment of the stock, and he replied:

"The thesis in a nutshell is that Franklin Covey is like buying Gartner (NYSE:IT) 10 years ago. They have very valuable and scalable IP, that their clients want and need, with little competition, which allows them to drive renewals of the existing subscription business at 90%+ and do enough new sales to grow revenue high single to low double digits for a very long time. Yet it only trades at about ≈2x revenue and a low double digit multiple to economic EBITDA - despite the likelihood of 20-30% annual growth in free cash flow for 5-7 years. Given the 'build once, sell many times' business model, they have tremendous operating leverage and EBITDA should grow much faster than revenue, with free cash flow growing even faster than EBITDA given further leverage on some below-the-line items (like capex and rent)."

Another small-cap fund that featured FranklinCovey stock is Symmetry Invest in Denmark. Their February 2021 presentation "Underappreciated business transformation" also provides an in-depth analysis of the company.

I reached out to Andreas Aaen of Symmetry Invest for his current view:

"Franklin Covey keeps executing far ahead of even our original expectations. In our February 2021 report we estimated FY21 EBITDA of $22.5m and FY22 of $33.7m to get to our fair value estimates. FC managed to print $28m in FY21 and is on its way to achieve >$40m in FY22. While most other high growing subscriptions businesses trades at high multiples of revenue with FC you get a fair low multiple even based on real free cash flow. We have yet to find another subscription business growing +20 % a year in a huge market trading for 2x revenue and 15x Free cash flow even at today's prices."

FranklinCovey is still under the leadership of Robert A. Whitman, who owns 4% of the stock and is the company's largest individual shareholder. Given that Whitman already produced a 45-fold return since his leadership gave the company a fresh start, there is a growing number of investors who believe that FranklinCovey is likely to continue its successful path. They are starting to notice:

- The ongoing quantitative and qualitative growth of the business following its switch to a predominately subscription-based business model.

- The size of the remaining growth opportunity both in the US and the rest of the world.

- The possibility that FranklinCovey will continue to use parts of its cash flow to fund occasional add-on acquisitions. In a highly fragmented market, the company will regularly come across value-accretive bolt-on acquisitions.

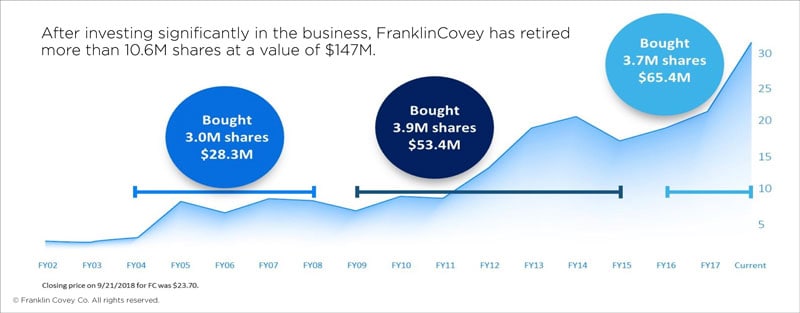

Much as the company is not well-known among investors yet, it's a hidden gem with a fairly resilient model and a proven track record for treating its shareholders well. Since Whitman took charge, FranklinCovey has bought back around USD 150m worth of its own stock and it will likely continue to do so.

This is a company that demonstrates the beauty of a content-based subscription business like few other publicly-listed companies. It doesn't cost FranklinCovey anything if more people access its library of content. Given that it already has most of the training content in place, the company has a high flow through from incremental sales to incremental adjusted EBITDA.

Because of the disproportionate effect that incremental customers have on a company's profitability, content-based businesses like FranklinCovey tend to sell for comparatively high multiples when they are sold. Transactions in this sector are rare, though, because most owners prefer to simply keep their businesses. This makes it somewhat difficult to find comparative numbers.

In early 2021, the team at Symmetry Invest tried to create a comparative valuation of FranklinCovey based on the performance of its All Access Pass product alone. Their calculation yielded a fair value of the stock of USD 91 based on expected 2022 results, and USD 126 based on 2024 estimates.

Newsflow and an upward revision of projections could help catalyse a further stock price increase as the year progresses:

- In early January 2022, the company disclosed that the first quarter of its current fiscal year 2021/22 had gotten off to a strong start. The adjusted EBITDA of the quarter came in at USD 9.9m, way above the company's guidance of USD 6.3m. Total subscription sales were up 32% compared to the same period of the previous year.

- The company reiterated its previous guidance of an adjusted 2022 EBITDA of USD 34-36m, but it's now quite likely that the full-year guidance will raise its projections once it has reported its second quarter figures in early April 2022. Full-year revenue should climb by about 15% to ≈USD 250m, and the adjusted EBITDA should come in closer to ≈USD 38m (if not even higher).

- For 2023, Stonegate Capital Markets estimates ≈USD 280m in revenue and adjusted EBITDA of ≈USD 48m. Based on these figures, FranklinCovey is valued at less than 2 times EV/Revenue and ≈13 times EV/adjEBITDA. One of the best comparable companies, NYSE-listed Gartner (ISIN US3666511072), trades at over 5 times revenue and over 20 times EV/EBITDA.

Stonegate Capital Markets estimates the stock's current fair value in the range of USD 47-62; this will have to be increased if or when FranklinCovey ups its guidance for 2022. Whichever way you look at it, FranklinCovey isn't expensive – and it'd be a steal were the stock to fall back below USD 40 during another round of market volatility.

Those who don't want to speculate on another round of sell-offs in the broader market may well buy some of the stock at the current price. Come April 2022, an upward revision of estimates for 2022 could lead to a surpassing of the stock's old high of USD 52. As I said at the beginning of this article, if a stock holds up well when everything else is hurting, it's usually a sign of further gains to come.

And for everyone else who likes to buy the stock of a subscription-based business when it's truly "down and out", I have another story waiting for you.

Blog series: Subscription businesses

There's more to "Subscription businesses" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

World-leading subscription business at sell-out valuation

FranklinCovey is cheap, but there is another subscription company that is even cheaper.

It's a company that is the market leader in its sector. During the past decade, it has grown over 20% p.a.

The company's product is timeless, and it offers a service that taps into multiple traits of human nature and desire.

Right now, its stock is getting smothered. However, I have no doubt that it'll emerge a long-term winner once the current sell-off is coming to an end.

Interested to find out more? All details will be revealed in my latest report, published exclusively for Lifetime Members early next week.

Sign up now (if you haven't already!), to get this report straight to your inbox as soon as it's out.

World-leading subscription business at sell-out valuation

FranklinCovey is cheap, but there is another subscription company that is even cheaper.

It's a company that is the market leader in its sector. During the past decade, it has grown over 20% p.a.

The company's product is timeless, and it offers a service that taps into multiple traits of human nature and desire.

Right now, its stock is getting smothered. However, I have no doubt that it'll emerge a long-term winner once the current sell-off is coming to an end.

Interested to find out more? All details will be revealed in my latest report, published exclusively for Lifetime Members early next week.

Sign up now (if you haven't already!), to get this report straight to your inbox as soon as it's out.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: