During the first half of 2021, takeover mania in the UK has gone bananas:

- More bids for British companies than in the same period of any year for the past decade.

- More deals in the UK struck by private equity firms than in any year on record.

- Much higher average bid premiums than would have been paid historically.

Amazingly, this trend might accelerate yet further.

KKR & Co. (ISIN US48251W1045), one of the world's largest private equity groups, has just set up a new team of five dealmakers who will focus on buying British companies.

Why the rush?

For longstanding readers of Undervalued-Shares.com, none of this will come as a surprise.

You've read it here first

I had been onto this trend early on – in fact, too early!

On 23 August 2019, I published a Weekly Dispatch headlined: "Smart money has started to buy Brexit Britain".

As I put it back then:

"The recipe is relatively simple. Here are the key ingredients to cook up delicious takeover profits:

- World-class companies that are greatly mispriced on the stock market because certain media outlets and politicians stoked hysteria for the past three years.

- Bidders with oodles of cash to deploy and a need to generate returns.

- A capital market that is "open" unlike any other in Europe.

…

Here is how I see it: There'll be more bids for British companies, and soon."

After I published this article, things did take a while longer. Bidders were (overly) hesitant. For most of them, it would have been better to buy back then. Valuations of London-listed stocks were at their lowest – their lowest in 30 years, to be precise!

Politics and a pandemic temporarily got in the way, but the trend did materialise in the end.

I published a follow-up piece on 1 January 2021: "Brexit special: a list of potential takeover targets". The London market has since been gripped in a veritable takeover mania.

Here as just some of the recent headlines:

"Private equity barons rush to snap up British firms 'on the cheap'"

The Times, 15 May 2021

"Deal fever sweeps the aisles at Britain's undervalued grocers"

The Times, 4 July 2021

"KKR steps up pursuit of UK companies amid private equity buyout frenzy"

Financial Times, 6 July 2021

I believe this trend has a lot further to run, which is why I'd like to point it out to you once more.

3 reasons why the UK will see more bids

Indices have their flaws, but they are useful for assessing a situation at a glance.

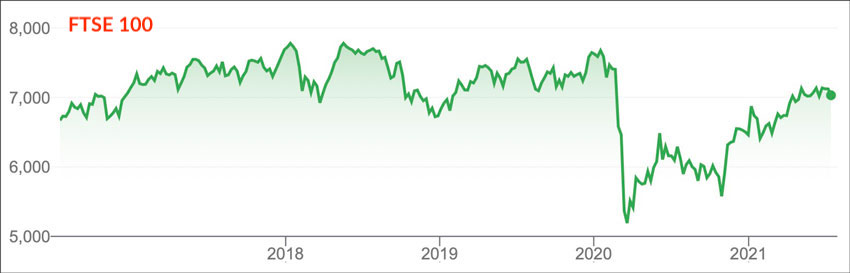

Since late 2019, the FTSE-100 index has not moved an inch. The market has since become more nuanced, i.e. some stocks have moved up dramatically but many others are still trading at rock-bottom valuations.

In the context of M&A, the low valuations of publicly-listed British companies bring about two things:

- Attract buyers, all the more when stocks everywhere else have become rather expensive over the past few years.

- Require huge premiums when bids are made, or else they stand no chance of succeeding.

Case in point, the recent bidding process for Senior (ISIN GB0007958233), the GBP 700m aerospace and defence group. The stock appeared to be a boring Old Economy company, but these kinds of companies tend to be all the more interesting for private equity bidders.

On 19 May 2021, the stock was trading at GBp 102 (GBp = pence). On 20 May 2021, Lone Star Global Acquisitions bid GBp 176 per share. The board rejected the bid as too low. Lone Star upped the bid to GBp 185 per share. Again, the board rejected the bid as too low. Lone Star issued a revised bid of GBp 200 per share.

This would have given shareholders a premium of almost 100% compared to the stock price before the bid approach. Such high premiums for relatively large companies would be very difficult to find elsewhere in Europe – usually it'd be 20-30%.

Still, the board rejected even the offer of GBp 200 per share as too low.

It's interesting to check why the bid got rejected. Senior, a supplier to the problem-ridden Max-737 jet that is produced by Boeing (ISIN US0970231058), had run into trouble even before the pandemic. However, these issues are about to become a thing of the past. As Senior's chairman put it: “The groups end-markets are showing clear signs of recovery." Why sell out on the cheap just as things are turning around?

Indeed, a recovery of earnings is something that can be seen across the London market right now – and it has a lot further to run.

From 2016 to 2020, the UK's stock market suffered from a particularly brutal, lasting decline in earnings. The country's companies were caught up in trade wars, falling energy and commodity prices, the ongoing Brexit uncertainties, and the recession caused by the pandemic.

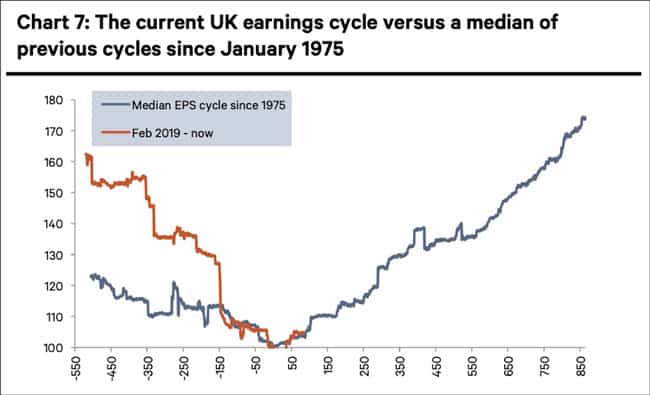

Earnings have now started a recovery. Historically, Britain's earnings cycles lasted 1,206 days and produced a 98% increase in earnings. As the following chart created by Berenberg Research shows, based on the historical duration of cycles, the market is currently only in the first inning of the new cycle. Put another way, even if the broad market recovered further, it'd still be cheap because of increasing earnings.

Last but not least, enter the #1 advantage of the UK's stock market. Among Europe's major stock markets, the London Stock Exchange makes for the most open capital market.

Try making a bid in France – the government will be all over you if you bid for a "strategic" company, which could even be the case if you try to buy a French supermarket chain.

Try bidding for a German company – the country's corporate law is still rooted in the Fuehrer principle, as I once showed in a Weekly Dispatch.

Try having a go at a Swiss company – you'll be up against a tight-knit establishment where everyone knows each other from having been in the trenches together (literally!).

In the UK, on the other hand, companies large and small are bought and sold as a matter of due course. English law is the basis of international commerce, the City of London has a deep talent pool to advise on any kind of transaction, and as the world's fifth-largest economy, the UK offers many potential targets.

For anyone wanting to invest in bid candidates or engage in some kind of M&A-related arbitrage in Europe, the London Stock Exchange currently is THE market to be.

Which is why I went back to my archive and looked up some bid candidates for you. After all, Undervalued-Shares.com is supposed to help you generate new ideas and broaden your thinking.

3 more ideas for you

The 1 January 2021 issue of my Weekly Dispatches already contained a whole raft of British bid candidates. The article is worth checking back to for inspiration.

Plus, here are a few new ideas.

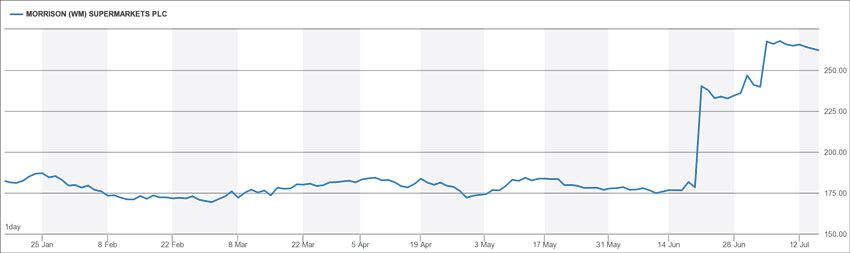

Britain's grocers have seen a lot of interest as of late, following the GBP 6.8bn bid for Asda and the ongoing bidding battle for Morrison (WM) Supermarkets (ISIN GB0006043169) where Apollo Global (ISIN US03768E1055) may yet launch a counterbid.

Morrison (WM) Supermarkets plc.

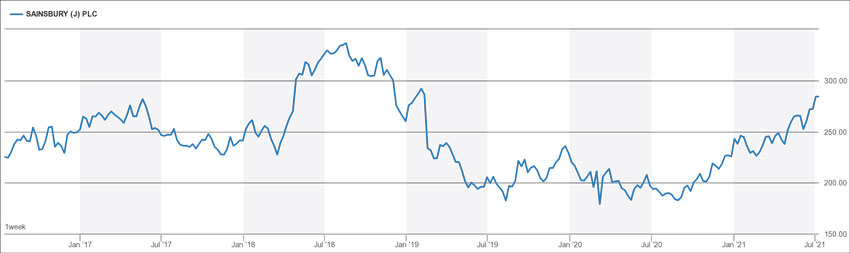

Once Morrison is dealt with, J Sainsbury (ISIN GB00B019KW72) will come into focus as the most vulnerable target of the British supermarket sector. Its long-term shareholder, the Qatar Investment Authority, has sold GBP 300m worth of shares to Daniel Křetínský, the billionaire investor known as the "Czech Sphinx". The transaction could well have laid the groundwork for a bid for Sainsbury's. It's worth keeping in mind that Amazon (ISIN US0231351067) made an approach to Waitrose, the upmarket British grocery chain, in 2017 but was rebuffed. Will the e-commerce giant enter the fray again and compete with private equity bidders? British supermarkets come with reliable cash flow, high margins, and interesting real estate assets. The entire sector is going to stay "in play" during the coming months and Sainsbury's is the obvious way to play it.

Sainsbury (J) plc.

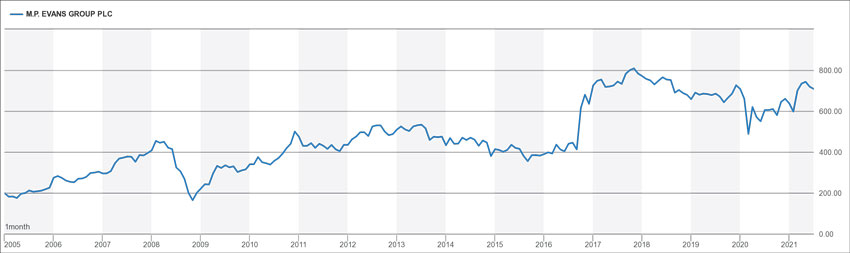

The consumer goods space is deemed boring by most investors, but it offers all the more potential targets because valuations are so low. It might be worth taking a closer look at MP Evans Group (ISIN GB0007538100), the GBP 400m palm oil producer. The company had received a hostile bid in 2016, which it rebuffed it. The bidder, Kuala Lumpur Kepong Berhad (KLK), acquired a 22.2% stake at the time and has recently upped its stake. The stock is trading for GBp 720 even though it has a net asset value of GBp 1,100. The NAV may even be higher right now, given the global price rise for agricultural commodities.

M.P. Evans Group plc.

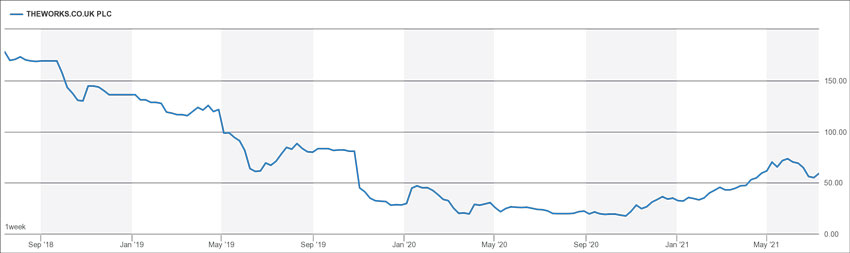

Small-cap sleuths could look at TheWorks.co.uk (ISIN GB00BF5HBF20), a GBP 40m minnow that investors have been neglecting for years. The company is the UK's leading family-friendly retailer of value gifts, arts, crafts, toys, books and stationery. It has over 500 stores nationwide and generates GBP 250m in sales when there aren't lockdowns. Retail has its challenges, but these are well-known and priced in. TheWorks.co.uk has one of the cheapest valuations in the sector. At its current bombed-out valuation, a bidder could buy a quality business with huge reach across the UK. This company will turn up on the radar of any financial investor screening the UK market for potential targets in the retail space.

TheWorks.co.uk plc.

These are just some of my off-the-cuff ideas and casual market observations. Please don't mistake any of these stocks as my definitive list of takeover targets in Britain. I have only done the most cursory research and merely mention them to give you a few pointers for further research.

I did, however, produce in-depth research about other British companies in the past, and some of them are now takeover candidates:

- Capital & Counties (ISIN GB00B62G9D36) owns the Covent Garden estate in Central London, and I consider it a prime target for a bid by a Sovereign Wealth Fund. The stock is trading well below its NAV, even though Covent Garden is the highest-quality real estate asset imaginable.

- John Menzies (ISIN GB0005790059) is one of the world's leading ground-handling agents at airports. It's a prime target for Cerberus and Apollo Global, the two private equity companies, since they already own ground-handling firms and need to acquire more market share. John Menzies stock has recently seen massive investments by insiders, and its situation is probably comparable to Senior, inasmuch as the stock price is so ridiculously low that a bid would have to involve a silly premium to stand an acceptance chance.

- Just Eat Takeaway.com (ISIN NL0012015705) is not per se a British company, but its primary listing is in London and the UK is one of its three most important markets (Just Eat was a British company before it merged with Takeaway.com from the Netherlands and Grubhub from the US). Its stock price is way lower than that of its competitors and the company is extremely vulnerable to a hostile bid.

If you are looking to get involved in Britain's takeover mania, you should consider checking those companies out.

In any case, the UK's stock market will continue to see bid activity on an unprecedented scale. All the while, it's also seeing a record number of new companies going public – many of them in high-growth areas, such as Fintech or cyber security. Over the coming years, the UK market as a whole should be doing well - watch this space for updates!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Yet another British opportunity…

... not a takeover candidate per se, but very promising in other ways!

Owning this particular stock is like an insurance against Europe experiencing tough times. If Europe struggles economically – because of inflation, rising taxes, and a lack of innovation – this stock should go up.

This company could grow by a factor of 4-7 times during the 2020s even if it just kept growing at its recent growth rates. If the economy turns sour or politicians tax people like never before – it will do all the better!

Who am I talking about? Find out in my latest report, out for Members this week.