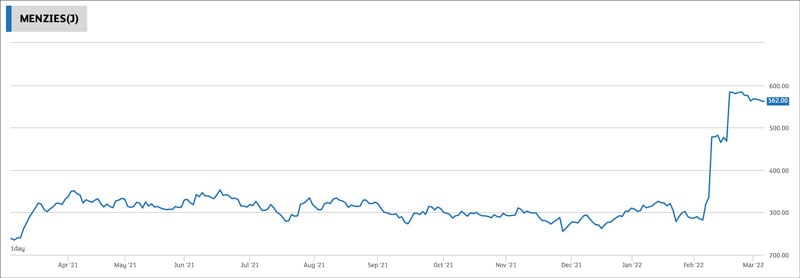

It's taken longer than expected, but the subsequent bid was fulminant and quick.

John Menzies (ISIN GB0005790059), the British airport ground handling specialist that I had featured in one of my research reports, received a hostile takeover approach from Kuwait.

The stock ended February 2022 with a gain of +100% - quite a remarkable performance during a month that was generally rather challenging for equity investors.

Given the plethora of undervalued takeover targets in Britain, where will bidders strike next?

Undervalued-Shares.com set out to investigate.

John Menzies.

It's (still) raining bids

The wave of takeover bids for London-listed companies is something that I reported on repeatedly and early.

Too early, to be honest.

But it's been playing out just as planned after all, once the initial panic of the pandemic subsided. In 2021, the London market saw 110 attempted or completed takeover transactions. That's a bid or attempted bid for a publicly listed company every 79 hours.

These bid situations were unusually lucrative. As I wrote in my 16 July 2021 Weekly Dispatch, these takeovers involved "much higher average bid premiums than would have been paid historically". This has been due to the low valuation of the London stock market or, to be more precise, of old economy companies listed in the UK.

Tech companies were glamorous for a long time, but recently it's been old economy companies that brought their shareholders stunning returns (while most tech stocks were in reverse gear).

As far back as August 2019, I outlined how London-listed companied had the lowest valuations in 30 years. The valuation differential between the US and UK markets particularly attracted bidders from across the pond: off the 53 firm offers made in 2021 for publicly listed British companies, 27 came from US bidders. The relative undervaluation of the pound sterling versus the dollar only added to the overall attraction.

This included an increasing willingness to pursue hostile takeovers. Unlike many other European countries, the UK has a very open capital market. In 2021, France blocked the potential takeover of a French supermarket chain by a Canadian bidder because of "national interests". In the UK, such nonsense would rarely happen. For Brits, even hostile takeovers are par for the course if you run a market-based economy and a global stock market.

It's very likely that, during the course of 2022, the boom in UK public M&A activity will continue. There is a plethora of underappreciated small and medium-sized British businesses that have carved out a niche and become important players in their industry, and which make for attractive bid targets because their stocks are undervalued.

In July 2021, the professional advisory firm, Alvarez & Marsal, concluded that 36% of the potential hostile takeover targets in Europe were based in the UK. There are USD 2tr of "dry powder" available to the private equity industry, and Britain is one of the prime targets for some of that money getting deployed.

Which companies will these investors hone their gun on next?

Here are a few specific ideas for you to research further, and one where Undervalued-Shares.com can offer a lot of in-depth research.

Big, chunky targets

The #1 forecast that today's Weekly Dispatch would like to make is that activist investors and bidders will set their sights on fewer but larger targets.

We have already seen instances such as US activist Elliott Management calling for the mega-sized British pharma company, GlaxoSmithKline (ISIN GB0009252882), to overhaul its leadership.

During 2022 (and 2023), we are likely going to see more takeovers and activist activity (or a combination of both) involving very large British companies.

One of the sitting ducks of the London market are the country's leading supermarket chains.

We already saw a US private equity group, Clayton, Dubilier & Rice (CD&R), win the bidding battle for the UK's fourth-largest supermarket group, Morrisons. Shareholders pocketed a 62% premium in just four months.

Two other British supermarket groups remain targets. Tesco (ISIN GB00BLGZ9862) is seen as an attractive target for private equity investors, and Sainsbury's (ISIN GB00B019KW72) is known to have been courted by private equity. In August 2021, Apollo Global Management (ISIN US03769M1062) allegedly explored a bid for Sainsbury's, and Fortress was also reportedly interested after losing the bidding war for Morrisons. Analysts at Bernstein last year believed that Tesco was "the most attractive" takeover target among British supermarkets, not the least because of its clear-cut focus on the UK.

There are potential targets across the board of many industries, and sometimes involving famous British brands. My 24 September 2021 Weekly Dispatch asked: "Burberry - the next takeover target?". The famous luxury goods maker remains a potential target.

There are also some tech or tech-related bid opportunities. This includes cases where an initial bid approach didn't work out, but may yet be followed by another, higher bid.

Australia's Aristocrat Leisure (ISIN AU000000ALL7) tried to purchase British gambling software company Playtech (ISIN IM00B7S9G985). However, shareholders rejected the GBP 2.1bn bid even though it represented a ≈90% (!) premium compared to before the bid situation started. The mind boggles! The stock is now down quite a bit, but it could see a renewed bid from the Australians following a six-month cool-down period, or from Asian bidders that are already liaising with the company.

The depth (size) and breadth (range of industries) of UK firms that could become takeover targets is breathtaking, as is the potential for earning very significant bid premiums. Even now, British old economy stocks are undervalued across the board. It's a target rich environment.

Another such target is hiding in plain sight and will be known to anyone who has ever spent a weekend in London.

A super-prime target in the centre of London

John Menzies is a company that I featured at a rather inopportune moment. After I published my initial report, the pandemic shut down the world, and stocks of tourism-related businesses collapsed.

In the case of Menzies, we have now come full circle and the original investment thesis did play out in the end. It earned a decent return even compared to the prevalent prices of 2019, and many of my readers had averaged down during the pandemic sell-off.

It's worth going back to the second such case among my older research reports.

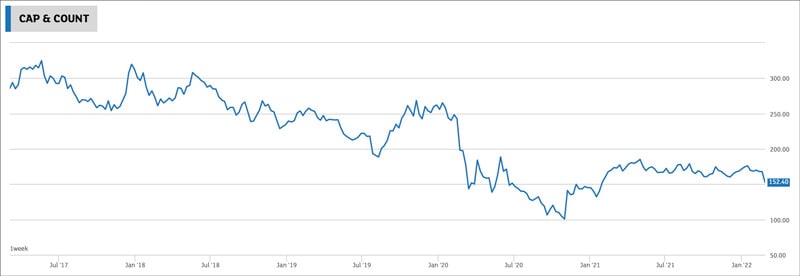

Capital & Counties Properties (ISIN GB00B62G9D36) is a company that I still consider one of the best takeover targets of the UK market.

"CAPCO", as the company is also known, owns much of the neighbourhood around Covent Garden. This is AAA+ real estate of the kind that sovereign wealth funds and other long-term investors are licking their fingers for. In a normal year, 60m visitors find their way to shop, eat or mingle around Covent Garden.

CAPCO took a beating during lockdowns, but it also managed to use the crisis to further its agenda. During the pandemic, CAPCO purchased a 25% stake in a similar company, Shaftesbury (ISIN GB0007990962). Shaftesbury controls the real estate around Carnaby Street, another world-famous Central London destination that is on the must-see list of just about any first-time London visitor.

Within weeks of my initial report, investors linked to the Saudi sovereign wealth fund made a bid approach but didn't succeed. The stock subsequently dropped through the floor and it's been slow to recover. However, the business has been doing quite well of late. The lockdowns even resulted in a few permanent advantages, such as 1,000 additional cover spaces for outside restaurant seating. These were added using emergency regulation during lockdowns, but will now become a permanent addition to the Covent Garden estate.

Earlier today, I sent Undervalued-Shares.com Members an updated research note with the latest details and estimates for CAPCO. By mid/late 2023, CAPCO could be a stronger business than before the pandemic.

Will it still be a publicly listed company then, or will someone make a successful, lucrative bid for the company sooner than that?

I bet the latter will be the case, and it's probably going to be at least 50% above the current stock price (if not higher).

The prime candidate for a bid is the Norwegian Sovereign Wealth Fund, Norges Bank. The Norwegians already bought a 14.99% in CAPCO, and they also directly own 25% in Shaftesbury. Since Norges Bank is known to be amassing super-prime real estate in Central London, figuring out that it could eventually launch a bid for the entire company isn't rocket science. That is, if there isn't someone else beating Norges Bank to it while the other 85% of CAPCO remain in the hands of other investors. The Norwegians must be aware that it's a time-sensitive bid opportunity.

Now could be a great time to check out this stock, because it's come back down in price recently.

Capital & Counties Properties.

Many UK stocks remain undervalued, and there is a chance to earn takeover premiums at a time when many other segments of the stock market are struggling. It's not a particularly glamourous investment approach, and story stocks such as Peloton (ISIN US70614W1009), Zoom Video Communications (ISIN US98980L1017), or Beyond Meat (ISIN US08862E1091) are more interesting to talk about at dinner parties. For the moment, though, boring old economy companies that attract bids are not to be sniffed at.

Undervalued-Shares.com will continue to report about these opportunities. As a matter of fact, an exciting in-depth research report about a British company is in the pipeline for Undervalued-Shares.com Members. Stay tuned for more!

The best business in the world?

Who wouldn't want to invest in an investment newsletter publisher that features the following?

Readership grown in 18 of the past 20 years.

Profitable in 20 of the past 20 years.

A founder which started the company with just USD 50,000 - and is now worth several hundred million dollars.

At long last, such an opportunity is available in public markets.

My latest research report, just out for Undervalued-Shares.com Members, has all the details.

It's the definitive investment analysis of the world's only publicly traded investment newsletter publishing company!

The best business in the world?

Who wouldn't want to invest in an investment newsletter publisher that features the following?

Readership grown in 18 of the past 20 years.

Profitable in 20 of the past 20 years.

A founder which started the company with just USD 50,000 - and is now worth several hundred million dollars.

At long last, such an opportunity is available in public markets.

My latest research report, just out for Undervalued-Shares.com Members, has all the details.

It's the definitive investment analysis of the world's only publicly traded investment newsletter publishing company!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: