Trust Americans to come up with a catchy name for a new theme.

When I first outlined ideas on how to profit from rich people leaving their home countries, I gave my article a real mouthful of a headline: "Microstates, private cities, new countries – an emerging investment theme?"

Hedge fund manager Harris "Kuppy" Kupperman boiled it down to a simpler term: "the 0.1% refugee crisis".

Right away, the theme started to go viral, prompting Kuppy to organise a joint online session to discuss ideas on how to go long this trend. So big was public interest that 1,800 people signed up – the most sign-ups Kuppy had ever got for such an event. Attendees inundated us with so many questions that we stayed online for 2.5h.

A video recording is available, but knowing that some prefer the written word, today's Weekly Dispatch provides a summary of this session (including some stock ideas!).

Wait – what crisis?

"0.1% refugee crisis" is a catch-all term to describe a wide variety of people.

To be clear, it's not just the ultra-high-net-worths who are moving to greener pastures. In fact, you don’t even need to be rich at all to fall under this theme.

As I said during the online discussion with Kuppy: "If you are young and not rich yet, you HAVE to consider alternative jurisdictions. Excessive bureaucracy and taxation are now a permanent part of life in most Western nations, and it will likely prevent you from ever becoming affluent in the first place. Even if you do defy the odds and succeed anyway, you will find that exit taxes will prevent you from taking your wealth to enjoy it abroad."

In the US, to be part of the 0.1% would require you to have USD 50m.

However, a stunning 22m Americans (6.6% of the overall population), are at least millionaires. Many will develop an interest in places that offer them a combination of benefits. Throw in young, aspiring people, and you could make it the 10% refugee crisis.

It all started with the very wealthy seeking friendlier climes, though.

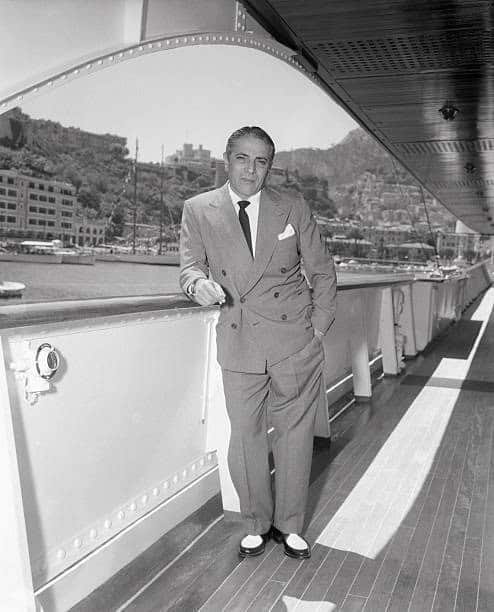

No other place embodies this trend quite to the same degree and for as long as Monaco. During the 1950s, Aristotle Onassis, then the world's richest man, moved the headquarter of his Greek shipping business to the tiny principality. Bringing along glamorous friends and investing in refurbishing run-down real estate, Onassis single-handedly has done more for the future of this jurisdiction than anyone else – including Rainier III, Prince of Monaco from 1949-2005.

Aristotle Onassis onboard his yacht in a much less-developed Monaco (1955).

However, sheltering wealthy migrants has long come with reputational issues. Somerset Maugham once called Monaco "a sunny place for shady people". The term stung, and it stuck. Politicians the world over depict what they call "tax havens" as one of the ultimate bogeymen. Guardianista-type journalists love to dish it out to anyone based "offshore".

Do these platitudes match reality, though?

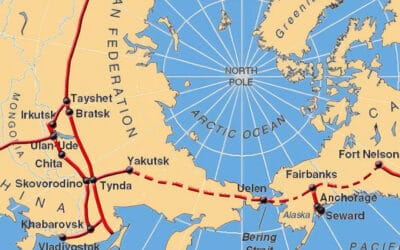

Since 2009, almost the entire world has moved towards tax transparency. Secret bank accounts and letterbox companies are no more. Today, if you want to benefit from jurisdictional advantages, you have to live in that respective jurisdiction and base a substantial part of your business there (the technical term being "substance requirements"). Jurisdictions that adhere to these rules now even get an official stamp of approval: they are on the OECD's "White List", the official list of good guys.

Politicians and some journalists will never stop railing against rich and productive people who decide to move where they are treated best – a perfectly legitimate choice. There are those voters who love generous welfare systems or strict regulation of all aspects of life – fair enough. Just as fair is the fact that some countries opt to do things differently, and also at the behest of their voters.

Take Guernsey, one of the Channel Islands and a place that I run a business from. It's been a democracy for longer than many other European jurisdictions, and as such needs no lecturing from the outside world. It has a hard-limit on the size of government. No more than 24% of GDP can go towards the state, by law. This compares to 44% in the UK, 49% in Germany, and 57% in France. The electorate of Guernsey doesn't seem to desire political parties (all members of parliament are independents), opposes government debt (because it's unfair to future generations), and rejects oppressive bureaucracy (because government should serve the people, not the other way around). The island jurisdiction's income tax is just 20%, and there are no taxes on sales, capital gains, or inheritances. Does that make it a "tax haven"? While The Guardian thinks it does, Guernsey has been on the OECD White List since its very inception in 2009. Neighbouring Jersey just got a clean bill of health from the world's money laundering authority, MONEYVAL – and Guernsey will very likely get the same stamp of approval again in the next year. With such a track record, who is to seriously argue against people moving there legally to join a different way of life?

Source: KPMG, August 2024.

Going where you are treated best is going mainstream

The never-ending barrage of cheap political slogans has not prevented jurisdictions of this kind to become more appealing to a fast-growing number of people.

It used to be only the very rich who could access information and advice on how to use such jurisdictions to better their life, but the Internet and trends perpetuated by the pandemic lockdowns have changed the playing field altogether.

Few other people embody this new trend quite as much as Kathleen "Kathy" Di Paolo. Young, female and media-savvy, Di Paolo calls herself an "International Tax Consultant". Her website, though, goes beyond just taxes. Di Paolo "empowers Entrepreneurs, Digital Nomads, Freelancers, Expats, and all other Wanderers of the World with financial knowledge by teaching them about tax residency schemes, tax exemption programs, and low tax countries her readers probably never heard about before."

The former international tax lawyer now offers her services on her website Wanderers Wealth, and 23,000 fans are following her and her fiancé's globetrotting lifestyle on Instagram.

If using low-tax jurisdictions got you deemed a "tax dodger" in the past, it now has a younger, friendlier face.

And Di Paolo isn't alone. There is the equally youthful Ladislas Maurice (aka The Wandering Investor), who has tens of thousands of followers of all age groups on platforms like LinkedIn, Instagram and YouTube, eager to learn international real estate investing in locations like Montenegro and Panama. Investment Migration Insider, run by a husband-and-wife team in their 30s, publishes background information about jurisdiction shopping, and sells affordable e-guides such as "11 Special Regimes for Low-Tax Living in High-Tax Europe".

Source: Investment Migration Insider.

None of this is new, though. The desire to improve your life by moving to a place that treats you better has been around for longer than anyone can remember.

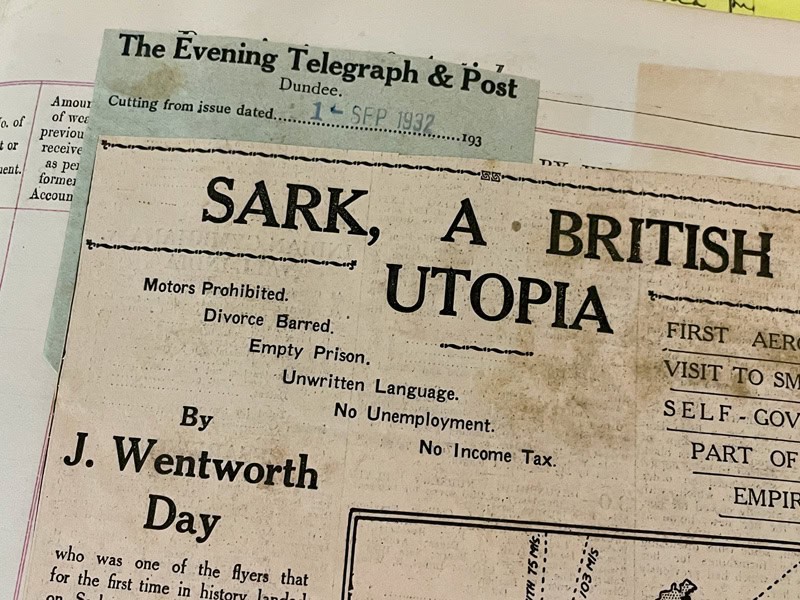

Case in point, Sark. The tiny island that I have made my home has recently seen a lot of (international) media attention. Though even as far back as a century ago, Sark was already experiencing "the arrival of many rich Canadians seeking evasion of government levy".

As the newspaper reporting of the time admitted, it wasn't just taxes that attracted these new residents:

"There is something about island that gets us all. Some day to drift down a blue Summer sea to a little green-and-white island, and there on its shores, with the echo of its surf-songs to leave the worries and complications of civilization far behind, and 'get away from it all' – well, that's the magic inner dream of almost every man and women."

Source: The Evening Telegraph & Post, 1 September 1932.

Indeed, when I speak to people who moved to Sark, it becomes clear that this idea of someone moving somewhere just to get away from taxes is anything but a myth. Reasons for such a move always include lifestyle, climate, community and similar factors – with lower taxes thrown in as just another bonus.

In fact, there are now SO many places on Earth that offer newcomers an attractive deal on taxes that a jurisdiction which tried to win residents solely by offering lower taxes would be guaranteed to fail. The market has become competitive, with 100+ jurisdiction trying to attract the rich, the productive, the academically overachieving, and the creative.

Only a few will emerge as substantial winners, and it's those that Kuppy and I were interested in for the purpose of investing.

How to invest?

In most Western nations, taxes are increasing, and freedoms are eroding. It's unlikely this trend is going to change anytime soon. Closing borders is more difficult nowadays, and we will likely see many of the rich and productive fleeing. In some jurisdictions, they will seriously move the needle.

Source: The Telegraph, 31 August 2024.

How to get in on the act as an investor?

The bad news first, it's not easy, and many investments in this sector have been private.

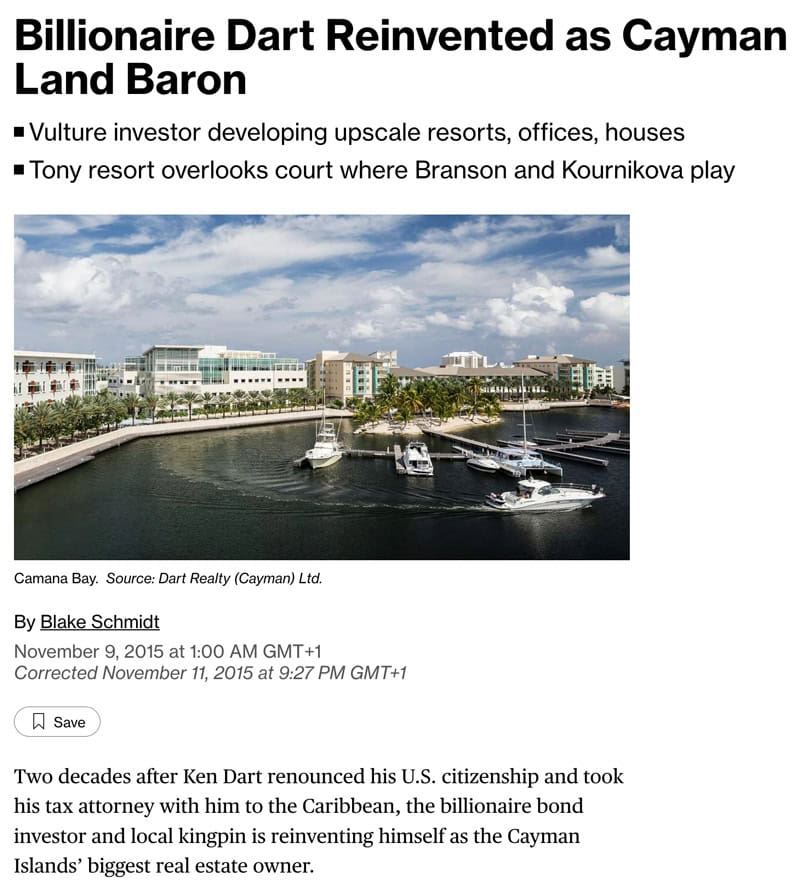

Case in point, the incredible investment homerun of Kenneth Dart in the Cayman Islands. A reclusive heir and billionaire, Dart is renowned as a skilful investor. He moved to the Cayman Islands in the 1990s and then spotted an opportunity following the devastating 2004 hurricane "Ivan". When the Cayman Islands was laying in waste, Dart bought up large chunks of real estate and helped the territory back on its feet by investing majorly at a time when others had written off the islands. He now owns 20-25% of the entire Cayman Islands, and rising prices for real estate have added billions more to his net worth. It is bound to grow in value further, given the attractiveness of the jurisdiction in today's world.

Source: Bloomberg, 9 November 2015.

Was there a way to participate in the success of the Cayman Islands? Only if you bought real estate yourself. Much as that has been (and remains) possible, it requires a chunky investment and the management of tenants. Real estate is the go-to asset class in all these jurisdictions, but it's not for everyone.

Luckily, there are stocks that give you pure exposure to such opportunities.

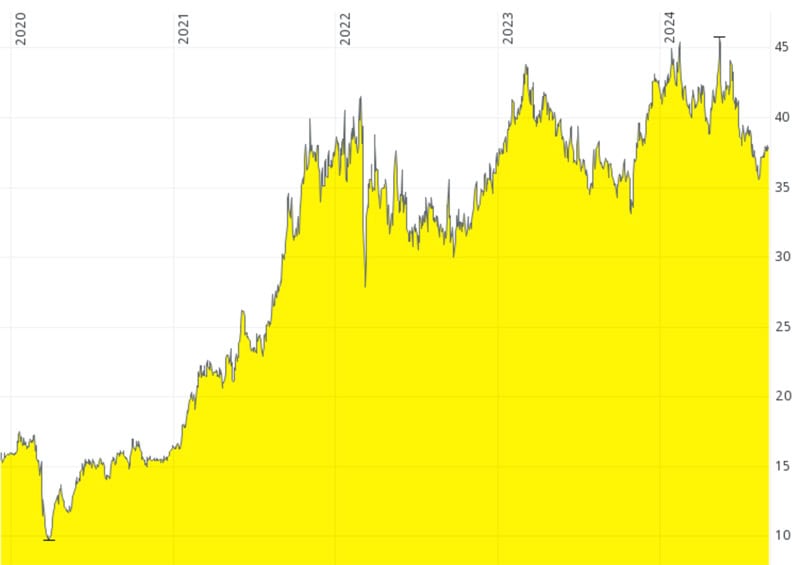

Kuppy spotted one such opportunity in The St. Joe Company (ISIN US7901481009, NYSE:JOE), one of the largest owners of real estate in the Florida panhandle. Florida has become a refuge for the 0.1%, and property has gone vertical. Since the current bout of madness broke out in the world in late 2019, the share price of "JOE" has gone up from USD 18 to now USD 60. Kuppy believes the potential of the company to have grown even further, and still has its position as a core holding.

The St. Joe Company.

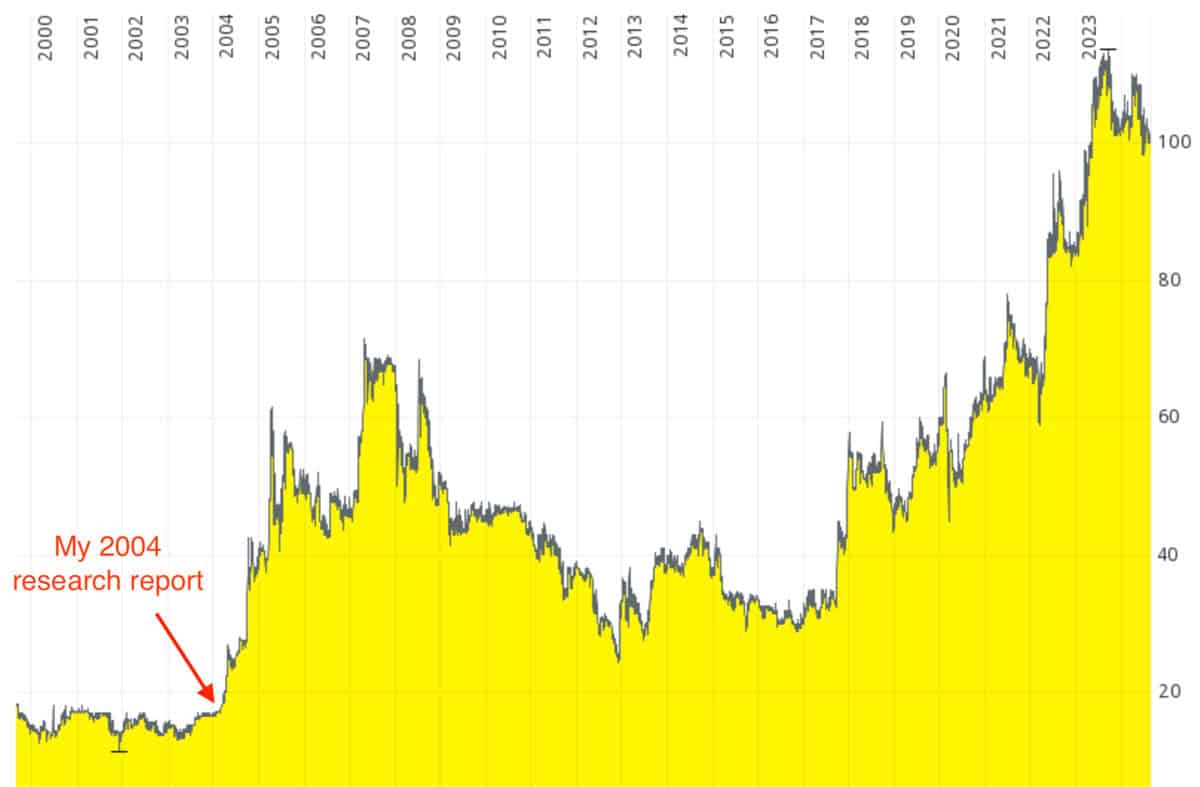

Another opportunity is the Monaco-based Société des Bains de Mer (ISIN MC0000031187, PA:BAIN), which owns the principality's best real estate. Yours truly discovered it in 2004 when it was trading below its cash value even. SBM's share price has since grown six-fold, and the stock is still greatly undervalued. Obviously, Monaco real estate is one of the ultimate assets to play the 0.1% refugee crisis.

Société des Bains de Mer.

The existence (and success) of these stocks begged the question, what other names are going to benefit?

During our joint online discussion, Kuppy and I went through a couple of names.

One obvious but still little-known name is The Bank of N. T. Butterfield & Son Limited (ISIN BMG0772R2087, NYSE:NTB), a private bank based out of Bermuda. Butterfield has no branch exposure to the US or the EU, and instead focuses on its home market in Bermuda, as well as the Cayman Islands, Guernsey, Jersey, and similar jurisdictions. It has a very conservative balance sheet, benefits from stable fee income from wealth management services, and has been in business for over 250 years. With a market cap of USD 1.7bn and a listing on the New York Stock Exchange, this is anything but an exotic small-cap stock. I wrote about Butterfield in October 2022 already, describing it as a "Plan B" institution. (Disclosure: Entities that I represent are in a business relationship with Butterfield Group.)

With a growing number of the 0.1% refugees choosing to live on a boat, Italian yacht manufacturers such as Sanlorenzo Yachts (ISIN IT0003549422, MIL:SL) could also be among the beneficiaries. The company's stock is up 2.5x since the madness of 2020 began.

Sanlorenzo Yachts.

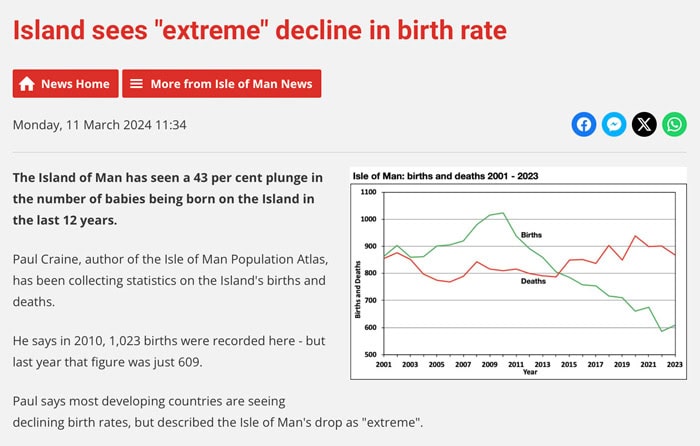

What about jurisdictions? One that is potentially completely overlooked right now is the Isle of Man, another Crown dependency with many features and metrics comparable to those of the Channel Islands. In fact, in the 2000s, I nearly moved there myself. The Isle of Man has recently made headlines for an extreme demographic crisis, and it has largely fallen off the radar.

Source: 3FM, 11 March 2024.

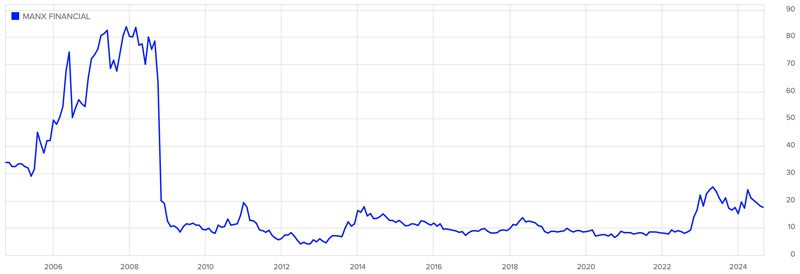

However, the island would have all the right features for a relaunch aimed at today's changing markets. Why not create a cheeky advertising campaign to market it as a tax haven for either gay men or those who are masculine in the traditional sense – the "Isle of MAN"? Global headlines would be guaranteed. (I am half-serious.) Amid all these possibilities sits an investible company: Manx Financial (ISIN IM00B28ZPX83, UK:MFX) is a London-listed holding company built around the Isle of Man's only domestic bank, Conister Bank. Controlled by the Isle of Man-resident billionaire investor Jim Mellon, its stock has been languishing ever since the Great Financial Crisis of 2008.

Manx Financial.

Manx Financial now has a market cap of just GBP 21m, and Mellon could easily bring the stock back to life with a new, innovative concept. Critics who have followed the company for many years counter this thesis, saying that Mellon no longer had it in him to orchestrate such a relaunch (15 years of a sideways stock price is backing their view). Whichever theory is right, Manx Financial is a stock with significant Isle of Man exposure, which shows that going long these specialist jurisdictions is possible for anyone with a brokerage account.

In fact, there are probably more such plays than you'd expect.

However, no summary would be complete without touching on…

The Sark IPO

Longer-term Undervalued-Shares.com readers will probably know of my plan to buy at least 20% of the island of Sark and launch a real estate company on the London Stock Exchange (see previous articles here, here and here).

For a frank, no-holds-barred conversation about the subject, check out my recent 1h conversation with Cody Shirk and Austin Brawner of The Adventure Capitalist. I believe it's the single most insightful conversation I have recorded about the subject with any podcaster out there.

Source: The Adventure Capitalist.

To get this endeavour to the finishing line, the Sark Property Company (of which I am CEO) needs to mobilise GBP 20m of equity and GBP 10m of debt. The company has secured the debt, and it has mobilised GBP 18m of the equity it needs – it's nearly there. The company will publish its full prospectus next week and it should then close its funding round. This Weekly Dispatch cannot serve as part of its fundraising campaign, and you will have to check the Sark Property Company's website to download the prospectus when it comes out (for legal reasons, I have to point you towards that document's risk disclaimer).

If you are currently in Germany, you could also head to the newsstand and pick up a copy of German news magazine FOCUS (also available for purchase as a PDF). The issue released today contains a three-page feature of the project.

Source: FOCUS, 6 September 2024.

If these efforts work out, an eventual IPO of this company on the London Stock Exchange could make for another pure play on the 0.1% refugee crisis. Keen on getting more exposure to this macrotrend, Kuppy is the company's prospective anchor investor with a GBP 4m ticket and now also a board member.

Over the coming years, more such opportunities will be listed, for sure.

As Kuppy said in his own long-read article about the subject, this is "an investible Mega-Trend that no one is following…. I feel like many of these prime jurisdictions are just hitting critical mass now, and about to enter the exponential phase. … Wealth is now mobile —successful people want to be with other successful people and away from the inevitable chaos as their home countries are undermined from within."

Amen.

Source: Praetorian Capital, 30 August 2024.

Send us your ideas

Along the way, we'll see many more listed plays emerge.

From the department of crazy ideas: someone could do a roll-up of service providers in the field of citizenship-by-investment. Henley & Partner leads the field and could make a SPAC deal to go public and buy up smaller competitors in this highly fragmented market.

A more conventional play would be to launch an ETF that is tied to the overall performance of a basket of suitable jurisdictions.

In any case, this trend will run a long time, and it'll become part of the investment landscape. Our thinking may have a dash of iconoclasm, but that'll change as the trickle turns into a flood.

Our desire is to be in on it while it's only just emerging.

With that in mind, both Kuppy and I would love to hear from you if you have further ideas on how to go long the 0.1% refugee crisis.

The 0.1% refugee crisis (video recording)

The new mega trend of the 0.1% refugee crisis – what are the causes of high-net-worth migration, and which sectors and jurisdictions are going to benefit?

Watch Kuppy and myself as we dive deep into those questions. If you enjoyed today's Weekly Dispatch, you will love this video!

It's a lengthy one (over two hours), but worth every second.

The 0.1% refugee crisis (video recording)

The new mega trend of the 0.1% refugee crisis – what are the causes of high-net-worth migration, and which sectors and jurisdictions are going to benefit?

Watch Kuppy and myself as we dive deep into those questions. If you enjoyed today's Weekly Dispatch, you will love this video!

It's a lengthy one (over two hours), but worth every second.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: