In early 2020, experts for distressed debt filed a lawsuit in London to force payment from the Cuban government. The move sent shock waves through the secretive world of investing in defaulted claims against Cuba. Never before had such a claim been brought to the English court system.

How is this story going to unfold? Undervalued-Shares.com had a chance to analyse the court documents, and will put you in the picture. Not only that, a small number of you will also be able to become part of the Cuban debt story (spoiler alert: this article includes an exclusive offer!).

If you are curious about making money from distressed sovereign debt, today's article gives you a model case to learn from.

A decisive phase for ancient Cuban claims

After last week's Dispatch about distressed opportunities in Venezuela, it's only logical to take another look at Cuba. Both countries had long kept a special bond, and were joined at the hip in some ways.

When Venezuela collapsed into an existential crisis in 2016, Cuba suffered from a reduction in support that it had previously received from its socialist brother (including much-needed oil). The island nation also had to endure increased US sanctions under Donald Trump and the economic fallout caused by the coronavirus pandemic. In mid-2021, Cuba even saw some large-scale protests, which was unusual for the otherwise quiet, repressed authoritarian state.

You'd think that anyone owning claims against Cuba would be happy to have someone bid a few pennies for it, given the overall desperation of the situation. Far from it, though. Despite the recent turmoil, Cuban debt has become an asset that is almost impossible to get hold of nowadays. For many years, claims had come up for sale occasionally and often at rock-bottom prices. Right now, you'd be hard-pressed to find any sellers.

How come?

A lawsuit filed in London has changed everything.

I had correctly predicted this development in my February 2020 report "Cuban debt: the awakening?" – probably the single most comprehensive (and entertaining) piece you can find about distressed sovereign debt claims in general, and Cuban claims in particular.

As the report described in more detail:

- Cuba had already signed compromise agreements for 85% of its old debt.

- Under its new leader, Raul Castro, the nation was willing to discuss the remainder.

- Economic need and legal pressure would eventually lead to a solution.

Why would Cuba care about repaying ancient defaulted debt?

A nation that has defaulted international debt outstanding is blocked from accessing international financing mechanisms, unless it comes to an agreement with the foreign owners of the defaulted debt. Usually, such a resolution involves paying the creditors a percentage of the outstanding debt, rolling old debt over into new debt issues, and stretching out payments over a generous period (or a mixture of these measures). In any case, the owners of the old debt need to be offered *something* so that, in exchange, they let the debtor off the hook.

Cuba has signed agreements for debt owed to Russia, China, and a host of other foreign debtors. As the largest claim holder, Russia was the first to agree to a solution, which is why it got the worst deal – just 10% repayment with generous payment terms, with the remaining 90% of the debt forgiven. Japan (with smaller claims) managed to get Cuba to agree to a repayment of 20% of the outstanding claim. Up to now, Cuba has negotiated agreements for USD 53bn of old debt, or about 85% of the outstanding claims. At times when Cuban debt was still trading more actively, these claims attracted prices of up to 42% of the outstanding amount.

The last parties to agree to a deal (the so-called "hold-outs") usually get the best deal. Such was the case with Argentina, which had defaulted on USD 93bn of sovereign debt in 2001. During the first wave of debt restructuring, the country settled with 93% of the bond holders and agreed to repay them 25-30% of the original amount. The remaining 7% had to wait until 2016 and go through the international court system, but repaid them between 75-100% of the original amount. Elliott Management, the New York hedge fund, famously made around USD 2bn in profit from its investment in defaulted Argentinean bonds, which it had picked up for the proverbial pennies on the dollar.

In the case of distressed Cuban debt, the party to watch is the so-called London Club. This is an alliance of Cuban debt owners who have grouped together to negotiate a deal for their USD 6.4bn in claims, which represent about 10% of the overall Cuban claims.

After years of trying to get Cuba to negotiate an agreement, the London Club eventually ran out of patience. In February 2020, one of the entities that form part of the London Club, an investment fund called CRF I, took the matter to the English court system.

A game-changing lawsuit

English law is the world's gold standard for commercial transactions, and English courts regularly become the venue for dealing with complex commercial matters. The Commercial Court at the Royal Courts of Justice in London is now hosting the probably single-most important legal case for resolving the remaining Cuban debt issues.

Judges in London are now weighing in on the matter (image credit: Thinglass / Shutterstock.com).

CRF I has filed a lawsuit for claims totalling USD 100m, suing both the Republic of Cuba and its central bank (the Banco Nacional de Cuba) for payment. These are claims that originated out of borrowing agreements between Cuba and two European banks (Crédit Lyonnais and L' Istituto Bancario Italiano), where the Cuban central bank had acted as a guarantor. It represents a small part of the USD 1.5bn in claims that CRF I had purchased over the years on behalf of its investors, but the verdict will likely extend to comparable claims.

How has the lawsuit been advancing?

Unbeknownst even to many participants of the Cuban debt market, the entire batch of court documents has actually founds its way onto the Internet. cubatrade.org has managed to get hold of them, though they are pretty buried among the website's labyrinthine content. The 14 documents are available under the following links:

- Claim Form (18 February 2020)

- Order (8 March 2021)

- Amended Claim Form (16 March 2021)

- Consent Order (17 May 2021)

- Sealed Amended Claim (14 June 2021)

- Amended Points Of Claim (14 June 2021)

- Amended Details Of Claim (15 June 2021)

- Order (17 June 2021)

- Consent Order (13 July 2021)

- Consent Order (19 July 2021)

- Points Of Defence (23 July 2021)

- Consent Order (4 August 2021)

- Points Of Reply (4 October 2021)

- Defendant's Response To The Claimant's Part 18 Requests Of The Points Of Defence (11 November 2021)

What can we learn from these documents?

For the first time ever, the Republic of Cuba has started to answer to the claims. Someone in Cuba's government seems to have realised that if it didn't react, the English court could simply issue a so-called summary judgment based on the information provided by the claimant. This could have enabled the creditors to pursue Cuban assets held anywhere in the world, reminiscent of Elliott Management's famous arrest of an Argentinean navy vessel with 200 crew onboard in a harbour in Ghana, Africa. Instead of creating another headache for itself, Cuba decided it was wiser to actively participate in the court case.

Based on the court documents, Cuba first tried to throw mud at the claimants. CRF I was called a "vulture fund" and accused of having paid bribes to Cuban officials. Seemingly not impressed by this strategy, the Royal Courts of Justice has now ordered the calling of expert witnesses, and an in-person trial is scheduled to commence in January 2023.

In addition, a second lawsuit has now been filed by the Industrial and Commercial Bank of China (ICBC), a state-owned commercial bank widely believed to be the largest bank on the planet. Why would a bank owned by Cuba's long-standing political ally sue for old debt? In 2015, ICBC had taken over an operation previously owned by Standard Chartered Bank in London. As a result, ICBC Standard Bank, the bank's subsidiary in London, ended up with custodial obligations towards clients that own old Cuban claims. It appears some of these clients forced ICBC to represent their interests, and the bank's London subsidiary has now filed claims against both the Republic of Cuba and its Central Bank. These claims total around EUR 200m of principal capital and around EUR 1bn in accumulated interest. The entire situation must be highly uncomfortable for both China and Cuba. However, for as long as ICBC operates a UK subsidiary, it will probably have no other choice but to fight for its clients' interests – because the UK subsidiary operates under British law.

The situation involving these lawsuits is starting to get serious, and Cuba knows it. It is one of the reasons why the market for Cuban claims has almost completely dried up.

As described in detail in my report on Cuban debt, there used to be a pretty active market for such claims. Specialised brokers issued bid and ask prices for Cuban claims, several investment funds provided exposure to Cuban claims on behalf of their clients or even published public offers to buy such claims, and specialist publications regularly reported about the state of the market.

Of late, it's become almost impossible to find Cuban claims that are for sale. I currently know of just one opportunity that exists to get in on this at scale. This would be for an institutional investor who has experience in distressed debt and wanted to deploy several million dollars into Cuban claims (contact me if you'd like to discuss this further). Outside of that single case, I am not currently seeing anything else that'd be for sale.

There are multiple factors at work. E.g., the immense difficulty to settle such trades at a time when banks are reluctant to go anywhere near sanctioned nations is another reason why trading has come to a standstill. However, anyone owning such claims will be aware that we are now entering a crucial phase. If you held on until now, you may as well stay onboard for the remaining time it will take to conclude an agreement with Cuba.

Just 15% of the initial claims remain outstanding, meaning anyone who is still invested is part of the final group of hold-outs. If you got any Cuban claims, you now stand a pretty good chance to be part of the most lucrative phase of the settlement.

The English court system has real teeth. The lawsuit brought by CRF I is backed by some of the same legal advisors that also helped bring the case of Elliott Management vs. Argentina to a successful conclusion. The awkward ICBC situation might compel Cuba to settle the entire matter – so that its ally China gets out of its difficult situation.

Last but not least, a new reality is setting in for Cuba.

Economics make it necessary (and cheaper) to settle

Cuba is an absolute basket case of an economy. It's difficult to overstate just how bad a state the nation is in.

The government pays the large number of state-employed Cubans an average salary of just USD 25 per month, which makes Cuba one of the poorest countries in the world. While Havana's crumbling architecture used to be part of the island's charm, collapsing buildings have now become a serious, regular occurrence and a threat to peoples' lives. According to the New York Times, the country cannot even operate its supply of drinking water anymore. Outside of having sunshine and salsa, most Cubans live in a state of sheer destitution.

Source: CGTN, 6 July 2022.

Is this a country that will likely find the money to repay foreign creditors?

Actually, Cuba may finally be at a stage where such a deal is going to happen.

In the weeks leading up to this article, the country announced one of the most revolutionary economic changes since the 1959 revolution – no pun intended. As Reason magazine reported on 17 August 2022:

"Cuba Liberalizes Economy as Economic Crisis and Protests Grow

In a major departure from established economic policy, the Cuban government has announced it will allow foreign investors into Cuba's retail and wholesale industries for the first time since Fidel Castro nationalized those industries in 1969."

The regime in Cuba is simply under a lot of pressure. As Bloomberg reported on 17 August 2022:

"More People Are Fleeing Cuba Now Than During 1980 and 1994 Crises

Cuba is seeing its biggest exodus to the US in decades following a series of economic body blows that have worsened shortages and power blackouts. Border officials have encountered nearly 178,000 people fleeing the communist-run Caribbean nation of 11 million so far this fiscal year, according to US government data through July."

Now that Cuba's economy is about to return to stone-age level, the regime is coming to terms with a reality that the BBC described as follows in a 17 August 2022 article:

"The new foreign investment bill, however, recognises that the country's centralised government cannot resolve its essential goods shortage without investment from overseas."

Implementing this policy isn't guaranteed yet, and Cuba has a chequered history of sticking to policy announcements. However, it's clear that foreign investment is a lot less likely to come to the country while it's battling commercial creditors in an English court.

As OnCubaNews concluded in a 27 July 2022 analysis:

"The Cuban economy's default situation or the postponement of non-payment is a primary issue to be resolved. … Cuba greatly benefited from the forgiveness of debts from large creditors such as the Paris Club, Russia, Japan and China, among others. Almost 90% of its debt was written off and, however, the remainder of these debts has not yet been paid due to the deep economic crisis in which the country has been plunged. But to really boost the Cuban economy, a viable solution must be found for this issue of foreign debt."

The writing seems to be on the wall. 64 years after Fidel Castro's socialist revolution and about four decades after its post-1989 debt defaults, Cuba may finally settle the remaining 15% of its defaulted foreign debt.

Which begs the question, how to get in on the act?

Join the Cuban debt club (limited offer for 10 readers only)

When I first reported about defaulted Cuban debt in early 2020, the CRF I Fund would have accepted new investors. It's now closed. As ever, you have to buy these things when everyone is holding their nose!

Admittedly, this was only ever going to be an investment for a small number of investors. Defaulted Cuban debt is a specialist affair, but also of interest to those with a desire to simply be part of investment history.

The latter will include those investors who remember the legendary case of André Kostolany, the late German speculator and book author. "Kosto" had famously made a fortune from buying defaulted German Reich bonds after the end of the Second World War, when no one thought the bombed-out country would ever get back on its feet or honour old obligations. These were German bonds issued in French francs, i.e. they qualified as foreign debt. Within five years, Kostolany made 139 times his money when the bonds recovered in price, from 250 francs to 35,000 francs.

It wasn't Kostolany's only coup involving distressed sovereign debt. During the 1980s, he bought ancient pre-Czarist bonds listed on the Paris stock exchange – long-forgotten bonds that were trading at just 1% of their par value. Kostolany made 100 times his money when post-Soviet Russia decided to settle the old debt for its par value.

Source: Independent, 15 January 1997.

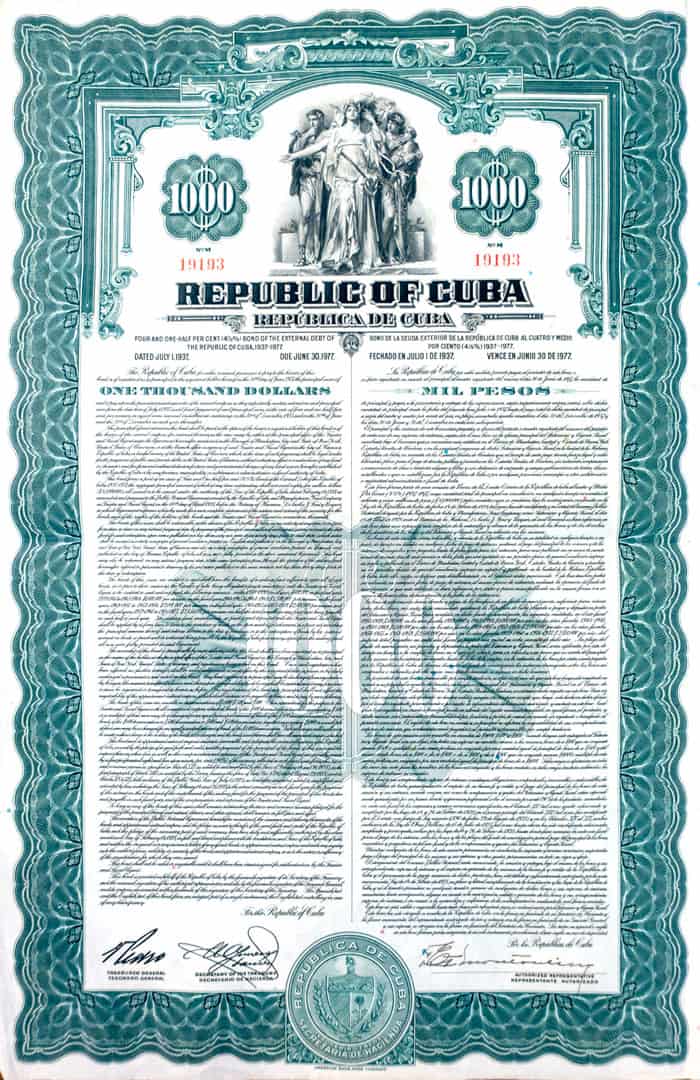

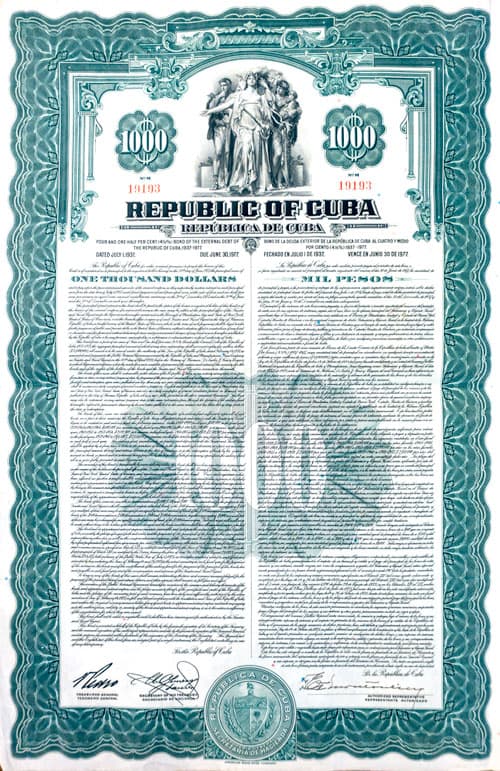

As someone who first invested in Cuban debt in 2006, I got to own a large number of pre-Castro Cuban bond certificates. These were issued in 1937 and 1950, respectively. These bonds are a special category of defaulted Cuban debt and represent a minute amount – just USD 150m of debt is outstanding. Still, it has to be settled and due to the small amont may represent one of the most interesting categories of Cuban claims.

When I released my Cuban debt report in February 2020, I decided to gift 100 Cuban bond certificates to the first 100 readers who signed up for an Undervalued-Shares.com Lifetime Membership. The resulting interest was crazy.

The offer sold out within days, even though Undervalued-Shares.com had few readers at the time and the bonds are technically speaking a "non-valeur", with decorative value only. The New York Stock Exchange delisted the bonds in 1995, and ever since they have turned up at auction houses, on eBay, or even at flea markets. However, the Cuban government will eventually have to settle them, too. Each bond has a par value of USD 1,000, and the two outstanding issues accumulate interest at a rate of 4.5% and 4% p.a., respectively. Including interest and interest on interest, they currently represent a claim of many times their par value.

At the time, I held back 10 such bonds from the 1937 and 1950 issues. I wanted to give them away as a gift whenever I was going to publish an update about the Cuban debt story.

The "Cuba 77" bond – theoretically a claim of USD 10,000.

Which means that today, you are in with a chance to snap up one of those last 10 bonds.

Be one of my next 10 readers to sign up for an Undervalued-Shares.com Lifetime Membership (USD 999/one-off), and get one bond thrown in for free (including postage to anywhere in the world!).

Simply use coupon code "CUBABOND" when signing up.

This is a first-come, first-served offer. My order system automatically counts down from 10. When all bonds are gone, the order mask will stop accepting the coupon code.

If you are lucky, the bond will eventually pay back the entire cost of your Lifetime Membership. In the meantime, you've got a decorative certificate that you can frame and hang on your office wall. (NB: It might have a bit of wear and tear – after all, it's older than yours truly – but it's a treasure nonetheless.)

It's your chance to be part of the Cuban debt saga, and to participate in a deal that "Kosto" probably also would have loved to be a part of.

Cuban debt claims are an exotic, illiquid investment – but one that will make headlines one last time when the issue gets resolved.

It looks like that day is finally getting a lot closer.

Become part of the Cuban debt saga

Get one of the last 10 Cuba bonds from the 1937 and 1950 issues entirely for free – by becoming an Undervalued-Shares.com Lifetime Member (USD 999/one-off).

It's yours for the taking, provided you are quick enough and among the next 10 readers to join!

To claim the offer, just enter coupon code "CUBABOND" when signing up.

(This code will expire once all bonds are gone.)

Become part of the Cuban debt saga

Get one of the last 10 Cuba bonds from the 1937 and 1950 issues entirely for free – by becoming an Undervalued-Shares.com Lifetime Member (USD 999/one-off).

It's yours for the taking, provided you are quick enough and among the next 10 readers to join!

To claim the offer, just enter coupon code "CUBABOND" when signing up.

(This code will expire once all bonds are gone.)

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: