In October 2019, I published an in-depth article about Virgin Galactic (ISIN US92766K1060), the space tourism company that went public through a SPAC. At the time, the company was preparing its first space flight for civilian passengers.

I advised that it could be worthwhile to buy the stock in anticipation of a public hype, and to sell at a very clearly defined moment ("in the period immediately before the actual first flights").

The hype did come and the stock rallied 500% at its peak.

The right sell moment also did come, as the following chart shows.

Today, I'll introduce to you a time-tested diagram that you can use to increase your investing success. This article will cost you ten minutes of your time, but it will improve your skills immeasurably. It's almost too simple a rule to even write an entire article about it, but it's too effective and important not to highlight properly.

Anticipation often beats reality

Everyone will have had occasions in their life when the anticipation of something proved a lot more exciting and pleasing than the actual event. The same happens on the stock market on any given day, and anyone who is aware of the mechanism behind it can make money.

For new technologies, in particular, the anticipation of something new often is a lot better than how it all turns out, at least initially. Quite possibly the most famous example? The Internet.

In the late 1990s, a tremendous investment boom and speculation mania set in for all things Internet. The dot-com bubble had few rivals in human history and was followed by a spectacular, multi-year crash where many stocks lost 80%, 90% or even 99%.

However, many of the predictions that fuelled the original investment hype did come through in the end:

- We now buy half of all books online.

- We now have the ability to watch any movie "on demand".

- We can now connect to literally anyone, anywhere, at any time.

Much as the market went through a period of disillusionment, it proved temporary. What followed was an extensive period of reality eventually catching up with the earlier expectations.

Much of this is rooted in our human tendency to overestimate what can be achieved in the short term, and to underestimate what can be achieved in the long term.

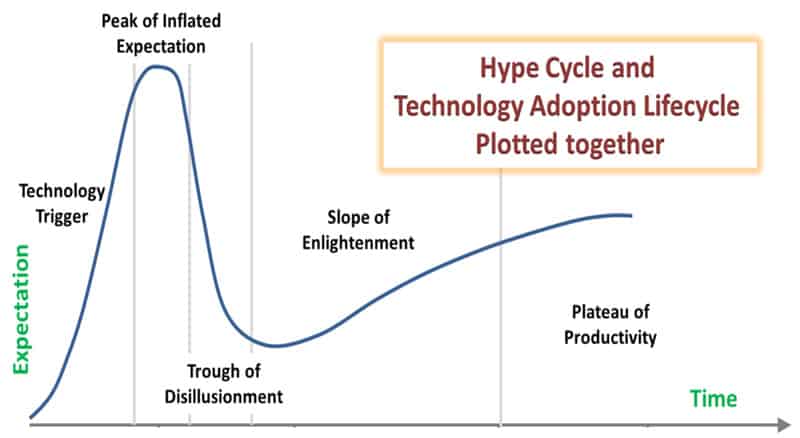

These cycles are captured in the "Gartner Hype Cycle", a graphical presentation showing how new technologies mature through five phases. The American research and advisory firm, Gartner, didn't create this graph for investment purposes, but it's highly useful for just that.

In the vast majority of cases, new technologies go through the cycles depicted in the Gartner Hype Cycle:

- Initial trigger.

- Public hype.

- Eventual catching up with earlier expectations.

It's the so-called "Peak of Inflated Expectations" that you should be most interested in.

In the case of Virgin Galactic, I expected this peak to be reached just before the lift-off of the first civilian space flight.

It was clear what was going to happen:

- Huge media interest and a billionaire tweeting to his millions of Twitter followers.

- Captivating imagery on the Internet.

- Congratulatory, televised speeches about changing the course of humanity.

Everything was bound to be superlatives, given that the story involved space flights, billionaires, and something that millions had dreamt of as a child.

Equally, it was clear that right thereafter, everyone would get back to reality. For a company with a new technology and a revolutionary product, this reality was going to involve:

- The grinding work of convincing more customers to buy the product.

- Putting up with inevitable unexpected hurdles and problems.

- Accepting that even after a successful launch, reaching break-even would still be a long way off (never mind profitability).

Changing the course of humanity doesn't happen overnight, nor does the creation of an entirely new industry.

At the time, this was one of the most widely reported-on "narrative stocks". Anyone who owned a piece would have had a difficult time escaping the overall enthusiasm. Still, there was always going to be a time when investors were going to remember that, ultimately, companies are only about the cash flow they produce for their shareholders.

In that regard, Virgin Galactic had gotten way ahead of itself. Which is why the company entered – entirely predictably – the "Trough of Disillusionment".

Just as I had predicted, it was the right decision to sell just ahead of the first actual flight. During the four weeks preceding the flight, the stock was trading between USD 30 and USD 54. It has since drifted lower - not unlike a spaceship gliding towards earth on a parachute (forgive the pun). At last count, the stock was worth just USD 15. Speak of a hard landing! Again, no pun intended.

So simple a rule it almost hurts

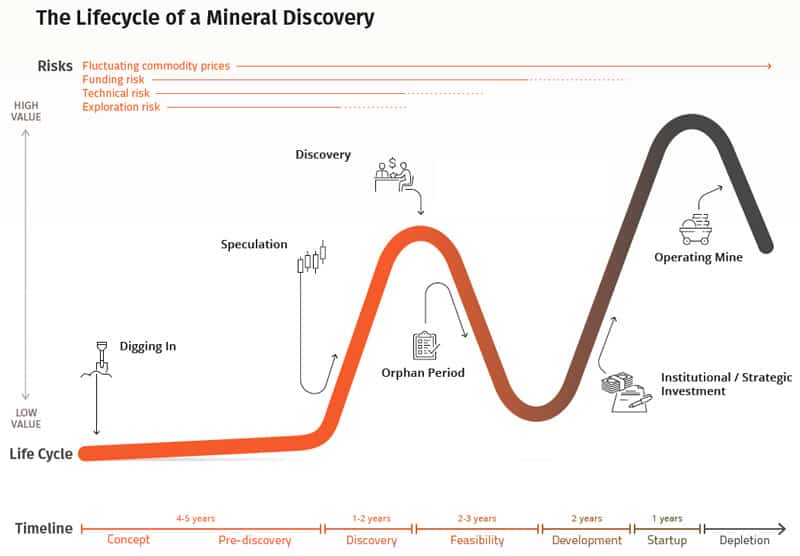

The Gartner Hype Cycle isn't entirely new, nor is it a perfect model. Anyone who has ever invested in resource exploration companies is likely to have come across the same equivalent graph applied to resource exploration companies. For these kinds of companies, the period of disillusionment is called "Orphan Period".

Source: Visual Capitalist.

Also, there is a lot of criticism of the model. Technically speaking, it does not show "cycles", the terminology is rather vague, and it all lacks a solid scientific basis. When it comes to its details, there is a lot that can be improved.

Still, the core idea behind it is accurate. I have used the Gartner Hype Cycle many times in my career to prevent myself from committing a grave mistake that almost any investor will be familiar with. In my experience, spotting an emerging new narrative to latch onto is easier than getting yourself to sell near the peak of the hype. It is SO easy to eventually believe in the hype yourself. I have trained myself to realise that each time I believe it's really worthwhile to hold on to a successful investment in anticipation of everything turning out as expected, it's quite likely the right moment to sell.

This is counter-intuitive, but it has worked for me many more times than it hasn't. Virgin Galactic is a case in point. I, too, watched the launch of the space ship. Emotionally, I was all in. Rationally, I knew that shareholders were in for a difficult period post-launch.

Other ideas for applying this rule (and a specific investment idea for you)

When you are holding successful investments in emerging new industries, always keep in mind that anticipation is often way better than reality.

Regularly remind yourself of the inevitable "Trough of Disillusionment". Print out a copy of the Gartner Hype Cycle and hang it on your office wall.

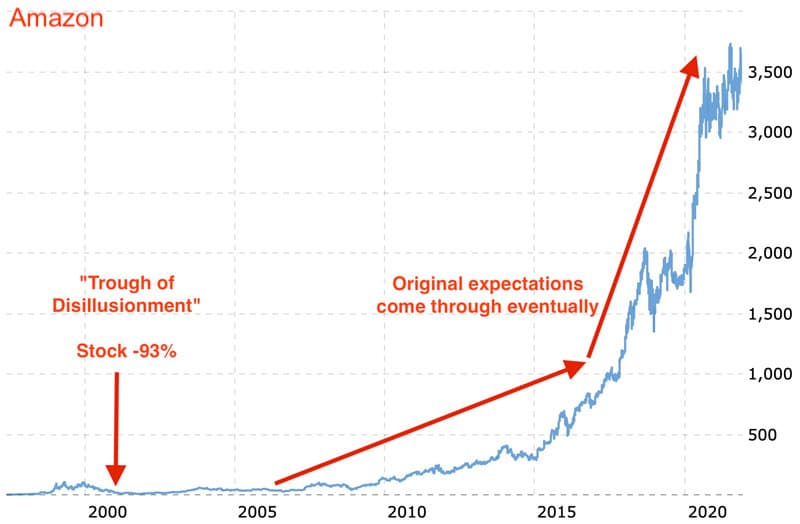

However, also keep in mind that this model can lead you towards yet more interesting investment ideas. Eventually, companies leave the Trough of Disillusionment behind and catch up with the initial expectation (at least to some degree – or they may even exceed it).

Take Amazon (ISIN US0231351067), for example. During the first two years of the dot-com boom, the stock had rallied from USD 1.50 to USD 94, only to fall back to USD 6 over the following two years, losing 93% of its value. Eventually, the expectations of the initial euphoria did come to pass, though, and the stock rose by a factor of 500 over the subsequent two decades.

It's one of the most extreme examples there is, but it illustrates the point.

Incidentally, I have written about a similar case and it's now going through a short-term Trough of Disillusionment.

In November 2020, I explained why Twitter (ISIN US90184L1026) had a brilliant future, probably for many years (if not even decades) to come. Following my research report, the stock had rallied from USD 44 to USD 78. A few of my key predictions have already proven right, such as President Trump's permanent ban (even though I didn't agree with it) turning into a positive for Twitter, or the company's recent replacement of CEO Jack Dorsey. However, the stock has just come down to USD 46 again – back to square one.

The current weakness of Twitter's share price is one of those troughs that I believe will – one day – appear like a blip in a long-term upwards move of the stock. Twitter stock won't rise quite as much as Amazon, but it certainly has the potential to grow in value several-fold over the coming years. The current phase will become a Trough of Disillusionment and, in retrospective, another opportunity to get in on very advantageous terms.

If you haven't read my report yet, now would probably be a good time to do so...

How To Get Access To All Capital Markets In The World At Once

There's more to investing than what the New York Stock Exchange or Nasdaq have to offer. There are 100,000 (!) publicly-listed companies around the world, so why limit yourself to your home market?

Tapping into international investment opportunities is easy, too! Join my chat with Mikkel Thorup (Expat Money Show) for two very simple solutions to help you get access to all the world’s capital markets at once.

How To Get Access To All Capital Markets In The World At Once

There's more to investing than what the New York Stock Exchange or Nasdaq have to offer. There are 100,000 (!) publicly-listed companies around the world, so why limit yourself to your home market?

Tapping into international investment opportunities is easy, too! Join my chat with Mikkel Thorup (Expat Money Show) for two very simple solutions to help you get access to all the world’s capital markets at once.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: