As the saying goes, "Lottery tickets are a surtax on desperation."

Given the cost-of-living crisis, surely desperation is on the up – are lottery ticket sales, too?

The Lottery Corporation in Australia is a rare case where anyone can buy a stake in a pure-play lottery business. The company didn't do a conventional IPO, instead it was spun off from another publicly listed company in May 2022. Hardly anyone outside of Australia noticed, even though it's a AUD 11bn (USD 8bn) company.

I spent a day educating myself about this widely-known but little-understood industry.

Here is a primer about the lottery industry, centred around this newly listed company.

The Lottery Corporation.

Big business – but operating out of view

Owning a casino or any other form of gambling operation is commonly known as a great business, because "the house always wins".

Owning a lottery is even better. In terms of profit margins, it's way ahead of the gambling industry.

The sports betting industry has a payout ratio of 90%. In other words, just 10% of the money that is bet by punters ends up in the pockets of the betting operators. For slot machines in casinos, the payout ratio can be as low as 70%, leaving up to 30% in the coffers of the operators.

Lotteries, however, are profitable on a different scale. They tend to have a payout ratio of around 50%, or 60% at best, which means that nearly half of the lottery ticket money stays with the organisers.

And a lot of money it is! In the US alone, consumers spend USD 80bn a year on lottery tickets. Compare this to cinema tickets, whose annual sales in the US total about USD 11bn. In 11 of the 50 states of the US, the government makes more money from lottery ticket sales than from corporation tax.

In most countries, lotteries are operated either by the government or a privately owned firm that has a long-term concession granted by the government. Because it all takes place in entities that are not usually required to report to the public, consumers rarely get a look at the underbelly of the industry.

Based on my research, there are less than ten publicly listed companies in the world that offer significant exposure to the lottery industry. Most of them offer exposure in a roundabout way, such as the printing of lottery tickets. It's an opaque industry that few have ever analysed in detail, and a difficult one to get quality exposure to as a private investor.

Since the spin-off of The Lottery Corporation (ISIN AU0000219529, AU:TLC), anyone can now take a closer look at how this industry works to the benefit of its owners.

The Lottery Corporation's underlying dynamics

For the lottery games operated by The Lottery Corporation, the payout ratio is 56%. Of each AUD 100 spent on lottery tickets, AUD 56 go towards prizes. Amazingly, about 2% of lottery winners never claim their prize, so the effective payout ratio is 55%.

Of the remaining AUD 45, AUD 28 (or 62%) go to the government. Call it a tax or gambling concession, the government is the single biggest stakeholder in the business.

The remainder goes to The Lottery Corporation and its partners, and that's where it gets really interesting.

For lottery tickets sold or processed through a retail outlet, The Lottery Corporation pockets EBITDA earnings of AUD 5 per AUD 100 of sales. For lottery tickets sold directly online to customers, the EBITDA earnings are AUD 15 per AUD 100 of sales.

That's an EBITDA margin of 15% vs. 5%. Online sales of lottery tickets are three times more profitable than bricks-and-mortar sales.

At last count, just 38% of The Lottery Corporation's ticket sales were done online, and the remainder through 7,200 retail outlets. The company operates lotteries in a number of Australian states and has about half of the population as customers. The relatively low digital penetration among its 8m customers could be this company's biggest attraction.

Since 2018, The Lottery Corporation's online sales have increased at a rate of about 5% p.a. This was much faster than the historical growth rate of 1-2%, and a significant element in this was the pandemic driving the overall digitisation of society. No one knows what the growth rate of online sales will be now that the world is (sort of) back to normal. It's safe to assume that the digitisation of lottery ticket sales will slow down compared to its boost over the past few years, but it's also likely that it will keep growing faster than previously. For The Lottery Corporation, a growth rate of 2-3% p.a. for its online sales seems a reasonable guess.

For every additional percentage point that online sales win vs. retail outlet sales, the company's EBITDA increases by about AUD 5m. Based on the growth estimate given above, the company is looking at increasing its margin from ≈17% in 2021 to ≈20% by 2026. Given the 86% ownership rate of smart phones among the Australian population, it wouldn't be surprising if longer term, online lottery ticket sales were trending towards 60% of total sales. In any case, it's safe to say that from its current rate of 38%, the only way is up.

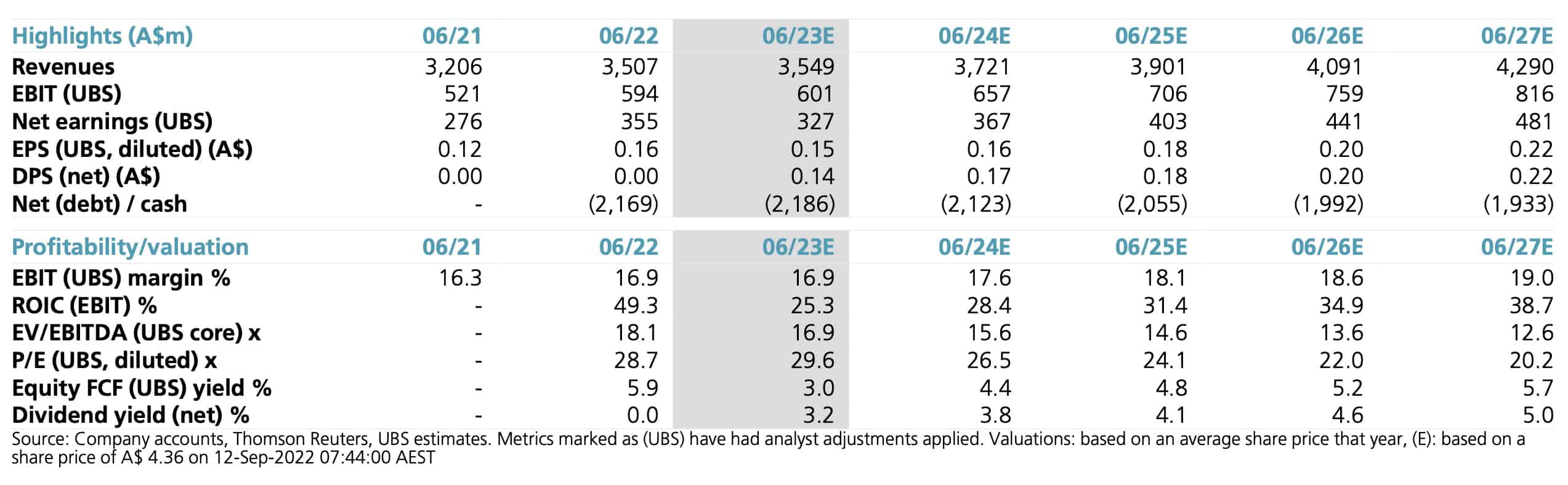

The Lottery Corporation's operative business requires little capital investment, and it is likely going to experience steadily increasing margins. The company inherited AUD 2.2bn in net debt when it was spun off from its former parent company, equivalent to about 3.2x the 2022 results. This is already below the company's stated gearing target of 3.5-4x net debt to EBITDA, and at the current rate this ratio will fall to ≈2.5 by 2025.

Source: UBS, 12 September 2022. Click on image to enlarge.

The stock isn't cheap-cheap, but it's not overly expensive either. At a price of AUD 4.83, it is trading at about 16x EBITDA. In 2017, another Australian lottery business was sold for a 17x multiple. Since then, the prospects of a growing digital penetration have improved significantly, and the Australian legislator has permitted some pricing changes that work to the benefit of the lottery operators. Were The Lottery Corporation to be sold today, it should fetch a higher multiple than was paid for the 2017 transaction.

What's likely going to drive the share price, though, are dividends and share buybacks. Given its decreasing low debt gearing, The Lottery Corporation will be able to afford not just its regular dividend, but also special dividends and share buybacks. According to a valuation model created by UBS analysts, the dividend alone should drive the stock above AUD 6, and possibly closer to AUD 7 if the digitisation of the business advanced faster than expected.

Following its debut at AUD 4.60, The Lottery Corporation stock fell as low as AUD 3.92 during that turbulent autumn of 2022. It's now trading at AUD 4.83.

When would be a good time to buy?

There is another little known fact playing into that question.

Is it an infrastructure investment?

The lottery business is often viewed as similar to infrastructure investments.

A number of the business' characteristics do mirror infrastructure qualities and should appeal to a similar investor base. After all, the business combines high barriers to entry, high regulation, low operational risk, low maintenance capex, and near-monopoly status. However, there is also an important difference.

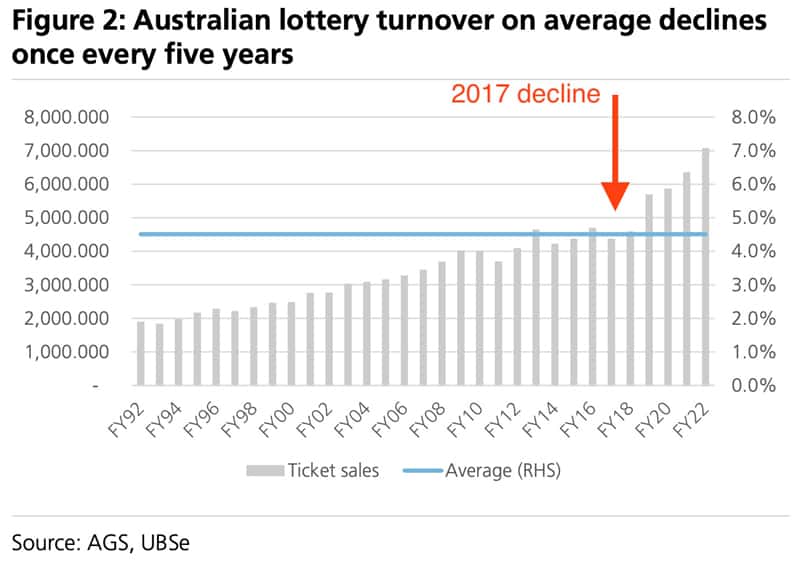

Infrastructure companies tend to grow extremely reliably, including during times of crisis. Their demand volatility tends to be extremely low. Lottery companies, on the other hand, do experience the occasional downturn. Lower income brackets buy the most lottery tickets, but also get hit the hardest during times of recession. During the past 30 years, Australia has experienced six years when lottery ticket sales were down – a down-year every five years.

Longer term, the lottery business does grow reliably in a combination of favourable demographics (Australia is an immigration country) and increasing household incomes. The lottery may be looked down upon by some as "a tax on the stupid" (French philosopher Voltaire), but it's actually a business with several angles to its demand side. Even for many rational people who know that you are more likely to be hit on the head by a passing asteroid than win the widely-advertised mega jackpot of a lottery, buying a ticket is a form of entertainment. It offers a few moments of thinking "What if….", and it caters to deep-seated human needs and desires. If it didn't, it wouldn't be so popular. Some may argue it's another form of Netflix, where the purchase makes a movie play in your head.

Given that human nature never changes, it's been a good business not just for decades but centuries. So good, in fact, that anyone who owns a lottery business hardly ever wants (or needs) any co-investors.

In my research, I found just seven other publicly listed companies worldwide that offer significant exposure to the lottery industry:

- La Française des Jeux (ISIN FR0013451333, FR:FDJ) is the operator of France's national lottery games with a market cap of EUR 7.5bn, and seemingly the closest peer to The Lottery Corporation.

- OPAP – Greek Organisation of Football Prognostics (ISIN GRS419003009, GR:OPAP) holds the rights to organise and manage lotteries and sports betting in Greece, and it has a market cap of EUR 4.8bn. It's fairly comparable to The Lottery Corporation but also dabbles in many other games of chance.

- International Game Technology (ISIN GB00BVG7F061, NYSE:IGT) isn't so much of a lottery operator but a service provider to lottery companies and other betting operators. It has a market cap of USD 5bn.

- Intralot (ISIN GRS343313003, GR:INLOT) is a gaming solutions provider that operates in 42 countries. The Greek company has been a lottery operator in Malta and Argentina, and a lottery partner in the US and Turkey. However, it's not a pure play on lottery, and a small-cap with a market cap of just EUR 240m.

- Pollard Banknote (ISIN CA73150R1055, CA:PBL) is a commercial printing company that produces scratch cards for government lotteries. This gives it direct exposure to lottery games, and in a unique way. However, similar to International Game Technology, Pollard Banknote is a lottery partner rather than an operator. Not being in the driving seat, it has been exposed to downward pressure on pricing and margins. Its market cap is CAN 500m.

- ZEAL Network (ISIN DE000ZEAL241, DE:TIMA) is a reseller of lottery tickets in Germany. It offers great exposure to the structural tailwind of digitisation, but it doesn't own a lottery operator license and has no control over the product. The company has a market cap of EUR 700m.

- Lottery.com (ISIN US54570M1080, Nasdaq:LTRY) enables Internet users to remotely purchase legally sanctioned lottery tickets in more than 40 countries. With just USD 13m market cap, it's a true micro-cap. The company's legally questionable business approach is asking for trouble, though, which may be evidenced by the fact that the stock is down 99% since 2021.

As this list shows, it's difficult for private investors to get pure exposure to the lottery industry. If you are a private equity company or a billionaire with chums in the government, you stand a chance of buying a concession. For everyone else, buying stock in The Lottery Corporation is probably the highest-quality pure play you'll find. The company's various state licenses have a weighted average of 26 years left before they expire, which is reassuringly long.

As to the timing of a purchase, it's probably best to wait for one of those years when revenues are heading down. While waiting for an event that only occurs every five years seems like an incredibly long yawn, much of your profit will lie in how cheap you acquired the stock. Also, the last such dip occurred in 2017 so the next one is already overdue.

Australian lottery turnover decline.

Will such a dip happen now that we are potentially facing a global recession? The current pressure on consumers could easily make you think that more people will now buy more lottery tickets in the hope of a major win, but this general notion doesn't hold up to scrutiny.

In a survey carried out by UBS in September 2022, 44% of Australian respondents said that if the cost of living were to rise by 5%, they'd either spend 5% less on lottery tickets (37%) or even stop buying lottery tickets altogether (7%). At the end of the day, even lottery tickets are consumer discretionary items and affected by the overall level of income.

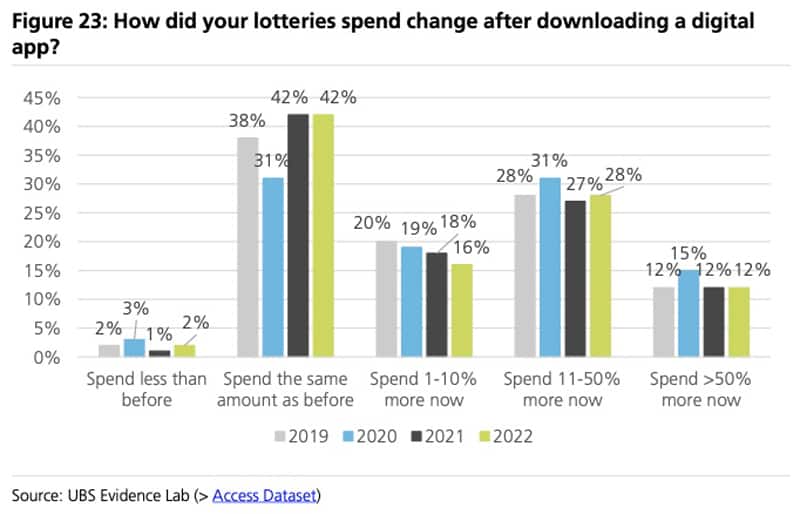

However, the same survey also yielded that 56% of customers spend more on lottery tickets once they buy them online. Of those, a remarkable 40% increase their spending on lottery tickets by over 10%. The combination of higher margins and increasing sales once consumers shift to a lottery app is probably the single most powerful argument in favour of this stock – particularly in light of the currently low digital penetration of 38%.

Lotteries spending change after downloading a digital app.

With that in mind, I'd put The Lottery Corporation onto the watch list and strike when the stock sees a sell-off. If you are looking for a safe long-term compounder and already have some spare cash, being a co-owner of a lottery business is probably much better than buying lottery tickets – though it does lack the entertainment factor.

For everyone else, there is Brian Koslow's timeless quote "Forget the lottery. Bet on yourself instead." (something I strongly believe myself).

A golden era for this value retailer

The cost-of-living crisis is biting hard all over Europe, increasingly driving consumers toward value retailers.

In the US, value retailers have already made fortunes for their shareholders.

Will their success story repeat itself in Europe?

With the cost-of-living crisis in Europe unlikely to be resolved anytime soon, this company should benefit from tailwind for a number of years to come.

A golden era for this value retailer

The cost-of-living crisis is biting hard all over Europe, increasingly driving consumers toward value retailers.

In the US, value retailers have already made fortunes for their shareholders.

Will their success story repeat itself in Europe?

With the cost-of-living crisis in Europe unlikely to be resolved anytime soon, this company should benefit from tailwind for a number of years to come.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: