Image by Gil C / Shutterstock.com

President Trump has called it "the failing New York Times" on at least 200 occasions, yet its stock has been going from record to record. Oddly enough, having the world's most powerful man call you "fake news" and predict your demise on a regular basis does seem to be conducive to business. Since Trump's election in November 2016, the formerly ailing New York Times stock (NYSE:NYT) has rallied from USD 11 to USD 35. It had last traded that high in 2005, and its performance even left the major indices in the dust.

Six major brokerage firms covering the company have recently rated it a "Buy". That's no surprise, given that subscriber numbers for the digital edition have grown by an impressive 27% during 2018, reaching 3.6m. The company has gone from starvation mode to showing a triple-digit million annual net profit. Its total paying readership, including the print edition, now stands at 4.5m.

The further outlook appears rosy, too. By 2025, the company is aiming to achieve 10m paying readers, which by then will mostly mean online subscriptions. To prepare for the expected growth, the "Old Gray Lady" now employ more journalists than ever before in its history: 1,600 in total, including a network of 200 journalists outside the US.

Much of this boom is due to the "Trump bump", i.e., the additional interest in news and opinion since the American peoples' momentous decision to change their country's politics. The Donald has proven a godsend for the long-suffering US media industry. Even the New York Times admits as much, even though it also points out (quite rightly) that other factors also contributed to its recent success.

Surely, with another highly contentious US election year looming, this has got to be the ONE stock to buy to benefit from the inevitable election circus. Right?

Or are Trump's attacks on the media a precursor for critical media organisations to fear the wrath of the government, possibly in forms that damage or even sink their business altogether?

I've done a deep dive into the matter and investigated. Here is what I've learned.

History matters

I don't think anyone can reliably judge the current developments in the US media without first taking a look back in American history for some context.

Much as it may sometimes feel like we are living in unprecedented, uniquely turbulent times, there is actually hardly anything new under the sun.

Never-ending Presidential accusations of media bias and outright lying by journalists?

Look no further than Thomas Jefferson, the Founding Father and 3rd US President who wrote: "Nothing can now be believed which is seen in a newspaper. Truth itself becomes suspicious by being put into that polluted vehicle."

The President putting out messages to their base and then basing their decisions on the public feedback?

Theodore Roosevelt famously did just that on a regular basis. Though he used the Sunday newspapers and the publicly available reactions on Monday instead of relying on Twitter and the number of re-tweets.

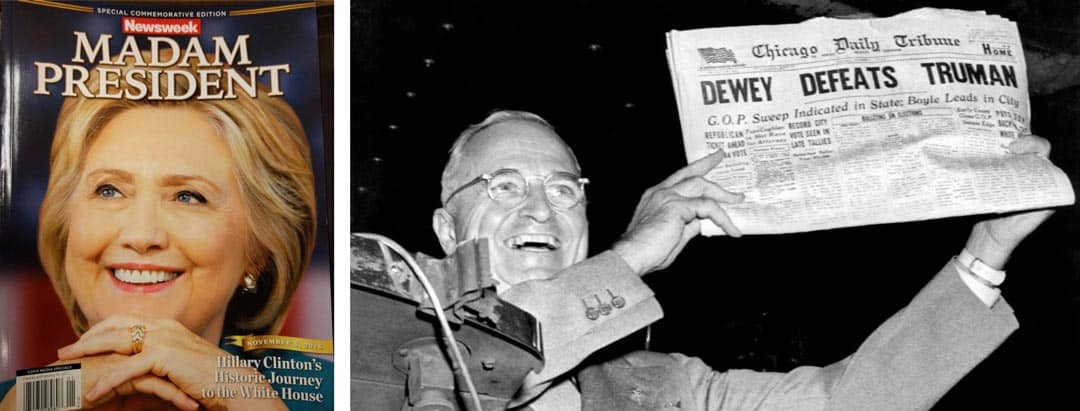

Journalists getting an upcoming election result spectacularly wrong and even sending out an edition that announces the wrong winner, with never-ending conflicts following?

When Harry Truman fought Thomas Dewey, Newsweek polled 50 political experts. They unanimously (!) concluded that there was no way for Truman to win the election, a prediction that outdid even the New York Times' infamous "Hillary will win with 93% certainty" assessment. It was Truman who won, ironically with almost the same generous margin of electoral votes as Trump. A snapshot where Truman is holding up a newspaper that erroneously announced his losing is now an iconic image in US history books. In an eerie case of history repeating itself, it was Newsweek that sent out magazines wrongly announcing that Hillary Clinton had won in 2016 (now available as collectors' item on Ebay). The relationship between the new President and journalists got off to a bad start in both cases.

It has all happened before.

I went to High School in the US and focussed virtually my entire time on American Democracy, Journalism, Sociology, and how it all relates to Modern European History (the worst grade I got was a B+, despite jumping two years ahead when my Headmaster realised I was bored). Now that you know about this part of my childhood history, you may fear I am about to get lost in my pet subject.

Not so, I am merely pointing this out to prepare talking about ever-repeating, rather predictable patterns that are just as valid and useful today, as they were a century ago.

These can also be demonstrated based on very recent history, which takes us closer to our interest in the New York Times stock or potential other US media companies.

Yours truly taking a break from arduous high school classes (1991).

Predictable media patterns in recent US history

Even the "Trump bump" providing additional business for certain news outlets isn't a new phenomenon, but rather an entirely regular occurrence in the US media industry.

To a significant extent, it is due to an established tendency for those who identify with the party that is out of power to rally around like-minded news media where they feel they are "not alone". In modern-day Newspeak, you could say the losers are retreating to their safe spaces. Or as the Financial Times described it in a recent opinion piece about the media industry: "For most people, truth is a second-order priority. Identity and entertainment have probably always mattered more."

During the Obama years, the big beneficiary was Fox News. However, since Fox and its affiliated networks were part of the much larger Murdoch media group, there wasn't a stock chart that could be shown to demonstrate the phenomenon. That's undoubtedly one reason why it got less media attention overall.

Nevertheless, this is a particularly well-established cycle even if you go back several decades. For example:

- During the Clinton years, the Conservative radio host, Rush Limbaugh, got a lot of wind under his wings and talk radio started to boom.

- Bush Jr. provided uplift for the liberal MSNBC network.

- Now that another Republican is in the White House, MSNBC is once again on the up.

There really is hardly anything new to all this. It extends across many of the factors that are currently the subject of particularly hot debate.

E.g., many feel that Trump's attacks on the media are a new, worrying aspect of the President-versus-media relationship, and one that may even put the business of specific media organisations in danger. Why invest in the New York Times if the Orange Man will shut it down in some Hitler-esque abuse of power?

Those fearing such moves should get a fresh perspective by reading up on the Obama years. It was Obama's administration that utilised the Department of Justice for mass-surveillance of journalists at the Associated Press, and which even snooped on the personal communication of a Fox News reporter. The same administration issued threats to prosecute a journalist under the terms of the Espionage Act, with the clear aim to prevent certain information from reaching the public and intimidating other journalists. All of this was called out by a coalition of 50 newsgathering organisations. No other paper than the New York Times ended up printing an op-ed calling President Obama "the worst president ever on … press freedom", and a New York Times editor criticised the Obama administration in 2013 for its "unprecedented secrecy and unprecedented attacks on a free press." Newsweek reported that Obama himself described his conflicts with the media as "war", in an article that has since been scrubbed off the web by editors who seem to be loyal disciples of Saint Obama.

The Obama administration even considered overseeing the content of radio programmes it perceived to be of "structural imbalance", i.e., a bias towards conservative views. A draft proposal by the Federal Communications Commission legal department included a plan to place government staff in radio newsrooms to monitor how stories were selected. There were even tentative plans to extend such government oversight of media to print media outlets. It all culminated in the Committee to Protect Journalists (CPJ) publishing a devastating report: "The Obama administration and the Press".

Does that ring a bell with regards to recent times?

If you take a slightly longer perspective than to merely follow the day-to-day news-cycle, you do have to wonder occasionally if some newspapers keep templates for clickbait-y headlines in stock so that they are easier to recycle.

Evidently, US-style freedom of the press is durable enough an institution to survive any one President. Stockholders of the New York Times needn't fear the wrath of the current occupant of the White House.

Quite the opposite. The question has to be asked whether the apparent repetitiveness and predictability of these patterns allow us to make money off the New York Times during the upcoming 2020 election spectacle.

That's the million-dollar question.

A stock with wild long-term swings

You could have made 20 times your money had you invested in the New York Times back in the early 1980s. Over the subsequent two decades, the stock rose from $2.50 to $50. The good times were rolling! So good seemed the prospects that near its peak the company bought back a staggering USD 1.8bn worth of its stock, believing that this was the best possible use for the company's funds. This turned out to be the equivalent of throwing 90% of this money into the fireplace.

In a matter of just five short years, almost everything was lost.

The stock dropped back to USD 4.50, mostly because of the ongoing decline in the print edition's circulation combined with the excessive cost structure that was built during years when money was easy. In 2009, the circulation fell below the psychologically important mark of 1m, and online subscriptions were not yet quite the successful, viable business that they are today. The Sulzberger family, who had gained control of the newspaper in 1896 and put members of its fourth and fifth generation in charge of overseeing their family heirloom, appeared out of touch and out of depth.

In 2005, the New Yorker published a seminal, extensive, and bruising piece about the family who controlled the company via preference shares with additional voting rights despite only owning 20% of the overall capital. In 2009, Vanity Fair spoke of a "doomsday clocking ticking" for the company. It appeared like the rapid advance of the online media business, the decline of printed newspapers, and the fierce competition for a shrinking print advertising market were going to knock the Old Gray Lady for six.

A very long-term look at the Ups and Downs of the New York Times.

Given the family's dwindling fortune, it required a USD 250m bailout investment by Mexican billionaire, Carlos Slim, to keep the operation afloat in 2009. However, it wasn't until the election of Donald Trump that the newspaper's fortunes turned around. For the New York Times, Trump's election triumph was equivalent to winning the lottery.

Its location in Trump's home city did give it an edge over other mainstream newspapers, allowing it to utilise three decades of experience in reporting about him. It also had more sources among Trump's network than any other US newspaper, or at least it could credibly claim as much.

Sales in its home market turned around massively, and it established itself – for better or worse – as one of THE publications to read if you opposed the new President (or if you, like myself, enjoy researching what the other side of the argument thinks).

Its turnaround was massively driven by a revamped online presence, and also by the overall growing trend to consume newspapers online rather than in print.

What's more, outside of the field of hyper-partisan politics, the New York Times continued to do some excellent reporting. Its opponents may call it "Nothing You Trust", a wordplay on the paper's acronym and its long-standing motto, "All the news that fits to print". But anyone who takes a halfway objective view of its content will have to concede that the New York Times' online edition is one of the higher-quality and more interesting publications you can subscribe to. That's true even if you reside outside of the US. Currently, 16% of its online subscribers live abroad, which is unusually high for a US publication.

The question though is, how good a business is it and will the good times last?

With Trump came salvation.

Digital subscription growth is driving this share price

Digital publishing can be an amazingly lucrative business if you reach the necessary economies of scale. Selling an additional digital subscription has incremental costs of virtually zero. Once your subscribers cover your fixed costs, selling additional online subscriptions is almost akin to printing money.

With now nearly 4m online subscribers compared to just 1m in late 2015, the New York Times has reached (and surpassed) that point of break-even. It took the New York Times 19 years to reach the first million online subscribers, but less than four years to grow by an additional three million subscribers. In 2018, it achieved a profit of USD 126m, compared to just USD 29m in 2016 and USD 4m in 2017. In terms of user experience, the New York Times website is the envy of the profession.

Now imagine 10m subscribers by 2025, and the stock's recent surge starts to make sense.

There is quite some distance to cover, though, before you get from 4m to 10m. The company would basically have to add a million new paying subscribers each year, i.e., it'd have to continue the growth of the past four years without slow-down or interruption.

Will the company get there?

2025 is way too far to even try and look into the future. However, it seems well possible that 2020 will prove to be a watershed year for the company.

More money than ever before will be spent on waging the next US Presidential election, in what will no doubt be a more contentious affair than any other prior election. Trump has been raking in campaign donations at a breakneck speed, and the Democrats in turn have been providing an incredible spectacle of party in-fighting and more candidates than anyone could possibly remember the names of. The 2020 campaign will glue eyeballs to screens, and open wallets for subscription offers. It'll be a "newsy" year.

If ever there has been a moment for the revamped business model of the New York Times to shine, next year has got to be it.

What's more, NeverTrumpers could flock to the paper to support it for ideological reasons and use it as their personal safe space. Some observers are even speculating whether the consistent "Buy" ratings for the stock are a campaign by Trump-opposing Wall Street players.

Such theories may be less far-fetched than it seems, given just how far the valuation has gone ahead of itself without analysts stopping to scream "Buy".

A premium price for an iffy earnings stream

At a share price of USD 35, the New York Times is valued at just under USD 6bn.

No matter how you turn it, this stock is currently trading at eye-watering valuation multiples:

- >3 x revenue

- 40 times estimated 2019 earnings

- >20 EBITDA multiple versus enterprise value

- 1.5% cash flow yield

- 0.6% dividend yield

These are valuations you'd struggle to achieve for fast-growing, purely digital media assets. The New York Times has been growing of late, but it's still in many regards an old-style, high-cost company with growth rates more akin to conventional media businesses. The company has some of the characteristics of an agile digital media firm, but its cost base is still that of a Dinosaur media company.

If sold outright, would anyone in their right mind pay USD 6bn for this company? Possibly, especially since it's a trophy asset. But it'd take a brave man to bid even more than that.

Though a company's stock isn't tied to theoretical M&A valuations. Can the New York Times' share price rise further yet?

It sure can. Imagine the New York Times publishing Trump's recent tax returns, or NeverTrumpers organising a Facebook campaign to mobilise 1m additional subscribers as a political statement of support, or quite simply an unprecedented public appetite for NYT-style reporting amidst turbulent times. Or all of the above!

In an era when stock market investing has – for many – become a matter of factors such as chasing momentum or putting money behind one's personal worldview, this stock could go a lot further still. Never mind the valuation.

Though it could also swing the opposite way. Factors working to the detriment of the company include:

- Fickle subscribers, who get bored quickly and are tempted by competitors' special offers. Who hasn't yet made use of a "USD 1 per month" introductory offer for a newspaper or magazine, only to cancel a day before the end of the three-month introductory period and switch to the same offer at the nearest comparable publication?

- Margin compression in the subscription business, not just through general competition but also through new services like Blendle, where you can purchase individual newspaper articles from major publications for pennies instead of committing to subscriptions. Also, distribution partners such as Blendle demand their cut.

- The "Trump bump" potentially being followed by a "Trump slump", because of parts of the public getting bored of it all. Some media outlets have already reported experiencing just that, although measuring the phenomenon is, of course, an imprecise science.

- Media organisations with owners who are not necessarily profit-orientated, such as the Jeff Bezos-owned Washington Post, taking the New York Times head-on through combative marketing and lower subscription prices. Bezos, worth more than USD 100bn despite his recent divorce, can easily outspend anything the Sulzbergers can feasibly come up with. The owner of the 6th largest US newspaper could afford to give it away for free, which would cause a real headache for the owners of the US' 3rd largest newspaper, the New York Times.

- If a Democrat was to take the White House in 2020, a more left-wing US government could decide to invest government funds to prop up loss-making media organisations. Don't laugh, Canada's Trudeau administration is already doing as much. This, too, can hurt the business of the country's remaining profitable media organisations.

And many more…

I do believe there is a reasonable likelihood that the New York Times' quality reporting will one day achieve and surpass the mark of 10m online subscribers around the world. It is the only US-based newspaper that has built a global brand suitable for achieving such numbers, similar to what the Financial Times has achieved in financial news. With over 134m unique visitors to its website every month, there is a large enough audience to which the company can pitch its paid-for products. Alexa ranks the New York Times website as the 116th most important website in the world, way ahead of the 473th rank the country's biggest newspaper, USA Today, achieved.

However, the path to the 10m paying online subscriber mark is likely going to be a rocky one. It is more likely than not to involve temporary setbacks rather than a straight line from here to 2025.

What's more, from my own experience as a voracious consumer of paid-for media, I see considerable margin compression on the horizon. The value of, or rather the price paid for, media content is on the way down. All newspapers will have to face up to that over the years to come. There is simply too much competition from sources that are for free, and pay-per-article models will eventually prove a viable alternative to subscription models. To get to the 10m paying online subscriber mark, the New York Times will probably have to be aggressive with its pricing and invest heavily in marketing, both of which hurt margins.

If anything, I'd place a risk discount on this company's long-term perspectives, as opposed to the growth premium that it is currently trading at. Online subscribers leave as quickly as they come, and this lack of durability should lead to a relatively lower valuation rather than a higher one.

Though despite that, I am the last person to disagree that this stock could go through the roof in a 2020 US election mania. Stranger things have happened.

Also, a second term for Trump, the possibility of which no one can deny anymore, could lead to liberals' heads exploding. There'd probably be another million or two in paying subscribers just for the safe space aspect. I saw it happening among my own liberal friends in the aftermath of 8 November 2016.

And in conclusion?

The New York Times' stock currently couldn't be further away from the kind of value investment that this website tends to seek out. This isn't an investment where I'll get to live out my obsession for buying the dollar for 50 cents (or 20, or 10). It's trading at very high multiples.

But it's a fun stock to watch for anyone who takes an interest in politics and how the combination of Zeitgeist, current events, and public manias influence the stock market. It's probably the single most prominent publicly listed company to regularly appear in Trump's tweets, at least so far. You could call it a fever curve of US politics. It's the US media equivalent of Tesla in the auto industry. You cannot afford not to follow it.

Assuming the broader market stays buoyant, this stock will probably be driven up further by a combination of overall momentum and the company's news flow about growth and improved margins.

Though it wouldn't take much for the pendulum to swing the other way, given the high degree of optimism that is currently priced into the stock. Given its current lofty level, such a fall could be a hard one.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get ahead of the crowd with my investment ideas!

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Archive with all past research reports

- Updates on previous research reports

- 2 special publications per year