Last week, I looked at opportunities among unlisted stocks. Today, I am looking at companies that are listed on a relatively unknown stock exchange – the stock exchange of the Channel Islands, a British Crown Dependency off the French coast.

The Channel Islands have become a thriving economy that few people have on their radar, and there are several ways investors can benefit from it. As part of all this, a stock market has emerged where plenty of overlooked investment opportunities could be hiding. There are nearly 3,000 listed securities on this exchange – incredible, but true! A relatively little-known market with a large array of listed securities immediately makes me wonder what might be hiding there.

You'll be in for a few surprises.

Unless you live in the Channel Islands – as I do – you are almost guaranteed not to have come across some of the facts, anecdotes and opportunities that I have assembled for you today.

Let's dive right in!

Where, what, who?

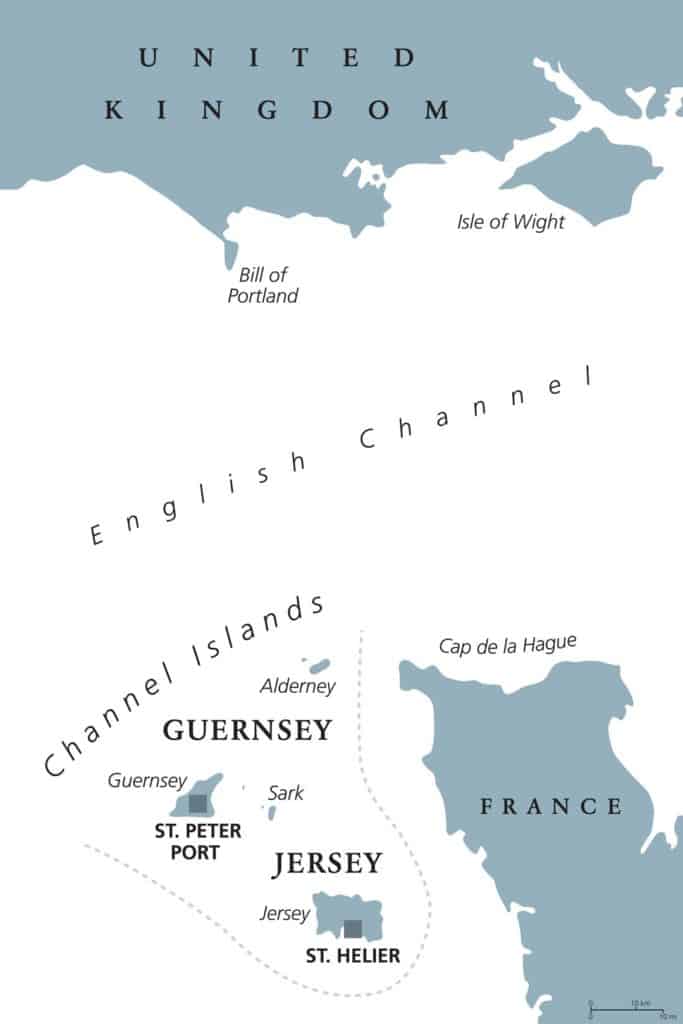

Even many British people have trouble finding the Channel Islands on a map.

The older generation tends to know Guernsey and Jersey as popular holiday destinations in the 1960s and 1970s, before the onset of cheap flights to Spain and Italy. The younger generation usually has trouble telling where they are. I can't even count how many times I have heard people mixing them up with the Isle of Wight (a holiday island just off Southern England) or the Isle of Man (a Crown Dependency in the Irish Sea).

What is confusing at first is that the Channel Islands are closer to the coast of France than England. Guernsey is 113 km / 70 mi. off the English coast but only 48 km / 30 mi. from France. You can see the coast of France from many spots in the Channel Islands, but you could never look as far as England.

Victor Hugo: "The Channel Islands are fragments of France which fell into the sea and were picked up by England."

Jersey has long been known for its temperate climate. It's almost exactly on the same latitude as Paris and has the most hours of sunshine per year anywhere in the British Isles.

Guernsey and Jersey issue their own money, which is pegged to the pound sterling.

It all makes sense when you look at it historically. The islands of Guernsey and Jersey have long held a strategic position for defence and trade, which is why they were vied over by successive rulers. From 1066 onwards, they were held by the Kings of England, until they became a disputed territory with France in 1202. In 1259, the matter was settled for good. In the Treaty of Paris, the English sovereign ceded his claim to the Duchy – except for the Channel Islands! The islands have remained under control of the English Crown ever since, though never as part of England but remnant of the Duchy of Normandy instead.

Over the centuries, the islands' governance system has evolved in a peculiar way that puzzles most visitors. They never became a part of the United Kingdom but remained independently governed Crown Dependencies. The islands of Guernsey (with Alderney), Jersey and Sark each have their own parliament, but any new laws need to be approved by an advisory council of the Queen (which, in reality, is never not granted). Oddly, the Queen rules over the islands not in her role as Queen but Duke of Normandy. When island residents toast to the Queen, it's "To the Queen, our Duke!"

The Channel Islands are not technically speaking an independent nation, nor are they not an independent country. They are a country for most intents and purposes, but they rely on the UK for defence and foreign policy – mostly! In recent years, they have garnered a growing degree of independence when it comes to foreign policy. They are nowadays free to even set their own foreign policy, provided it doesn't collide with the foreign policy objectives of the UK and doesn't amount to anything naughty. The islands have their own internet domains as well as their own United Nations country codes.

All of this always needs to consider the fact that the Channel Islands represent not one but three jurisdictions. Channel Islands is merely a geographical term, whereas the jurisdictions are the Bailiwick of Guernsey, the Bailiwick of Jersey, and Sark as a special case that is both self-governing as well as part of the Bailiwick of Guernsey.

Outsiders find it hard to make sense of all this, but it's a well-established system that has evolved over the centuries and quite simply stood the test of time. A 1973 constitutional review carried out by the UK parliament found no need to change anything. As they say, when it's not broken, don't try to fix it.

Richer than the UK, richer than Germany

What used to be an impoverished backwater after the war has risen to become one of Europe's most successful economies:

| GDP per capita (USD) | National debt to GDP | Unemployment rate | |

|---|---|---|---|

| UK |

40,000

|

89% | 3.8% |

| Germany |

44,000

|

62% | 3.1% |

| Guernsey | 52,000 | 5% | 1.1% |

| Jersey | 56,000 | 0% | 1.5% |

Each country has their own way of cooking their books, and I am suspicious of any number relating to national debt (because it's so easy to hide liabilities). On the whole, though, it's without question that Guernsey and Jersey are financially extraordinarily solid jurisdictions.

They have also excelled at creating a regulatory environment that brings the right people in, and keeps the wrong people out. Immigrants are welcome to the Channel Islands, provided they come with qualifications and a job. E.g., close to 10% of Jersey's population is of Portuguese descent, and about 3% are from Poland. Guernsey is known to attract highly qualified finance professionals from the UK who are looking for a life in a low-crime and low-tax environment. With knife crime in Sadiq Khan's London having just hit another record high, there are multiple attractions that draw in high-value immigrants from the UK mainland.

The jurisdiction has managed to lift itself out of poverty – and then some. With 172,000 residents, the Channel Islands have one-third the number of people as Luxembourg and over four times the number of residents of Liechtenstein. It's a small jurisdiction, but far from being a micro-jurisdiction.

Hiding money and evading taxes used to be among the services you could purchase at Channel Islands banks and fiduciaries, but those times are long past. New rules and regulations forced the financial services sector to clean up its act and close down secret accounts and anonymous trusts. Both Guernsey and Jersey are on the OECD White List of tax transparent financial centres.

The finance industry and its related sectors, such as legal and accounting activity, still make up 44% of Guernsey's economy. In the case of Jersey, they contribute 39.2% of GDP. The islands have turned themselves into a competence centre for trusts and fund administration, with a sprinkling of private banking and (recently) green finance.

The most remarkable service that this jurisdiction nowadays offers, though, is the listing of stocks and bonds on the local stock exchange.

The Channel Islands stock exchange expanded into the Isle of Man in 2017, when it changed its name to The International Stock Exchange (TISE). You'll probably think it can't have more than a handful of listed companies. Far from it: it has nearly 3,000 listed securities from 1,700 issuers with a combined market capitalisation of more than GBP 350bn (USD 460bn) - nearly 40 times the size of the local economy. In comparison, the main board of the London Stock Exchange has a market capitalisation that is equivalent to 1.2 times the UK's GDP.

Europe's leading market for corporate bond issuance

On an exchange like that of the Channel Islands, you'd expect to find local companies run by the island's entrepreneurs and tycoons.

These are indeed listed on TISE, and I'll cover them later.

What the market has recently become somewhat famous for in financial market circles, is its ability to quickly, flexibly and cheaply provide a listing for newly issued bonds. Most of these would be high yielding bonds, and issued by companies rather than countries.

TISE is a fully recognised exchange and a listing on TISE will count legally as a fully-fledged stock market listing. Its listing rules have always been based out of the original London ‘yellow book’, and, following a number of reforms, they are not hugely dissimilar to the London Stock Exchange, the AIM market, the Irish Stock Exchange, or the Luxembourg Stock Exchange. However, the exchange generally tries to be more flexible to meet client demands, and more proportionate in terms of applying its regulation. It’s a bit more like in the olden days, where a personal conversation can go a long way towards opening new possibilities. Which is the opposite to some EU regulation, where rules are rolled out with a one-size-fits-all approach.

E.g., the EU's Market Abuse Regulation ("MAR") reform for publicly listed securities in 2016 levelled the playing field for all investors, whether they invest in equities or bonds. "Selective disclosure", a practice where companies give more information to some investors and less to others, was banned altogether. However, companies that issue bonds often prefer to speak to a small number of sophisticated investors, and these do not need to be protected by regulation about selective disclosure. The EU effectively banned a widely-used, well-established and entirely accepted practice. As a result, the EU regulation became widely seen as too onerous for corporate bond issuers. The new rules should have been limited to equities rather than rolled out for securities of any kind.

For listings on TISE, selective disclosure remains entirely legal under certain clearly defined circumstances. Guernsey does have market abuse rules and a code of market conduct, which are the equivalents to MAR. But the listing rules permit a level of disclosure that differs depending on which type of investor and which type of security are involved. Sophisticated investors need less protection by the regulator, which in turn can make everything a lot easier and cheaper for the issuer. The TISE listing rules also respect long-established norms of the bond market. Nota bene, the Channel Islands had voted in 1973 not to become a part of the EU, which is why they were free to set their own rules.

As the Wall Street Journal put it, the EU's MAR reform led to multinational corporate issuers of bonds "fleeing" EU markets like Luxembourg, and issuing their bonds on TISE instead. This wasn’t just because of TISE’s flexible regulation. Guernsey already had a debt market, it is in the European time zone, and the local financial services industry is well-reputed (OECD White List). It may not be the cheapest or lowest-regulation jurisdiction overall, but it also offers local expertise and it’s widely respected among investors.

Just a few years ago, virtually no bonds were issued on TISE at all. During the first nine months of 2018 (the most recent period that I found reliable data for), nearly half of all European corporate bond issues (!) were done via Guernsey. Even global giants like Netflix and Blackstone have used TISE for their issuance of debt instruments.

To get information about some of these bond issues, you will often need to be given a password by the issuer. Any investor who qualifies for such a bond issue can get a password, however, it is another level of complication that makes this market less transparent. That's one of the practical reasons why it is a market where cunning investors can get an edge and make money on the back off less-informed investors. Remember what I wrote about in my last column: a lack of transparency or added difficulties in procuring information is frustrating for some, but an opportunity for those who make an effort to dig out the relevant information.

The Wall Street Journal recently dedicated a prominent feature to Guernsey's growing stock exchange.

Besides these corporate bonds, there is a whole sector of interesting stocks to look at.

Information about TISE-listed stocks is publicly available through the exchange's website, but hardly anyone looks at it. That's why I have a hunch that anyone who follows this market will regularly come across undiscovered gems and undervalued opportunities.

Also, given the Channel Island's economic success and relative safety, there could be an opportunity to simply latch on to the growth that some of the local companies are set to achieve over the coming years.

A first batch Channel Island companies to keep an eye on

If you'd like to get exposure to the local economy, there is a mini sector of companies that primarily focus on the Channel Islands economy.

These include some of the following:

- The Channel Islands Property Fund (ISIN GG00B62DS151, market cap GBP 160m), an investment company that owns some of the best commercial property on Guernsey. It's currently trading at a 5% premium to its net asset value, indicating that some investors view the company as a safe-haven investment. Its dividend yield is approximately 6%.

The Channel Islands Property Fund owns prime location real estate on the heavily space-restricted island of Guernsey.

- Bailiwick Investments (ISIN GG00B3KJH957, market cap GBP 70m) is a holding company for stakes in local businesses. The portfolio is spread across industries such as retail, media, property, bars, car dealerships, and recycling. The stock of the conservatively managed portfolio has been rising slowly but steadily since 2010. It is trading at a 10% discount to net asset value and has most recently been paying a dividend yield of about 4.5%.

- The FSO Financial Services Opportunity Fund (ISIN GG00BD37JS91, market cap GBP 56m) has accumulated stakes in a number of financial services companies, among them significant stakes in two of the largest fund administration companies of the Channel Islands (PraxisIFM and Oak). Given what I am hearing about some EU-based fund management companies looking for a lower-regulation place to escape to, these fund administrator companies could be an interesting long-term growth play. The stock is currently trading at a 15% discount to net asset value.

- SandpiperCI Group (ISIN JE00BJYJFX36, market cap GBP 78m) operates a range of retail outlets and has recently acquired a prominent local group of pubs. Such island-based businesses usually earn good margins, because islands by definition have limited competition and higher profit margins. If the population of the Channel Islands were to increase significantly, this portfolio could do well on the back of it.

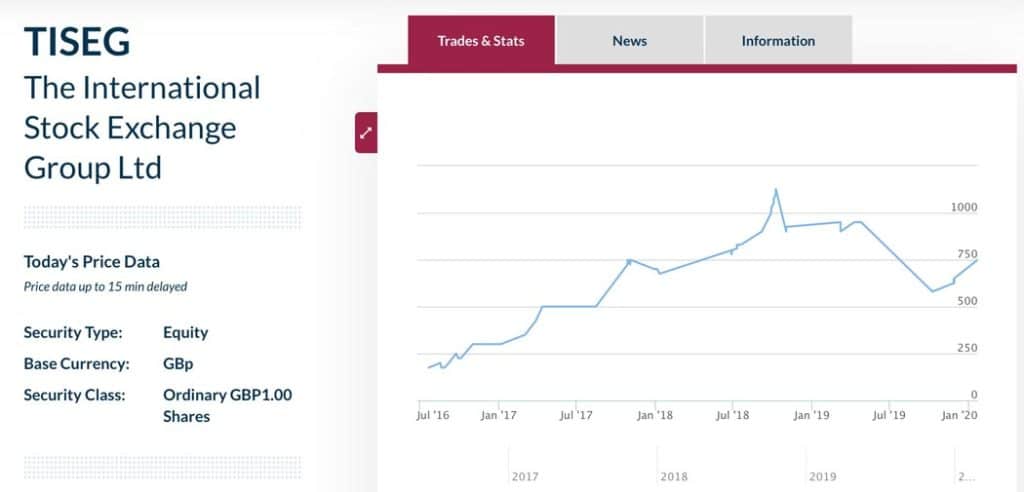

- The International Stock Exchange Group (ISIN GG00BYYLRY96, market cap GBP 21m) is itself a listed company. More about it in a moment.

- PraxisIFM Group (ISIN GG00BD0RGF89, market cap GBP 162m), one of the larger fund administration companies headquartered in Guernsey, is also listed (and part of the FSO portfolio). As I said, the islands' finance industry has a history of finding ways and means to create new growth opportunities, which might make it worthwhile to keep an eye on this company.

Trading these stocks should be easy in theory. Settlement of trades can take place through Euroclear or Clearstream, which any broker or bank can handle. However, to place a trade, a broker or bank needs to be connected to one of the TISE member firms – of which there are currently only three (Canaccord, Ravencroft, and Zedra). Most investors will probably still find it challenging to get access to this market, though that is likely to change on the back of TISE's efforts to increase its number of member firms. As accessibility goes up, demand for these stocks could also increase.

Outside these locally listed companies, there are Channel Islands-related companies that are listed on the London Stock Exchange:

- Jersey Electric (ISIN JE00B43SP147, market cap GBP 54m) has long been known among UK investors as a yield-play. As you'd expect, Jersey Electric runs a monopoly business. Its stock hasn't done much during the past five years, which for some investors is precisely what they wanted to buy into.

- JTC (ISIN JE00BF4X3P53, market cap GBP 470m) is one of the larger fund administration companies of the Channel Islands and headquartered in Jersey. It decided to list in London in spring 2018.

- MJ Hudson (ISIN JE00BJTLYP93, market cap GBP 98m) is a UK/Channel Islands law firm and service provider with a strong focus on the alternative asset management industry. It was admitted to London's AIM market in December 2019. The company is one of a handful of law firms that have floated since the UK's Legal Services Act 2007 allowed non-lawyer ownership of law firms. It is relevant to mention that they are focussed on the alternative assets space, i.e., private equity and hedge funds with a smattering of real estate, credit, and tax driven – rather than the traditional fund managers. It is definitely a play on the more “growthy" areas of asset management rather than a conventional fund administrator.

There are plenty of other publicly listed firms that are headquartered in Guernsey or Jersey. However, many of them only keep a corporate headquarter on the islands and have most of their actual operation elsewhere. A widely-known example for this is Burford Capital (ISIN GG00B4L84979), a GBP 1.5bn litigation funding company that has recently been in the news because of short-seller attacks. Also, many London-listed closed ended investment funds are in actuality Guernsey-based entities.

Are these the world's most exciting companies to invest into?

On the surface of it, most of them benefit from either a captive market with limited competition, or the growth of the financial services industry. Given that the Channel Islands mentality is closer to that of Switzerland than Silicon Valley, you are not likely to find overnight ten-baggers.

That said, there could be outliers hiding among the little-followed sector.

E.g., TISE is chaired by John Moulton, one of the British Isles' most successful private equity financiers with a net worth approaching GBP 200m. One would assume that there are ambitious growth plans, or why else would Moulton bother. Moulton is also one of the largest shareholders, with a stake of just under 9%. The company has a market cap of only GBP 21m, and spiralling EU regulation is likely going to lead to growing business for the exchange. The stock price of the London Stock Exchange (ISIN GB00B0SWJX34) is up ten times over the past ten years, and stock of Deutsche Boerse (ISIN DE0005810055) is up three times over the same period. TISE could be one to watch. Back in mid-2016, its share was trading as low as GBp 250. It subsequently rose as high as GBP 1,125 and is currently back at GBp 750. Given its low market cap and strong backing, it wouldn't surprise me if this eventually turned into a highflyer on the back of some clever ideas.

Some investors seem to have already latched on to TISE's stock.

Also, the Channel Islands themselves could yet be in for a transformative growth strategy if recent ambitious plans come to fruition – which would rub off on local businesses and assets.

The two most ambitious projects of the past 100 years

Jersey's population has grown from just 62,000 people in 1961 to 107,000 last year.

In Guernsey, the population has increased from 45,000 in the early 1960s to now 62,000. Unlike Jersey, which is comparatively spacious, Guernsey is visibly bursting at its seams.

To make space to grow and improve the quality of life of existing residents further, Guernsey is currently considering the single biggest development project of the last 100 years: to redevelop its vast and underutilised harbour as an area for hotels, offices, and residential housing. The proposals would inevitably include cultural and leisure development, as well as tourist attractions. Additional land could easily be added through land reclamation. If this were to take place, the size, character and international visibility of St Peter Port (and Guernsey) would change considerably.

Quite possibly, a game-changing project for Guernsey's economy.

Would this turn Guernsey into a Singapore off Normandy? It's unlikely that the conservatively governed island would go quite that far. However, given its low-regulation and low-tax regime, such comparisons wouldn't be entirely far-fetched.

An even more ambitious plan involves the potential to build a tunnel between Guernsey and Jersey, and onwards to the French mainland. A group of business leaders from both islands recently carried out some very preliminary feasibility studies for the tunnel. Such a project would likely cost a minimum of GBP 2.6bn and take five to ten years to implement. If it were to happen, it would open an entirely new chapter for the economy of the Channel Islands. Property prices would probably go through the roof in some locations, not the least because it would inevitably lead to a migration of wealthy and highly-qualified French people. Lower taxes are just one attraction, and others include the very low rate of crime, the overall coherence of Channel Islands civic society, and an outdoorsy lifestyle.

Last year, Jersey already appeared in the global top 10 ranking of property markets. At a time when many other residential property markets around the world were weak, prices in Jersey rose 7% over 12 months, making it rank in spot #8 globally. A sign of things to come?

Reading local newspapers can sometimes give you an edge.

Who wouldn't immediately think of parallels to the Channel tunnel project?

These are some of the possible routes for such a tunnel.

One for our watch list

To keep a sense of realism, the Channel Islands are also known for slow decision-making processes and delayed projects. The economy's successful headline figures shouldn't distract from the islands' other problems, such as the rapidly ageing population in the Bailiwick of Guernsey. Projects such as the harbourfront expansion have been talked about for decades, although recent rumblings seem quite serious.

Investments into a basket of local businesses that are listed on TISE could give you exposure to growth plans and put your money into a European safe-haven (where, for example, a Eurozone bank deposit insurance scheme wouldn't bite). All the more if you manage to utilise a weak period to pick up stocks in these companies at sell-out prices. As you know, I always lie in waiting for such opportunities to arise so that my readers can strike when a sell-out opportunity arises.

With all that in mind, I'll keep an eye out for any potential outstanding opportunities arising. After all, I get to read about them in my local newspaper. Information sources that virtually no one else reads will remain at the heart of this website's research into investment opportunities.

Last but not least, the islands are also always worth a visit! Check out this 5-minute video of the Sark Exploration and Opera Weekend, which I co-organised last year in collaboration with Sark's Head of State. The Channel Islands have many attractions, and making money is just one of them!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get ahead of the crowd with my investment ideas!

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Archive with all past research reports

- Updates on previous research reports

- 2 special publications per year