The past week in British politics has produced a lot of superlatives. How can investors turn it all to their advantage? Are there even any ways to make money, or is Britain going to disappear down a black hole?

The situation is fast-moving, complex, and politically charged.

There are three important aspects that private investors with an interest in the stock market should pay attention to – including one out-of-favour sector that could turn out surprisingly resilient during a recession and see share prices increase by over 100%.

The pound – how much further to fall?

When the pound sterling hit 1.05 to the US dollar, "shorting pound" started to trend on Twitter – "the sign we have hit the bottom for now", as I told a colleague.

Sure enough, Britain's currency has since rallied back to above 1.10 to the dollar.

No one can predict short-term currency movements. However, when a development in financial markets hits the newspaper front pages, most of it is usually already over, at least in the short term.

Will we see the pound below parity to the dollar, as so many have recently predicted?

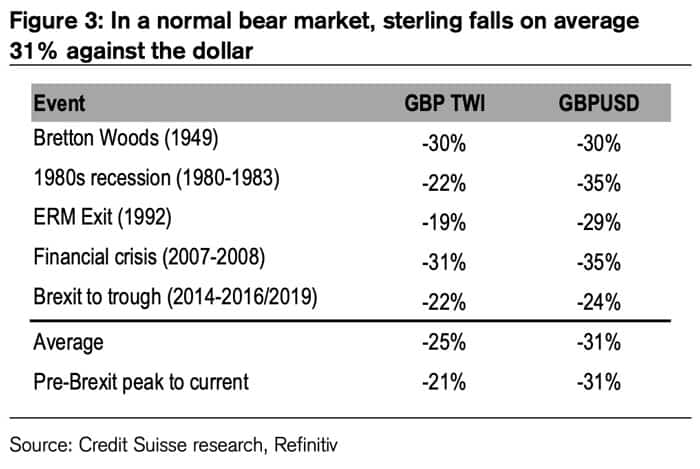

A look at the history of the pound's bear markets makes for an interesting perspective.

Since the end of the Second World War, the average bear market took the pound down 31%. At a rate of 1.05 to the dollar, it was down exactly 31%. Even the brutal recession during the early 1980s and the Great Financial Crisis of 2007-09 didn't achieve further than 35%.

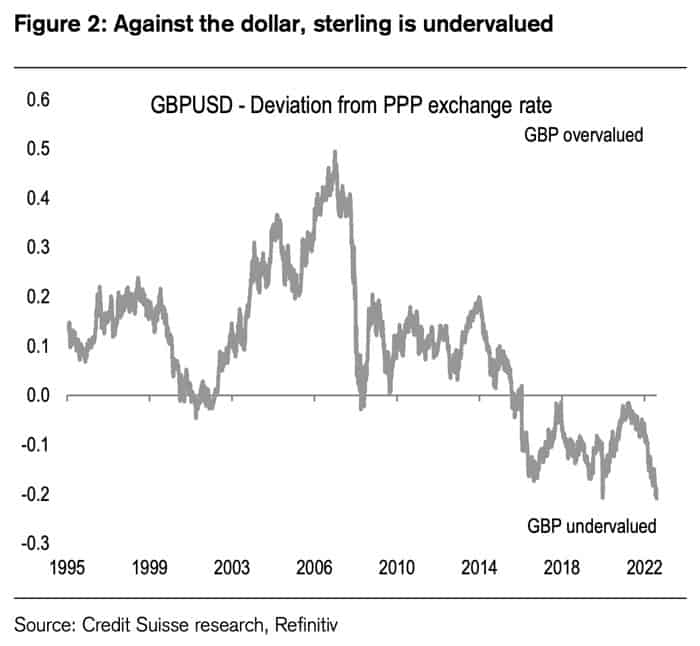

These comparisons are somewhat arbitrary, but they do provide some useful yardsticks, especially when combined with other indicators. Measured on a purchasing power parity basis, the pound is now more undervalued compared to the dollar than at any time since 1995.

None of this means the pound couldn't fall further. However, this provides some useful context for the overall situation as it shows that British assets are cheap compared to elsewhere.

Could Trussonomics surprise?

When Liz Truss got elected, I shrugged. Several Tory governments had failed to get much done, and with Truss's charisma of a white sheet of paper, I had zero expectations.

However, seeing her recent decisions, I started to experience a cautious sense of excitement of the kind I last felt in 2016. Maybe – and that's a big MAYBE – something will finally start to get moving:

- Lifting the fracking ban has practical implications for Britain's energy supply, but also HUGELY symbolic aspects. Effectively, Truss declared war on the West's eco-zealotry and underlined Britain's sovereignty.

- Doing away with a cap on bankers' bonuses sends a strong signal that Truss wants to make the City of London more competitive.

- Leaving the corporation tax rate at 19% (instead of lifting it to 25%) means Britain will have the lowest such tax rate in the Western world.

- Throwing out much of the patchwork of EU-derived laws reduces the overall level of regulation for British businesses.

These are the kind of policies that should have been introduced on day 1 after the Brexit referendum, but weren't. They are also the actions of a government that deserves to call itself Conservative, rather than one that is Conservative just in name.

There is no denying that Truss is attempting all this at a time when public finances are stretched. Cutting taxes and providing support for higher energy costs mean Britain will have to borrow GBP 400bn in the coming years. No British "Chancellor" (the British term for Finance Minister) has ever increased borrowing by so much. The Truss government provided scant details of how it will be financed, so it was natural that the exchange rate was going to suffer and interest rates were going to go up. Britain has the Western world's second lowest national debt to GDP ratio, but other short-term factors provide serious hurdles for funding this largesse.

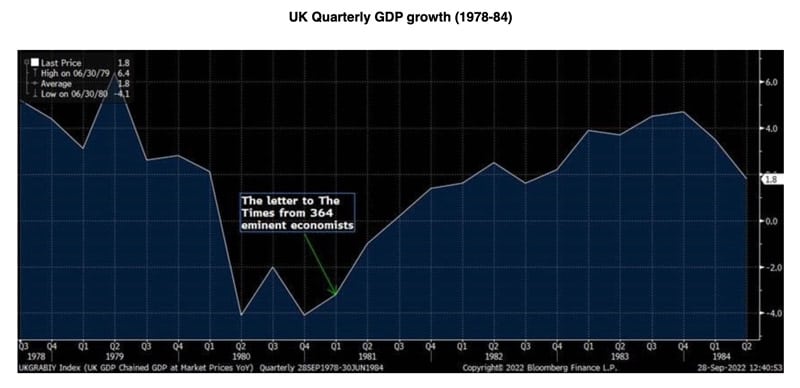

History books will eventually have to decide whether the strategy worked out. In the meantime, there are valid reasons for blocking out much of the surrounding hysteria. When Thatcher introduced her tough-love measures in the early 1980s, no less than 364 eminent British economists published a letter condemning her policies, saying they were threatening Britain's "social and political stability" (you can read the full letter here, thanks to my friend Manish Singh at Crossbridge Capital). It turned out the letter marked the low point of the crisis, and the subsequent success of Thatcher's economic policies remains unrivalled in British history following the Second World War.

The combination of measures now described as Trussonomics are risky, without a doubt. The question is, can Britain afford not to take bold, inconvenient action?

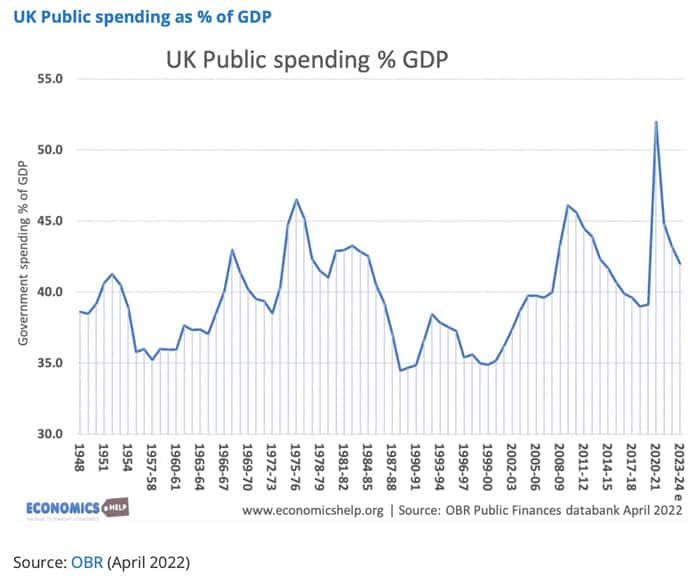

Public spending in Britain is currently above 45% of GDP, which places it near the top of the range since the end of the Second World War. In the 1980s and 1990s, it was as low as 35%. Truss already indicated that she wanted to identify areas where government can save money by being more efficient. Given that she just vowed not to back down from pursuing her agenda, further political storms are likely to lie ahead.

Britain could now turn out to be the petri dish for changes that are badly needed in the entire Western world, including (but not limited to):

- Reducing the GDP share of the state in a way like no other Western state has dared in the past 80 years. Anyone with an interest in the subject of cutting the state down to size should read up on "Geddes Axe", the infamous 1920s policy recommended by Sir Eric Geddes, who literally axed entire bureaucracy swathes. Europe would greatly benefit if one major European country demonstrated that no country needed to spend more than 35% on government (and possibly even a lot less).

"Geddes Axe" became a metaphor for changes that improved efficiency and increased simplicity.

- Unashamedly focussing on reliable and affordable domestic fossil fuel sources rather than falling for eco-fantasies that benefit special interest groups and talking up risky, immature technologies that are nice in theory but unsuitable for covering short-term needs.

- Returning financial markets to paying a positive real interest rate, following a period where negative real rates rewarded financial irresponsibility. Getting there will be painful because of the accumulated financial issues of the past decades. It won't happen in a straight line since the system will push back. However, it only becomes more painful the further it is pushed out.

It's easy to see why so many are upset about Truss's forays. The status quo represents a massive gravy train that millions benefit from. The EU, too, will feel threatened. Truss could finally get Britain into a position where it can aggressively weaponise tax and regulation to suck capital and jobs out of countries that are a member of the European Union. If Truss continues (and succeeds), voters across many other countries will take notice.

Will she succeed?

I don't know. The risk is that she arrived on stage simply too late. If she fails – for any reason – then Britain may well end up in a more dire situation than now, with the blame inevitably pinned on Truss. For now, however, I am waiting with abated breath if she doesn't surprise us all. Her Chancellor has a PhD in Financial History, so there is at least a chance that he really understands what he is doing.

If Trussonomics succeeds, it will do quite a lot for the attractiveness of British stocks. Increasing investment, rebooting the City, drastically increasing domestic energy output, and triggering entrepreneurial activity could turn Britain into a country that is valued at a premium rather than a discount. In due course, its exchange rate would recover as well.

In the meantime, I fully expect this mere possibility already doing a world of good for further lucrative bids for publicly listed British companies. Foreign investors, especially from the Anglosphere, will want to get in while the pound is so cheap.

British stocks to look at now

For three years, I have sounded like a broken record with my repeated writing about takeover targets in the UK:

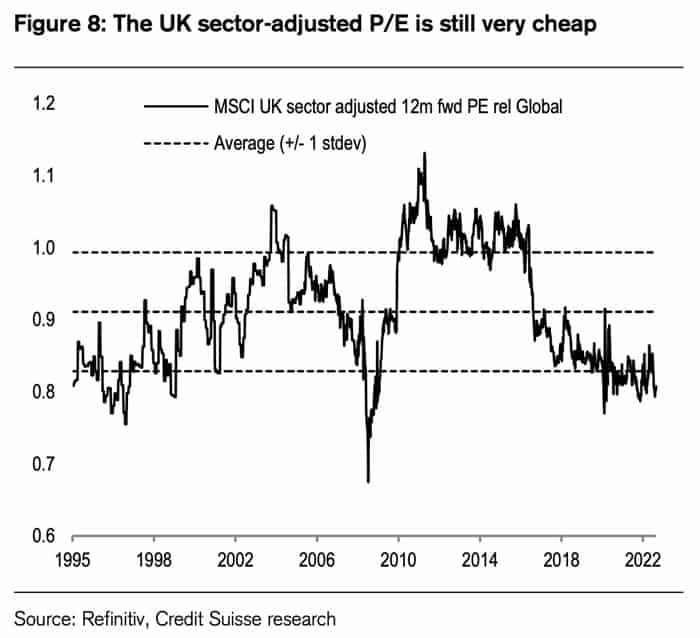

- The London Stock Exchange has many undervalued companies. Right now, based on sector-adjusted price/earnings ratios, British stocks are as cheap as they've ever been.

- Britain has an extraordinarily open capital market – the most open in Europe.

- American investors, in particular, like buying British companies because Britain and the US are very close to each both, both economically and culturally. Now that the dollar is so strong versus the pound, American investors will be taking a very close look at acquisition targets across the pond.

Indeed, according to data from Dealogic, UK companies valued at more than GBP 41bn have been acquired so far this year.

It's one of those little-known facts about the British stock market that many British companies earn the majority of their profits in dollars. In fact, FTSE 100 companies generate 78% of their earnings from overseas.They were already very cheap based on a sector-adjusted price/earnings ratio, and are now benefitting from the exchange rate.

Not entirely surprisingly, the FTSE 100 index is down "only" 9% this year. In comparison, the S&P 500 index is down 24%, Nasdaq has lost 32%, and the German DAX is down 24% year-to-date.

There are now three categories of British stocks that are worth a closer look:

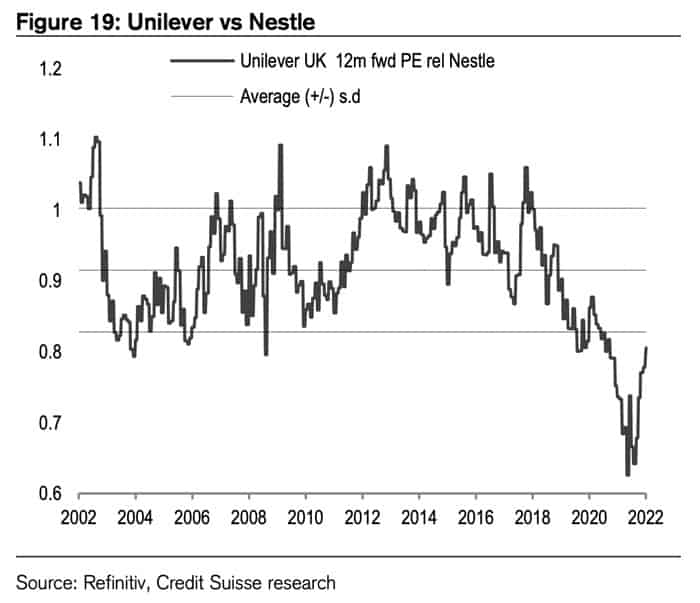

- Internationally known British companies that are cheap compared to their global peers. Notable names include British American Tobacco (ISIN GB0002875804, UK:BATS), Unilever (ISIN GB00B10RZP78, UK:ULVR), and Pru (ISIN GB0007099541, UK:PRU). Rentokil Initial (ISIN GB00B082RF11, UK:RTO) is currently trading at a 48% lower valuation than its international peer Rollins (ISIN US7757111049, NYSE:ROL). BT Group (ISIN GB0030913577, UK:BT) is, on average, 46% cheaper than Deutsche Telekom (ISIN DE0005557508, DE:DTE), KPN (ISIN NL0000009082, AMS:KPN) and Orange (ISIN FR0000133308, Euronext:EPA). ASOS (ISIN GB0030927254, UK:ASC) is 66% cheaper than Zalando(ISIN DE000ZAL1111, DE:ZAL).

- Companies that are subject to bid rumours because they benefit from their currency exposure. Morgan Advanced Materials (ISIN GB0006027295, UK:MGAM) makes 40% of its revenue in North America. Smith+Nephew (ISIN GB0009223206, UK:SN) gets more than half of its revenue from North America, and the stock is down ≈40% in dollar terms this year. Other companies that get over half their sales from the US include Smiths Group (ISIN GB00B1WY2338, UK:SMIN), Indivior (ISIN GB00BRS65X63, UK:INDV), and Bunzl (ISIN GB00B0744B38, UK:BNZL).

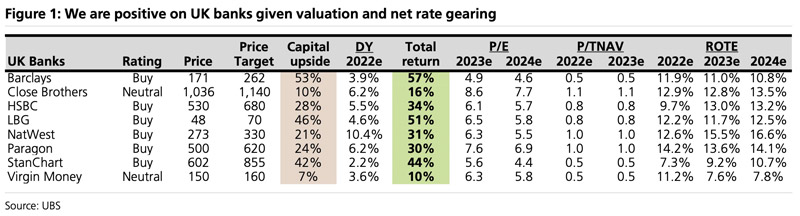

- British banks (somewhat surprisingly). Circa 70% of the increase in interest rates will be kept by the banks, making them one of the biggest beneficiaries of rising interest rates. While no company will be unaffected by what will likely be a year of recession, banks (in Britain and elsewhere) have become far less sensitive to a recession thanks to Basel III, IFRS 9, regular stress testing, and the end of the kind of self-certification mortgages that brought the Great Financial Crisis of 2007-09. According to Credit Suisse estimates, even a very severe recession would result in only a 25% downgrade of British bank earnings per share. British bank stocks are viewed as "very cheap on macro models and conventional valuation", with ≈130% upside for the entire sector. UBS also recently came out swinging for British bank stocks: "We see the UK banks trading at 6.1x 2023e EPS, too cheap given the normalised Free Cash Flow generation on offer. NatWest & LBG top domestic picks, StanChart top international name."

So, is it really all doom and gloom for the British market?

As the Financial Times put it on 29 September 2022: "Bankers predict a further wave of M&A activity as overseas buyers seek to take advantage of weakening sterling."

Bloomberg had predicted on 23 September 2022 that "a broad-based selloff may attract the attention of acquirers on the hunt for more internationally exposed firms caught up in the maelstrom."

In past Weekly Dispatches, I had written about the unusually high premia paid in bid situations for British companies.

Trussonomics is an experiment with an unknown outcome, and the pound could experience further pressure yet. We are currently quite possibly seeing a change from a system where the central banks controlled everything to a system where they are not going to be able to control everything any longer. It feels like the Western world has moved into terra incognita as far as its monetary system and government finances are concerned. Much as we are unable to say where exactly this will lead, we can – at the very least – determine where investors are offered the combination of value and credible upside due to specific catalysts.

In this regard, British stocks are now more than ever worth a closer look.

My latest stock pick

If you ever wanted to become part of a transformation story, here's an idea.

With a new CEO at its helm, my latest discovery – a US-based company with a multi-billion market cap – is about to undergo a change in narrative that could see its stock increase in value by 200% over two years.

The new hire – one of the most successful leaders in the industry – makes for a compelling investing case. Right now, investors still underestimate what this CEO will bring to the company. Your chance to get in early!

My latest stock pick

If you ever wanted to become part of a transformation story, here's an idea.

With a new CEO at its helm, my latest discovery – a US-based company with a multi-billion market cap – is about to undergo a change in narrative that could see its stock increase in value by 200% over two years.

The new hire – one of the most successful leaders in the industry – makes for a compelling investing case. Right now, investors still underestimate what this CEO will bring to the company. Your chance to get in early!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: