Over the past decade, "the enforcement of the law on shoplifting has almost completely collapsed".

This is a quote taken from a report in the UK, but it also applies to the US and increasingly to other Western nations.

The issue is set within a seemingly wider breakdown of law and order.

A politically inconvenient subject, it could harbinger a triple-digit billion dollar shift in revenues and investments.

Amid the spiralling problem of theft and what is (or isn't!) being done about it, are there any investment opportunities?

Source: The Times, 27 September 2023.

Firsthand impressions

The trigger for this article were several personal experiences yours truly had with shoplifting.

While visiting a Sainsbury's Local in London's Chelsea, I spotted a woman behaving suspiciously. Keeping an eye on her while she loaded up on donuts, I subsequently saw her walking out of the store. My alerting the staff didn't yield the desired result, even though the woman remained just a few metres away at a bus stop. Sainsbury's staff told me they are not allowed to leave the store, so they had to let it go.

On another occasion, I saw an obviously homeless person loading up on items in a Marks & Spencer Simply Food store in London's Notting Hill. He even asked a staff member for help in finding an item, and then walked out. The staff member will have realised what was going on. No one bat an eyelid.

Meanwhile, another Sainsbury's Local I often visit in Notting Hill put up yellow signs against shoplifting. Given what I had witnessed with my own eyes, the move came across as a large corporation putting on ineffective theatrics. It was not done to actually achieve anything, but to be seen as doing something.

Source: own photo.

It made me wonder, how will all this affect retail businesses and their shareholders? Will it affect them at all, or does it all come out in the wash – similar to credit card companies, where a percentage of fraud is simply priced in and doesn't hurt shareholders. Are there risks and opportunities that private investors should pay attention to?

A while back, I started collecting a broad range of material in the hope that this would eventually come together to a broader, exploratory piece.

The size of the problem

Following a handful of British newspapers, it appears that this is a problem which is hitting small and large retailers alike, and involving many well-known brand names:

Across the Atlantic, the situation appears to be similar, if not even worse:

This is a somewhat random collection of articles that I've collected over a longer period of time. Newspapers amplify matters – the house that isn't on fire isn't news after all. Still, it's simply too much reporting to not conclude that there is now a different level of shoplifting going on in countries like the UK or the US.

For other regions of the world, such news are less of a surprise. No one would really bat an eyelid about this Financial Times article: "'Everything is being stripped and stolen': Wealthy residents flee Johannesburg as it descends into lawlessness and infrastructural collapse".

This is Africa, after all. Johannesburg, no less!

The opposite would be expected of a country like Germany. However, in December 2023, BILD, Germany's largest daily newspaper, dedicated front-page coverage to the reporting (and controversy!) stirred up by a manager of an EDEKA convenience store: "They come from the asylum center, and fill up their bags."

The EDEKA case also stirred up controversy for another reason and pointed towards some of the side effects of the problem. The store manager told BILD that the thieves who steal huge bags full of items were usually "migrants" (newspeak for "illegal immigrants"), with around a third of them being Tunisian. He asked: "In the bag were spirits: vodka and liqueurs again. They are muslims – did they want to resell the alcohol?"

Indeed, entire parallel economies have sprung up around the issue. Anyone walking around New York City these days will notice that certain areas have become open-air resale markets for stolen goods. Do you need new Apple AirPods? Why bother going to the Apple store in Soho when a few blocks away you can buy the same product, wrapped in its original packaging, at a knock-off price? Such open-air illegal markets affect neighbourhoods and real estate markets. The entire issue has far-reaching consequences and goes way beyond the immediate loss to retailers.

Source: New York Post, 14 April 2024.

Source: Bruce Fenton, X account.

How large is the problem really, though?

That's more difficult to assess than the barrage of media reporting would make you believe.

In 2023, the National Retail Federation claimed that in the US, nearly USD 50bn worth of merchandise vanished in a mix of shoplifting and organised retail crime. Given this came from the world's largest retail trade association, this figure might have been trustworthy.

However, the lobbying group later retracted the statement and claimed the figure was actually only one-tenth this amount.

Was it a data error, as the federation claimed – or was political pressure applied?

If you believe the Financial Times' opinion pages, the entire shoplifting epidemic was a temporary mini-crisis that got hyped up as part of the current culture war: "Shoplifting, self-checkout and the limits of AI

Despite some dramatic footage of smash and grab heists, evidence for a wider problem proved thin. The 'unprecedented' 2022 losses added up to 1.6 per cent of total US retail sales, a return to the 2019 average loss rate after a dip in 2021."

No doubt, the Financial Times opinion writer would tell me "Don't believe your lying eyes."

However, we live in a day and age when the powers to be can claim for years that the sitting US president was "as sharp as a tack", only to turn on a dime and chuck him out once the obvious had become impossible to hide from even the most gullible of people. Who believes anything anymore? Many readers who commented under the Financial Times opinion piece were of a similar inclination.

As far as I am concerned, I believe my own observations and the pleading letter that 20 large US retailers sent to the US government to point to the multi-billion scope of the problem. CEOs of so many large companies don't come together to conspire in conjuring up fictitious problems.

In the US, the major retailer Kroger "labeled increased organized crime as a major factor for why it saw a drop in gross profit margins".

In the same article, Walgreens Boots Alliance reported that "organized retail crime is one of the top challenges facing retailers today".

With that in mind, I was wondering how to make a buck out of the situation – and ideally, without turning to the seemingly risk-free returns offer by going shoplifting myself!

Technology as a solution

There is nothing new to politicians claiming they'll reign in the problem.

In September 2023, the UK's then-policing minister, Chris Philp, called to "arrest shoplifters even if they steal goods under £200, and a zero-tolerance approach as figures show officers fail to attend more than two thirds of thefts".

The new Labour government has now promised a crackdown on shoplifting by "scrapping the effective immunity for low value shoplifting introduced by the Tory party". As the UK's Treasury chief, Rachel Reeves, put it: "Having listened closely to organisations like the British Retail Consortium and the trade union Usdaw, I am providing additional funding to crack down on the organised gangs which targets retailers and to provide more training to our police officers and retailers to stop shoplifting in its tracks."

The question is, at this seemingly advanced stage of the problem and given everything else that is feeding into the issue, can any of these efforts ever be successful?

Britain's police force is now at a point where in many areas of the country it attends less than 50% of burglaries. If even the capacity to tend to break-ins is so overstretched, what are the chances sufficient resources will be dedicated to policing shoplifting?

Governments are unlikely to be effective in tackling the issue, and the larger societal trends that have led to the problem arising in the first place are also not likely to experience a major turnaround given the reluctance to even speak about many of them.

What's the solution then?

Presumably, technology.

The retail sector's last major wave of increased use in technology was probably the introduction of self-checkouts in grocery stores. These have had a mixed effect, with many customers being so disgruntled about them that they switched to online shopping instead. There is also a significant body of evidence that self-checkouts have only contributed to the rise in shoplifting, as many people are more comfortable to sneak past a machine than a human being.

In a bid to tackle shoplifting, a group of British retailers has recently teamed up with technology companies and the police. They are planning to instal facial recognition equipment at all their stores, aimed at hindering known shoplifters from even entering the store. Through forcing all customers through a security gate, entering a supermarket will be similar to boarding an airplane.

There are already many examples of experimental stores that require customers to go through such a system, including an (in)famous Whole Foods store in Washington DC.

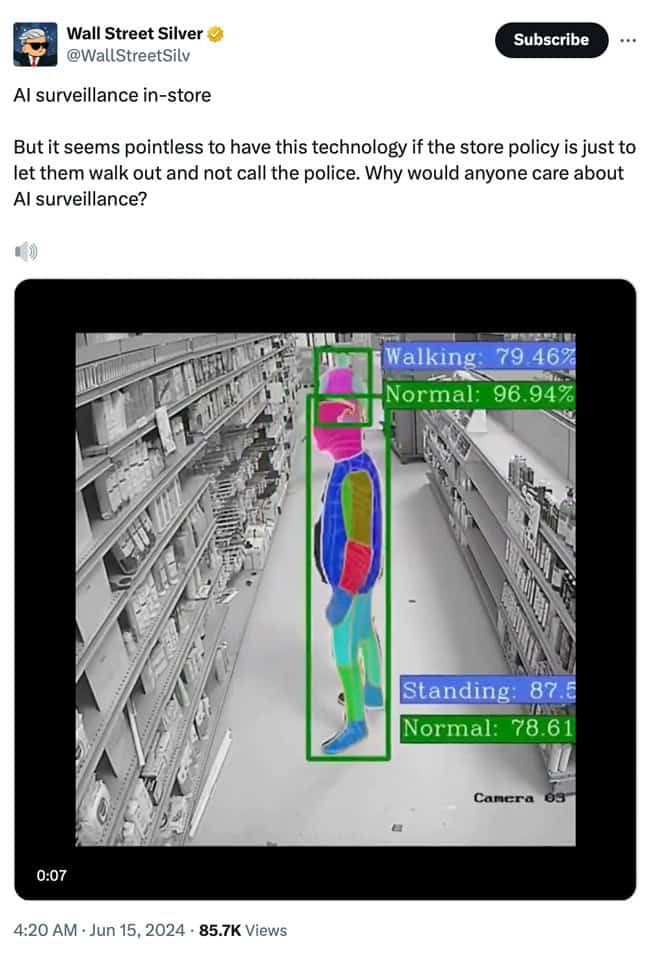

Source: Wall Street Silver, X account.

Such a use of technology will likely be taken further through AI for monitoring customer behaviour in stores. AI software has already been used to automatically identify customers who are in the process of (or about to) commit shoplifting. Given the current lack of ability of staff to step in, it's not clear yet how that would be of actual help, but it'd sure feed into a giant database.

Source: Daily Mail, 5 April 2024.

The wider implication of this could well be that the Western world, too, is gradually moving towards a Chinese-style social credit system. Are you a known shoplifter? You will no longer be able to pass through the gates of stores and instead be banished to an existence fuelled solely by e-commerce. Given Western consumers' well-established preference for convenience over privacy, this is the most likely path.

Source: Wall Street Silver, X account.

In the UK, Aldi has been testing a concept where a customer needs a smartphone and a QR code to enter the store.

Source: Daily Express, 9 June 2023.

Who are the likely winners of such a trend?

Companies that operate in the fields of facial recognition, AI, database, and cloud storage come to mind. More specifically, there is now and entire segment of "loss-prevention stocks", which includes:

- CCL Industries (ISIN CA1249002009, TSX:CCL), a Canadian retail solutions provider that also owns Checkpoint, a leading developer of RF and RFID based technology systems for loss prevention and inventory management applications.

- Johnson Controls International (ISIN IE00BY7QL619, NYSE:JCI), a specialist for building controls with divisions for access control and surveillance management, as well as for smart and connected shopper engagement.

- Prosegur Compañía de Seguridad (ISIN ES0175438003, ES:PSG), a global specialist for security solutions.

- Avery Dennison (ISIN US0536111091, NYSE:AVY), a company that offers intelligent retail solutions which deter theft, enable recovery of stolen goods, provide supply chain visibility and authenticity, and reduce shoplifting.

- StrongPoint (ISIN NO0010098247, OSL:STRO), a retail technology company that has developed " Vensafe", described as "a smart, secure way to sell high-theft items without the hassle of locked cabinets, security tags, or removing items from the shelves".

Source: StrongPoint.

There'll likely be other firms to play this trend.

The privatisation of policing

There are many headlines suggesting that trust in the policing system is declining:

As several of these headlines suggest, hiring private security is going to increase further. Companies that offer these kinds of services – such as Prosegur Compañía de Seguridad – should have plenty of growth ahead.

Another company that I had featured in a research report for Undervalued-Shares.com Members is Serco Group (ISIN GB0007973794, UK:SRP). The company handles jobs that the government is outsourcing, ranging from private policing to housing asylum seekers. I have long recommended it as a hedge against dystopian risks.

Source: Undervalued-Shares.com.

Self-defence

The issue of theft is just one form of the growing lawlessness. It is likely that self-defence of any kind will become more of a growth market than it already is.

Owners of corner stores will buy more weapons – at least in the US, where the citizenry is allowed to defend itself.

What are good stocks to play the theme? Maybe US gun manufacturers like Smith & Wesson Brands (ISIN US8317541063, Nasdaq: SWBI)?

Redefinition of luxury?

Being able to take your Rolex for a stroll in Central London used to be a common pastime for the world's wealthy. A significant reason why luxury goods sell is the possibility of showing them off in public.

We may be in the early innings of this market reorientating itself towards other experiences: "More than one in five Londoners attacked or threatened in past five years".

Source: The Standard, 13 August 2024.

Theft in public and related violence are a major part of this entire trend towards a breakdown in law and order. London's police have already issued advice not to use your smartphone in public more than you absolutely have to. And really, why would you use a MOBILE phone while you are on the go? Anyway, many thieves have actually already moved on from smartphones. Theft of luxury watches and jewellery through street robbery has become the major problem.

Luxury brand Audemars Piguet has taken this as a PR opportunity. The firm offered its customers to replace stolen watches, providing an alternative form of insurance.

Source: Daily Telegraph, 8 April 2023.

The question is, though, whether the changing feeling about security in cities like London (whether real or perceived) isn't going to change consumer behaviours. As The Times already asked: "Is time running out for the luxury watch as a status symbol? Share prices plummet as London street robberies put wealthy off flaunting expensive models".

Wealthy consumers may steer their spending more towards safe experiences. Is it worth checking out the stocks of luxury resorts and cruise ship companies?

Walled neighbourhoods and high-security residential developments are another likely beneficiary.

General loss of trust

Countries like the UK and the US used to be high-trust societies.

Today, an increasing number of people are questioning whether "the system" is still working.

The widespread acceptance of shoplifting is a key aspect in this, but not the only one. Other examples of why many residents of Western nations have lost faith in their societies to some extent include the following:

An entire generation of politicians has long worked towards redefining what it means to break the law. The attempts to redefine "illegal immigrants" as "undocumented immigrants" or "migrants" is just one of the many examples of the normalisation of crime, and it's well-documented.

If laws and basic rules of civil behaviour have less and less real meaning, why bother accepting any of them?

The public can now see:

At least, some of all this gets us some really good comedy. Relax for a moment by enjoying the following spoof video.

Source: WeGotItBack, X account.

In any case, it's not surprising to see headlines such as:

An increasingly large portion of the population of Western countries are beginning to lose their social connection to the system. What happens when the law-abiding citizens see that they are the stupid ones? Quite a few eventually decide to hop on the bandwagon:

The frustration of law-abiding citizens can turn to sheer anger when they see the seemingly overstretched police dedicating resources to policing the incredible crime of cycling on non-dedicated paths in public parks.

Source: own photo.

It's easy to conclude that, indeed, "Britain has become a lawless country where good people have to live in fear".

What are the other implications that investors need to heed and which may offer opportunities?

Restaurant chains in big metropolitan areas may be affected: "Why no one goes out to eat in D.C. anymore. Misguided public policy has led to fear on the streets and surcharges on restaurant bills.".

Repaying debt is now seen by some as a choice: "'I've not repaid a penny of my £70,000 student loan since leaving Britain – and never will'. The debt-laden graduates relocating abroad to illegally dodge repayments".

Home invasions and squatting are an increasing occurrence in Western nations, which erodes trust in property rights: "American homeowners are panicking after a property invasion spree".

More than one professional investor that I have spoken to in the recent past feels that property rights are eroding for shareholders, too. When politics and the powers to be deem shareholders to be in the way, their rights get kicked overboard. The most famous case for that was probably UBS' treatment of Credit Suisse's AT1 bonds.

GAVEKAL described this in a note:

"A bank can merge with another bank without shareholder approval being granted. The logic runs that if a bank is systemically important, minority shareholder rights have to be overrun in the name of the 'greater good'. This is an important precedent that minority shareholders in all systemically important banks will no doubt take notice of. Minority shareholders in systemically important banks have no real rights." (Contact me if you'd like a copy of the entire note, titled: "The Credit Suisse Take-Under")

What are some immediate conclusions for investors?

- Developed markets are now emerging markets: that being so visibly the case, there is a case for investing in emerging market assets, both equities and bonds.

- Gold as a safe haven: in times like these, gold as the ultimate trusted asset will continue to do well.

- 1% refugee crisis: those who have the skills and wealth to do so will continue to flee to jurisdictions where they can get away from some or all of these problems. See my webinar with Harris "Kuppy" Kupperman for an in-depth discussion of this trend.

Source: Praetorian Capital.

- Retail real estate has become a mixed bag: "Mugging spree is threatening future of West End, say retailers"

- Store closures and consolidation: in April 2023, UBS estimated that 50,000 stores in the US would close, with the beneficiaries being both larger chains who can afford sophisticated systems at scale, and e-commerce players. Contact me if you'd like a copy of the corresponding 96-page research report.

Source: Wall Street Silver, X account.

- Inflation: the wider problem described in this article contributes to the ongoing issue of inflation.

Undervalued-Shares.com isn't the first publication to look at this subject. Amid all the material that I've gathered, the most useful one for investors is a long-read report by Barron's, linked to below.

Source: Barron's, 8 April 2022.

What else is out there?

My selection of source material for today's Weekly Dispatch is subjective, and incomplete.

I have yet to do more homework on investible stocks to play these trends.

It may not even be a trend, but an imaginary problem that only exists in the minds of angry middled-aged men like me.

With all that said, what do you think? If you have a view to contribute or an idea for stocks to play, please do drop me a note!

Hot off the press: new in-depth research report

Once the reconstruction of Ukraine begins, it could become the biggest foreign-sponsored reconstruction programme of the last 80 years.

Think Marshall Plan, but on steroids.

The reconstruction will present a triple-digit billion market opportunity – but opportunities for private investors to get in are scarce.

My latest research report – out just now – features one company that will likely become the focus of investor money pushing into the country – and is easy to trade!

Hot off the press: new in-depth research report

Once the reconstruction of Ukraine begins, it could become the biggest foreign-sponsored reconstruction programme of the last 80 years.

Think Marshall Plan, but on steroids.

The reconstruction will present a triple-digit billion market opportunity – but opportunities for private investors to get in are scarce.

My latest research report – out just now – features one company that will likely become the focus of investor money pushing into the country – and is easy to trade!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: