Gold stocks remain undervalued, with considerable upside potential. I picked the brain of Dominic Frisby, who has just released a new book on gold, to get his take.

The strong ruble – what is it telling us?

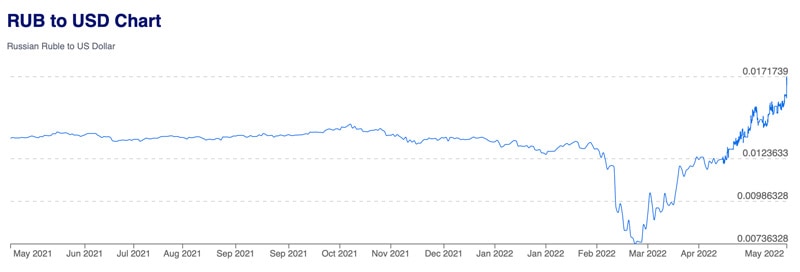

President Biden mocked the Russian ruble as "rubble", and claimed this was a result of his policy decisions. Indeed, during the early days of the war in Ukraine, the Russian currency briefly halved in value.

However, it subsequently more than doubled from its lows. Not just that, but the ruble is now the world's top-performing currency.

Russia's currency has turned into a fascinating case study. Here is a brief explanation of how all this happened, and why everyone should pay attention.

The ruble vs. the dollar.

The driving factors in a nutshell

Currency movements are notoriously hard to analyse, and even harder to predict. For that reason, I've never spent a great amount of effort on foreign exchange rates during my investing career.

When I decided to dedicate some time to analysing what has just happened to the ruble's exchange rate and what it might teach us, I first turned to public reporting in other media.

Quite tellingly, there isn't a great deal out there.

It seems that in our polarised political environment, pointing out that Russia's currency has become the world's strongest currency is not popular. There was a flurry of Schadenfreude-type media reporting when the ruble went into a tailspin at the outset of the Ukraine war. However, it's been mostly crickets since it staged the most fervent of comebacks.

There are SOME good pieces of reporting about the ruble out there, including:

"How Russia rescued the ruble", NPR, 5 April 2022

"Are sanctions against Russia working?", Vox, 4 May 2022

"Sanctions and the exchange rate", VoxEU, 16 May 2022

I sifted through the existing reporting, so that you don't have to.

Even though there is a myriad of factors at work, three factors stroke me as the most relevant for anyone who wants to set the currency's performance into a broader context.

1. The European Union's (unsurprising) capitulation

Following Western sanctions against its financial sector, Russia decided to force Western nations to pay for gas in rubles rather than dollars or euros.

Initially, the countries that make up the European Union seemed mostly unified in their stance. For over two months, it seemed like Russia's demand was not going anywhere.

On 27 March 2022, under the leadership of Germany, the West's position was "G7 rejects Russia's demand for gas payment in rubles" (Deutsche Welle).

On 27 April 2022, we were informed that "EU Tells Gas Companies Not to Bend to Russia's Demand for Rubles" (Bloomberg).

On 2 May 2022, the public learned that "EU ministers show unity ahead of Russia's next gas-for-roubles payment deadline" (Euractiv).

Just a few days later, however, the EU's position collapsed.

As Bloomberg reported on 12 May 2022:

"Ten more European gas buyers have opened accounts in Gazprombank, doubling the total number of clients preparing to pay in rubles for Russian gas as President Vladimir Putin demanded.

A total of twenty European companies have opened accounts, with another 14 clients asking for the paperwork needed to set them up, the person said, speaking on condition of anonymity to discuss confidential matters. He declined to identify the companies."

How was that even possible, given that sanctions prohibit the use of rubles?

The EU had – once more – engaged in public theatrics, only to act very differently when push came to shove. In a combined act of double-speak and taking the public for fools, Brussels has now taken the position that no breach of sanctions is taking place if companies send euros or dollars to a dedicated account at Gazprombank, issue a unilateral statement saying that this concludes the transaction, and then have the bank convert the currencies into rubles. The result is, of course, a complete and total capitulation of Brussels vis-à-vis Moscow's demand.

Speaking in simplified terms, there aren't that many rubles going around, but many EU countries are completely dependent on buying the currency to ensure their energy needs are covered (and at an expense that doesn't leave their industry uncompetitive vis-à-vis Chinese competition). It's a simple equation of demand and supply. Without a doubt, given just how large the EU's demand for Russian energy is, this particular issue has played a major role in the ruble's strength. Markets don't lie, and Putin's win now shows up in the exchange rate of the ruble. Notably, this move has so far only encompassed paying for gas, but it could soon also apply to oil and other commodities.

All of this could have wider implications for investors, as you'll see in the remainder of this article.

2. Conventional measures

When the crisis struck, Russia adopted a range of measures from the classical playbook of managing such situations:

- Interest rates were increased to 20%.

- Restrictions were placed on converting local deposits.

- Export companies had to convert 80% of their foreign currency into rubles.

These measures weren't rocket science, and they weren't guaranteed to work. However, in their entirety, they are likely to have contributed significantly to the ruble's stabilisation and subsequent strenghtening.

3. Speculation about the ruble's backing with gold and commodities

Ever since the start of this conflict, there has been growing speculation that Putin was going to turn the ruble into a currency that is backed by gold and commodities. Russia doesn't just have lots of gold, but also many of the commodities that Western life depends on. Even the transition to so-called renewable energy to get out of Russian oil and gas will depend considerably on raw materials sourced from Russia – which now need to be paid for in rubles.

What exactly a commodity-backed currency entails and if it would work remains hotly debated.

For an in-depth analysis arguing that this will have far-reaching effects on the world's financial system, you can read "The Coming Global Financial Revolution: Russia Is Following the American Playbook", published by Scheerpost on 4 April 2022. To expose yourself to the counter-thesis, check out "The Russian threat to dollar hegemony is nothing but a fantasy", published as an op-ed by Al Jazeera on 12 April 2022.

In any case, these developments come at a time when many investors are perceptive to the risk of such changes occurring, however likely or unlikely they may be in reality.

For decades, the West has been engaged in printing fiat money, and central bankers have gotten away with it. Everyone trusted the system to somehow keep it together.

Of late, this trust has started to erode, and quickly so. Inflation is suddenly running at 5-10% p.a. officially; unofficially (or for those on a lower income), it's more like 15-20%. Even those who are usually enthralled by the power of the state now question whether their savings' value can still be preserved.

Along comes the story of the ruble getting backed by gold and commodities. You'll inevitably have some percentage of the investing public that gets curious about the subject or even starts to look for ways on how to get exposure to the currency. As one professional investor noted in an email to me: "Russia being disconnected from the global financial system could be an immense positive if the debt laden Western financial system collapses, affording the country's financial system some insulation against the repercussions."

Might there be Russians who are actually quite happy to simply stay in the ruble instead of keeping their savings in Western currencies? The euro has just lost 12% this year, an unprecedented fall. If, later this year, the EU runs into actual energy shortages and sees parts of its industry collapse, would you like to tie your entire future to this currency?

All of this has generated an unprecedented level of interest in the ruble as an outlier currency that could be a hedge, a component for diversification, or a contrarian bet. When I asked readers last week if they'd be interested in a potential investor trip to Moscow, I got quite a level of response (and you are still welcome to register your interest).

Why is this relevant to you?

You might say: "I can't invest in rubles or any other Russian assets. Why should I care?"

There is the interesting question whether the ruble isn't a microcosm of much larger changes that have started to take hold in the world.

Speaking to many people from entirely different backgrounds and persuasions, I can't help but notice that there is a major change in perception going on. It can roughly be summarised as follows:

- More people than ever – and across the entire spectrum – are questioning if the narratives served up by politicians and the mainstream media hold up to scrutiny.

- A growing number of people has begun to realise that interest rates may not stay low for much longer (as has been promised for years) and do matter after all.

- Building on the previous two points, never before have so many people told me: "I am so afraid that our entire financial system could go out the window. How do I make sure that I still own something when we come out the other side?"

With it comes an unprecedented level of questioning whether in some instances, the West's public simply got the wrong end of it or was actively misled.

E.g., weren't the Democrats the kind guys, and wasn't Joe Biden elected to bring unity and healing to his country? Elon Musk, a lifelong Democrat, recently tweeted that the Democrats had "become the party of division & hate". It means something and has impact when someone with 94m social media followers comes out with such views. What if we were to see many more such about-turns? What would it mean for your investments? How would you keep your wealth safe in a world where everything we thought we knew suddenly got thrown into doubt?

The ruble wasn't supposed to be strong. EU companies weren't supposed to pay for energy in rubles.

The theory about that lab in Wuhan was supposed to be a conspiracy – not "the most likely origin of COVID-19". There is now that running joke: "What's the difference between a conspiracy theory and the truth? About six months."

I can't remember a period in my life when so many long-standing truths have suffered a sudden death, and often enough in such spectacular fashion.

It begs the question, what surprises are we going to see next?

There will be no getting away from this

We now live in an environment where many no longer dare to publicly express their opinions and concerns. However, as soon as someone speaks up and points out the obvious, many express relief and gratitude.

The question I advise everyone to ask themselves right now is: what other indicators are there that we are going to see seismic shifts in our lives, financially and otherwise?

Private property, and the safety of it, is an obvious one.

Russian assets and Russian investors were disconnected from the global financial system. I sense there is now a widespread belief that the same could happen to any one of us, for almost any reason. Suddenly, private property is no longer taken for granted.

Throw in the growing concern that our so-called elites may not have our best interest at heart, and it all makes for worrying trends that have now started to affect everyone:

- No one can get away from the inflation caused by incessant printing of fiat money.

- Everyone is affected by the supply chain issues exacerbated by lockdown policies.

- The valuation of all stocks is now suffering from the about-turn in interest rates.

The West's conflict with Russia is just one aspect of it, and it all comes together to what could be a rather tumultuous first half of the 2020s.

What can we do about it?

Undervalued-Shares.com is a research service, but it's also a community. Whenever I put messages out into the universe, I get interesting and valuable feedback.

"Capital controls – a return to the 1970s?" struck a real chord with Weekly Dispatches readers. Its #1 conclusion was that we'll have to diversify, including geographically and even with regards to the custody of financial assets. If you aren't wealthy enough yet to keep several accounts in different jurisdictions, owning some physical gold or gold-related assets could be a viable way to diversify. Ditto for Bitcoin, if you are so inclined.

Yet others see wisdom in diversifying some of their assets into Russia. It's a daring contrarian thesis, and many will ask how this is even possible given sanctions. It is – if you know how. E.g., there is a NYSE-listed investment holding that is a proxy for owning stock in a broad selection of Russia's biggest companies. Its stock is trading with a 50% discount to its net asset value, even though the net asset value itself was depressed by falling stock prices on the Moscow Stock Exchange. When I introduced Undervalued-Shares.com Lifetime Members to this rather controversial opportunity, it attracted huge interest, which is in itself an interesting indicator. (Never mind the tremendous interest of Chinese and Indian investors venturing into Russia to pick up assets that Western investors are currently selling for the proverbial song.)

Without a doubt, we live in interesting times and have now entered unchartered water. What are the potential reverberations on all of us during the years to come? How can you protect yourself or even benefit from it all? I do believe that at any given time and no matter how depressing the circumstances, the world is full of possibilities to deal with the circumstances we are facing. I am committed to exploring some of them for you.

Easy, cheap exposure to Russian stocks

If you, too, want to diversify some of your assets into Russia, this NYSE-listed investment holding will be for you.

It's probably the single-best way to get diversified exposure to Russian blue-chip equities, and you can currently get in at a 50% discount.

Easy, cheap exposure to Russian stocks

If you, too, want to diversify some of your assets into Russia, this NYSE-listed investment holding will be for you.

It's probably the single-best way to get diversified exposure to Russian blue-chip equities, and you can currently get in at a 50% discount.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: