Gold stocks remain undervalued, with considerable upside potential. I picked the brain of Dominic Frisby, who has just released a new book on gold, to get his take.

Time to “short” coronavirus vaccines?

If there is ONE speculation in the world that most wouldn't dare to even speak about, what would it be?

Betting on a total collapse of the current vaccination narrative would certainly qualify.

Not only is it deemed unlikely – actually, impossible – by the majority. It's also the one idea you mustn't even consider as it would make you a danger to public order.

Needless to say, if you are looking for ultra-contrarian investment ideas with asymmetric risk and huge upside, anything that is verboten is exactly the sort of stuff you should be looking into.

What if the prevalent coronavirus vaccines did eventually turn out a dud or even a health risk? Could you make money off such a reversal by shorting the stocks of leading vaccine manufacturers such as Moderna (ISIN US60770K1079) or Pfizer (ISIN US7170811035)?

I went out to investigate.

Why the Wuhan lab theory is so interesting

Every now and again, a thesis gets widely accepted even though it has countless obvious holes. Once the actual truth is finally established, many wonder why they didn't realise much earlier that someone had led them down the garden path.

Case in point, the entire hoo-ha around the Wuhan lab.

At the outset of the pandemic, there were many indications that the lab COULD have been the origin of the virus. Anyone with two brain cells to rub together would have asked for the matter to be investigated while the evidence was still fresh.

Many scientists and media outlets knew better, or at least wanted you to believe so.

The Washington Post, 17 February 2020:

"… conspiracy theory that was already debunked"

New York Times reporter Alexandra Stevenson on Twitter, 17 February 2020:

"… the kind of conspiracy once reserved for the tinfoil hatters"

Science magazine, 19 February 2020:

"Scientists 'strongly condemn' rumors and conspiracy theories about origin of coronavirus outbreak. A statement in The Lancet assails misinformation about the possibility that COVID-19 came from a lab in Wuhan, China"

The majority of the public did fall for it. If you proclaimed during spring/summer 2020 that you considered the lab origin theory a possibility worth investing, you were almost sure to get ejected from polite society. Twitter banned some of its users for spreading the story, calling it "disinformation".

How times change. A possible origin of the virus in the lab in Wuhan is now widely accepted as anything but a conspiracy theory:

"The belief that Covid escaped a Chinese laboratory is no longer dismissed as a Trump provocation"

"Senior Biden officials finding that Covid lab leak theory as credible as natural origins explanation"

The Daily Telegraph, 15 December 2021:

"Wuhan lab leak 'now the most likely origin of Covid', MPs told"

There are many nuances and details to this. E.g., it has just emerged that US government-funded scientists immediately realised a potential involvement of the Wuhan lab but followed a public denial strategy because "it could hurt international harmony". Seriously?

Source: Spiked, 12 January 2022.

The bottom line is: you weren't supposed to even contemplate anything but a natural origin. As it now turns out, there is a high probability that you were misled, and even in bad faith.

It wouldn't be the first time that governments, supranational organisations, and corporate media worked together to make the populace believe something that simply wasn't true. In 2004, the media all too hastily spread "intelligence reports" that Iraq harboured weapons of mass destruction that could be deployed against Western cities without even a warning. I lived in London at the time and still remember picking up a copy of the Evening Standard at South Kensington tube station carrying the cover page headline: "45 minutes from attack". The resulting fear created widespread support for starting another war in the Middle East. As we now know, this was the most consequential lie in our generation. No one was ever held accountable for it, as was brilliantly captured in Rolling Stone's 22 March 2019 article: "How the press that sold the Iraq War got away with it".

If the tightly intertwined government and corporate media apparatus can't even get its ducks in a row about the origin of the virus, how is it supposed to reliably lead the management of the pandemic? Asking this question doesn't strike me as unreasonable.

Also, all of this makes for some interesting conclusions to be drawn about investments.

Have my friends turned into fantasists?

Before anyone wonders, I've received 37 vaccinations throughout my lifetime (counting multiple shots for the same disease). Anyone who expects me to dish up anti-vaxxer fare will be disappointed.

Until recently, I had never given much thought to vaccines. When current events got me interested in the subject, I started reading "Vaccine: The Controversial Story of Medicine's Greatest Lifesaver". A reviewer at Nature described the 2008 book as "a well-researched but never boring 500-page history that pricks both camps, taking a critical look at both the anti-vaccinists' championing of pseudo-science and the medical establishment's repeated tendency to downplay the genuine dangers of vaccine side-effects."

After I educated myself to a baseline level, I didn't race to get vaccinated, nor did I rule out getting vaccinated. I described my thought process in more detail in a research report about American vaccine manufacturer Novavax (ISIN US6700024010), which became one of the most widely read reports that I published in 2021. That year has also helped me gather additional observations and compare them to well-established narratives.

Side effects being rare? Not if I ask around my friends (including several doctors). Did those doctors file a report about adverse effects? Usually not, mainly out of fear of repercussions but also because some countries have recently made it more cumbersome to file such reports.

Speaking of repercussions, one friend who works in the senior management of a clinic told me they witnessed an unprecedented number of patients with blood clots: "We all know what it's probably caused by. We won't make a fuss about it because we fear backlash from government authorities."

Fantasists, conspiracy theorists, liars?

I'd write it off if these hadn't been long-standing friends and trusted contacts. Admittedly, I can't verify their reports, and anecdotes don't make for scientific evidence. However, seeing how some scientists knowingly misled the public about the possible origin of the virus, could my friends' issues be an early indicator of discovering more inconvenient truths?

Their feedback made me look closer.

Follow the money

The vaccines that are currently on the market do seem to have been a success in many ways.

They were developed at record speed at a time when the world was in great distress, and a significant amount of data also suggests that they are effective against severe disease, hospitalisation and death, at least for a certain period following the injection. I have yet to see someone make a convincing case that the vaccines didn't prove valuable for protecting the more vulnerable parts of the population.

However, an increasing number of people are wondering what happened to some of the following initial claims:

- "Two weeks to flatten the curve."

- "Two vaccinations and we can all go back to our lives."

- "Entirely safe."

What we seem to be getting now looks more like:

- Lockdowns, masks, and other measures for perpetuity.

- Such a short-lived and limited vaccine efficacy that you need to prepare for vaccinations #3 and #4, and possibly #5, #6, etc. thereafter.

- More side effects and undesirable issues than we were told.

What else are we going to find out further down the road?

By way of my work, I am fairly well connected internationally, including to members of the World Economic Forum and the odd tech billionaire, two groups that are suspected by some as planning a sinister agenda. Most of the people I know from these groups are vaccinated, which is why I struggle to believe that a well-connected elite of lizard people is planning to depopulate the world by knowingly injecting everyone with poison.

What I do find credible, however, is that the age-old principle of following the money helps to make sense of everything that has happened over the past two years.

The coronavirus pandemic has proven the biggest ever bonanza for politicians, some corporations and special interest groups. Never since the Second World War have governments and certain industries usurped so much power and so many resources as during the pandemic.

There is no better example for demonstrating the scope and manner of resource redistribution caused by the pandemic than the March 2020 CARES Act by the US government.

The "Coronavirus Aid, Relief, and Economic Security Act":

- Constituted the largest economic stimulus package in US history, outdoing even the rescue packages of the Great Financial Crisis of 2008.

- Benefitted the government bureaucracy through USD 400bn of extra funding and considerable emergency powers.

- Provided billions of dollars to private corporations, both directly and indirectly.

Could the prospect of an unprecedented amount of extra funding and extra power possibly have influenced the decisions of our elected representatives? Politicians of all persuasions came together and agreed near-unanimously to grant themselves additional money and extraordinary powers – the surprise!

As Charlie Munger famously said: "Show me the incentive and I'll show you the outcome."

An increasing number of books, such as "A State of Fear: How the UK government weaponised fear during the Covid-19 pandemic", have started to analyse the history of this pandemic. I'd love to see someone write a book dissecting how financial incentives could have played a role in pandemic-related decision-making.

Looking at it from the perspective of a profit-driven private corporation, it all made for an extraordinary opportunity:

- Governments pulled out all the stops for a medical product to come to market faster than would normally be the case.

- Governments increasingly mandate their citizens to become clients of a profit-driven private corporation, or employ so-called nudging, i.e. coercing people through indirect means.

- Governments granted vaccine manufacturers immunity against any legal liabilities for potential ill effects of the newly developed vaccines.

Could the prospect of such an opportunity have influenced the decision-making at profit-driven private corporations?

Some will point out that Pfizer is the same company which in 2009 was "hit with the biggest criminal fine in US history as part of a $2.3bn settlement with federal prosecutors for mispromoting medicines and for paying kickbacks to compliant doctors."

They could also point to the long list of criminal (!) convictions that pharma companies from around the world have racked up. The current top 20 list includes several companies that were (or are) involved with coronavirus-related vaccines and medications in some shape or form: AstraZeneca (ISIN GB0009895292), Johnson & Johnson (ISIN US4781601046), GlaxoSmithKline (ISIN GB0009252882), and Merck (ISIN DE0006599905).

On the other side of the argument are those who will trust the scientific consensus and credibly argue that ill effects are not just rare but also quite simply a better alternative to not having any vaccines and medications.

Will the discussion ever be settled in favour of one or the other side? Unlikely, because it has become so complex by now that it's almost impossible to make a complete argument.

However, there is an undeniable shift in public opinion. An increasing number of fully vaccinated people won't take any more shots. As The Atlantic headlined in a 10 January 2022 article: "More Americans Are Saying they're 'Vaxxed and Done'". Their reasons are diverse and range from concerns about damaging their immune system by taking too many doses to simply feeling they were lied to about having to take just two doses and be done.

The onset of the Omicron variant has led to a renewed wave of doom-laden warnings, in a way that many people started to wonder if some politicians actually hoped for a bad outcome. These past six weeks have seen the Overton window crack open a lot more. We are now looking at a much-widened range of ideas that significant parts of the public are willing to consider and accept. The case of Ivermectin, the antiparasitic medication treated as poison by some and saviour by others, illustrates as much.

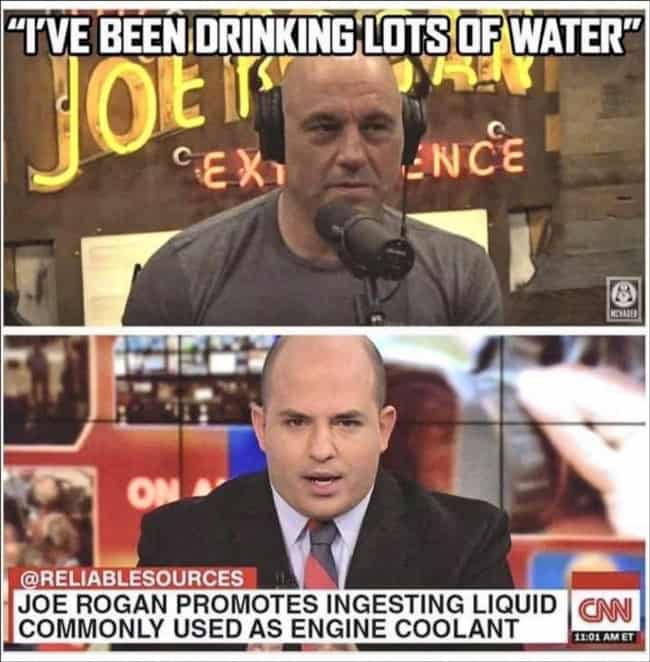

The ridiculous (but interesting) Ivermectin saga

In June 2021, in an effort to research all sorts of pandemic-related subjects, I purchased some Ivermectin pills. I had no idea if I would ever take them, but was curious how and under what circumstances I could procure the drug given that I was not supposed to get it (even though it's legal). Besides, I figured that anything which MIGHT turn out useful in case of catching the Rona would be worth having in my drawer.

Back then, the likes of CNN effectively called you an idiot for considering a "horse dewormer" drug that was dangerous to humans. Shortly afterwards, CNN's top medical analyst, Dr. Sanjay Gupta, admitted under the duress of tough questioning by podcaster Joe Rogan that his network had lied about the drug ("They shouldn't have said that."). The unvaccinated Rogan had taken Ivermectin as part of a mix of medications when he caught the virus, and was almost back to normal after just two days. Mega-wealthy Joe Rogan, who had received Ivermectin from a US doctor, put it quite clearly to Dr. Gupta: "I can afford people medicine, Motherf**er."

Following Rogan's personal use and subsequent reporting, it has suddenly become possible to talk and write about Ivermectin in an unprecedented way. There is now an increasing number of people who wonder if Ivermectin was part of a treatment regime implemented in Uttar Pradesh, an Indian province that seems to have had some remarkable success with its coronavirus policies. Uttar Pradesh had decided not to wait for the arrival of expensive, scarce coronavirus vaccines but provide its population with a mix of alternative products, both prophylactic and for early treatment following infection. This had been confirmed by the authorities of Uttar Pradesh as far back as May 2021.

If it did and if it were effective, what would it mean for vaccine manufacturers? Outside of potential commercial competition from a product that costs mere pennies to manufacture, there is another issue. The emergency exceptions granted by Western governments to vaccine developers legally depended on no alternative treatments being available. As the FDA website sets out, criteria for granting these exceptional authorisations include "that there are no adequate, approved, and available alternatives". If it turned out that Ivermectin had been sidelined to enable governments to grant privileges to profit-driven corporations, there'd be potentially unimaginable ramifications – legally, financially, and politically.

This is just one of the examples why some people now wonder if shorting the stocks of vaccine manufacturers could be another trade of the century.

One of them is Edward "Ed" Dowd, an investment professional whose opinions can be found on Twitter. If his mega-controversial thesis bears out, he could become the Michael Burry of the vaccine trade.

The investment professional who sees Pfizer go to zero

As Dowd tweeted on 2 January 2022:

"As a former BlackRock investment professional with a view that $PFE is going to zero this actuarial data point is gold to my thesis. Those who own this stock should be absolutely terrified if they thought there was no merit to my thesis of fraud."

He referred to "Indiana life insurance CEO says deaths are up 40% among people ages 18-64", a 1 January 2022 article from The Center Square that went viral (and which is blocked for Internet users in the European Union).

As Dowd tweeted in a thread discussing this particular article:

"The actuaries are on to it…what are the truth ministries going to do now? Hint: it ain't Covid.

…

I can't emphasize how big of a deal this is…actuaries just assess risk with math. They will be pushing the costs on to employers. Don't trust VAERS?…well the actuaries trust math so they don't care what you think."

(VAERS = Vaccine Adverse Event Reporting System)

While the Indiana life insurance article went viral on social media, it has received little coverage elsewhere so far. Whether or not the increase in death rates has anything to do with the coronavirus vaccinations or not remains at the heart of controversial debate, but it did further contribute to the discussion whether these vaccines are what they were held up to be.

There are many reasons why we have recently seen a widening of the Overton window and a growing interest in discussing such theses. Among them is the increasing amount of evidence that past policy decisions relating to the pandemic have led to side effects that may one day become recognised as outweighing the benefits. Was the so-called cure worse than the disease? As mere examples:

- "Children born during the pandemic score lower on cognitive tests", as the BMJ British Medical Journal reported on 16 August 2021: " … those born after the pandemic began showed … an average IQ score of 78, a drop of 22 points from the average of previous cohorts."

- "Britain's drinking deaths rose at record rate in pandemic", as The Guardian reported on 7 December 2021: "We've seen increases in loneliness, depression and anxiety during the pandemic and these could also be factors."

- "Experts fear thousands of additional lung cancer deaths caused by Covid lockdowns" (because of delays in diagnosis), based on this 25 November 2021 report by the Geriatric Medical Journal.

Not to mention all the other issues, which include (but are not limited to) an increase in suicides, mental health issues and their negative effect on the natural immune system, and personal financial destitution following the collapse of millions of small businesses.

Source: inews, 23 December 2021.

There will be many complex factors behind each of these issues, but it's difficult to deny that more and more people are wondering whether key policy decisions of the past two years were right and serious warning signs got ignored. After all, for most of the issues that are now surfacing, there will have been some voices on public record who had warned about them much earlier but got ignored.

Will it all continue to shift in a different direction, and could it eventually have such an effect on the stocks of vaccine makers that it becomes worthwhile to bet on their demise?

Dowd, who during his time at BlackRock helped manage well-performing funds of up to USD 14bn, thinks so. He opined in tweets here, here, and here, and just gave a 1h video interview about the potentially collapsing vaccine narrative.

Dowd's conclusion: "The answer folks is that the safety data that $PFE sees internally on the mRNA 'vaccines' is so bad the lawyers are in the C-Suite. This is avoiding jail time. Good luck owning this stock folks. When I ran money we called this a tell."

I reached out to Dowd ahead of this article for his view on how to best capitalise on this opportunity. He replied:

"Obviously Pfizer, Moderna & BioNTech are at the forefront of the bet here with Pfizer holding up better so far due to passive index flows. I believe fraud was perpetrated in the clinical trials given the institutional momentum & potential monetary prize. If this is proven it will eviscerate the liability protection contracts. However this disaster has far reaching implications. The big tech social media censorship of counter narratives will be implicated in this debacle causing competition, regulation & antitrust backlash. Insurance companies are at risk & Q4 death & disability results will be illuminating & likely costly. I also believe lawsuits against large corporate mandates for the Fortune 500 (especially for those that continue given current data) could be very costly. Additionally, given the backdrop of the Fed withdrawal of liquidity & the coming loss of trust in most every institution the overall market this year will likely struggle and give back much of the promise of a vaccine driven recovery that we discounted last year."

Indeed, it's difficult to argue that the fallout from such a development wouldn't touch on almost all areas of life and business – just as the pandemic itself has done.

This article being a mere thought experiment and a first step towards potentially studying this thesis further, I did come up with a few observations and conclusions myself.

Some options to benefit from these developments

The obvious possibility would seem to lie in shorting the likes of Pfizer, Moderna, and BioNTech.

The details, however, are more nuanced:

- Pfizer produces a range of other products and is projected to have a wall of cash flow over the coming years. Merely losing the coronavirus-related business line may not necessarily hit the company's performance and stock price enough to make this worthwhile.

- Given how much of the political establishment, corporate media and other powerful special interest groups went "all in" on the current narrative, they are likely to pursue almost any measure to protect their position.

- Short speculations usually take longer to materialise than anticipated, and you could well run out of money while waiting for the fraud to be uncovered. Also, shorting does have a cost, and puts on these shares are not cheap right now.

Should anyone short these stocks just yet? I am open-minded but not convinced – all the more because there could be some interesting indirect ways of playing the theme.

Growing frustration with censorship on social media could give rise to a new generation of social media companies. Once an issue that affected niche subjects and alleged "extremists" only, censorship has now reached a point where the BMJ British Medical Journal, one of the oldest medical publications in the world, had to write (and publish) a scathing letter to Facebook/Meta (ISIN US30303M1027) after its 2 November 2021 article "Covid-19: Researcher blows the whistle on data integrity issues in Pfizer's vaccine trial" got censored.

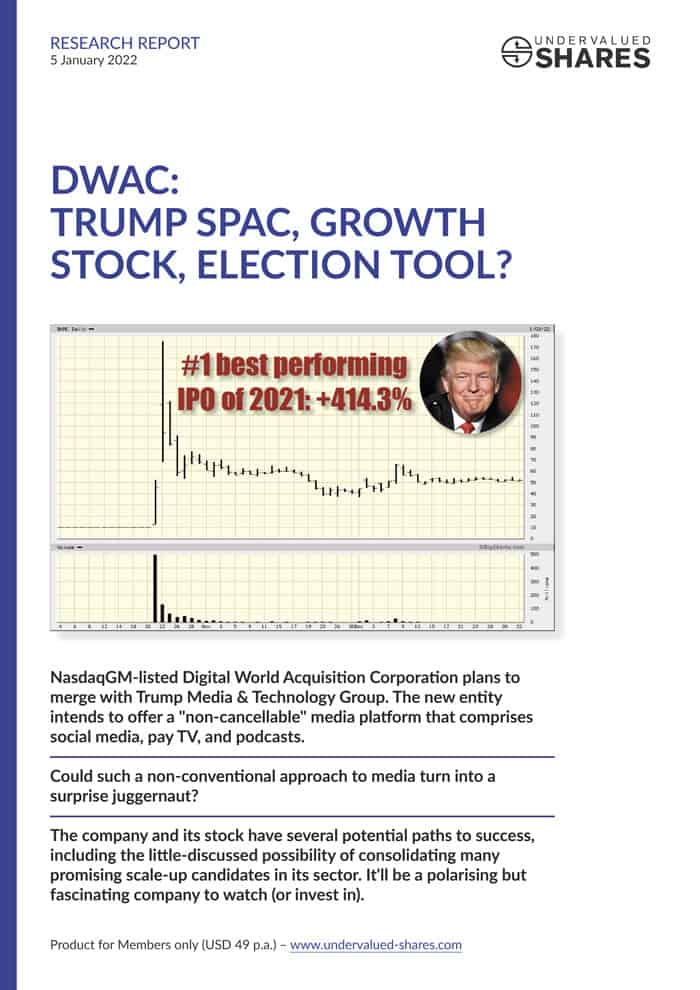

Internet users and investors alike have started to bet on new platforms that offer an attractive alternative to the likes of Facebook/Meta. Rumble is preparing to go public via the SPAC CF Acquisition Corporation VI (ISIN US12521J1034), which is up 26% compared to its SPAC issue price despite SPAC prices being down across the board. The SPAC Digital World Acquisition Corporation (ISIN US25400Q1058) is preparing to take Donald J. Trump's new media platform online, and it already became the best-performing IPO in the US in 2021. Much as there are multiple driving factors, the growing vaccine controversy and related developments play into it, and could play an even stronger role during the months to come.

It could also pay to short some corporate media stocks, given how these companies have played a vital role in establishing and defending the narrative. Some Western corporate media have recently started to receive direct funding from government (Trudeau's Canada being an infamous example), and from players like the Bill & Melinda Gates Foundation (which famously granted millions to Germany's DER SPIEGEL). How long until the corporate media experience a mass defection of viewers and their stocks come under pressure? The whole narrative spelled out herein has certainly started to spread. Rogan's influential podcast kicked open a door, and now more specialist publications are continuing to dissect the various aspects.

E.g., QTR's Fringe Finance (a blog worth checking out) recently published an excellent analysis titled "The Mainstream Media Is Losing The Fight Of Its Life", shortly followed by advice to "Short The Whole Fucking Vaccine Thing". There is a small group of people who have had similar ideas recently, such as former Australian Senator and now "controversial" blogger Cory Bernardi who set out the idea to short Pfizer stock in a tweet on 1 January 2022. He has since deleted the tweet (as he does with all tweets that are older than one week), but below is a screenshot that I saved. Case in point, there are other content producers on to the same subject and you could also follow their content to see if interesting, non-obvious investment ideas to play this theme pop up.

Source: Cory Bernardi Twitter feed.

I am keen to find ways to make a mint if – and that's still an IF – we see a seismic change in narrative. My bet is, though, that it is going to happen. Most likely, it will be driven by events in the US, where the Democratic Party under the failing Biden presidency is threatened by a major loss in the November 2022 midterm elections. It could also be driven by UK prime minister Boris Johnson's current fight to remain in office following the ongoing Partygate disclosures.

How else can you benefit financially if the existing narrative surrounding the pandemic and key policy decisions continues to come under pressure? As always, I'd be keen to receive feedback and input from you, my treasured readers.

To be continued… 🙂

How (else) to benefit from the growing vaccine controversy

Internet users and investors alike have started to bet on a new generation of social media companies.

Case in point, Digital World Acquisition Corporation which has agreed to merge with Trump Media & Technology Group.

The new company could have a golden opportunity in media - and its stock already became the best-performing IPO in the US in 2021.

Disregard at your own risk!

How (else) to benefit from the growing vaccine controversy

Internet users and investors alike have started to bet on a new generation of social media companies.

Case in point, Digital World Acquisition Corporation which has agreed to merge with Trump Media & Technology Group.

The new company could have a golden opportunity in media - and its stock already became the best-performing IPO in the US in 2021.

Disregard at your own risk!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: