The country that is so famously located where Europe meets Asia is not your run-off-the-mill equity market. Many foreign investors struggle to even get trades executed in Turkish stocks.

Surprisingly, it's also one of the most liquid emerging markets there is.

Turkish Airlines is the world's most actively traded emerging market stock.

Plus, the Turkish market made impressive gains in 2022 – up 110% in dollar terms!

Who knew?

Turkey has major elections coming up in May 2023, which could be a game changer for the market.

Are there more opportunities for investors who have the wherewithal to spot signs early?

The strongman at the Bosporus

Needless to say, any analysis of Turkey has to start with Recep Tayyip Erdoğan.

Erdoğan has been in power for 20 years, though to what extent this is due to truly democratic decisions or authoritarian streaks is subject to controversial debate.

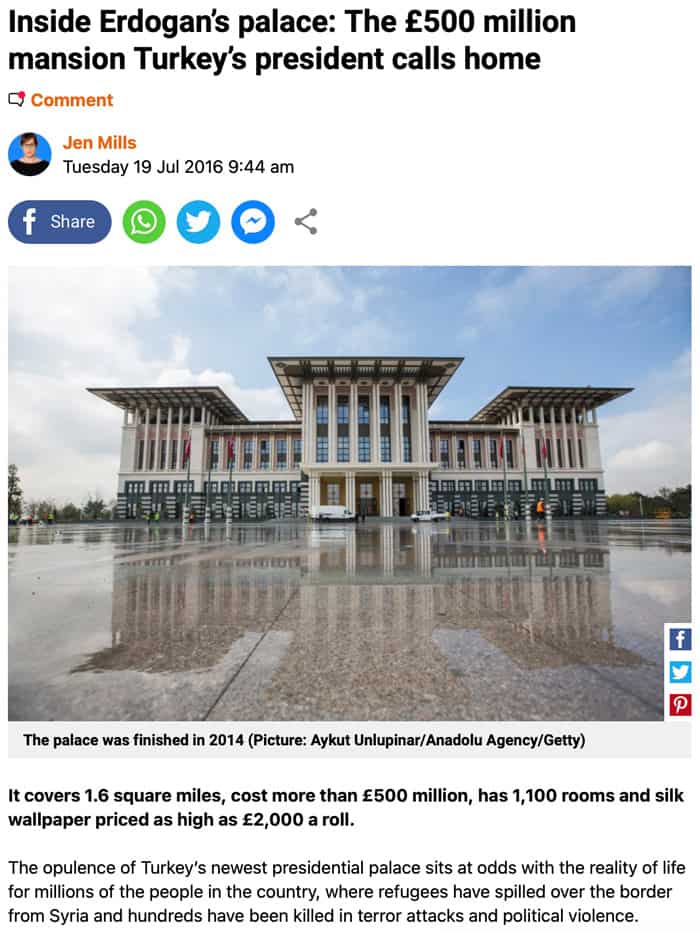

Erdoğan rules from a newly-built 1,150 room presidential palace, which he built at a cost of USD 615m to demonstrate his country's place on the world stage. In a country where one fifth of the population lives below the poverty line, such an ostentatious construction project did of course not happen without criticism. Some said Erdoğan fancies himself a modern-day Sultan who wants to return to the glory days of the Ottoman Empire.

Source: Metro, 19 July 2016.

His adversaries also point to Erdoğan's aggressive Islamic agenda. He wants to instil in the public consciousness that people's overall well-being is directly linked to being devout Muslims. Previously, Turkey had previously been famous for being a secular country, following the 1920s reforms by the country's legendary founder, Mustafa Kemal Atatürk.

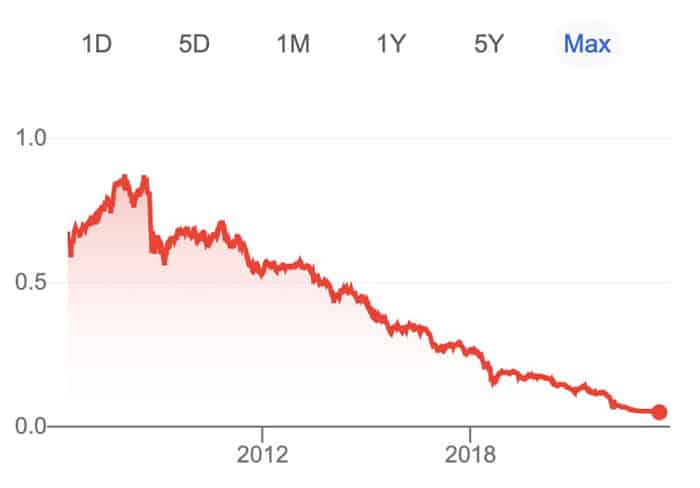

For foreign investors, Erdoğan's worst misdeeds were his ongoing unconventional economic policies, such as a wave of public spending aimed at students, working people, business owners, or commuters, which included measures like tax relief, cheap loans, energy subsidies and even pledges not to raise road and bridge tolls. In short, Erdoğan has been in constant pursuit of buying votes at the treasury's expense. To fund his largesse, Erdoğan roped in the country's central bankers who let him get away with abusing the printing press. Inflation soared as high as 85% in December 2022, and real interest rates have been deeply negative. As a result of the manipulating monetary policies, the Turkish lira has lost 94% of its value compared to the US dollar since 2007.

Turkish lira vs US dollar (source: Yahoo!).

It's not a pretty picture, so why have Turkish stocks been up so much last year?

A booming stock market

With sky-high inflation, a rapidly falling exchange rate of the Turkish lira, and negative real interest rates, Turkish savers were left with little options of how to protect their savings. Buying gold is cumbersome, and foreign currency accounts as well as hedging instruments were heavily regulated. Dumping money into equities seem liked the best way forward.

Last year, the equity market rallied 200% based on the local currency and 110% based on US dollars. Out of the 100 stocks that make up the Bist 100 index, 98 gained in value.

The boom was largely driven by domestic investors. Foreign investors had been deserting Turkey for years, mostly due to politics and the macroeconomic instability. Between 2018 and 2021, the share of foreign ownership in Turkey's stock market had dropped from 65% to less than 30%. In 2020, MSCI had even threatened to downgrade Turkey from "emerging market" to "pioneer market".

As it now turned out, the participation of international (i.e., Western) investors wasn't really needed to drive the market up. The number of local investors in the Turkish stock market rose from 2.4m to 3.8m in 2022 alone. Having the savings of millions of Turkish investors flow into the local stock market provided plenty of fuel for rising equity prices.

Source: Financial Times, 30 December 2022.

The market also benefitted from the strength that does exist in pockets of the Turkish economy. In 2022, sales of Turkish exports hit a record high thanks to the slumping lira, and Turkey also benefitted from its growing ties with Russia. After refusing to join the sanctions against Russia (arguing that a balanced approach could help Turkey mediate between Kyiv and Moscow), exports from Turkey to Russia have doubled.

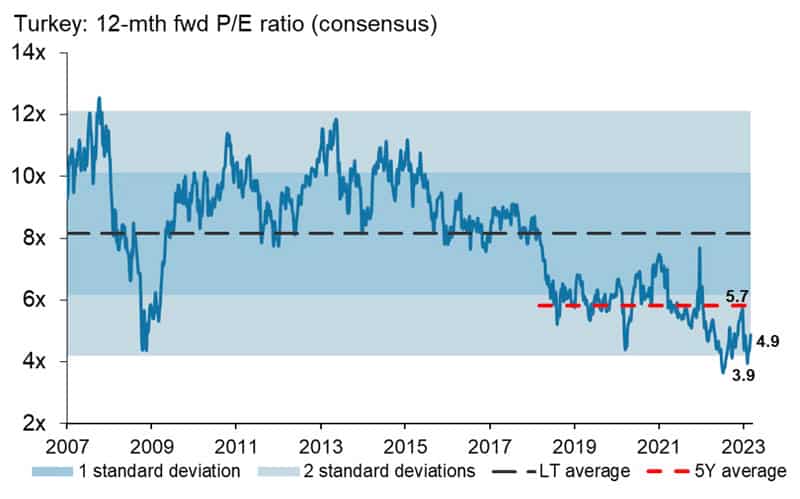

Amazingly, despite these gains in dollar terms, the Turkish equity market remains almost the cheapest it has ever been.

Until 2017, the price/earnings ratio of the Turkish equity market mostly fluctuated in a corridor between 10 and 12. Currently, this ratio stands at 5, which is cheap both in absolute and relative terms. The market could double and still only be valued at the lower end of its historical valuation range. Within such a doubling, some individual stocks could do spectacularly well.

Source: Morgan Stanley, 7 March 2023.

Where will it go from here?

The upcoming presidential and parliamentary elections on 14 May 2023 are likely going to determine the direction.

A potential sea change in politics

For the first time during his two-decade reign, Erdoğan is genuinely at risk of losing power through a loss at the ballot box.

Raging inflation and the other problems created in its wake have weakened his position with the electorate. The earthquake in February 2023, which claimed 48,000 lives, also damaged his reputation; Erdoğan was said not to have done enough for the affected region, and much of the low-quality construction that contributed to the high death figures took place during his era.

In 2017, Erdoğan had merged the positions of president and prime minister, which allowed him to govern with greater power than ever. This also led to a unifying of the opposition: all six non-government parties have come together to form the National Alliance, which (possibly for the first time ever) is headed by a credible candidate: Kemal Kılıçdaroğlu, an economist who had recently been leading some polls with a 55/45 lead against Erdoğan. Polls are of course only ever worth that much, and the National Alliance is at some risk of fraying, which could help Erdoğan. If no presidential candidate gains 50% of the vote during the first round, the election could go into a run-off. How all that will square up with potential election irregularities also remains subject to debate. There is no certainty that there'll be any political change in Turkey.

Without a doubt, though, Erdoğan is facing the biggest challenge of his reign. There is a genuine chance for Turkey to have a new government in power by summer.

What would that mean for investments?

A last-leg devaluation could boost the market

The initial period of a candidate (or party) gaining power provides a golden opportunity to implement unpopular measures. During the first 100 days, new leaders can get away with murder.

There are clear signs that Erdoğan getting voted out of office would signal a new beginning for the Turkish economy. The alliance led by Kılıçdaroğlu has signed up the support of the two very popular mayors of Ankara and Istanbul, Mansur Yavaş and Ekrem İmamoğlu. The top-level leadership of the anti-Erdoğan alliance has made it clear that it wants to end "voodoo economics", which would include making the Turkish central bank independent again. Their designated expert for turning around the economy, Ali Babacan, is generally seen as "investor darling". A combination of returning monetary policy to independence and putting adults in charge of economic policy would send a strong message to foreign investors - it'd be the catalyst that the stock market needs to experience a revaluation.

If Kılıçdaroğlu wins the election, the new government is likely to implement another devaluation of the Turkish lira. This can then be blamed on Kılıçdaroğlu's predecessor, and it'll make Turkish exports even more competitive. A final round of devaluing the currency ahead of implementing sensible economic measures would be a text-book strategy for a situation like this.

This mix makes for an interesting situation that investors should well follow:

- A potential rerating of Turkey's political risk, with international capital flowing back into the market.

- Measures to improve the economy's competitiveness (short term) combined with steps to bring it back to stability (long term).

- Very cheap equity valuations, including for companies that are truly world-class.

Turkey has long had a terrible rap among foreign (Western) investors, and a change in government could see the international investor community focus on the country's strengths.

These include:

- A sizeable population of 85m people.

- Great demographics.

- An entrepreneurial society, with recent forays into tech.

- Rising geopolitical importance, including as energy corridor between Russia and the rest of the world.

- A unique location between Asia, Europe, and the Middle East.

Anyone who has been to Istanbul will understand what I mean by the country's great entrepreneurial spirit. It's a buzzing, booming, modern city – with much of its economy running on euros and dollars. When I last visited in June 2022, I concluded (to my own surprise) that I'd be happy to spend more time there (which, sadly, is not something I'd say about quite a few Western European capitals anymore).

With all that wrapped together, the Turkish stock market is a market that I am rather interested in. Something that is cheap, opaque and a bit unpopular generally piques my interest.

The question is, which specific companies should investors look at?

Leading Turkish companies

Not many investors would know which Turkish companies to buy stock in, other than Turkish Airlines, which nowadays trades under its Turkish name, Türk Hava Yolları (ISIN TRATHYAO91M5 and US90010R1095, IST:THY).

One stock that I regularly spot in portfolios of emerging market fund managers is Şişecam Group (ISIN TRASISEW91Q3, IST:SISE), the world's third largest producer of glassware. The company is heavy on exports, which is why it counts as one of the biggest beneficiaries of the devaluing lira.

During my cursory following of the Turkish stock market over the past few years, I've noticed companies such as:

- Koç Holding (ISIN TRAKCHOL91Q8, IST:KCHOL), Turkey's largest industrial and services group that single-handedly controls 6.4% of Turkish GDP. It commands 20% of the market cap of the Istanbul stock exchange.

- Anadolu Efes (ISIN TRAAEFES91A9, IST:AEFES), Europe's fifth largest brewer and among the world's tenth largest brewers by production volume.

- Arçelik (ISIN TRAARCLK91H5, IST:ARCLK), the leading household appliances producer in Turkey with a domestic market share of >50%, and the third largest white goods player in Europe.

- BİM (ISIN TREBIMM00018, IST:BIMAS), the pioneer of discount stores and supermarkets in Turkey.

- Coca-Cola İçecek (ISIN TRECOLA00011, IST:CCOLA), the sixth largest Coca Cola bottler in the world (!) in terms of sales volume. The company sells not just in Turkey but also in Pakistan, Kazakhstan, Azerbaijan, Iraq, Jordan, Kyrgyzstan, Syria, Tajikistan and Turkmenistan.

Is any one of these stocks a screaming buy right now?

Should investors leave all the hard work to someone else and buy an investment fund instead?

It's a question that I am dying to get a clear answer to myself, because I find the entire constellation rather interesting indeed. In fact, I am willing to invest extra effort into researching this opportunity in the most in-depth way possible – by doing on-the-ground research and meeting companies, experts, and local investors. Turkey is simply too interesting a market to ignore right now.

If you like, you could even join in!

Investor trip to Turkey – save the date

Following the success of the Undervalued-Shares.com investor trip to Poland in September 2020, I am currently planning another trip to Turkey.

The visit will take place from 24-26 May 2023 – right after the elections. I have signed up the help of an emerging market expert to make the trip as useful as possible. Thanks to my co-organiser's local contacts, we'll be able to meet with an amazing line-up of experts, executives and companies.

The tentative programme currently comprises:

- Meetings with independent economists, entrepreneurs and investors.

- A briefing from the TÜSIAD (Turkish industrial chamber).

- Meetings with ≈10 Turkish companies listed on the Istanbul Stock Exchange, including some of the ones mentioned above.

This trip will host ≈12 participants, all of whom need to be finance professionals with a relevant background: fund managers, analysts, wealth managers, representatives of family offices, journalists/bloggers, etc.

Participants will have to book their own travel to Turkey and accommodation, but everything else will be taken care of. Logistics, joint dinners and similar will be charged at cost; the price to participate will be EUR 400. On Saturday 27 May 2023, an optional day will be offered with fun activities outside of the realm of investments. (Spouses/partners/strays are welcome to join the dinners and the touristic Saturday excursion but not the daytime meetings.)

Interested? Drop me a line with a few sentences about yourself at [email protected]. Looking forward to hearing from you!

Latest report for Lifetime Members: publicly listed Venezuela recovery play

Is there a more crisis-ridden country than Venezuela?

Would you seriously consider investing in it?

You should, and maybe even urgently so.

Secretive fund managers have started to chase assets in the country, and it is now becoming apparent, why.

Investing in a Venezuelan turnaround could gain a LOT of momentum in 2023 – and even possibly as early as the next few weeks.

Undervalued-Shares.com reveals the single best option to profit from a recovery.

Latest report for Lifetime Members: publicly listed Venezuela recovery play

Is there a more crisis-ridden country than Venezuela?

Would you seriously consider investing in it?

You should, and maybe even urgently so.

Secretive fund managers have started to chase assets in the country, and it is now becoming apparent, why.

Investing in a Venezuelan turnaround could gain a LOT of momentum in 2023 – and even possibly as early as the next few weeks.

Undervalued-Shares.com reveals the single best option to profit from a recovery.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: