The British market is liquid, easily accessible, diverse – and much of it is trading at record-low valuations.

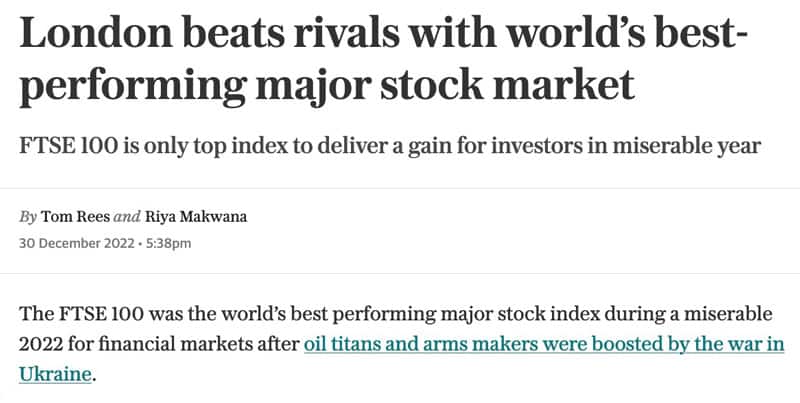

Britain's FTSE-100 index was the best-performing major index worldwide in 2022, thanks to its export-focussed companies from sectors such as energy, defence, and banking. Still, it continues to be one of the world's cheapest stock markets.

The more domestically-orientated FTSE-250 was a dire underperformer, but it's also the breeding ground of many lucrative takeover offers.

In amidst all this, will Britain soon see growing momentum to rejoin the European Union? Could this provide a spark for a "Rejoiner Rally", or even make for a sustained comeback of the market and reset valuations altogether?

This is an outlier investment thesis that I believe has legs. (In the light of current events, I pushed out an interview that I had previously scheduled for this week.)

A painful article to write

For full disclosure, I am a hardcore Brexiteer.

I publicly supported the campaign for Britain to leave the European Union before anyone even took it seriously.

I volunteered to be an ambassador for one of the campaigns, the artist who produced the song "17 Million F*ck Offs" was not just a guest on my last Galapagos cruise but actually my cabin buddy, and I happily accepted that more than one of my oldest "friends" unfriended me over my support of the cause.

24 June 2016 was one of the most enjoyable days of my life. I regret none of it and would do it all over again. In fact, I happily put on the record once more that I detest the European Union more than almost anything else on the planet – liquorice coming a close second!

However, I am also a realist.

So much so, that in 2017, I largely gave up on Britain's efforts to become a sovereign country, and it played into my decision to move to the Channel Islands instead. Once I had noticed that literally the entire political establishment and permanent bureaucracy of Britain was not willing to actually implement the vote of the referendum and treat Brexit as an opportunity, I knew this was probably only going to go one way. They were going to drag their feet and make a mess of it by simply not doing anything – whether for a lack of want or a lack of capability.

When you are facing circumstances that you don't like, you have to decide whether to fight harder or retreat. It was difficult to watch the Tory party win an election in a landslide only to then not act in unison on the country's #1 political issue (and in some ways even sabotage the cause from the inside). Seeing all this, it was hard not to conclude that it wasn't worth fighting anymore.

From my perspective, we have now entered a new era when arguing about the pros and cons of Brexit has become yesterday's discussion. We'll soon see the powers that be switching their efforts to rejoining, and that's where the new game will lie.

The European Union has a history of making people who voted the "wrong" way vote again until the "right" result has come in, sometimes involving a slightly modified question. Why should it be any different with Brexit?

In my perception, things have now come together to a mix that will make a broader campaign to rejoin a viable project. Times of political, economic and societal turmoil are ideal for campaigning to rejoin, because they make for an opportunity to blame anything and everything on Brexit. The West will probably face more instability in the years to come, and even though much of this is a result of the past 30 years of misguided policies across both the UK and much of the West, many will blame Brexit.

Those with the strongest vested interest in rejoining, i.e. career politicians, government bureaucrats, thinktanks, and NGOs, have strong financial incentives to focus much of their time on rejoining. As I always say somewhat illustratively: "These people have all day, every day to chip away on the task. I, on the other hand, also have other things to do."

It's also important to keep in mind what an upset the Brexit referendum was. For its opponents, it cannot be allowed to stand. Britain, and the pesky people who voted for Brexit, need to be humiliated and brought back in line.

One friend recently counter-argued that if this were to play out, Britain would see a civil war. It could, but will it? If the last few years have taught us anything, I believe it's that our politicians are able to get away with almost anything. By now, I have come to imagine politicians get together in the evening to have a jolly good laugh about what it was that they now got away with again. The political establishment has every reason to feel emboldened with just what they were able to pull off these last few years.

That's why I am pretty sure that 2023 will see the kick-off for a more visible campaign to rejoin the European Union. I can literally smell it in the air.

Here is why this makes for an outlier investment opportunity.

Sizing up the opportunity

The British stock market is a funny beast.

As a colleague of mine always argues, there is no such thing as the British stock market. Rather, there are several markets for British stocks.

This becomes clearer when you look at the differing 2022 performance of the FTSE-100 and the FTSE-250 indices, respectively.

FTSE-100: +1%

FTSE-250: -19.7%

Why the difference?

The companies that make up the FTSE-100 index are more international. Many of them earn a major part of their revenues overseas, including in the United States, and last year's weakness of the pound sterling propped up their earnings. The index also contains a large number of banks, energy and defence companies, i.e. three sectors that were on the up in 2022. This made the FTSE-100 the world's best performing major index last year.

Source: Daily Telegraph, 30 December 2022.

The FTSE-250 index, on the other hand, is more domestically focussed. The energy crisis, the cost-of-living-crisis, the Tory party's embarrassing leadership circus, and a number of other factors saw this part of the market fall by a higher percentage than comparable major markets. Its performance of -19.7% compares to -12.3% for Germany's DAX and -9.5% for France's CAC-40.

As with any index, once you dig deeper, a nuanced and diverse image occurs. You could even break this down further and argue there are two FTSE-250s. One is domestically focussed, e.g. retail companies. The other is actually also very international, and comprises many companies that are experts in their niches, such as specialised engineering firms or specialist insurers. Within these subsets, you'll find different kinds of opportunities.

Undervalued-Shares.com has repeatedly written about the attractiveness of British companies as takeover targets (see previous Weekly Dispatches here, here and here). Indeed, M&A activity has been booming, and thanks to the low valuations, investors were able to pocket unusually high premiums. Just last week, an offer was made for the bombed-out shares of Dignity PLC (ISIN GB00BRB37M78, UK:DTY), a company that is profiting from the UK's record-high death rates. Six months ago, Undervalued-Shares.com Members had received an in-depth report that predicted this eventual takeover offer. The takeover bid is 26% higher than the price when I wrote about it – not the most exciting bid premium, but not a bad result either after a holding period of just six months.

With all that said, from here onwards, I'll change my tack.

Cherry-picking individual British stocks to benefit from takeover bids will remain a lucrative game. However, I also believe it's time for a broader bet on British stocks to stage a rally – driven by a growing narrative about UnBrexit coming our way.

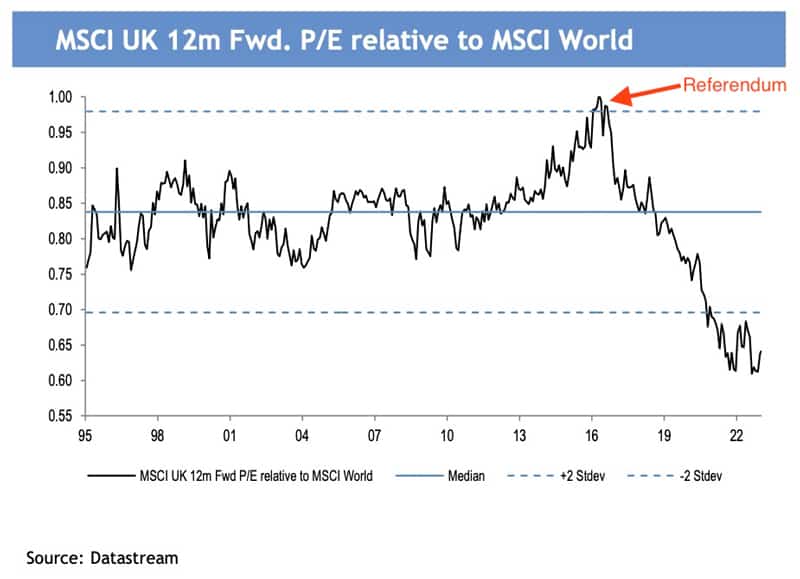

Today's markets are also driven by narratives, more so than they've been in the past. Anyone on the other side of the Brexit argument will delight in the chart below. It shows how, since the Brexit referendum in 2016, the British stock market has become ever cheaper when measured by price/earnings ratio, now valued at 10. Relative to the rest of the world, the British stock market has never been so cheap during my lifetime.

MSCI vs UK.

The British market being so cheap is not actually a singularly British phenomenon. E.g., Italy – still a member of the European Union – is now trading on a price/earnings ratio of 8, which is 20% cheaper still than Britain. Germany's entire stock market today is worth less than Apple (ISIN US0378331005, Nasdaq:AAPL), and its price/earnings ratio of 10.9 is only a smidgen higher than that of Britain. Markets trading at low valuations compared to historical standards is fairly widespread in Europe nowadays.

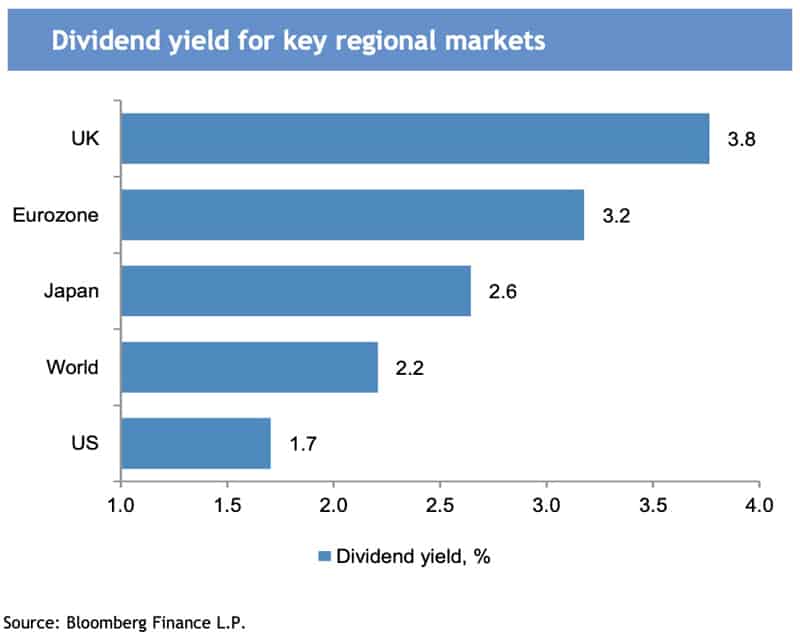

As J.P. Morgan put it in a recent research note about the world's most favoured markets, Britain is "trading at a record discount vs other regions and it offers the highest dividend yield globally". And that's before you have even made an effort to locate those stocks that are particularly attractive to dividend investors.

Dividend yield for key regional markets.

What it all needs is a catalyst, though. After all, a cheap stock can stay cheap for a long time or even forever. Only when there is a spark to get things going can a stock (or a market) experience a revaluation.

For the British market, I expect that spark to be a growing push to rejoin the EU:

- It makes for a great narrative, and the mainstream media will hype it like never before. BBC journalists will be gushing about it all day, every day.

- It's a genuinely new theme. For once, there is something that is not priced in yet, and "new" stories attract investors.

- Millions of investors in Britain and elsewhere will latch onto this as their personal conviction play, as it plays to their long-held political beliefs (similar to the times when investors bought war bonds to be patriotic).

For folks like me, it'll be an opportunity to at least make some money out of it, as consolation for having lost the overall battle.

The question is, how to play such a theme?

Runners and riders

It's too complex a question to provide a short answer to. E.g., the exchange rate of the US dollar is a polarising subject and will influence whether to go for export-orientated FTSE-100 firms or not. The same is true for interest rates, which have a heavier influence on the FTSE-250 than on the FTSE-100.

Some of the themes that are worth considering include:

- If rejoining the EU would be so economically advantageous for Britain as a whole and helps its domestic economy, then surely the FTSE-250 index as a whole will benefit? This is a theme you could play through an ETF (I am no expert on ETFs and therefore can't recommend a specific one.)

- If Britain "behaved" again, surely even more British companies should become the target of foreign bids? Will French and German corporations start to buy up cheap British companies? So far, a large percentage of the action had come from American bidders because they feel comfortable and familiar with the British market.

- Following the prevailing logic, rejoining the European Union should provide a boost to the pound sterling. After the pound's 10% fall in 2022, an investment in British stocks could benefit from exchange rate gains.

Source: The Times, 31 December 2022.

The options to play such possible development are endless.

Personally, takeover bids will remain my favourite. There'll be more of them, and I continue to look out for another one or two candidates that I can introduce Undervalued-Shares.com Members to.

I also believe in a comeback for European bank stocks, including British bank stocks which offer particular attractions.

Plus, there are special opportunities, such as Serco Group (ISIN GB0007973794, LSE:SRP). This outsourcing specialist is a major beneficiary of illegal immigration and asylum seekers, because it provides housing and other services on behalf of government agencies. The Tory government has allowed illegal immigration via the Channel to spiral to an unprecedented level in 2022, which shareholders of Serco Group have every reason to be grateful for. Should the European Union experience another massive influx of people from North Africa and the Middle East, it'll spread them out, and Britain will receive its share. Serco will likely experience an even bigger windfall.

As you can see, there are plenty of ways to stake a bet on the theme.

Importantly, it wouldn't even have to get to Britain actually rejoining. Even with a major backing campaign, success would not be guaranteed. What is safe to say, however, is that the circus surrounding such a campaign (and its mere existence) would drive speculation. The investment case could consist of buying into British stocks now, given their undervaluation and high dividend yields – and cashing out if or when such a development took place and started to move the market.

What do you think? If it came to Britain rejoining the European Union, which stocks would you see as benefitting the most?

As ever, your input is welcome and appreciated.

Serco Group – turning crisis into opportunity

It's not worth getting upset about things that are, ultimately, beyond your immediate control.

If the world as we know it disappears, why not simply make money off its disappearance?

Stocks of defence companies and uranium producers have already experienced a re-rating, due to the new geopolitical situation.

Outsourcing specialist Serco Group is likely to experience the same, and very soon.

Serco Group – turning crisis into opportunity

It's not worth getting upset about things that are, ultimately, beyond your immediate control.

If the world as we know it disappears, why not simply make money off its disappearance?

Stocks of defence companies and uranium producers have already experienced a re-rating, due to the new geopolitical situation.

Outsourcing specialist Serco Group is likely to experience the same, and very soon.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: