Investing in legal claims against sovereign nations is usually complex and time-consuming, but it can also be surprisingly easy and accessible.

A year ago, the Weekly Dispatches featured Rusoro Mining (ISIN CA7822271028, CA:RML), a tiny Canadian company that owns financial claims against Venezuela totalling USD 1.7bn. Fast-forward not even 12 months, and the stock is up a whopping 200%.

Gold Reserve Inc. (ISIN CA38068N3067, US OTC:GDRZF, CA TSX:GRZ) is another such Canadian company. Four short months ago, I sent a detailed report on the company to Undervalued-Shares.com Lifetime Members. During the past few weeks, the share price shot up 131%.

What happened?

Is there more to come?

And where in the world might you find the next such opportunity?

Rusoro Mining.

The curious case of Venezuelan legal claims

Defaulted Venezuelan debt is the largest pool of contested assets on planet Earth today. There are distressed claims totalling a staggering USD 150bn, or maybe more. No one knows for sure, since the entire sector is quite opaque.

If you aren't aware of the background, check back to my 26 August 2022 Weekly Dispatch "Venezuela – a multi-bagger recovery play?".

As I wrote back then:

"Rusoro Mining is a company that used to operate a gold mine in Venezuela, but which nowadays is effectively dormant, except its ongoing lawsuit against the Republic of Venezuela.

Between 2006 and 2008, Rusoro Mining had acquired Venezuelan mining licences that gave it gold reserves of 5.6m ounces, as well as further possible 6.8m ounces subject to additional exploration work. … In 2011/12, Venezuela nationalised all mining assets without paying suitable compensation. … Four years later, arbiters made an unanimous decision in favour of Rusoro Mining, granting USD 967m in damages plus interest. … Additional interest has since accumulated, at a rate of over USD 80m p.a., and will keep accumulating. As of today, the claim amounts to USD 1.7bn including interest. ... In comparison, the Rusoro Mining's current market cap based on its fully diluted share capital of 585.6m shares is a mere USD 32m (CAN 41m). Even just the additional interest accumulating each year is over twice the current market cap. By distressed debt standards, this is a cheap claim to buy into."

I stayed clear of publishing one of my usual research reports about the company, because the liquidity of the stock was simply too low.

However, I did point my Lifetime Members towards another such company recently, Gold Reserve Inc. As I wrote in the in-depth report that I released on 17 March 2023, Gold Reserve combined:

- Large, legally solid financial claims against Venezuela.

- The prospect of at least a doubling of the stock, and potentially even going up tenfold.

- Sufficient trading liquidity to buy in.

The report on Gold Reserve proved popular with my Lifetime Members, who could hoover up the stock while the price was merely going sideways over the initial 2.5 months.

Gold Reserve Inc.

Why the rallying stock prices of late?

2023 is shaping up to be a fateful year for Venezuelan legal claims.

Maduro is cornered

Creditors scored a major legal victory earlier this year, when a US court allowed them to go after a US asset owned by the Venezuelan government.

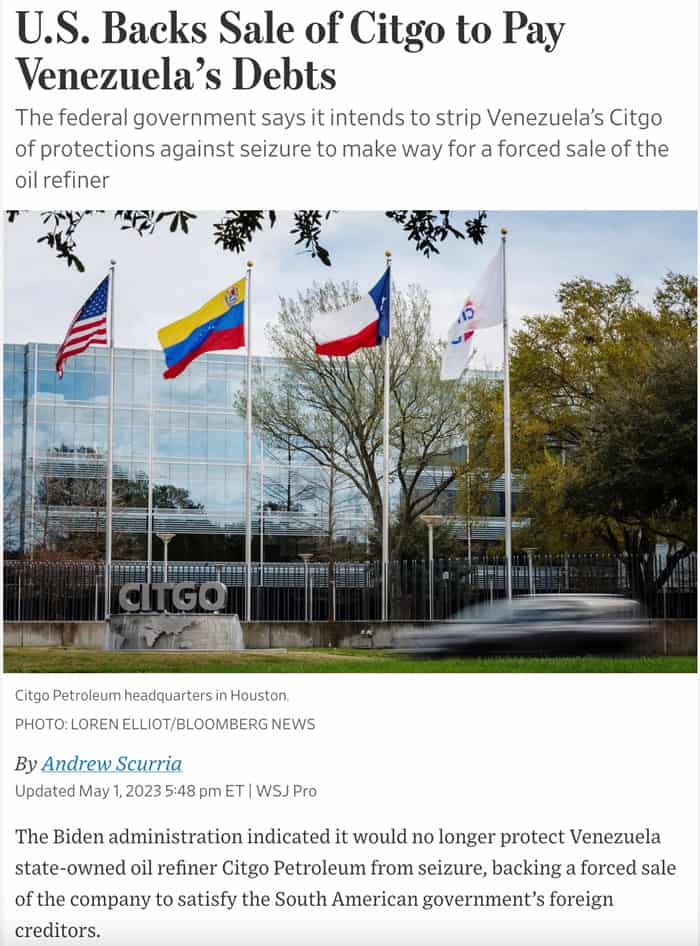

Somewhat counterintuitively, despite the difficult political situation between the two nations and the long-standing US sanctions, Venezuela actually owns several oil refineries in the US. They're organised as a separate company, CITGO, which in turn is a subsidiary of Venezuela's state oil company PDVSA, which in turn counts as an arm of the Venezuelan government under its current president, Nicolás Maduro.

CITGO has three refineries in the US and over 4,000 gas stations, and it generates yearly dividends of between USD 500m-1bn. The operation's value was recently estimated between USD 8-10bn.

Creditors in the US had long seen this valuable asset as one way to get compensation for the losses they had suffered from the Venezuelan regime's nationalisation policies. Shortly after my report on Gold Reserve came out, the door to seizing CITGO was blown wide open by a US court judgment. The Delaware court confirmed that claimants had the right to seize shares of CITGO because the company was, in effect, an "alter ego" of the government of Venezuela. As such, creditors of the Venezuelan government could satisfy their claims using CITGO's enterprise value and cash flow.

After years of legal battles with no decisive outcome, this was the decision that totally changed the situation for anyone holding such claims. Suddenly, there was the prospect of using a US court to collect billions by seizing a US asset and selling it at an auction.

Source: Wall Street Journal, 1 May 2023.

During the ensuing months, US courts even allowed companies that had not been part of the original CITGO case to join in and add their claims – such as Rusoro Mining and Gold Reserve. In May 2023, a US judge temporarily suspended these six new creditors from the ongoing action against Venezuela, but on 7 July 2023, an appeals court did uphold these creditors' ability to use the CITGO asset to satisfy their claims.

This latest decision put a rocket booster under the stocks of both Rusoro Mining and Gold Reserve.

Venezuela is now effectively cornered and SOMETHING is going to happen this year.

This could include an auction of CITGO in autumn with the proceeds going straight to the pockets of the creditors, or some kind of arrangement with the Venezuelan government.

With nowhere to go and at risk of losing its strategically important refineries in the US, the Venezuelan government is now likely to strike a deal. As OilPrice.com reported on 7 July 2023, "Venezuela Looks To Pay Down $20 Billion In U.S. Debt With Oil Exports".

Losing control of CITGO is something the Venezuelan government will want to avoid at any cost. It may end up agreeing to a deal whereby it will send 200,000 barrels of crude oil per day to a trustee who then sells the oil and uses the proceeds to pay creditors.

These 200,000 barrels out of a total daily production of 700,000 barrels would come off oil deliveries that Venezuela currently sends to China at a heavily discounted price but for a cash payment. If Venezuela sent the oil to the trustee instead, it wouldn't get the cash but it'd achieve a price that was going to be higher by USD 20 per barrel. It would avoid seeing its US refineries sold off at an auction. Creditors would not get all of their money from a single auction in autumn 2023, but they'd stand to collect twice as much money over time as they'd get from the sale of the CITGO asset. Collecting USD 20bn over a reasonable period of time instead of USD 8-10bn in a single payment will appeal to creditors. It should make for a decent recovery rate for those who have their claims in the mix of legal cases.

None of this is signed yet, but Venezuela is finally under intense pressure to act, and the creditors have the upper hand.

What does it all mean for the further potential of Rusoro Mining and Gold Reserve?

The rally could continue

An interesting indicator for the likely outcome is a bond issued by PDVSA. The PDVSA 2020 bond issue (ISIN USP7807HAV70) is the only bond that is secured against CITGO shares, and its price has already more than doubled this year, from 19% to 41%. This is remarkable, given that the general market consensus for an eventual settlement of Venezuelan debt had been lower (generally an estimated recovery rate of 25-30%).

PDVSA 2020 bond issue.

The stocks of Rusoro Mining and Gold Reserve have always been of interest to investors seeking a much higher pay-off than what they could feasibly earn from bonds. As I wrote last year: "If Rusoro Mining was paid 24% of its outstanding claim and had to share 20% of that with its litigation funder, the stock would have to increase in value by a factor of ≈10."

Depending on how many creditors join the legal auction relating to CITGO, and how long it all takes to get cash into the hands of creditors, there could be a lot more upside still to Rusoro Mining's stock price.

For Gold Reserve, the situation was slightly different. As my research report for Lifetime Members explained in great detail, based on its financial compensation claims, the stock had an upside of "only" two to three times compared to its price of then USD 1.06. However, Gold Reserve also owns a 45% stake in a major Venezuelan gold project. This is a stake that was issued to the company fairly recently as part of ongoing negotiations with the current Venezuelan regime. This project is also surrounded by difficult legal questions and Venezuela has tried to revoke the stake, but the asset could eventually lead to a Gold Reserve share price as high as USD 10. It's a stretch goal, but with its higher trading liquidity and an excellent management team that can easily fund legal actions out of the company's cash reserves, Gold Reserve is, in some ways, the higher-quality stock.

As ever, there is a non-zero risk of unexpected legal or political developments getting in the way. Keep in mind that the Venezuelan debt saga has been going on for longer than anyone can remember. Overall, though, the prospects now seem to be stacked in favour of the creditors and in a way that we have never seen before.

Just when no one thought these old claims would ever come back into life, they turned into one of the hottest non-correlated assets out there. Who'd have thunk? Venezuela is actually generally moving back on the radar, thanks to its ongoing economic recovery in at least parts of its economy. E.g., you can't just buy cheap financial claims against Venezuela, but also discounted real estate. Even prime real estate in Venezuela can be had at a significant discount to replacement cost right now, if you know how to navigate this market. Arqos Capital, a boutique fund management firm, will soon close its current funding round for a Venezuela real estate fund (contact [email protected] for details).

Speaking of distressed assets with massive potential, investment sleuths may now have the chance to pursue another such win in another famously crisis-stricken South American country.

Check out Argentinean GDP warrants

Besides Venezuela, no other Latin American country is as infamous for mistreating its creditors than Argentina.

In fact, Argentina's credit history is so bad that you have to ask if anyone but financial masochists would ever lend the nation money.

That's not to say that claims against Argentina wouldn't be interesting from an investment point of view. It always boils down to price. Take Burford Capital (ISIN GG00BMGYLN96, UK:BUR), a litigation finance specialist listed on the London Stock Exchange, as an example. In my report for Undervalued-Shares.com Members, I explained why its stock price didn't include ANY value at all for a potential multi-billion claim against Argentina – in effect, the claim was thrown in for free but offered a massive upside, which made the stock a truly undervalued share. When a New York judge confirmed the claim in March 2023, Burford Capital stock doubled within weeks (and Undervalued-Shares.com Members who had acted on my report benefitted accordingly). It could well have a lot further to run depending on the imminent next phase of the case, which is scheduled to play out in a New York court later this month, with a decision expected in August 2023.

There is an entire sector of distressed legacy claims, and a deep-dive can uncover all sorts of unusual investment opportunities. For example, buying a distressed Argentinean claim for pennies on the dollar is something you may currently be able to do with another little-known, unusual asset: so-called GDP-linked warrants.

These warrants were created by Argentina as part of its seemingly never-ending series of defaults and negotiations with creditors in the 2000s. In simplified terms, they pay an annual coupon depending on Argentina's GDP growth exceeding 3% in any given year. The warrants mature in 2035 and will pay a maximum of 35 cents. Until 2011, they had already paid 16 cents – so there are 19 cents left to pay.

In the meantime, good old Argentina tried to wiggle its way out of its obligations by redefining how its GDP is measured. However, in April 2023, a London court decided in favour of creditors who claimed that changing the rules along the way was permitted.

The Argentina 2035 EUR Warrants (ISIN XS0209139244) currently trade at 3.5 cents, and Argentina 2035 USD Warrants (ISIN US040114GM64) trade at 1.5 cents. Both could see a multiple of their current price paid out over time, and both of them got moving again recently.

Argentina 2035 EUR Warrants.

Argentina 2035 USD Warrants.

The London court ruling only affects payments for the year 2014, and a similar case pending in New York has not been decided yet. However, New York courts tend to be more investor-friendly than London courts, and there is now a significant likelihood that the same rulings will be made for other years. A 33,000-foot assessment of these Argentinean GDP-linked warrants makes me believe they are the latest asymmetric opportunity in the distressed asset space.

This is an idea that those of my readers who have a knack for this sort of investment can research themselves. After all, Undervalued-Shares.com in general, and the Weekly Dispatches in particular, are a service designed to provide ideas to readers with a view to everyone then doing their own research.

Alternatively, make use of my archive of research reports…

Gold Reserve Inc. and Burford Capital: further to run

If you aren't tempted by Argentinean GDP warrants, how about Gold Reserve Inc. and Burford Capital?

Both investment cases have further to run, and both are little-followed by the investing public and the mainstream media – and offer all the more exciting opportunities for that very reason!

Undervalued-Shares.com has published some of the most extensive and comprehensible pieces on research available on both these companies.

Now is a good time to take another look, if you haven't already.

Gold Reserve Inc. and Burford Capital: further to run

If you aren't tempted by Argentinean GDP warrants, how about Gold Reserve Inc. and Burford Capital?

Both investment cases have further to run, and both are little-followed by the investing public and the mainstream media – and offer all the more exciting opportunities for that very reason!

Undervalued-Shares.com has published some of the most extensive and comprehensible pieces on research available on both these companies.

Now is a good time to take another look, if you haven't already.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: