Gold stocks remain undervalued, with considerable upside potential. I picked the brain of Dominic Frisby, who has just released a new book on gold, to get his take.

INVESTMENT REPORTS

My best investment ideas

My in-depth research reports contain my best investment ideas every year (up to 10 for Annual Members plus at least an additional 4 for Lifetime Members). They always cover ONE specific investment in great detail - mostly liquid shares that you can purchase on major stock exchanges, and occasionally a small cap company or an alternative investment. Check out my FREE sample report (PDF - 4MB) as an example. Please note, I do not provide investment advice and readers need to make their own decisions (see my disclaimer for details).

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

An asymmetric opportunity

22 August 2025

In November 2024, Undervalued-Shares.com Lifetime Members received a research report on a little-known company listed on London's AIM: TruFin PLC. It offered deep undervaluation, clear value catalysts – and included information not published anywhere else.

Nine months later, the stock has doubled.

The AIM market is far from straightforward. Many brokers don't even offer access. Transparency is often lacking. And many stocks go unnoticed.

But that's exactly where the most compelling special situations emerge.

If you missed TruFin, here's another asymmetric opportunity you won't want to overlook.

Buying growth at value prices

11 August 2025

2025 sees European stock markets leading the world in performance, driven by fiscal stimulus, global diversification trends, and attractive valuations.

If you know where to look, you can find top-quality European companies that are global players with plenty of growth potential and low valuations. Some of these firms even become prime targets for cash-rich bidders.

This in-depth research report analyses one such multi-billion European company.

With strong growth potential, a low valuation, and the very real possibility of a lucrative takeover bid, it's the perfect opportunity for savvy investors seeking to buy growth at value prices.

Taking Europe's finest to the US

24 July 2025

"Investors seeking returns from the buoyant American market are turning to European stocks which have significant US exposure but are trading at a discount to their transatlantic counterparts."

– Financial Times, 5 October 2024

The company analysed in this report is one such European stock that investors will be turning to.

It managed to grow 10x in the UK within four years, and it's now taking its products to the US – a market 12 times bigger than the UK!

A US investor has recently taken a stake and is set to play a key role in supporting the company's expansion.

Now is the perfect time to look at this opportunity in more detail.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

A smart route to the mining market

11 June 2025

Has a new commodity bull market quietly begun?

Early signs point to the start of a new mining boom.

Mining stocks famously can multiply in value – but picking the right ones is complex.

Why not leave the task to seasoned professionals?

This investment vehicle is run by industry insiders with decades of experience – and it's currently trading at an unusually steep discount.

A forgotten leader in European finance – poised for a comeback?

28 May 2025

European finance stocks rarely get investors excited – but that's exactly where the opportunity lies.

These stocks may seem dull, but with the right catalyst, they can deliver exceptional returns.

Take European bank stocks: since 2022, when Undervalued-Shares.com began highlighting their potential, they have gained between 50-200%.

Or the European online brokerage firm, which Undervalued-Shares.com featured in a 2024 research report. That stock is now up 100%.

Where next in "boring" European finance?

P/E of 2.5 and >20% dividend yield with this coal stock

21 April 2025

The stock analysed in this report is SO cheap that you will not believe the figures.

P/E of 2.5 and >20% dividend yield – how is that even possible?

In fact, the P/E is less than 1 once you eliminate the company's massive cash hoard. With a bit of luck, its average dividend for the next two years could even come out above 30% p.a.

Funnily enough, it's the second time this stock is trading at such low valuation multiples. It was similarly cheap in 2021 and then soared by 15x.

Now that it's back down, it's a good time to take another look.

It's unlikely that you'll see this stock do 15x again, but it should be a relatively low-risk 2-3x when the situation normalises – and you'll get plenty of dividends while you wait.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

Iconic New York at a discount

18 March 2025

Once every decade (or two), the world's iconic cities offer you an outstanding investment opportunity in real estate.

E.g., in the 1990s, London's Canary Wharf was truly down-and-out. The amount of excess real estate felt overwhelming, and Londoners looked down on the area as a place that no one would want to live in. You could have purchased a house for GBP 50,000-70,000. Today, the average house price in the area is GBP 610,000.

In places like London or New York, if there is a cheap but attractive area in an otherwise expensive city, its residents will sooner or later engage in location arbitrage.

Today, one particular part of New York offers a similar opportunity.

You can currently buy into it at a discount, ahead of prices probably catching up with much more expensive neighbourhoods of the Big Apple.

A newly-listed, little-known company provides easy access to this opportunity.

Buy Florida land – where it's still cheap!

28 February 2025

Florida is forever going through pronounced cycles, but with an upward trajectory overall.

It offers a combination of sunshine, seaside living, and low taxes – all while being in the United States of America rather than a Caribbean micro-state or a Latin American banana republic.

Much as the state has its issues, it's safe to assume that the secular trends that have been driving real estate values in Florida remain intact.

Over the next 5, 10 and 20 years, the Sunshine State is bound to do well.

Today's report deals with a region that could be Florida's most exciting part for the next 20 years.

There is one stock that allows you to easily get exposure to this investment theme.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

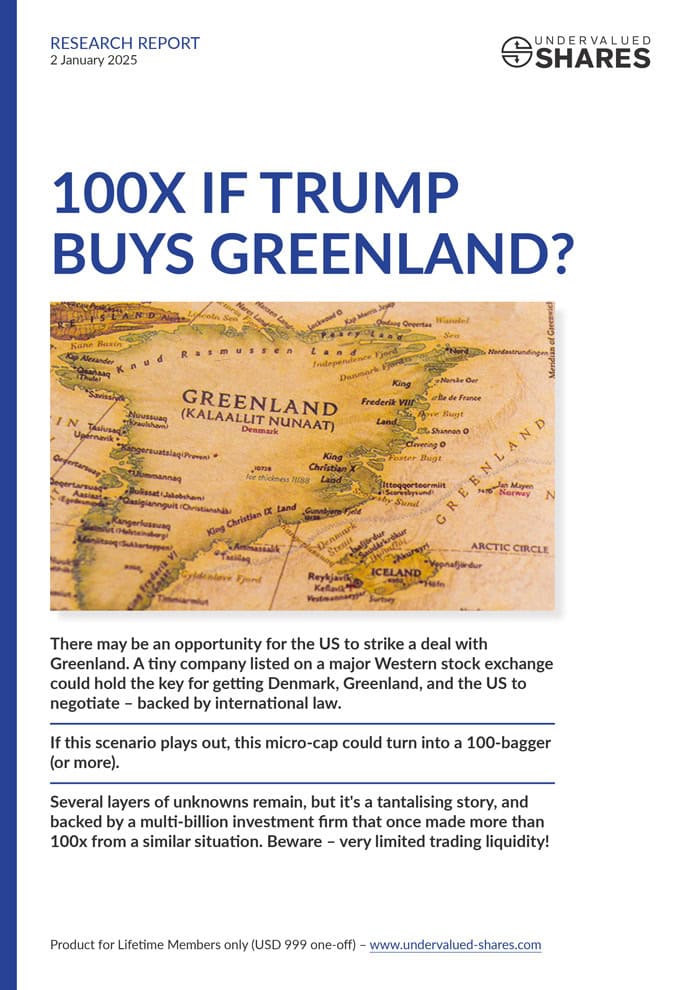

100x if Trump buys Greenland?

2 January 2025

For Donald Trump, ownership of Greenland is "an absolute necessity".

He is the man one must not take literally, but who should always be taken seriously.

Could there be an angle that the public hasn't noticed yet, and which makes this ambition more realistic than it appears?

Undervalued-Shares.com ventured where few others dare to venture.

If you (like a growing number of investors!) ever asked yourself how to get exposure to the Greenland investment thesis, this report has the answer.

BEWARE, though: it is not for the faint-hearted!

Dominant, fast-growing tech play in emerging markets

12 December 2024

Domestic tech champions are springing up in emerging markets around the world. Since their markets are less mature, these companies often grow faster than their counterparts in the US.

Some of these markets have very high barriers to entry, often starting with language alone!

In fact, the company featured in this report may have one of the strongest moats in the world.

Its New York-listed stock is trading at a cheap valuation both in absolute and relative terms.

Talk of buying a fast-growing, world-class tech company at a fraction of US valuations!

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

2-2.5x from an investment holding liquidation

12 November 2024

Never before have AIM stocks been in such dire straits.

Lack of liquidity, lack of investor research – and now a cutting back of tax breaks courtesy of the new UK government.

There is increasing pressure for undervalued AIM-listed companies to do *something*.

Selling out to private equity, listing in the US, or even outright liquidations... We are going to see it all.

The AIM-listed small-cap analysed in this report will likely return all its capital to shareholders. This should yield 2-2.5x over the coming 12-24 months, with low downside risk.

Ukraine reconstruction: one stock to benefit

1 November 2024

Once the reconstruction of Ukraine begins, it could become the biggest foreign-sponsored reconstruction programme of the last 80 years.

Think Marshall Plan, but on steroids.

Infrastructure, housing, public facilities – so much needs rebuilding!

Billions will at some point pour into Ukraine, without a doubt.

What if there was a stock that is ideally placed to benefit from Ukraine's eventual reconstruction?

Actinium-225, aka "the world's rarest drug"

10 October 2024

If a single gram of Actinium-225 was available, it would fetch in the double-digit millions.

The trouble is, hardly anyone has got any of it.

This uber-rare radioactive isotope has turned out a potent weapon to treat cancer. The head of oncology at Novartis believes it could become "a mainstream therapy" for tackling the "big traditional cancers". That's 50 (!) different forms of cancers.

Commonly referred to as Ac-225, the material delivers a cannonball punch to cancer cells, but without affecting neighbouring healthy cells.

Big Pharma is pouring billions into new pharmaceuticals using Ac-225.

One little-known Western European company has suddenly emerged as the potential global market leader for supplying the material that is at the heart of it all.

Internet leader at a bargain price

15 August 2024

The world's leading Internet companies tend to be hugely profitable, and their stocks valued at a premium.

Once in a while, though, you can buy into them at a bargain price.

In 2022, Meta/Facebook hit a weak patch, and the stock fell below USD 100. A mere two years later, it's up 5x at USD 500.

That same year, Spotify fell as low as USD 75. Investors doubted the future of the company. Today, the stock is up 4x at USD 335.

Every now and again, there is a chance to buy a global Internet leader at a bargain valuation.

What's the latest such opportunity?

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

4x from a deal with Ukraine?

16 July 2024

Politics remains a divisive subject.

Not everyone will like the idea of investing in Russian stocks.

There are so many moving parts on the Russia question that it's very difficult to predict an outcome. However, most such situations eventually come to some form of conclusion.

The investment discussed in today's report is affected by issues such as:

- A potential US election win by Donald J. Trump.

- A potential defeat of Ukraine in the war with Russia.

- An exposure of Western sanctions as ineffective.

Speak of digging into controversial subjects!

Wind energy – turnaround ahead?

10 July 2024

European renewable energy stocks have been battered, and are down 75% since 2021.

Investments into wind energy will continue, though. The new UK government has just lifted the ban on onshore windfarms, and windfarms are now also promoted in the context of energy security. What's more, their economics have improved a lot.

Over 500,000 wind turbines are installed across the world. During the remainder of the 2020s, their number will likely grow by about 10% p.a.

Wind energy stocks are currently down-and-out, but they have previously proven resilient. Three cyclical downturns have occurred in this sector since 2000; each time, leading wind energy firms came back bigger and stronger.

Which stock stands out as a likely winner?

Laggard turning growth stock

24 May 2024

The company featured in this report was a popular growth stock a few years ago. Shareholders enjoyed the share price going up 5x within just two years.

Subsequently, the price went back to where it came from. It's currently a lame duck.

The company has tremendous growth opportunities, though – both organically through innovation and through M&A.

However, management is not up to the task – which is why the company's founder is now stepping in. He controls 19% of the vote and presses for a change in leadership. Institutional shareholders have been unhappy for a long time, and are likely to support him.

The upcoming AGM will be crunch time for this company – but by then the stock could already be trading significantly higher.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

Undervalued liquidation case

23 April 2024

The London-listed stock analysed in this bonus report for Undervalued-Shares.com Lifetime Members is a real estate company that decided to go into liquidation. All assets will be sold, and the proceeds paid out to shareholders.

The company in question has a complex and somewhat sordid past. It has completely fallen off the radar, except for funds that are specialised in complex special situations and which quietly mopped up enough shares to control the majority of votes.

Two of these investors recently significantly upped their stake. They will know that:

- A liquidation is going to yield a 2x return for shareholders.

- Recent macro tailwinds could make for an even higher return.

- An ongoing litigation case could yield an additional windfall profit.

With a bit of luck, this case should throw off 3-3.5x the current share price. At the same time, the downside seems very limited, given that you are buying real estate at a 50% discount.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

Mid-cap bid target

28 March 2024

Western Europe has many industry-leading mid-cap companies that are hardly known among investors.

The company featured in this report:

- Commands a 50% market share in its industry in Europe (= duopoly).

- Has hardly any risk of decreasing demand for its products.

- Is trading at just 6x EBITDA, or even less.

- Has started to grow at a clip of 30-40% p.a. in a major overseas market.

Despite a market cap of >EUR 500m, few analysts or fund managers follow the stock.

Yet, they should.

The company's CEO and COO have been given a strong financial incentive to at least double the share price by mid-2026.

It looks likely that they will succeed.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

British going-private candidate

19 March 2024

It's raining takeover bids in the UK. As Bloomberg reported in January 2024: "Almost nine out of 10 UK corporates see a positive picture for M&A in 2024."

Low equity valuations, an open capital market, and companies finally leaving behind the effects of the lockdowns conspire to a wave of corporate action, and unusually high bid premia.

One particularly fertile hunting ground for bidders are small- and mid-caps. Often with little or no analyst coverage and limited trading liquidity, these stocks have literally fallen through the cracks.

The company featured in this report is such a small-cap. It has 50-100% upside in case of a bid, and at least just as much upside if no bid materialised and the company remained listed over the coming years.

How is that possible?

Frasers Group: The Berkshire Hathaway of British retail

14 March 2024

The London-listed stock of Frasers Group is currently trading at 800 pence.

The company's new, successful CEO has an incentive package that will grant him a cool GBP 100m worth of stock if he gets the share price to 1,500 pence by October 2025.

Another incentivisation package is with its staff. Over 1,000 Frasers Group employees will receive a bonus of GBP 50k-1m if the stock hits at least 1,000 pence by October 2025.

Speak of management and staff motivation!

At its current level, the stock is trading at less than 5x EV/EBITDA. Its price/earnings ratio of 8 is 50% below the stock's own ten-year average, even though earnings per share will likely grow by 14% p.a. between 2024-2026.

On the current level, the highly cash-generative company is buying back stock.

This is a stock that fulfils the criteria for low downside, significant upside – and a catalyst!

Formula One Group: moving up a gear

2 February 2024

Nasdaq-listed Formula One Group owns one of the world's best-known sports brands, but it is little-understood by investors. After five years of successful strategic changes, the company's financial outlook could experience a leap during 2024/25.

Potential catalysts include a likely tie-up with Apple. Netflix' recent move into wrestling signals that cash-rich tech platforms will continue their move on sports rights.

Of the major sports events in the world, Formula One appears the most ideal target for transformative changes that involve digital media.

Surprisingly, the stock of Formula One Group does not yet reflect the vast potential for improving asset monetisation over the coming years.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

In the crosshairs of private equity

3 January 2024

What do you call a publicly listed company where ALL large shareholders agree that the company should be sold?

A prime takeover target.

Most likely, private equity companies will soon be salivating over the prospect of bidding for my latest find.

The company in question is the market leader in its region, with a strong balance sheet and a valuable brand name.

During the last three months of 2023, the company's sector has seen FOUR acquisitions, including an offer for a public company with a 56% bid premium.

For today's featured company, a bidder will likely have to offer a premium of at least 50-75% above the current share price.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

The world's cheapest oil stock?

20 December 2023

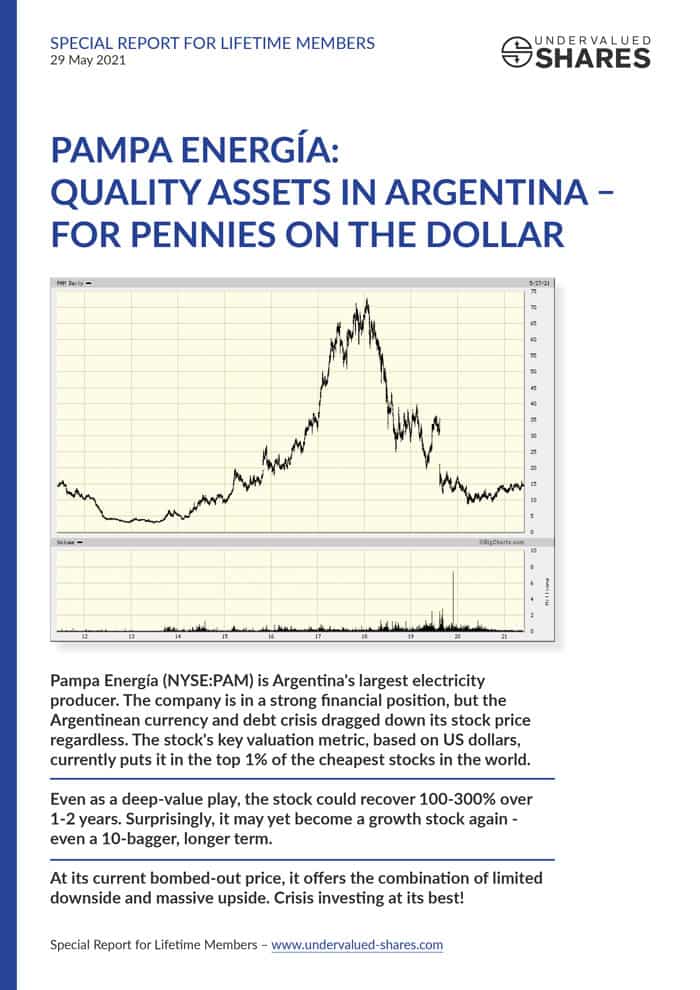

Two years ago, Undervalued-Shares.com featured a stock that was "in the top 1% of the cheapest stocks in the world."

With an EV/EBITDA multiple of 2.2, Pampa Energía was as cheap as they come. The company was located in a crisis-ridden country, but its stock was easily tradable on the New York Stock Exchange.

Today, the stock is up 200%.

Such is the power of buying into assets at extremely depressed valuations.

Today's report features a stock that is valued at an EV/EBITDA multiple of 0.3 (not a typo!) based on 2025 estimates.

There is a catch – but one that should be resolved sometime after February 2024!

Until then, it's worth considering to buy into this opportunity while no one is paying attention.

Still waters run deep

30 November 2023

Steady-steady often wins the race.

If you had bought into today's featured company in 2010, you would by now have received all of your money back through dividends, and retain a stake in a business that is worth 2.5x more than what you invested originally.

In the UK, this company is the most profitable in its sector. Crucially, it's now also turning into a growth play.

After years of strong cash flow but anaemic growth, it should soon be re-rated as a tech company with significant growth potential not just in Britain but internationally.

You will know the brand name, but you are unlikely to have heard about this new investment thesis before.

Robotics play – with multiple catalysts

16 November 2023

Are you eager to invest into robotics, but struggle to find the right stock?

Take a cue from the Japanese, the undisputed global robotics superpower. As of 2022, 45% of all industrial robots in the world trace their origin in Japan.

Yet, sometimes, even the Japanese have to rely on a foreign robotics company!

It's a company whose robotics technology is so advanced that one of the leading Japanese firms decided to become its customer.

This is as strong an endorsement of a robotics technology as you can get.

As to the stock itself?

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

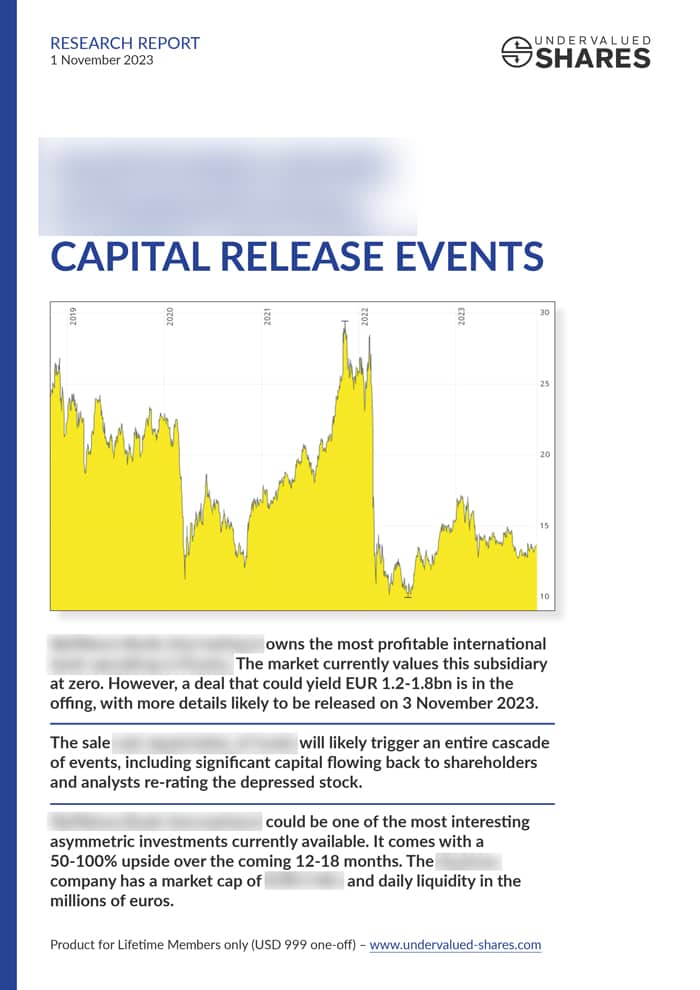

A bank stock… Yikes!

1 November 2023

I don't usually spend much time analysing banks, mainly because they are very complex to analyse.

There are exceptions, though.

Sometimes, the stock market logic underlying a bank stock is simply too compelling to disregard the sector as a whole.

Take Bank of Cyprus as an example. When I featured the London-listed bank in September 2022, I put aside Cyprus' infamous corruption and the general malaise of European bank stocks, believing that other, more powerful factors were going to override these concerns.

Just over a year later, the stock is up 122%.

At the risk of making the case yet again for unpopular, little-known European bank stocks, today's research report reveals a similar opportunity.

The bank in question has a ≈EUR 5bn market cap, and an easily tradable stock that could rise 50-100% over the coming 12-18 months.

Too good to be true?

Renaissance of oil and gas stocks

26 September 2023

A growing number of people are waking up to the fact that "green energy" was a gargantuan hype orchestrated by special interest groups.

The reality is, oil and gas will remain the backbone of the world's energy industry not just for years but probably decades.

Oil means life – literally, for billions of people.

Following years of underinvestment, investors who provide capital to the sector are still offered outsize returns. Oil and gas stocks are among the cheapest in the world, and they produce massive amounts of cash for their shareholders.

There could soon be a violent rally of undervalued oil and gas stocks.

A Swiss "quick flip" bid target with liquid trading

25 August 2023

The company featured in my latest research report is among the global market leaders of its sector, and operates in a secular growth market. The industry is undergoing a consolidation, and the company in question is going through a phase of internal challenges. It is very likely going to become a target for a bid, possibly even instigated by its management.

Compared to historical valuation multiples, a bid should come in at least 40% above the current level. The stock is highly liquid, and one of the lead investors has recently upped their stake through the market. Is now the time to pay attention?

Dr. Martens plc: luxury for rebels

10 May 2023

Dr. Martens plc produces the eponymous boots, commonly known as "Doc Martens", "Docs" or "DMs". When the company went public in January 2021, the placement was eight times oversubscribed. Eager investors piled into a truly unique brand that was widely seen to have tremendous growth potential.

26 months later, the stock is down 65%. The company had to issue three profit warnings and replace some of its management team.

Is the share price ever going to turn around?

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

European telco consolidation - a new investment theme?

27 April 2023

The European Union has over 100 telecoms operators, which makes it 20 times more fragmented than the US. A review of the industry is underway, though, which the European Commission says will have "no taboos" and might reduce the number of operators to just 5-10.

Will we soon see a wave of M&A among European telco companies?

Morgan Stanley concluded that "the tide may be turning on telco M&A", and points towards the sector's strong outperformance during the last wave of European telco M&A in 2013-2015.

The market barely has the subject on its radar, but this could soon change. The taboo-free review of the European Commission is due as early as June 2023.

There is one telco stock, in particular, that could shine during this period of consolidation.

Growth stock bargain – limited time only

28 March 2023

Growth stocks have fallen dramatically over the past two years.

Many of them will never return to their previous levels. Overvalued to begin with, they now suffer from higher interest rates and weak balance sheets, or operate in businesses that are simply not going to deliver the kind of growth rates that investors once hoped to see.

There are exceptions, though.

Following the broad sell-off, investors can now find quality growth stocks that are trading at reasonable valuations. Some of them represent equity stories that will come back into fashion, especially if their growth is driven by powerful, almost irreversible secular trends.

This research report analyses a family-controlled French firm listed on Euronext Paris. Over the next 12-18 months, the stock has 50-100% upside – because of a number of specific catalysts that should start to set in shortly.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

Gold Reserve Inc.: 2-10 times your money from Venezuela

17 March 2023

Not just Venezuelan expats, but also secretive fund managers have recently been piling into Venezuela – of all places!

Why would they chase assets in one of the world's most crisis-ridden countries?

Venezuela holds the unfortunate record for "the largest economic decline in modern history outside a war zone". During the 2010s alone, its potent mix of socialist policies, high level of corruption, hyperinflation, and international sanctions destroyed 80% of the economy.

It is now becoming apparent why there has been such interest among insiders in gaining exposure to Venezuela. Not only has the country's situation recently shown early signs of a potential turnaround, such as stabilised inflation stabilised and double-digit growth rates. On 15 March 2023, a catalyst became apparent that could give a critical matter necessary for a Venezuelan turnaround a LOT of momentum in 2023.

Undervalued-Shares.com introduces what may be the single best option to profit from a recovery – this is truly "hot off the press".

Notably, even US citizens are allowed to buy into it!

Aston Martin: 180-degree turn

28 February 2023

It's not the first time for me to write about Aston Martin Lagonda Global Holdings plc. When I last wrote about the company, I warned against investing into it.

This was just after the 2018 IPO, and what followed was the most disastrous performance of any high-profile IPO in the UK over the past five years. At one point, Aston Martin stock was down 97%!

Today, I am going to blow the horn for the company.

Aston Martin is one of the world's most iconic car brands, and it's currently also one of the most interesting investment cases on the London Stock Exchange.

Longer term, it may be one of those stocks that one shouldn't part with. Remember what happened to Ferrari since it went public in 2016?

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

Multi-bagger penny stock – thick skin required!

16 February 2023

Who wouldn't like to turn USD 10,000 into USD 500,000 within just a year or two?

Exactly.

Investments that increase in value by a factor of 20, 50, or 100 do exist. Take Adolf Lundin, for example, who had made such investments his life's work, and became a multi-billionaire on the back of it; he even once landed a 500-bagger. Or the stock of Petrel Resources, a highly speculative company operating in Iraq, which went up by a factor of 50 after I featured it in 2003.

Could you land similar coups?

Of course! Here is one such idea – highly speculative, highly controversial, and not for the faint-hearted.

Glencore: a smarter way to play the copper market

27 January 2023

Are fossil fuels a thing of the past?

Many have assumed so for years, but got it completely wrong. In 2022, the profits of the global coal mining industry tripled to USD 97bn. Investors who got in early oftentimes multiplied their investment.

No other firm exploited this trend more successfully than Glencore. The global commodities firm was the industry's biggest winner in 2022, with reported coal earnings of USD 13.2bn. It even beat the world's largest coal miner, China's mighty Shenhua, which came in second with USD 12.2bn.

Akin to an unconstrained hedge fund, Glencore aims to make money off any opportunity in the commodities industry, anywhere in the world.

There is a new secular opportunity arising in copper, and Glencore has yet again positioned itself at the forefront.

Swatch Group: Hayek heirs under pressure

9 December 2022

It used to be "the world's largest watch company", but not anymore. In 2021, Swatch Group slipped to the #2 spot when measured by revenue. Worse even, its four biggest brands – Omega, Longines, Tissot and Swatch – have all lost market share. These four brands account for 75% of the group's revenue.

12 years after the death of its legendary CEO and major shareholder, Nicolas G. Hayek, the company is lagging the industry rather than leading it. Even the recent hype about the "MoonSwatch" may yet turn out a pyrrhic victory.

Swatch Group is highly profitable, has a gold-gilded balance sheet, and sits on a mountain of cash. Yet, the market treats it as a company in decline. The value of the Omega brand alone could almost match the current enterprise value – and Swatch owns 16 (!) other watch brands.

Its record-low valuation could turn out a temporary bargain. 2023/24 has the potential to bring transformative changes to the watch industry in general, and Swatch Group in particular.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

Atari: the forgotten legacy brand company

30 November 2022

Remember Atari? The video game pioneer is still listed on the stock market – who knew? The stock is trading on Euronext/Paris, and on OTC exchanges in the US and Germany.

Atari's legendary brand name is more active than you'd probably expect. Even today, the company's name gets 500m web searches every year, and www.atari.com is visited by 30m people.

The ability to create stories around genuine heritage is what makes a brand so valuable. The depth and quality of Atari's brand heritage are fascinating, and the brand would have incredible potential, if only it was utilised properly.

The stock has long been dormant, and it has lost 99.9% of its value over the past 20 years. However, the brand name is still there.

One investor has recently woken up to its potential, and he is currently buying up every single share he can get hold of (literally – every single one).

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

Falklands – the treasure islands?

7 October 2022

Back in 2004, I published a 142-page report about the little-known oil resources of the Falkland Islands. It was a pioneering piece of research at the time – and very controversial!

The islands have since seen an oil exploration boom, and exploitable oil reserves were found in 2010. However, with the oil price tanking in 2014, the prospect of actually producing oil in the Falklands vanished. The share prices of the fledgling Falkland oil companies all fell by over 90%, some companies went under altogether.

Given the new world's energy situation, are we soon going to see a "Falkland Islands Oil Boom 2.0"?

This report shows you an opportunity in a part of the world that few investors have on their radar – but which is likely going to see a resurgence of public interest soon.

Investing ahead of a narrative change

30 September 2022

To succeed in investing, it's not enough to be right. You have to be right AND outside the consensus. This is a little-understood quirk of the stock market.

The stock featured in this report is about to undergo a change in narrative, something that few investors have realised yet.

The company in question recently appointed a new CEO, who is one of the most successful leaders in the industry. Right now, investors still underestimate the transformative steps that this CEO will bring to the company. The initial results of her work and her long-term plans, however, will soon start to become apparent.

By then, you need to be invested already to benefit from the first leg of what will likely be a multi-year upward move that could see the stock increase in value by 200% over two years.

Never-ending crises? Bring 'em on!

3 August 2022

Reading the news has been a particularly depressing affair of late.

Wars, pandemics, illegal immigration, censorship, declining government finances, selectively applied laws, the decline of the nuclear family – you name it.

Then again, it's not worth getting upset about things that are, ultimately, beyond your immediate control. Instead, take charge of the things that you can control!

If the world as we know it disappears, why not simply make money off its disappearance?

Stocks of defence companies and uranium producers have already experienced a re-rating, due to the new geopolitical situation.

The company featured in this in-depth report is likely to experience the same, and very soon.

Safe haven Switzerland

13 July 2022

"Being wealthy isn't enough. You need to have some of your wealth in Switzerland!"

In our changed new world, Switzerland is set for a renaissance as THE place to safely stash assets.

The country stands to benefit from a great migration of wealth that is about to happen for an entirely new reason. Jurisdictions such as the Cayman Islands, the Bahamas or even Malta will become "the next Russia", i.e. they will increasingly find themselves cut off from much of the Western world's financial flows.

This may not just happen at some point. It already IS happening. Those who still use lower-quality banking jurisdictions will soon want to flee to higher ground while they still can. Several higher-quality banking jurisdictions will be the winners of this development, with Switzerland likely the biggest of them all.

How can YOU benefit from this financially?

Death care: a crisis-resistant industry

24 June 2022

On five out of seven days in mid-June 2022, over 90% of the stocks in the S&P 500 declined – the most overwhelming display of selling in history. There hasn't been a precedent for a sell-off of this nature since 1928.

Yet, the stock of one particular American company stood relatively firm.

Service Corporation International (ISIN US8175651046, NYSE:SCI) is the leading provider of funerals in the US. Even after the recent sell-off, its stock trades a mere 12% below its all-time high. Compared to ten years ago, it's up 500%. Over the past 20 years, it's up 34 times. Speak of a crisis-resistant investment!

The death care industry benefits from the only absolute certainty that we all have to live with: sooner or later, everyone becomes a customer.

At a time when tech, software and Internet investments have gone out of fashion, one particular death care company could come back into focus. Around the world, there are about a dozen publicly listed companies that provide funerals, cremations, and related services. I picked the one that is currently out of favour, but probably for not much longer.

The stock featured in this report should benefit from not one or two, but three catalysts during the remainder of 2022. The first one of these catalysts is due next month.

Big Tobacco on the up

8 June 2022

Since 1 December 2021, stocks of Big Tobacco have been on a roll:

Altria + 25%

British American Tobacco + 31%

Imperial Brands + 16%

Philip Morris International + 22%

Japan Tobacco + 7%

Compare that to the Nasdaq Index, which is down 21%.

Weren't tobacco stocks supposed to remain "out" forever, because so-called ESG investors aren't allowed to touch them?

As it turns out, cigarette companies are good for a few old-school factors that have recently come into fashion again. Factors such as substantial earnings, high dividend yields, and reliable growth prospects.

Plus, they are even a hedge against inflation.

Will the trend continue?

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

How to buy Russian stocks (on the cheap)

12 April 2022

"Is there ANY way I can buy Russian stocks at today's depressed prices?"

This has been the most frequent question that I've been asked over the past couple of weeks – if not ever!

Obviously, most conventional ways to get exposure to the Russian equity market are currently blocked:

- Trading in ADRs was halted indefinitely.

- Some ETFs decided to liquidate.

- Brokers can no longer process orders.

Yet, a few loopholes remain!

I have identified what I think is the best way to get in. You could make use of this loophole through any ordinary broker.

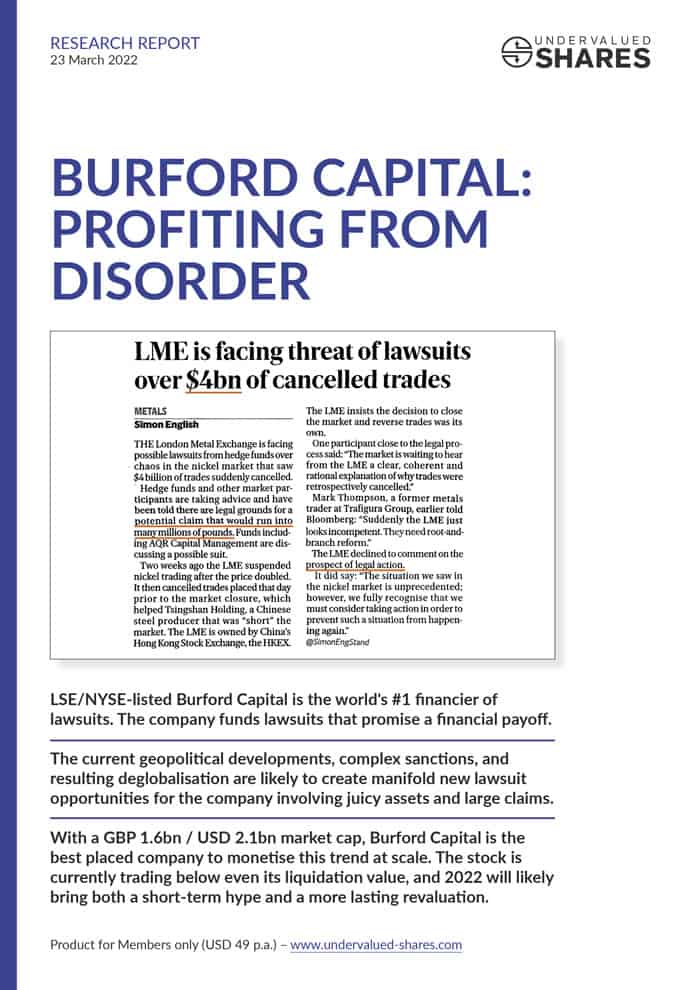

Burford Capital: profiting from disorder

23 March 2022

The current global situation has already produced several new trends that are obvious, such as rising food and energy prices, growing investments into defence, and a stronger focus on cyber security.

However, trends that are already known to the wider public have a distinct disadvantage when it comes to investing in them: they are usually already priced in, at least to some extent.

Which begs the question, which non-obvious trends are yet to emerge?

It currently looks like the coming years will see large-scale conflicts – politically, economically, and unfortunately maybe even militarily. We are facing an age of disorder.

What are some of the non-obvious winners of this trend? Which companies could benefit from disorder, and which stocks have yet to price in the upside of such scenarios?

Undervalued-Shares.com has done some lateral thinking.

Subscription cash machine

3 March 2022

If there is one business that I truly know something about, it's the publishing of subscription-based investment newsletters.

I started working in this industry when I was 16. My career spans decades, and I have been involved with over 50 investment newsletters during that time (despite a break from 2010-2018).

This research report is the definitive investment analysis of the world's only publicly traded investment newsletter publishing company!

In a very modest way, this report is akin to an "insider" spilling the beans, as it lets you into a secret that my colleagues don't want you to know about:

Instead of subscribing to investment newsletters, you should buy stock in a successful investment newsletter publisher.

At long last, such an opportunity is available in public markets.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

The beauty of subscription businesses

7 February 2022

Massive sell-offs in tech stocks provide opportunities to pick up stocks of world-leading companies at sell-out prices. Timing is difficult, though, and no one will ever manage to catch these volatile stocks exactly at the bottom.

However, what you do have full control over is to pick companies that are not at risk of going out of business if the market takes longer to turn around. Also, you can (and should) focus on businesses that have a track record of growing even during periods when financial markets and the broader economy are weak.

That's why I have long been a proponent of companies that run subscription-based business models. Such companies don't start at zero every year. Instead, they can tell you in advance how much baseline revenue they are likely to generate from existing subscribers.

The business of analysing and forecasting is difficult enough. By focussing on businesses with subscription-based models, you take some of the uncertainty and complexity out of the equation. Why make live more difficult than necessary? Keep it simple!

Still, you need to pick the right businesses.

Here is a subscription-based business that I believe will thrive throughout the 2020s.

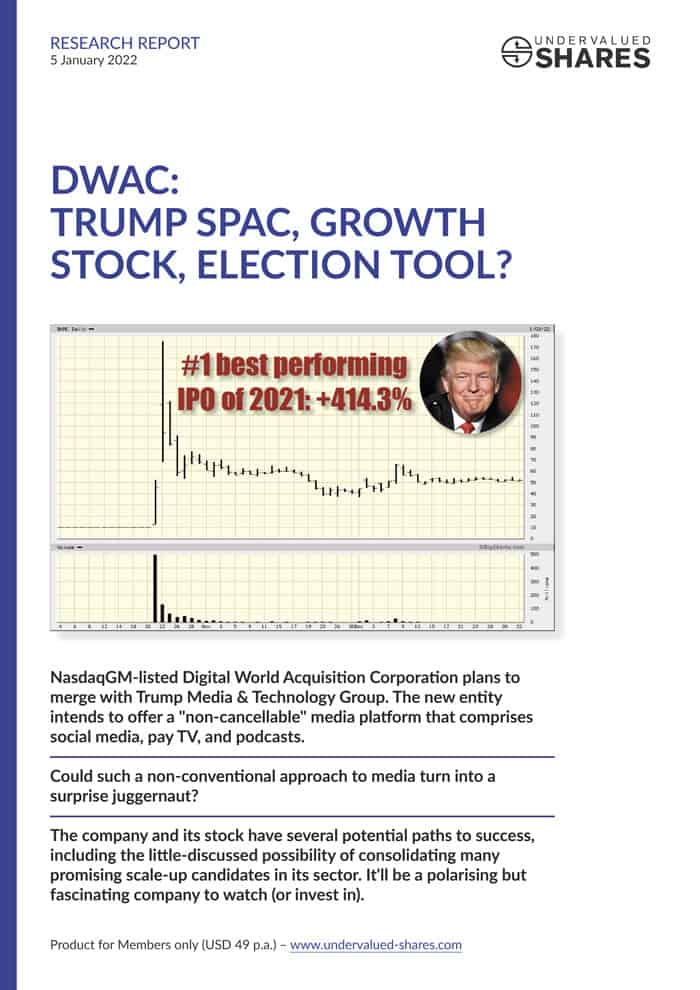

The Trump SPAC: polarising but fascinating

5 January 2022

Former US president Donald J. Trump will launch a media company by taking over a SPAC. The planned deal is anything but peanuts. By the end of the first quarter 2022, he could have a listed company with a USD 10bn market cap and USD 1.3bn in cash reserves.

Trump's net worth could increase by a staggering USD 6bn.

What are the chances of the deal working out as planned, and should private investors keep an eye on this SPAC?

Could it become the ultimate "meme stock" and go through the roof?

Within the next months, Digital World Acquisition Corporation will be renamed Trump Media & Technology Group. It will be a polarising but fascinating company to watch – or invest in!

What did I find out when I did a deep-dive of the company?

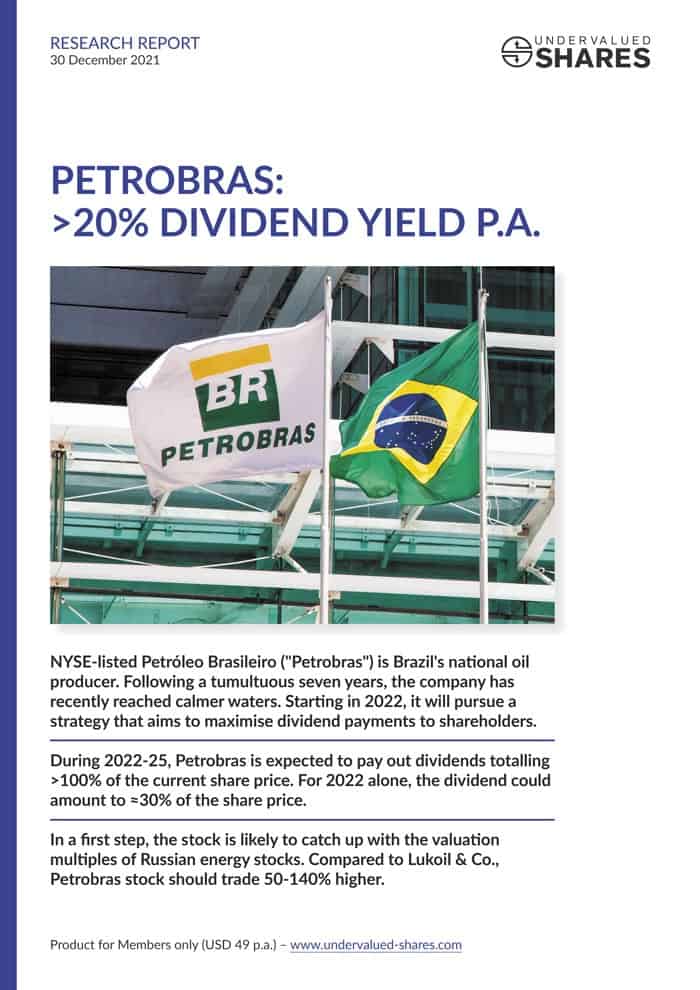

The world's best dividend blue chip?

30 December 2021

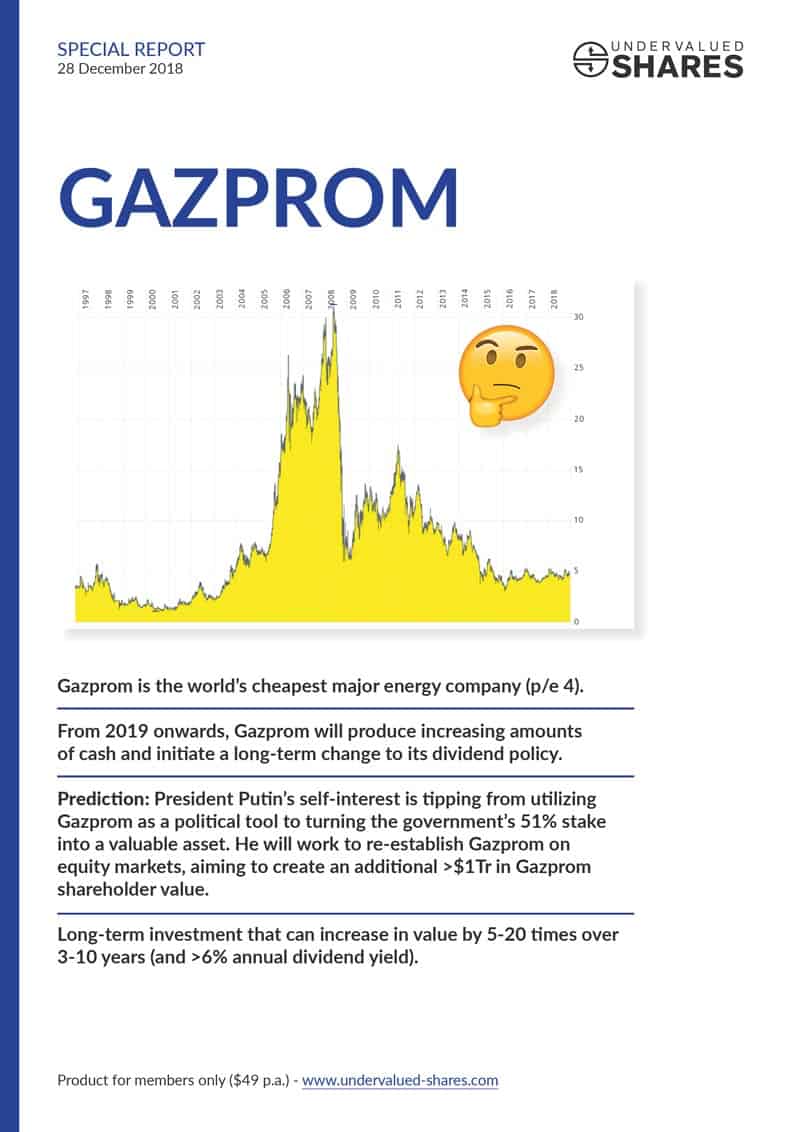

On 28 December 2018, when I relaunched Undervalued-Shares.com, I dedicated my first research report to Russia's former gas monopolist, Gazprom.

Not only has the stock since more than doubled in price, it also pays a monster dividend. Anyone who bought the stock in December 2018 is set to get a dividend yield of 28% (!) in 2022. Gazprom turned into an outstanding income investment.

Today's featured stock should go a very similar route.

Petróleo Brasileiro ("Petrobras") is Brazil's national oil producer. Following a tumultuous seven years, the company has recently reached calmer waters. Starting in 2022, it will pursue a strategy that aims to maximise dividend payments to shareholders.

If you missed buying Gazprom when its stock was given away for bargain basement prices three years ago, this may now be your second chance

Seizing Latin America's e-commerce and fintech opportunity

23 December 2021

Online shopping is more popular than ever. The idea of using the Internet to find the best deals and have products delivered to your doorstep is an unstoppable force conquering the world.

However, different regions of the world are adopting e-commerce at different speeds.

In China, over 50% of all retail purchases are done online. In the US, it's 20%. In South America, it's a paltry 6%.

Ecommerce in South America is where it was in the US in 2009.

However, it's growing fast. Latinos and Latinas also like bargain hunting on the web and having goods delivered home.

There is one Nasdaq-listed company that is to South America what Amazon is to the US. This is a quality company with a proven track record and many millions of customers.

Its stock has recently become cheap again.

If you believe that South America's young, tech-savvy population will take to e-commerce in the same way as North Americans, Europeans and Asians, this is the #1 stock to look at. It provides you with an opportunity that is similar to buying Amazon stock in 2009.

Bayer AG: a German blue chip with 100% upside

10 September 2021

It is tremendously valuable to have a few decades of real-life experience to lean on.

Among other things, it helps you put things in perspective. You find it easier to keep a cool head when everyone else is panicking.

Case in point, the hysteria surrounding Bayer's "Roundup" trials in the US.

Admittedly, it's an awful mess:

- Many victims and human misery.

- EUR 23bn in one-off charges in 2020 alone.

- EUR 74bn of shareholder value destroyed.

However, I believe: "This, too, shall pass."

Following my analysis, I expect Bayer to experience a similar recovery as the one it staged from 2003 onwards. Back then, the German life science company experienced a similar scandal – but its stock subsequently rose by a factor of 7.

Will Bayer manage to stage a turnaround yet again?

This report believes it can, and will. Starting in 2022, and possibly as early as Q4/21.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

Game on: a European entertainment champion goes global

12 August 2021

Europe isn't exactly famous for producing global tech and entertainment champions. However, they do exist and that's where the opportunity lies.

Find a cheap European company that has world-leading products, give it some more capital to develop a global growth strategy, and list its stock on a major stock exchange such as London – or sell the entire company!

That's exactly the scenario I expect for my latest find. Smart money has started to move in on this company, yet I bet you have never heard of it:

One of the most successful media executives from the US has recently acquired a 5% stake.

One of the most successful (and secretive) European activist funds has taken a stake of nearly 10%.

This company has been lying dormant, but that won't be the case for much longer. In early December 2021, it should get a lot of attention.

Right now, the stock is trading at just a sliver more than the price paid by the American media executive. If things work out, it could trade 125% higher by mid-2022.

Intrigued?

Novavax: The vax company that came from nowhere

30 July 2021

I recently wondered which coronavirus vaccine I would pick for myself - if or when I get vaccinated.

When I asked a trusted medical doctor for his advice about coronavirus vaccinations, he mentioned an option that I hadn't thought of yet: "If you aren't in a risk group and can wait, then wait for Novavax to hit the market in autumn 2021."

"Novavax" is both a vaccine and a company. The broader public isn't aware of it yet, but there are some metrics about the company that should make you pay attention:

- Novavax received USD 2bn in public support to launch its vaccine, more than any other American vaccine company.

- Countries around the world have already ordered 1.4 BILLION Novavax doses, which earlier this year made it the second-most ordered vaccine on record.

- Those countries with pending pre-orders aren't just developing nations but include the US (110m doses), the UK (60m), and Australia (51m).

Science Magazine asked whether Novavax is going to produce the "best" coronavirus vaccine.

Would you have known about these details? If not, it's probably worth your time to read on.

Benefitting from the decline of the European middle class

13 July 2021

Historically, Europe has been the quintessential middle-class society. However, the kind of white-collar office job that long provided job security and a high income increasingly becomes the prime target of automatisation, artificial intelligence and other new technologies.

The pandemic will only accelerate the ongoing rupture between the haves and the have-nots. Taxes will go up, which will further squeeze the budgets of hundreds of millions of people across Europe. There'll be a bifurcation of society.

Who will be among the biggest beneficiaries of these worrying trends?

I found an unlikely candidate. This company is a rags-to-riches story, and even outside of its investment angle, it makes for fascinating reading.

IWG plc: a stock with infinite return?

16 June 2021

How about an investment where (after some time) you need to keep zero money invested but keep the stock anyway?

If this sounds too good to be true, bear with me.

I've uncovered one company that is gearing up for a large, tax-free capital return which could give shareholders all their money back – and you will keep your share in the growing business, too.

It's a very unusual situation. IWG plc is in a growth market that can increase fivefold by the end of the decade. It's the global market leader in its industry and has been the #1 for many years. However, it's currently trading at a third (or less) of its intrinsic value.

IWG's management is already working on deals that will enable the capital return. Once you have received your initial investment back, from there onwards you'll literally have an infinite return. It's not going to happen overnight, but it should happen within a year or two – and possibly sooner.

Another Undervalued-Shares.com exclusive!

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

Crisis investing in Argentina: follow the insiders

29 May 2021

Argentina offers some of the world's best investment bargains. Most Argentinean stocks have lost over 80% of their value since the latest economic crisis began, including the high-quality ones.

In some ways, it's similar to Russia in the late 1990s, when top-quality assets were available for a song.

Argentina insiders know that yet again, the country's latest crisis will actually make for a huge opportunity. Smart money is moving in on Argentina.

This report for Lifetime Members is about Pampa Energía, a stock that I believe is akin to no-brainer investment. Even as a deep-value play, the stock should recover 100-300% over 1-2 years. Surprisingly, it may yet become a growth stock again – possibly even a 10-bagger, longer term.

The market has completely missed this story so far, but I believe there is one reason why this will change over the coming months.

If you like buying the dollar for 10 pence, you will love this story.

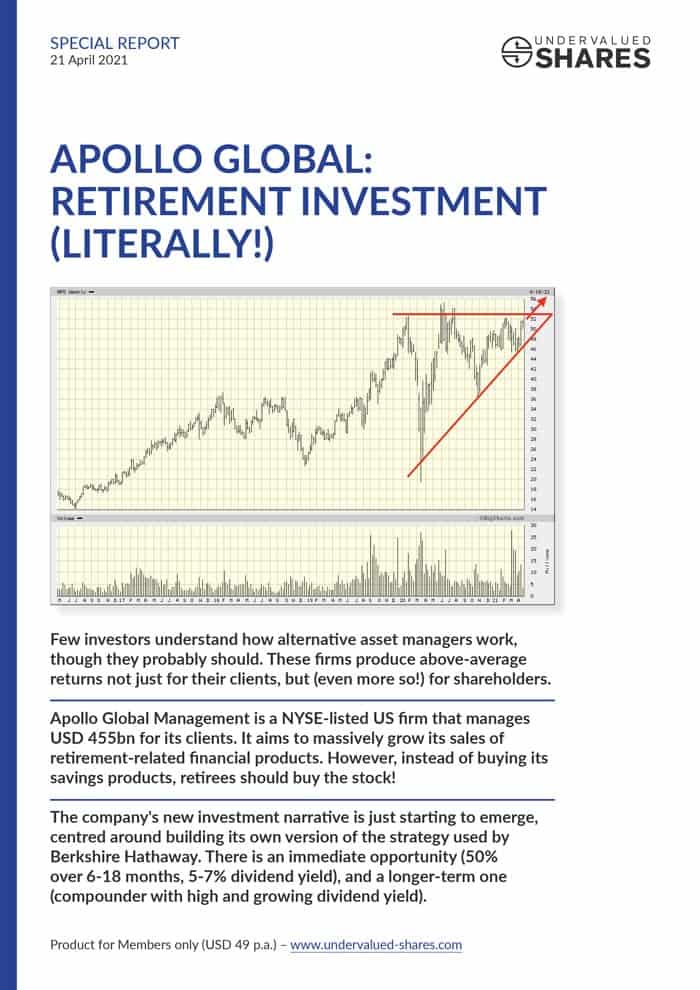

Apollo Global – plus 50% by mid-2022?

21 April 2021

Buying stock in Apollo Global Management is like getting 500 of the world's best investment professionals to work for you.

The US-based alternative asset manager has one of the best track records in the investment industry. 39% p.a. gross IRR since 1990, anyone?

Because its staff are so successful in managing other peoples' money, Apollo Global was able to grow its client assets from USD 0.8bn to USD 455bn since it was founded in 1990.

The company has much of its client base "locked in". An astonishing 60% of its client assets are permanent capital, which gives Apollo Global a solid foundation to stand on. In comparison, the industry leader, Blackstone, only has 22% permanent capital.

However, the shine recently wore off. During the past 6 and 24 months, the stock has massively lagged behind its peers. The share prices of Blackstone, KKR and Carlyle Group outperformed that of Apollo Global by a mile.

Will "APO" soon stage a catch-up rally?

I have investigated this possibility in detail - with some surprising findings!

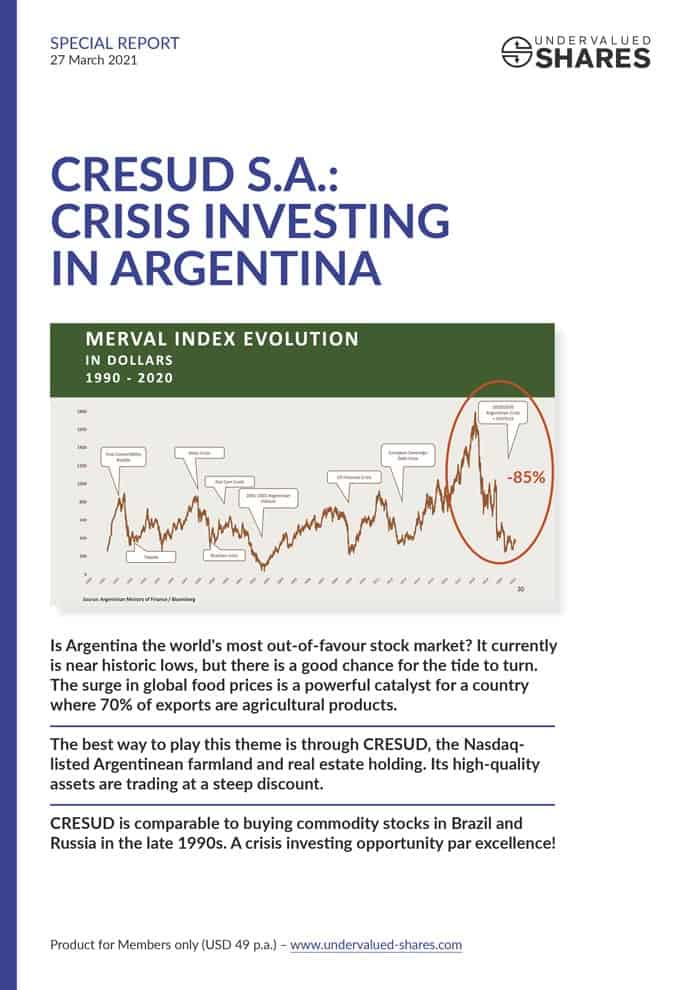

CRESUD S.A. - "Argentina is the gift that keeps on giving"

27 March 2021

Argentina is one of the world's most out-of-favour stock markets.

As the Wall Street Journal reported recently: "The country's total stock-market valuation has collapsed from USD 350 billion in 2018 to USD 20 billion last year."

Such a collapse is stunning, all the more so at a time of rallying global markets. Based on that one indicator alone, anyone with an interest in crisis investing would naturally take a look at Argentina.

There is now a concrete reason to do so – a potential catalyst to help the country back on its feet.

Since mid-2020, major agricultural price indices have surged by over 40%. Prices are now at their highest level since 2013, and some predict there is more to come.

One of the biggest beneficiaries? Argentina, the country that makes 70% of its export income from agricultural products.

Is now the time to pile into Argentinean assets at vastly discounted prices?

I set out to investigate.

Reopening play

16 March 2021

Who would possibly want to invest in a cruise ship operator at this particular time?

Even worse, who would want to do so after the stock has increased six times (!) in 12 months?

The company featured in my latest research report is currently not operating any of its vessels, but its stock is trading at an all-time high.

Surely, it's madness to even consider it for an investment?

Not everything is quite as it seems at the surface. Hear me out with this story.

The company in question has just increased its total addressable market by a factor of 15. Based on 2026 projections, its target market will be 40 times bigger even compared to last year's growth prospects. It's now operating in a market projected to grow by 18% each year, which will enable the "best in class" players to grow even faster.

With a simple, logical change to its business model, it has completely transformed its future prospects.

Not that the market would have noticed yet.

This change in strategy was only just announced. I believe Undervalued-Shares.com is first to report about it in great detail.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

"Secret" tech company from Israel

5 March 2021

The company featured in this bonus report for Lifetime Members has spent four decades hiding in a basement.

Literally!

Five banks shared ownership of this tech company, and they didn't want to share it with the outside world. It was a monopoly, and highly profitable. The Israeli public was unaware of the existence of this company, yet everyone used its services.

In 2019, the Israeli government forced the banks to sell some of their shares and allow the company to go public. It's been listed on the Tel Aviv Stock Exchange since. Few have noticed so far, not the least because the company's reporting only recently became available in English.

If my analysis is correct, this stock could increase in value by a factor of 2-4 over the coming 12-24 months. Longer term, it offers significantly more potential. The debt-free, cash-rich company could turn into a "compounder stock", just like Visa or Mastercard.

However, there is a catch! This stock is for experienced investors only.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

M&A fever among junior mining stocks

17 January 2021

Large gold mining companies are approaching the end of their minable reserves – the so-called "reserve cliff". These large corporations will increasingly use their record levels of cash to rebuild their reserves. What's the easiest way to do so quickly? Acquire junior mining companies!

A recent bidding war is indicative of what's to come.

Cardinal Resources (ISIN: AU000000CDV9) had explored and developed a 5m ounce reserve in Ghana, Africa. When a bid was made for the company, no less than THREE other bidders entered the fray. One of them was a Chinese company with state-backed funding to mop up the strategic metal around the world.

Nine months later, the Chinese emerged victorious. The biggest beneficiaries were the company's shareholders, who made between three and four times their money.

There is a lot of pent-up demand for M&A in the gold sector. It's almost certain there will be plenty of similar situations unfolding over the next one to two years.

The question is, how to find such opportunities before the market wakes up to them?

Fear not, Undervalued-Shares.com is here to help!

Just Eat Takeaway.com: the must-own e-commerce stock for 2021?

23 December 2020

Jitse Groen is the Internet billionaire you will not have heard of before. He is the 40-something founder, CEO and major shareholder of Just Eat Takeaway.com, the online food delivery company.

Industry insiders call him "the Jeff Bezos of online food delivery”.

Groen has a 20-year track record of taking aim at new target countries and nuking his local competition. He literally nukes them. The superior firepower of his Amsterdam-based company threatens even the DoorDashs and Uber Eats of this world.

Through his Blitzkrieg-style tactics, Groen has already managed to build the #1 online food delivery company of the Western world. Only China’s Meituan is bigger.

Groen's company is terrible, though, at telling its own story. That’s why the stock market has, so far, largely overlooked the stock.

Things are about to change, and 2021 is about to get hot.

Twitter – the great revival story of 2021?

20 November 2020

Who can afford not to use Twitter?

It's the world's #1 real-time news engine, and provides free access to 50% to 80% of the world’s leading experts in any given field.

However, Twitter is the ugly duckling among publicly-listed social networks. It still struggles to monetise its unique content and market niche, and its stock has remained flat since 2013.

Could the company’s lull be about to end?

Elliott Management has invested USD 1bn in Twitter stock. The firm is the world’s largest activist investor, and has a successful track record in turning around flailing technology companies.

There is plenty going on behind the scenes, which I have taken a closer look at.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

Ready for the next Fiverr?

20 August 2020

Undervalued tech companies with blue-sky potential aren't easy to find.

But they do exist!

My latest discovery reminds me of online marketplace Fiverr, one of THE beneficiaries of the changed world we now live in:

- Global leader in its technology.

- Huge addressable market.

- Proven management team.

If the plan works out, the company in question will become a money printing machine for its shareholders. It simply has tremendous economies of scale – as tech does!

And even if the plan doesn't work out, the company's existing business should still yield investors a profit.

Limited downside, huge upside – that's the combination I like best.

Poland's new "Golden Age" for investors

24 July 2020

Tim Draper, the Silicon Valley billionaire investor and trendspotter, is expecting a new "Golden Age" for Eastern Europe – and Poland, in particular.

Indeed, the country has achieved a lot:

- 27 consecutive years of economic growth, averaging 4.2% p.a. from 1992 to 2019. Per capita incomes are up by a factor of three and consumer businesses are booming.

- During this period, Poland has grown faster than:

- All other former Eastern Bloc countries.

- All other large countries in the world with a similar level of income.

- Singapore, Taiwan, and South Korea.

- Other historical economic achievements include:

- Europe's longest recorded growth spurt ever.

- One of the most extended growth periods recorded in world history.

- Second fastest ever rise from poverty to high-income (behind South Korea).

Poland has achieved all this without relying on excessive debt. In 2018, it was the first country of the former Eastern Bloc to become a "developed country". It's now the sixth largest economy of the EU, ahead of Sweden.

Which investments should private investors focus on? I have found ONE stock that could be the ideal proxy for covering the entire Polish market and economy.

Volkswagen/Porsche SE

26 June 2020

5 reasons to invest in the world's largest carmaker – summed up in a 51-page report.

My latest report about the two intertwined companies builds on the report that I published in January 2019.

Back then, I explained how the Porsche/Piëch families control Volkswagen through their publicly-listed family investment vehicle, Porsche SE.

The report summarised Volkswagen's challenges and opportunities, and what it meant for retail investors who were fetching a ride on the coat-tail of the families by buying into Porsche SE.

Even my German readers commented how much they had learned from the initial report, and how interesting the unusual background story was.

17 months on, it is time for a follow-up with a standalone report.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

A new med-tech champion

31 May 2020

Undervalued-Shares.com reveals what is almost certain to become the European champion in a technology that could truly change the world (and for the better).

The company in question is not one of these companies that are all plans and ambitions, but one that has already established itself:

- #1 market position in Europe, and #5 globally.

- Half a million paying customers – the famous "proof of concept".

- Profitable business.

No one else has pulled together these details yet, even though the company might become a household name across Europe during the next few years.

There is already an exclusive circle of investors who have pooled EUR 100m (!) to amass a majority stake.

The market has simply not realised yet what's cooking – which allows you to catch this opportunity early on.

Secular growth opportunity in tech

22 May 2020

Don't we all wish we could travel back in time and load up on shares of Apple, Amazon, Google, and Netflix?

You now have the opportunity to do just that.

In the US, there is one particular sector of the tech industry that has made investors between 100 to 1,300 (!) times their money since the early 2000s. This sector came out of nowhere and is worth USD 200bn today. Three companies dominate the space, and their shareholders have been minting money.

Elsewhere in the world, the growth of this particular industry is about ten years behind the US – but catching up fast.

There is ONE publicly listed company that allows you to catch this opportunity early on. Its home market is undergoing the same developments that the US has already gone through. This opportunity is – for all intents and purposes – almost as good as travelling back in time.

Fiverr - like Amazon stock in 1997?

22 April 2020

The technology sector offers some of the best opportunities for catching one of the elusive "100-baggers". If a company manages to grow by 25% p.a. for 15 years, it will have multiplied by a factor of 28 by the end of that period. Throw in some economies of scale, and you may get that 100-bagger that everyone is hoping to find for their portfolio.

Today's featured company, Fiverr, is a candidate for achieving such growth throughout the 2020s.

It's an online company that is already world-leading in its market. You could even say that it has created its own market by approaching a problem in a different way than everyone else. It could be a category-defining company.

Its target market generates USD 5tr per year, but only a tiny fraction of that has already shifted online.

If my instinct is right, Fiverr is a ground-floor opportunity similar to investing in Amazon 20 years ago.

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

"Crisis investing", Lundin-style

7 April 2020

Who wouldn't like to turn USD 10,000 into USD 500,000 within just a year or two?

I have hunted down a case that is not too dissimilar to what Petrel Resources was in 2003, and the timing might just be perfect.

The company in question ticks many of the right boxes:

- Highly controversial.

- A gigantic, but toxic asset (worth either billions or nothing at all).

- Swashbuckling major shareholders (with a track record for making things happen).

I have been following this company for no less than 16 years, and it's undoubtedly one of the most unusual corporate situations you can find on public markets. If you wanted to bet 1% of your portfolio on a Lundin-style investment, now's the moment.

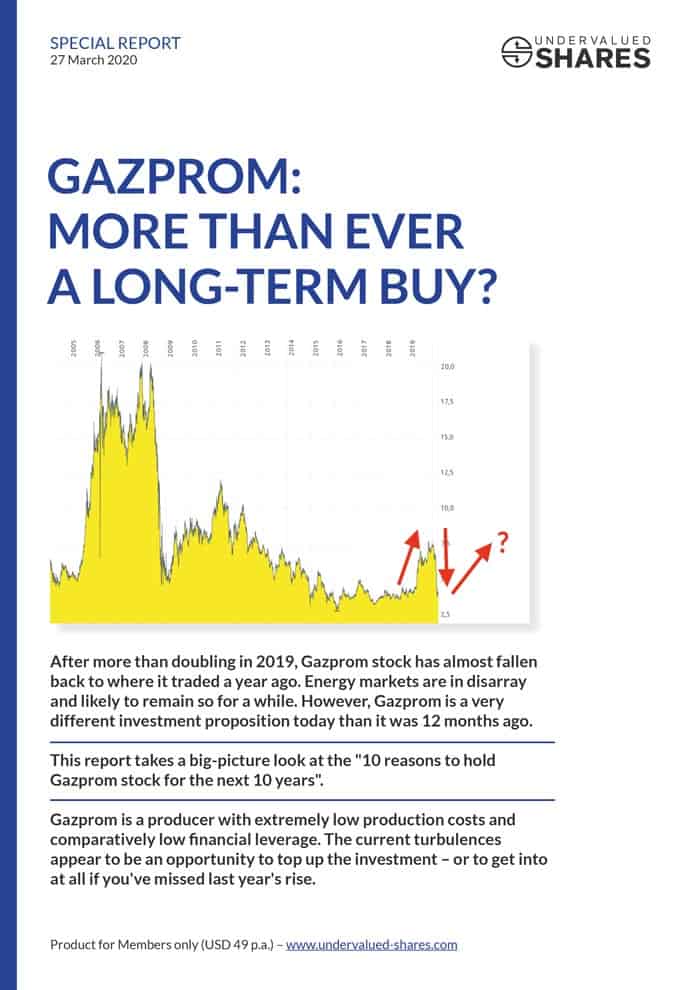

Gazprom: more than ever a long-term buy?

27 March 2020

The stock of Gazprom rose 128% after my December 2018 report, but has since lost most of its gains due to the double-whammy of the coronavirus crisis and oil price crash.

Is now a second opportunity to get onboard at fire-sale prices?

This report provides you with a very different perspective to the one shared by conventional investment media. It spells out the "10 reasons to be invested in Gazprom for the next 10 years".

Short term, the company probably offers a double-digit (!) dividend yield.

Long term, it's one of the most compelling corporate restructuring stories you can find on the world's stock exchanges. If Putin plays his cards right (as he has done recently), Gazprom shareholders could earn hundreds of billions of dollars between now and 2030. If you missed the FAANG stocks in the 2010s, you might want to consider owning Gazprom for the 2020s.

This report is both an update to my December 2018 report and a standalone piece that you can read without prior knowledge of the company.

Bonus report: Cuba – how to profit from distressed debt

6 February 2020

Have you ever come across the idea of investing in defaulted sovereign debt?

André Kostolany, the late German stock market guru and bestselling book author, landed his two biggest investment coups by buying defaulted bonds:

- With defaulted German bonds from 1930, he made 139 times his money.

- Russia's pre-1917 czarist bonds made him 100 times his investment.

Cuba has outstanding defaulted debt, which has long been the subject of ongoing speculation. It is currently "out", but new developments could soon lead to Cuba's defaulted debt being "in" again.

Defaulted Cuban debt is a rare and exotic asset, but it's open to investment.

In my new 56-page report, you can learn about investing in defaulted bonds in general, as well as the specific opportunity of defaulted Cuban debt.

British Airways - how to earn "monopoly rent" from Heathrow Airport

17 January 2020

British Airways controls the majority of so-called "landing slots" at Heathrow Airport. The peculiar, little-known ownership rights can be akin to a money printing machine.

Britain's former flagship carrier is not itself listed on the stock market, but you can indirectly buy into British Airways by investing in International Airlines Group (IAG, ISIN ES0177542018). IAG is a holding company that owns 100% of British Airways. It also owns Iberia, Aer Lingus, Vueling, and Level – making it Europe's third largest airline company.

Based on my analysis, IAG could be a share to buy and tuck away for the next ten years. Across the next decade, it could generate an average 12% to 15% p.a. for its shareholders, even if there was a recession along the way. That would be anything but a bad return from a company that has been in business for a century, and the stock of which is a highly liquid blue chip (GBP 12bn / EUR 15bn market cap).

In my view, IAG stock is one for the retirement portfolio. I am so bullish about it, that I made the effort to research and write one of the most complex research reports of my past 25 years of writing.

"Buy American" – an ultra-contrarian investment for short and long-term gains

20 December 2019

I try very hard to feature stocks where I am a lone voice in the desert. The less aligned with the consensus my views are, the better! Provided, of course, that I have uncovered the facts and figures that justify taking such a non-consensus position.

If you asked investors about the company that I have featured in my latest 47-page report, you'd probably get the following consensus view:

- It operates in an industry that is primarily famous for frequent bankruptcies.

- Brutal competition and price-conscious customers have killed its profit margins.

- The investor community is going to forever shun the entire sector.

However, my non-consensus evaluation of the company is quite different:

- The industry has morphed into an oligopoly with benign competition.

- Two of the world's best value investors have already bought up 25% of the company. One has recently been buying more, and the other one has publicly stated that he might end up bidding for the entire company.

- Starting in early 2020, there are concrete catalysts for the stock price to move higher.

Warren Buffett has already ploughed billions into this opportunity. But there is a lot more to it than just Buffett's interest.

This is a report that will surprise you with many of its findings.

A clever niche opportunity among mutual funds

29 November 2019

Undervalued-Shares.com has uncovered a highly unusual special situation among Germany-based mutual funds.

The fund in question owns one unlisted investment, which could soon be listed on a stock exchange. The conservatively managed and highly rated fund has been accounting for this stake based on its October 2018 historical purchase price. Were this portfolio company to be IPO'ed, the fund would likely experience an "overnight" net asset value increase of 7%; and maybe even more.

Virtually all pieces of this puzzle are already in the public domain. However, no one has made an effort yet to put two and two together.

It's a conservative investment, i.e., it won't double overnight. But it is one that could appeal to those of my readers who would like to "stash away" some money.

This fund could, in retrospective, turn out to be the equivalent of "free money".

All is exclusively revealed and explained in this Members-only, 20-page report by Undervalued-Shares.com.

Italian banks – a Renaissance (for some)

1 November 2019

Greece used to be the poster child of Europe's banking crisis. However, it has recently become the poster child for fulminant returns. Stocks of leading Greek banks are up massively since January 2019:

- Piraeus Bank: +300%.

- National Bank of Greece: +190%.

- Eurobank Ergasis: +90%.

- Alpha Bank: +68%.

- Attica Bank: +300%.

These aren't small-cap companies, but some of the largest banks of the country.

The entire Greek stock market has had the best performance in over 20 years. Few investors saw this coming. They underestimated the tinderbox reaction that happens when stock valuations are at rock-bottom and news about a gradual turnaround start to come in. For Greece bank stocks, going from "terrible" to "okay" was enough to spark a major rally.

If you missed out on Greece, then you might get a second chance with Italy. One Italian bank, in particular, sticks out as an attractive value play with clear catalysts on the horizon.

Just like the Greek banks, the dynamics currently at work in Italy's banking sector are not yet widely understood or noticed. My report looks at these misconceptions, and it draws a few surprising conclusions.

100 times your money?

7 October 2019

Once a year, this website features a company that has the potential to deliver a 100-fold return over a five to ten-year period.

Sounds incredible? There are actually timeless rules and guidelines for spotting such outliers early on, and scientific studies provide further analysis of them. Following these well-established rules is much more likely to yield outstanding long-term results than buying into highly speculative stocks and hoping to hit the jackpot overnight. It's not easy, but if you aren't systematic about trying you'll certainly never get there.

My report about this year's candidate also explains how to train yourself to spot such opportunities. It delves deeper into the subject of finding the kind of outlier company that can turn EUR/USD 10,000 into EUR/USD 1,000,000 over a realistic timeframe.

Most importantly, the 22-page report features a company that is listed on a major European exchange. This company's stock has a lot of potential in any case, and it might just turn out to become a potential '100-bagger'.

I thought long and hard about the first such candidate to introduce, and this report is the result. Of course, it's for Members only!

Brexit bargain

26 September 2019

Have you ever been to Covent Garden in London? This major tourist attraction is actually available for investment. The famous "Market Hall" and 78 surrounding properties are owned by a (little-known) publicly listed company.

Because of several recent developments (Brexit being just one of them), the stock price has fallen 50%. The company's management is currently working on implementing several steps aimed at turning around the stock's performance. News about this is due out soon.

The company in question could fall prey to a bid. It could also turn out to be a low-risk, high-quality value investment for those who are seeking long-term capital growth. My 24-page report discusses who should look at this investment and why.

John Menzies plc: British takeover target

13 August 2019

World-leading company (top 3 globally) John Menzies plc is virtually sure to get into the crosshairs of a takeover bid sometime during the next 12 months, possibly a lot earlier.

Its industry has high barriers of entry; it is projected to grow organically at nearly twice the speed of global GDP growth, and it offers a rare opportunity to consolidate a highly fragmented sector from the ground up. Large private equity companies are known to be interested in this space, but there is a real lack of suitable targets - except John Menzies plc!

Based on an estimate of its cash flow and a comparison with other recent transactions in the ground handling industry, the stock could attract a bid at a price that is 75% higher than the stock price at the time of publication.

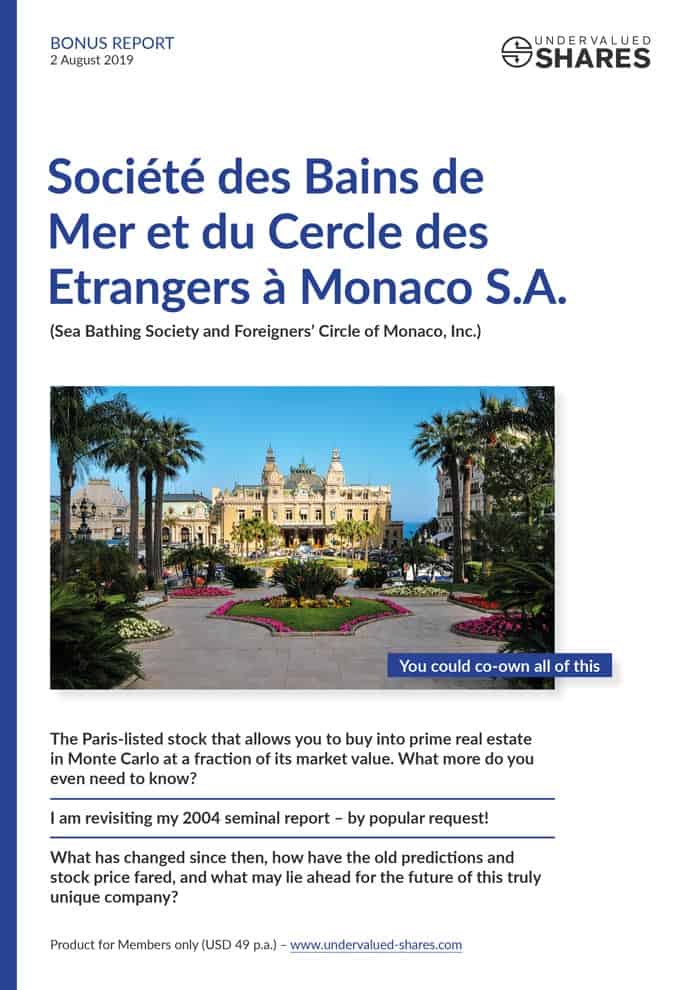

Bonus report: Société des Bains de Mer de Monaco (SBM)

2 August 2019

Is this the world's most glamourous publicly listed company? Paris-listed SBM owns much of Monte Carlo's most valuable real estate, including the Hôtel de Paris, the Café de Paris, and the uber-luxurious One Monte Carlo residential development.

Established in 1863, the company is majority-owned by the ruling monarch of the Principality of Monaco, Prince Albert II and his family.

The 76-page report is the sequel to my seminal 2004 analysis of the company. At the time, SBM was trading at the value of its cash reserves and the entire debt-free real estate was effectively for free. The share shot up 228%, but then stagnated again for a decade.

Recently, SBM shares once again gathered steam. Is it time to buy again?

Bonus report: the coming end of Gazprom's pipeline export monopoly?

23 May 2019

Vladimir Putin enjoys making unexpected moves, and one such upcoming move could be the end of Gazprom's monopoly right to export gas in a gaseous state through pipelines.

Gazprom did already surprise the market recently, by announcing a doubling of its dividend payment for 2018. This led to the share price making a bigger one-day leap than on any other day during the past decade. Also, it catapulted the dividend yield for my readers to a staggering 13% p.a.

Are more surprises coming the way of Gazprom shareholders?

This bonus report, which adds to my 91-page research piece issued on 28 December 2018, takes an initial look at the currently available evidence.

European technology takeover target

26 April 2019

Occasionally, this website will steer away from its habit of focussing on long-term investments, and introduce an investment with a short-term horizon.

E.g., back in November 2018, I wrote about a luxury hotel operator that I believed was going to receive a much higher takeover bid than the market anticipated at the time. Just two weeks later, this bid came in and my readers were able to pocket a quick 34% profit.

Bid situations are an exciting area, but timing and valuations are critical:

- You don't want to buy into a company where it subsequently takes years and years before anyone makes a bid.

- You'll need to be pretty sure that as and when a bid is made, it offers a sufficiently high upside compared to the price you paid.

- Last but certainly not least, you'll want good fundamentals to ensure you don't face a huge downside in case the anticipated bid doesn't happen for whatever reason.

With this 30-page research report, I am confident there is a new, attractive case for placing a bet on a coming takeover bid with ample upside, a reasonably clear time horizon, and limited downside.

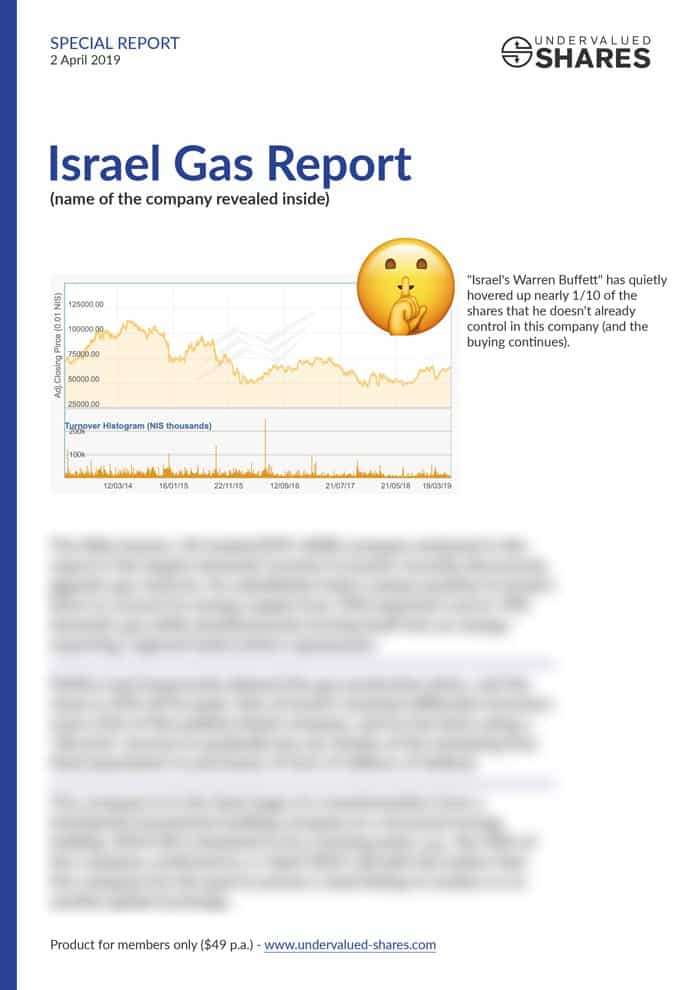

Israel gas report

2 April 2019

Israel was long joked about as the ONLY place in the Middle East that didn't have any oil or gas. This changed in 2009/10 when one of the world's largest ever gas fields (and multiple smaller ones) were discovered in the depth of the Eastern Mediterranean off the coast of Israel.

Several publicly listed companies were involved in the discoveries, and the subsequent hype led to some of their shareholders temporarily making up to ten times their money.

However, the discoveries didn't lead to the quick ramping-up of Israeli gas production that the market had hoped for. Politics caused a six-year delay because Israel was struggling with how to handle such a mega-resource. Share prices faltered again.

This 104-page report looks in detail at the one company that is likely to emerge as the big winner of all of these developments, and it provides extensive background about the industry and the current changes in the region.

This share is currently on hardly anyone's radar screen, but it's already clear why this is virtually certain to change in 2019 and 2020.

Porsche SE

28 January 2019

In 2008, carmaker Porsche attempted a hostile takeover of Volkswagen – a company with 50 times its own car output! The audacious transaction ended in financial disaster. The Porsche/Piëch family needed a financial bail-out and lost ownership of its car brand.